Oat_Phawat/iStock via Getty Images

Introduction

Saint Helier, Jersey-based Caledonia Mining Corp. Plc (NYSE:CMCL) released its production update for the third-quarter results of 2021 on October 13, 2021.

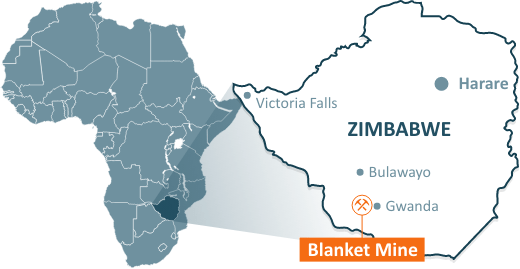

Caledonia’s primary asset is Blanket Mine, a gold mine in Zimbabwe. The company has 64% ownership.

CMCL: Map Presentation (Caledonia Mining)

1 – 4Q21 and full-year 2021 results Snapshot

The company announced its 4Q21 and full-year 2021 results on March 17, 2022.

The gross revenues for 2021 were $121,79 million, up 21.8% year over year. Adjusted earnings were $2.26 per share, up from $2.04 per share in 2020. Gold production for 2021 was 67,476 ounces compared to 57,899 ounces in 2020, above the top end of the guidance range, and was a new record for annual production.

2021 cash generated from operations before working capital increased by 17%, from $42.4 million to $49.6 million.

During 4Q21, Caledonia acquired the mining claims at Maligreen in the Zimbabwe Midlands with a mineral resource of approximately 940K ounces of gold in 15.6 million tonnes at a grade of 1.88g/t.

The 2022 gold production guidance is expected to be between 73K and 80K ounces or 13% up from 2021 gold production.

Important Note: The Company is constructing a 12MWac solar plant at approximately $14 million to improve the quality and security of Blanket’s electricity supply and reduce Blanket’s environmental footprint. The plant will provide about 27% of Blanket’s daily electricity demand.

CEO Steve Curtis said in the press release:

Operationally, the last 12 months have marked a turning point for the business. The Central Shaft has been a huge project costing approximately $67 million, all funded through internal cashflow and I am delighted that it was commissioned in the first quarter of 2021.

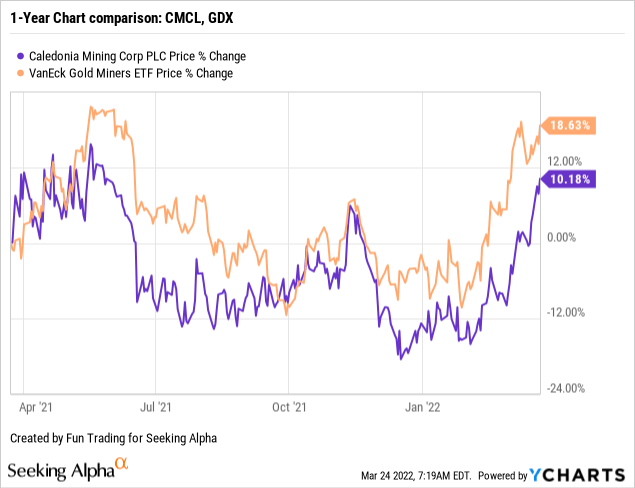

2 – Stock performance

The stock performance has been chaotic on a one-year basis, as we can see below. However, the stock is getting some momentum at the moment. CMCL is up 10%.

3 – Investment Thesis

The company is a good candidate for a long-term investment. The company has virtually no debt and a steady cash flow with future growth.

I see one issue only, as I said in my previous article. The company’s unique producing asset is the Blanket mine in Zimbabwe. Thus, by definition, the business model is risky when we look at it from a long-term investment perspective. Even so, the Blanket mine is a good gold producer. Hence, it is prudent to invest cautiously here.

Thus, I suggest trading short-term LIFO with a minimum of 50% of your long position to alleviate any potential risks and take advantage of the gold volatility, which is very high at the moment.

Caledonia Mining – 2021 Balance Sheet and 4Q21 Gold production – The Raw Numbers

| CMCL | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Total Revenues $ million | 28.13 | 25.72 | 29.98 | 33.50 | 32.14 |

| Quarterly Earnings (excl. non-controlling %) $ million | 2.97 | 4.55 | 2.69 | 6.94 | 4.22 |

| EBITDA $ million | 8.71 | 9.74 | 7.93 | 12.76 | 11.44* |

| EPS (diluted) $ per share | 0.24 | 0.37 | 0.21 | 0.57 | 0.33 |

| Operating Cash Flow $ million | 11.62 | 1.96 | 12.73 | 7.11 | 9.10 |

| CapEx in $ million | 11.91 | 6.53 | 8.21 | 9.01 | 14.08 |

| Free Cash Flow | -0.30 | -4.57 | 4.52 | -1.90 | -4.98* |

| Total cash in $ million | 19.09 | 13.03 | 16.67 | 13.21 | 16.27 |

| Total LT Debt in $ million | 0.00 | 0.00 | 0.18 | 0.27 | 0 |

| Dividend $/share | 0.11 | 0.12 | 0.13 | 0.14 | 0.14 |

| Shares Outstanding (diluted) in million | 11.25 | 12.30 | 12.83 | 12.17 | 12.18 |

| Gold Production | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Quarterly Production K Oz | 15,012 | 13,197 | 16,710 | 18.965 | 18.604 |

| Gold Price in $ | 1,845 | 1,738 | 1,792 | 1,764 | 1,768 |

| AISC in $ | 1,083 | 1,077 | 933 | 909 | 1,020 |

Data Source: Company press release.

* Estimated by Fun Trading.

Analysis: Revenues, Free Cash Flow, Net Debt, and Gold Production

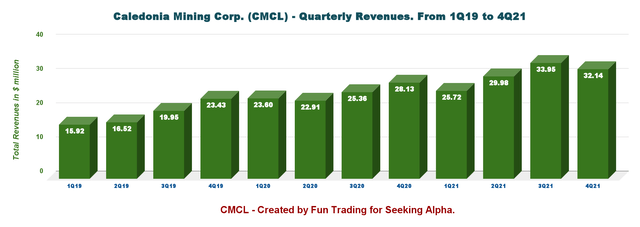

1 – Quarterly revenues were $32.14 million for 4Q21

CMCL: Chart Quarterly Revenues History (Fun Trading)

Revenues were $32.14 million in the fourth quarter of 2021, up 14.2% from the same quarter a year ago and down 4.1% QoQ. Net income excluding non-controlling interests was $4.22 million or $0.33 per diluted share. It was a good production quarter which led to solid revenues.

CEO Steve Curtis said in the conference call:

very excellent performance in 2021, which you are familiar with, over 67,000 ounces. These have already been announced, costs well contained. Financial performance, very good, 21% increase in turnover. That’s a combination of ounces and good gold price, 11% increase in the adjusted EPS and a 49% increase in the dividend that all of you as shareholders or interested parties would have been familiar with already. And then, we have been speaking about the new opportunities for all for quite some time now, and we have already announced the Maligreen Project.

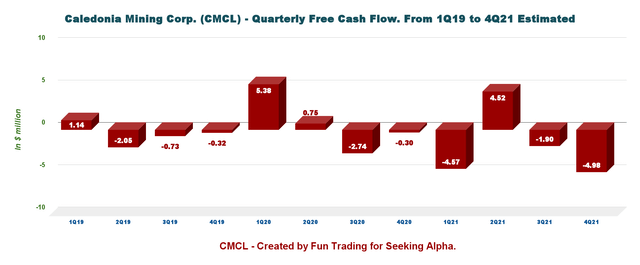

2 – The Quarterly Free cash flow is estimated at a loss of $4.98 million in 4Q21

CMCL: Chart Quarterly Free cash flow history (Fun Trading)

The generic free cash flow is the cash from operations minus CapEx. Cash flow from operations went down this quarter, and the company’s free cash flow was a loss estimated at $4.98 million.

The trailing 12-month free cash flow TTM is still a loss of $6.93 million. The high CapEx related to the completion of the Central Shaft is the reason for the loss. CEO Steve Curtis said in the conference call:

So, this is the proof of the pudding that Central Shaft is delivering and it was a worthwhile investment. And we are therefore confident that we can go forward and ramp up to the 80,000 ounces as we are guiding 73,000 to 80,000 ounces for 2022. But, everything is pointing in the right direction.

The company is paying a quarterly dividend of $0.14 per share.

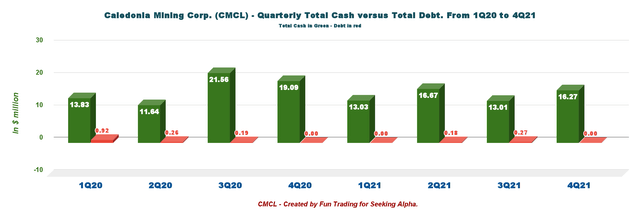

3 – The company is net debt-free and had $16.27 million in cash at the end of December 2021

CMCL: Chart Quarterly Cash and debt history (Fun Trading)

The company has no long-term debt. The cash position was $16.265 million at the end of December 2021.

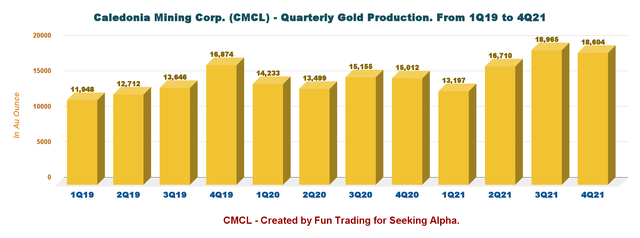

4 – Quarterly production analysis

4.1 – Gold production

Gold production for the quarter was 18,604 Au Oz, up 23.9% compared to the same quarter a year ago and slightly down sequentially.

CMCL: Chart Quarterly Gold Production history (Fun Trading)

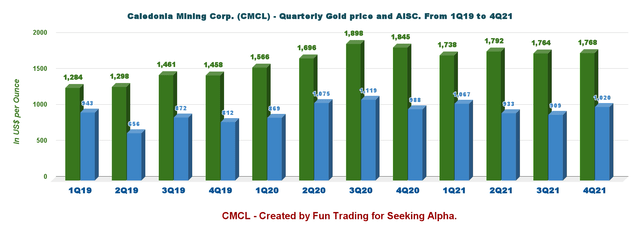

4.2 – Historical gold production and AISC

Gold’s price was $1,768 per ounce this quarter, and AISC was $1,020 per ounce.

CMCL: Quarterly and Gold price history (Fun Trading)

| Caledonia Mining Corp. | 2017 | 2018 | 2019 | 2020 | 2021 |

| Gold Produced in Ounce | 56,133 | 54,511 | 55,182 | 57,899 | 67,476 |

| All-in Sustaining Costs ($/oz) | 847 | 802 | 820 | 946 | 982 |

4.3 – 2022 Guidance

2022 production guidance is between 73K and 80K Au Ounces. It is significantly higher than the previous year due to the completion of the central shaft. The company said that it expects 80K ounces annually from 2023 onwards.

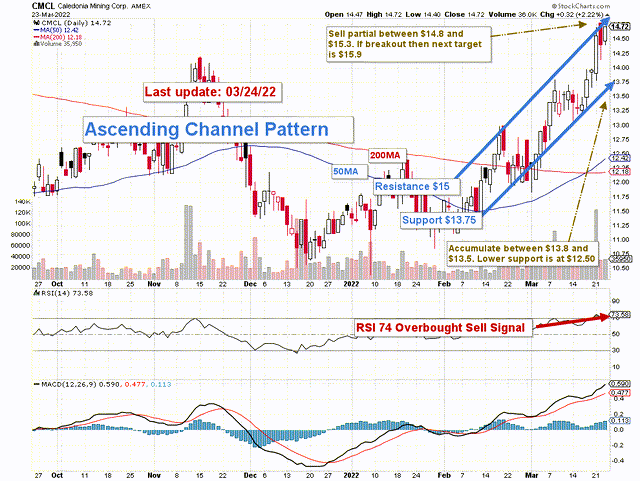

Technical analysis and Commentary

CMCL: TA Chart short term (Fun Trading)

Note: The chart is adjusted for the dividend.

CMCL forms an ascending channel pattern with resistance at $15 and support at $13.75. The trading strategy is to trade LIFO about 50% of your total position.

I suggest selling between $14.8 and $15.3, about 25%, and waiting for an eventual breakout to sell another 25% at or above $15.9.

However, if gold turns bearish again, CMCL will likely drop below $13.75 and could cross the support to retest $12.50 again in the worst-case scenario. I suggest accumulating below $13.75.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Be the first to comment