edichenphoto

Just as low interest rates can fuel increases in real estate valuations, rising interest rates are a significant headwind as financing costs are higher and discount rates more punitive. With the Federal Reserve aggressively raising interest rates, many real estate stocks have been hit hard, and AvalonBay Communities (NYSE:AVB) is among them, down over 25% year to date, essentially wiping out all gains over the past five years.

Seeking Alpha

AVB is among the nation’s top apartment real estate investment trusts (REITs) with a focus on the higher-end of the multifamily rental market. While the company’s focus in large, legacy markets in the Northeast and West Coast is not ideal, investors are able to purchase shares at a discounted valuation, and its core markets are recovering. The stock currently offers a 3.4% dividend yield, and given strong rental market fundamentals, I believe go-forward dividend growth should exceed the 2.54% five year growth rate.

Despite its declining share price, AVB is actually performing quite well. Its second quarter core funds from operations (FFO) were up 23% year on year to $2.41. This is the critical figure for a REIT as it shows what can be paid out for a sustainable dividend. $0.41 of the $0.45 gain came from rising same store operating income. In other words, each multifamily complex is generating substantially more cash flow than a year ago.

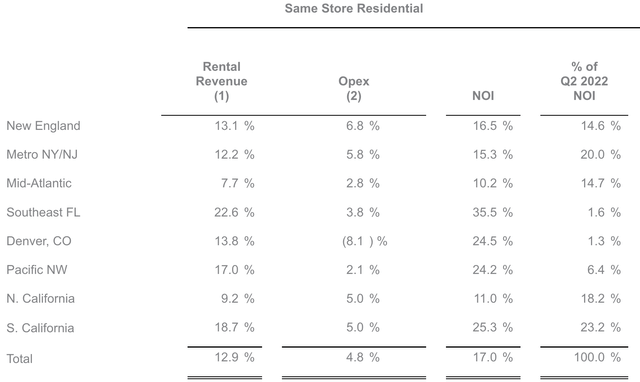

In fact, same store revenue rose 13.1% from a year ago as rents rose 12.9%. Because costs only rose about 5%, same store net operating income rose about 17%. As you can see below, rental increases were strong across all regions. AvalonBay’s exposure to cities like New York and San Francisco made the COVID downturn painful as they were relative underperformers with elevated concessions required to maintain occupancy. However, they are now coming back strongly.

AvalonBay

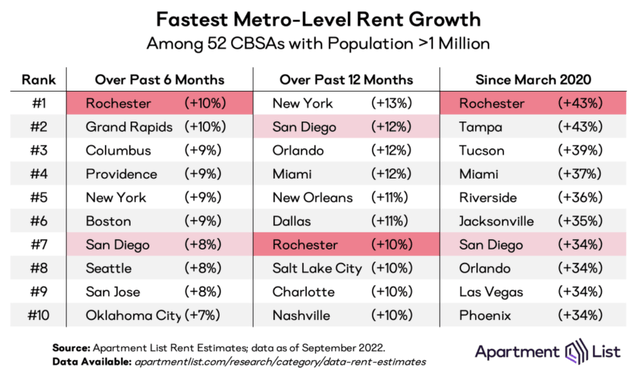

This is not just an AvalonBay phenomenon but a market-wide one. This chart below from ApartmentList is particularly interesting. Unsurprisingly since the start of COVID, Sun Belt cities like Tampa, Miami, and Tucson have experienced some of the fastest rental growth thanks to continued population inflow. But over the past six months, the legacy cities where AvalonBay operates in like New York, Boston, and San Jose are now leading the way, making significant comebacks. While the Sun Belt still has undoubtedly has more favorable medium-term demographics, it seems reports of these big cities’ demise have been a bit overstated.

ApartmentList

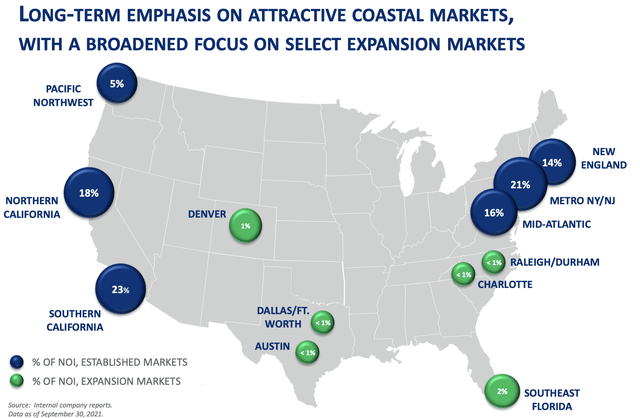

With AvalonBay getting about 90% of its operating income from the Northeast and West Coast, it’s geographic mix is not ideal in my view versus a REIT like Mid-America Apartment (MAA), which operates primarily across the Sun Belt. However, as we are seeing, these markets still can generate substantial rental income and growth. Importantly, AVB is pivoting and trying to diversify its geographic mix with expansion ongoing across these faster growth Sun Belt regions, which should enhance its growth profile.

AvalonBay

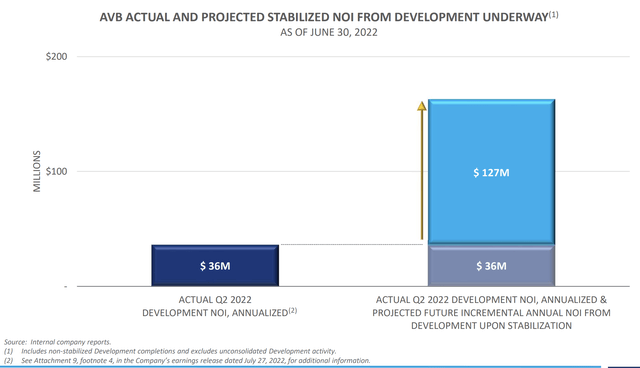

These expansion projects underway are expected to boost NOI by about $125 million over the next two to three years. That is about $0.90 per share, or a 9% increase from the $9.86 in FFO management expects to generate. Just given the existing size of its legacy operations, diversification will take time, but the plan is in place to gradually shift the business to gain exposure to faster growth markets. In the meantime, legacy markets are bouncing back hard.

AvalonBay

It is important to note that AVB has the balance sheet to finance expansion projects even in a period of rising interest rates, AVB is running leverage of just 4.9x EBITDA below its 5-6x target. Carrying less debt makes its cash flow less impacted by moves in interest rates. This is particularly the case because the average maturity on its debt is 8.4 years, meaning most of its interest costs were locked in when rates were low with limited refinancing needs over the next few years. This position the company to navigate the coming volatile period well. Additionally with leverage below target, if assets in growth markets come on the market at distressed valuations, AVB has the financial flexibility to make acquisitions. This could accelerate its growth and diversification efforts.

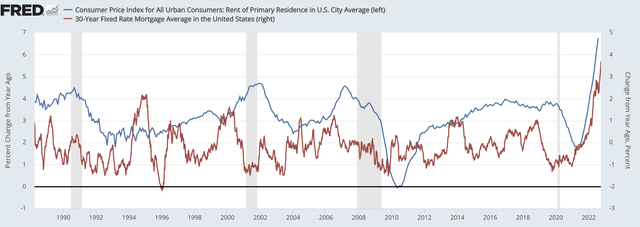

While higher rates are causing fear in real estate investors, I think that apartment owners are well positioned to handle it. As you can see below, when mortgage rates spiked in 1999, 2005, and 2020, rental inflation subsequently accelerated. As buying a home becomes more expensive, more Americans who would otherwise buy a home are pushed back into the rental market, boosting demand, and increasing prices.

St. Louis Federal Reserve

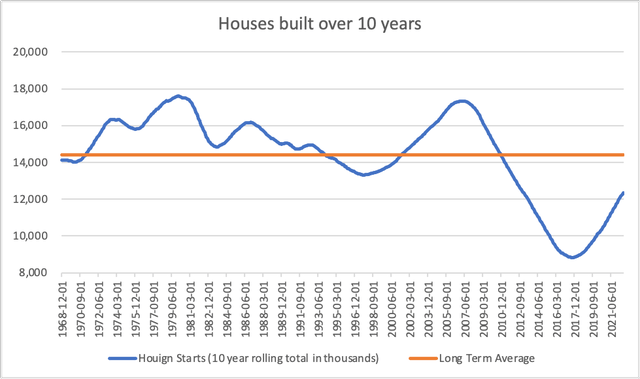

Additionally, America is operating with a housing shortage. After building nearly 15 million homes a decade in the second half of the 20th century, we overbuilt during the housing boom (17 million) but then overcorrected last decade, building just 9 million homes. This has left America 2-4 million homes short vs trend, but people still have to live somewhere. This is why housing, either buying or renting, has steadily grown more expensive. And with higher rates likely to slow home construction, these supply issues are set to persist.

St. Louis Federal Reserve

The tightness of the housing market means that rental inflation is likely to keep rising. I would expect AVB to see rental inflation slow from the double-digits seen in recent quarters as many of its markets have recovered much of their underperformance, but I would expect rental inflation to then run in the mid-single digits and exceed overall inflation given supply shortages. Combined with incremental NOI from investment in new markets, AVB can generate high single-digit FFO growth over the next three years in my view.

It’s $1.59 dividend consumes just 65% of FFO, leaving it on a very sustainable footing. As such, given its balance sheet is already below the low-end of its leverage target, dividends should be able to rise at least as quickly as FFO, or 6-8%, a marked step-up from the 2.5% of the past five years. With a starting yield of 3.4%, that dividend growth provides a compelling package for dividend growth investors who can expect double-digit total returns over the coming years. Given its elevated dividend growth prospects, I think shares are attractive to a 3% yield or $212 a share, representing 14% upside from current levels.

Be the first to comment