CHUNYIP WONG

AvalonBay Communities (NYSE:AVB) is one of the two largest apartment REITs on the market today with a market cap of $23.7 billion. The other largest REIT is Equity Residential (EQR) who has a market cap of $24.5 billion.

AvalonBay Communities develops, acquires, owns, and operates multifamily apartment communities across the U.S. The company focuses on major metropolitan markets with higher populations and higher wages. Their top markets include:

- New England

- Pacific Northwest

- California

- New York

The company currently has a portfolio that consists of 275 communities that are made up of 82,503 apartment homes.

Strong Results Cheap Valuation

During the company’s recent Q3 earnings report, AVB reported FFO of $2.46 and Core FFO of $2.50 a year over year increase of 25.5% and 21.4%, respectively.

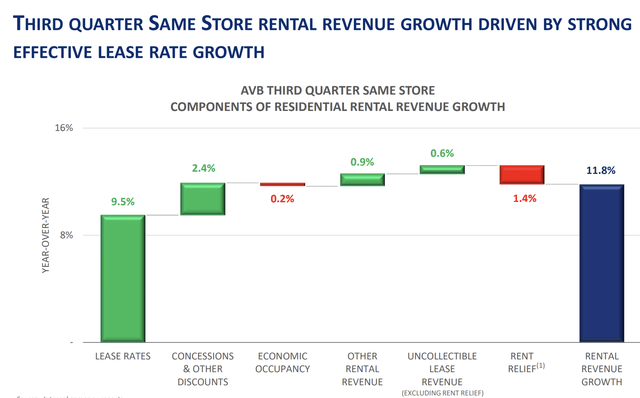

When looking at the company’s same-store data, AvalonBay reported rental revenues of $574.78 million, which was an 11.8% increase over prior year. The revenue growth is great, but when you peel back the data, you can see what drove that increase, and it was primarily a 9.5% increase in lease rates, which speaks to the company’s strong pricing power.

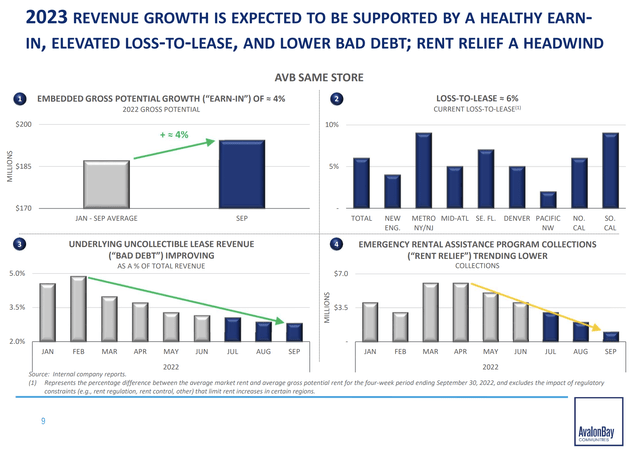

The 9.5% lease rate increase speaks to the pricing power AvalonBay has with their customers and with the locations they have. The rental rate increases are suspected to slow, but there’s still some leasing price tailwinds given the loss to lease rate of 6%, which suggests the company’s average rates are 6% below market rates.

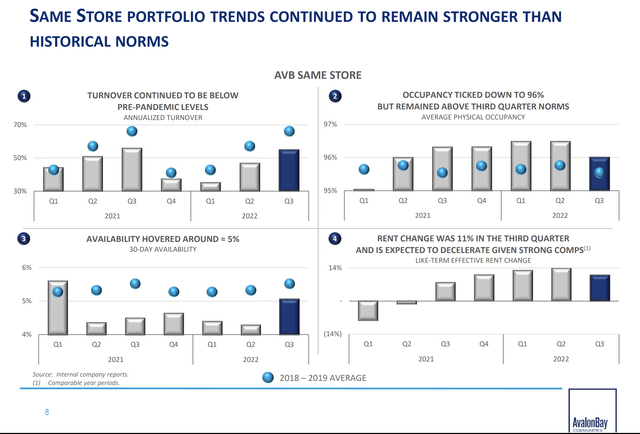

The company ended the third quarter with a portfolio occupancy rate of 96%. Availability hovered around 5%, well below the company’s pre pandemic lows.

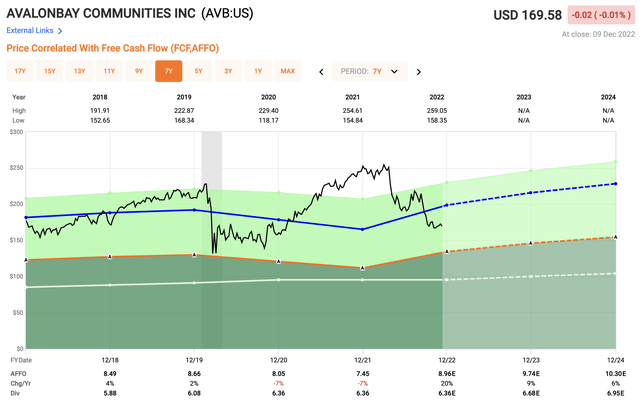

Given the strong results we saw in Q3, the continued tailwinds in pricing, and strong occupancy, AVB is trading at a low valuation when compared to its historical averages.

To first put things into perspective, shares of AVB over the past five years have traded with an average AFFO multiple of 22.2x. Right now shares are trading at a forward AFFO multiple of just 17.4x, over 20% below their historical average.

Given the strong drawback in shares, and considering the economic headwinds ahead, AVB shares look like a great opportunity to start or average into a position at current levels in my opinion.

Risks Ahead

Although stocks are trading at what I consider to be a cheap valuation, there are still notable headwinds and risks to shares of AVB in the near-term. We are beginning to see an uptick in unemployment in certain parts of the US as well as signs of a weakening consumer.

Consumers gained a ton in savings during the global pandemic, but those gains have since been wiped away and in addition to those being gone, consumers are putting more money on credit cards. The economy is also headed towards a recession, which could put even further pressure on consumers.

Uncollectible rents and occupancy rates are two things investors should pay close attention to when it comes to AvalonBay Communities.

An Attractive Dividend

AvalonBay Communities currently pay an annual dividend of $6.36 per share which equates to a dividend yield of 3.75%. AVB shares have a 5-year dividend yield of 3.25%.

One of the things I do not like about AVB is their lack of dividend growth. The board has not increased the dividend in over three years.

The dividend is plenty safe with a low payout ratio of only 63%.

Investor Takeaway

AvalonBay Communities is a blue chip apartment REIT, one of the two largest apartment REITs on the market today. The company reported strong Q3 earnings with FFO growth of 25.5% led by strong same-store rental revenue growth of 11.8% driven largely by increased rental rates.

The company still has some tailwinds in terms of increased rental rates as they currently are 6% below market rents. The company is also backed by a strong A rated balance sheet to fall back on when things do get tough in the economy.

There are some concerns around the state of the economy and the consumer to worry about, but much of that is priced into the sizable pullback in stocks we have seen.

Trading at a share price below $170 is very intriguing for this blue chip REIT.

Be the first to comment