fizkes/iStock via Getty Images

Investment Summary

After a lengthy saga surrounding the patent protection on its investigational Lumryz formula, the dust has settled and we now have more clarity on the situation at hand with Avadel Pharmaceuticals plc (NASDAQ:AVDL). With AVDL now in the pilot seat to steer the trajectory of its Lumryz formula, we opine therein lies an alpha opportunity to collect upside to price objectives of $9.60 then c.$13 in this name.

We’re here today to discuss our key findings regarding the Lumryz label, explaining the remedial breakthrough it intends to provide to an otherwise complex segment. Net-net, we rate AVDL a buy, and are constructive on the more defined route to commercialization for its investigational drug.

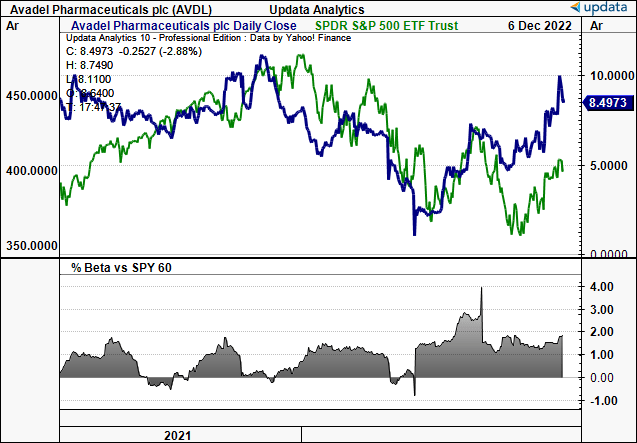

Exhibit 1. AVDL 2-year price evolution vs. S&P 500, with corresponding equity beta

Data: Updata

Key downside risks to the thesis:

1. Short-term Volatility: Avadel Pharmaceuticals plc is a relatively new company and is still in the early stages of development, so there may be significant short-term price swings due to market forces and news events.

2. Regulatory Risk: The development and approval process for drugs is complex and subject to regulatory risk. There is no guarantee that Avadel Pharmaceuticals plc will be able to successfully bring its drugs to market.

3. Competitive Risk: Avadel Pharmaceuticals plc faces intense competition from larger and better-established pharmaceutical companies, which may inhibit the company from achieving its goals.

4. Financing Risk: Avadel Pharmaceuticals plc is a relatively small company and faces financing risks due to its limited cash flow and access to capital.

Investors should be well aware of all these risks before taking any position in AVDL.

Lumryz key catalyst to drive upside capture

In our opinion, the key catalyst to move the needle in AVDL’s case is the momentum around its investigational treatment for narcolepsy, called Lumryz.

We’ll talk a bit about Lumryz in a second. But first, it’s essential to understand exactly what narcolepsy is, in order to convey the differentiated strengths of Lumryz, and subsequently, our investment thesis.

Narcolepsy is a chronic neurological disorder that affects the brain’s ability to regulate the sleep-wake cycle. It is characterized by excessive daytime sleepiness, as well as other symptoms such as sudden muscle weakness (cataplexy), hallucinations, and sleep paralysis.

People with narcolepsy have a dysfunction of the hypothalamus, the part of the brain that produces hormones that regulate the sleep-wake cycle. Specifically, patients have a deficiency of the neurotransmitter hypocretin, which is involved in maintaining wakefulness. As a result, people with narcolepsy have difficulty staying awake during the day and may experience sudden, irresistible sleep attacks. You may or may not know or have seen someone with the condition before.

The exact cause of narcolepsy is not known, but it is thought to be a combination of genetic and environmental factors. Narcolepsy is often inherited, but not everyone with the genetic predisposition for narcolepsy will develop the condition. Certain environmental triggers, such as infection or stress, may also play a role in the development of narcolepsy.

The prevalence of narcolepsy is estimated to be ~0.05% in the general population, although this figure may be an underestimate due to misdiagnoses. It is more common in males than in females, with a male to female ratio of 1.5:1. The highest prevalence occurs in the 15-30 years age bracket.

The current medications used to treat narcolepsy include the following:

- Stimulants: [such as dextroamphetamine, dextroamphetamine-amphetamine, methylphenidate, and modafinil; antidepressants, such as fluoxetine and venlafaxine; and sodium oxybate (Xyrem),

- Antidepressants: Tricyclic antidepressants (“TCAs”), Selective serotonin re-uptake inhibitors (“SSRIs”), Norepinephrine-dopamine re-uptake inhibitors (“NDRIs”).

- Gamma-hydroxybutyrate (“GHB”).

- Sodium Oxybate [Xyrem, more on this later]: This drug is a central nervous system depressant and is used to help manage excessive daytime sleepiness in people with narcolepsy.

It is the sodium oxybate compound [not Xyrem] that AVDL is competing against in the standard of care with its Lumryz formula.

Lumryz is a revolutionary long-acting injectable formulation of sodium oxybate. Its unique mechanism of action involves increasing the levels of gamma-aminobutyric acid (“GABA”) in the brain, resulting in a calming effect on neurons and improved sleep. Furthermore, Lumryz normalizes the sleep-wake cycle, providing effective relief from the debilitating symptoms of narcolepsy, such as excessive daytime sleepiness and cataplexy.

The pharmacodynamic effects of Lumryz take several hours to fully develop and can last for up to 8 hours, providing sustained relief from these symptoms. It is intended for once-nightly administration in the management of narcolepsy, offering a breakthrough solution for individuals suffering from this condition.

The main advantage of Lumryz over competing formulas that treat narcolepsy is its long-acting injectable formulation. Compared to oral medications, this formulation has a much faster onset of action and can provide extended periods of relief from excessive daytime sleepiness and cataplexy. In addition, the formulation has a higher bioavailability, meaning that more of the active ingredient reaches the target tissue or organ, resulting in improved efficacy. Finally, the once-nightly administration makes it a convenient option for those with narcolepsy.

Lumryz overhang removed from investment debate

There’s been ongoing patent dispute between AVDL and Jazz Pharmaceuticals (JAZZ) regarding the Lumyrz formula.

JAZZ filed a complaint back in May FY21′ in a Delaware Court alleging that AVDL infringed upon five patents related to JAZZ’s competing narcolepsy drug Xyrem. JAZZ claimed that AVDL’s FDA application to market its own narcolepsy drug, under patent FT218 at the time, violates these patents due to the use of the same active ingredient, sodium oxybate. Xyrem generated $1.7 billion in net product sales for JAZZ in 2020 -74% of net product sales – and thus was a key factor for its growth route down the line.

On November 18th, 2022, the same Delaware Court ordered JAZZ to delist its patent from the FDA’s Approved Drug Products With Therapeutic Equivalence Evaluations list, better known as the “Orange Book”.

We suggest the FDA’s tentative approval and the Court’s decision represents a momentous upside catalyst for AVDL. It removes the overhang surrounding Lumryz and provides more clarity on the path to commercialization in our estimation.

This approval also confirms that the latest possible date for final approval of Lumryz is after the expiration of the REMS patent on June 17, 2023, approximately seven months from now. Upon final approval, AVDL will be poised to launch the label into what we believe is a market opportunity worth more than $3-$4.7Bn.

Therein lies the alpha opportunity for AVDL looking ahead in our opinion.

We encourage investors to keep active on this to ensure correct timing and the most upside capture.

AVDL technicals indicate more upside to come

We studied AVDL’s technical and market data in the absence of EPS upside looking ahead. Shares have retraced all of the downside that was priced in with the patent saga listed above.

After rallying for the past 3-4 months, the stock continues to set higher high’s and higher low’s. It has broken out above its previous resistance points, riding its 50DMA as support for the past 11 weeks.

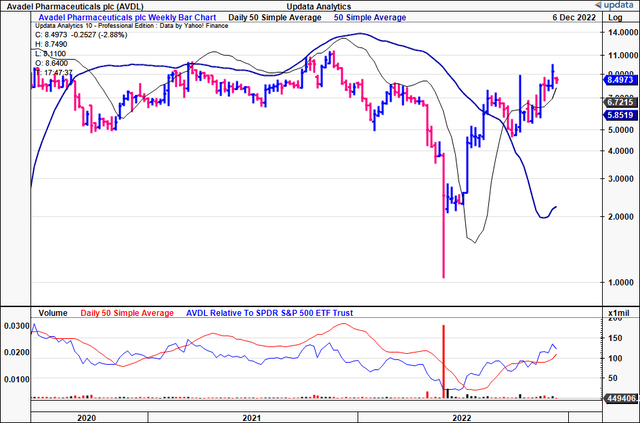

Exhibit 2. AVDL 18-month price evolution [weekly bars, log scale] – note the support from the 50DMA

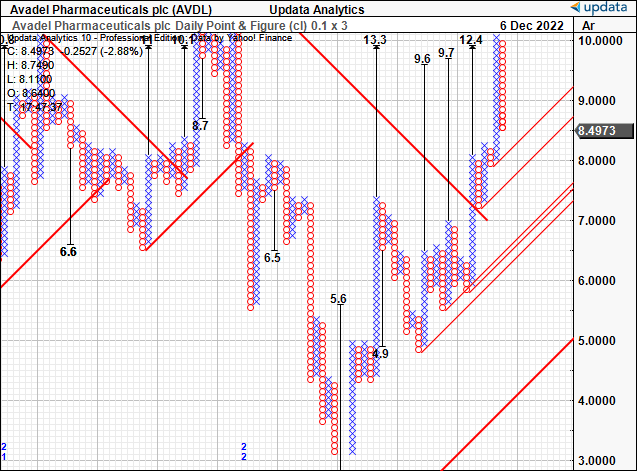

The above price action has transposed favourable onto our upside targets seen in the point and figure studies below.

We’ve got numerous upsides pointing to a range of $9.60-$13.30. The stock has broken out above a long-term resistance line as well.

It has also sent off multiple inner and outer support lines, each pointing to the ranges listed. We therefore seek our next objectives to $9.60, then c.$13.

Exhibit 3. Upside targets to $13

Data: Updata

In short

In that vein, we rate AVDL a buy and are seeking upside targets to $9.60 then $13 in this name. Whilst it will be a while before we see the pull-through of Lumryz into its financials, the market is already rewarding the future growth potential, and thus we advocate that current market levels make for adequate points of entry.

Be the first to comment