Sundry Photography/iStock Editorial via Getty Images

Coupang (NYSE:CPNG) stock is down more than 55% YTD. While I feel the pain of shareholders who bought the stock early, new investors might appreciate the attractive valuation as a buying opportunity and accumulate a position. Coupang is a quality company, with attractive business opportunities and growth potential in South Korea. In my opinion, Coupang is poised to ultimately become the country’s dominating e-commerce player, likely to increase market share from 20% as of 2022 to more than 60% by 2030.

I assign a Buy recommendation to Coupang stock and calculate a target price of $19.37/share, which indicates approximately 30% upside.

About Coupang

Coupang is the leading e-commerce company in South Korea. The company operates a consumer platform and a countrywide logistic and delivery network that enables the company to offer industry-leading standards in delivery time and frequency. That said, Coupang offers same-day, next-day, and multiple-times-a-day delivery services which give the company a strong non-price-sensitive advantage over competitors. Coupang also offers Rocket WOW for less than $3 per user, which is a subscription service similar to Amazon’s Prime (AMZN).

Coupang’s Opportunity

Coupang has seen strong growth in the past and now claims a market share in South Korea of approximately 20% in e-commerce. And I argue that the company is poised to eventually claim a monopolistic position, if government regulation does not interfere with Coupang’s expansion. My argument is based on the fact that Coupang’s leading logistic network and thereby delivery system is hard to replicate and provides competitive advantages of such scale that consumers will eventually switch to the leading service provider (See Amazon’s success based on scale and network effects).

Outside of South Korea, I personally do not see much potential for Coupang as giants such as JD (JD), Alibaba (BABA), Sea (SE), and Amazon are much better positioned to invest and compete. But Coupang’s domestic >$100 billion e-commerce market is still considerable and packed with growth opportunities. Specifically, I see four verticals where Coupang could find opportunities:

First, while the e-commerce penetration in South Korea is already very high, the market is still fragmented. As mentioned in the previous section, Coupang’s market share as of early 2022 is only approximately 20%. As I expect the company to claim a 60% market share by 2030 latest, the company’s business operations are poised to triple.

Secondly, Coupang might find opportunities in new business opportunities such as food and grocery delivery. This is still an early-stage market in South Korea and could offer the company an attractive growth vertical that is strongly supported by Coupang’s strong logistic network and brand recognition.

Finally, Coupang could push to increase average spending per customer by expanding into high value/high margin verticals such as fashion, cosmetics or electronics.

Fundamental Performance

Coupang is not profitable. But profitability doesn’t appear to be a short-term objective for the company. In 2021, Coupang generated $18.4 million of revenues and recorded a net loss of $1.5 billion (-8.4 margin). The loss, however, was mainly driven by high investment spending as the company is still heavily investing in logistic infrastructure, especially for grocery delivery. That said, cash from operations was much better than net income, although negative too, at -$410 million. Capital expenditures were $673 million. Coupang’s balance sheet appears healthy and able to support further business growth. As of Q1 2022, Coupang holds $3.4 million of cash and cash equivalents and $2.4 billion of total debt. For reference, Coupang currently trades at a $20.3 billion market capitalization.

How analysts see Coupang

Going forward, analyst consensus estimates Coupang’s revenues for 2022, 2023, 2024 and 2025 are $21.77 billion, $26.46 billion, $31.66 billion, and $36.81 billion, which implies a CAGR of >25%. Respectively for the same periods, EPS is estimated at -$0.48, -$0.20, $0.15, and $1.02 (Source: Bloomberg Terminal, June 2022). If analyst consensus, which seems reasonable to me, is correct, Coupang shares would now effectively be trading at a 2025 forward P/E of approximately x11.

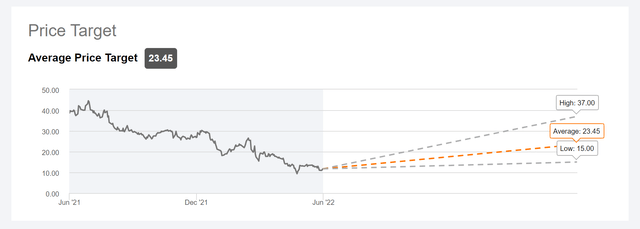

Moreover, the average analyst price target for Coupang implies an upside of more than 100%, based on a $23.45/share target price.

Residual Earnings Valuation

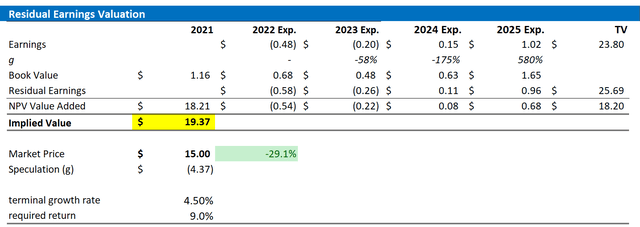

If analyst estimates are correct, what could be a fair valuation for Coupang stock? To support my value thesis, I would like to quickly present a valuation based on the residual earnings framework. Arguably, my assumptions are simple and conservative:

- I base my EPS estimates on the analyst consensus estimates until 2025. I find these are very reasonable, so I don’t see a reason to challenge them.

- After 2025, I extrapolate business activities into infinity (terminal value).

- I apply a conservative 9% WACC.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5% plus one percentage point to reflect a slight growth premium.

Based on the above assumptions, my calculation returns a base-case target price for Coupang of $19.37/share, which indicates an approximate 30% undervaluation.

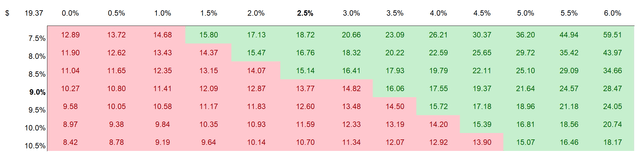

Investors might have different assumptions with regard to Coupang’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red cells imply an overvaluation as compared to the current market price, and green cells imply an undervaluation.

Analyst Consensus; Author’s calculation Analyst Consensus; Author’s calculation

Risks

I would like to highlight the following downside risks that could cause Coupang stock to materially differ from my price target:

First, a worsening macro-environment including inflation and supply-chain challenges could negatively impact Coupang’s customer base. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Second, much of Coupang’s share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Coupang’s business outlook remains unchanged.

Third, inflation and rising-real yields could add a significant headwinds to Coupang’s stock price, as the higher discount rates affect the net present value of long-dated cash flows.

Finally, the thesis in this article builds on the assumption that Coupang can enjoy significant growth in South Korea and claim a >60% market share. This, however, could be challenged as the country’s regulators might interfere with Coupang’s growth in order to preserve healthy competition.

Conclusion

Coupang is a quality business and the company’s stock appears undervalued. Personally, I appreciate the significant share-price weakness YTD as an attractive an entry point. I calculate a fair implied value of $19.37/share, indicating approximately 30% upside. Buy.

Be the first to comment