Nadya So

Investment Thesis

I think National Beverage (NASDAQ:FIZZ) will do just fine in a recessionary market. Although they might do just fine, I rate the stock as a Sell because the foreseeable future is uncertain, and the company isn’t generating cash like it used to. Without further announcements from management, I wouldn’t be too confident rating it as a Buy/Hold, so a Sell for now. However, I think the company is doing great in regards to innovations with new drinks and attractive packaging.

Winning PEOPLE’s Food Awards

Source – LaCroix Cherry Blossom photo by BusinessWire

In June 2022, one of National Beverage’s products, LaCroix Cherry Blossom, won the PEOPLE’s Food Awards 2022: The 65 Best Supermarket Products of the Year. The award was given to them by more than 150 testers from 32 states and rated nearly 1,300 new supermarket products to find the most delicious “best of the best.” This is great for the company because FIZZ has always pursued constant innovation in drinks and packaging. The award shows that they are successful with their innovations and may even create more award-winning flavors.

“We developed the distinctive taste and stunning packaging of to convey the Dazzling Taste of Spring! The PEOPLE award further confirms the acknowledged leadership and innovation of our LaCroix brand.”

As declared by a LaCroix spokesperson, it does confirm that this achievement was made possible because of their ability to innovate with new and creative flavors and drinks. FIZZ introduced the drink in March 2022. It is well-known because “It’s like spring in a can!” and is widely known for its light floral notes. I think the company also has good marketing because of its timing to release the Cherry Blossom drink and join the National Cherry Blossom parade, which I believe helped them attract consumers because of their floral design float. I think that if they continue to pursue constant innovation, it wouldn’t be surprising if they achieve another award. However, even if management is quick to adapt to economic conditions and is boosting dividends and results for FY2022, I still think that they can’t completely beat the macroeconomic situation if things get worse.

Recession Situation

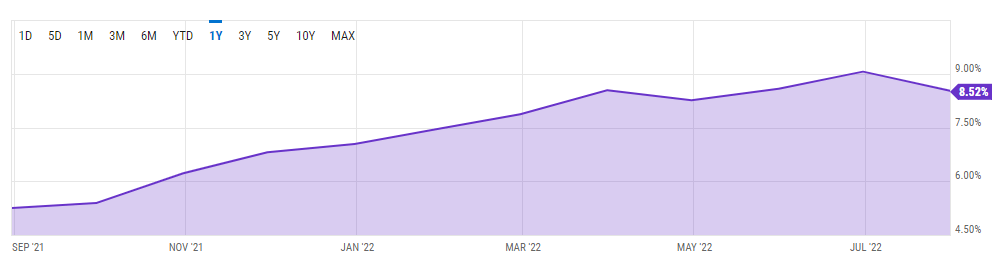

Source – Ycharts – US Inflation Rates

I think the recession will negatively affect FIZZ. The US inflation rate rose from 5.25% in September 2021 to 8.5% in July 2022, a 3.25% increase for the past 12 months. Prices start increasing, and consumer income doesn’t typically increase at the same rate as prices. In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation.

I’m not saying that FIZZ will lose all of its customers. What I’m trying to say is if the recession situation worsens, then the consumers will feel the impact, especially the ones in the middle class, and may cut spending money on non-essential products. I cannot predict the future and how the economy will turn out after a few months. However, I still think that FIZZ should be rated as a Sell. We are in a highly volatile economic situation. Without further announcements from management on how they would insulate themselves against potential inflationary pressures and how it would affect their consumers, there’s still an ounce of doubt for me to rate it as a Hold/Buy.

Financial Analysis

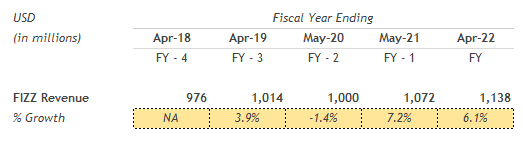

Source – Author – Data from SEC.gov

To start things off, FIZZ had a 7.2% revenue growth in FY2021 and a 6.1% growth in FY2022. This may be driven by increased product volume over the past year and the recent launch of their LaCroix Cherry Blossom. I think an excellent strategy by FIZZ is that they release new drinks spontaneously.

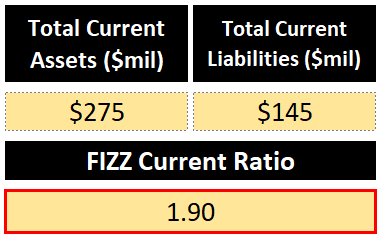

Source – Author – Data from SEC.gov

I believe this is a better strategy compared to releasing new beverages simultaneously. The company had $48 million in cash in FY2022, a 75% decline compared to FY2021. Although they have $275 million in total current assets and $145 million in total current liabilities, they still have a 1.90 (compared to last year’s 2.48) current ratio.

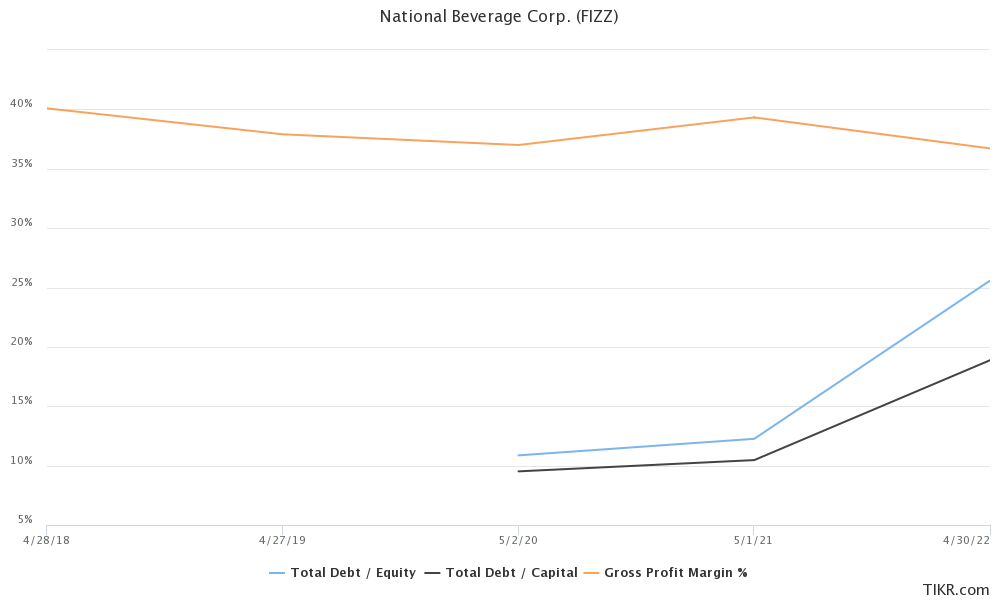

Source – Tikr – D/E – Total Debt/Capital – Gross Profit Margin %

FIZZ has been issuing debt for the past couple of years, and has just enough cash to cover its short-term expenses. The company has an irregular schedule of paying dividends, but they boast of paying a total of $6 dividends in both FY2021 & 2022. In the fourth quarter of FY2022, the company also recorded $1.70 earnings per share, the second highest EPS recorded by the company. The company has been consistent with its gross profit margin around 35-38%, although it has fallen by a percent or so in the past years.

Valuation

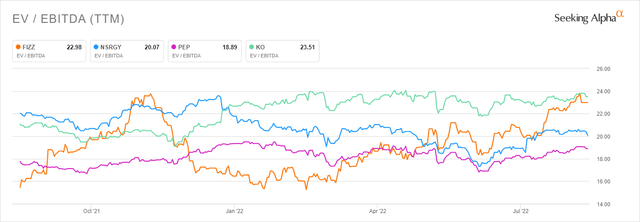

Source – Seeking Alpha – EV/EBITDA (TTM)

I use the EV/EBITDA multiple to determine if a stock is overvalued or undervalued. I chose competitors like Nestlé S.A. (OTCPK:NSRGY), a Swiss food and drink processing company; PepsiCo (PEP), an American food, snack, and beverage corporation; and Coca-Cola (KO), a carbonated soft drink company because I think that they would be appropriate comparables for FIZZ. The company is trading around 22x EV/EBITDA, higher than PEP and NSRGY, but trading closely with KO. It was trading around 15x on March 2022 and is presently trading around 22x today (which may be influenced by increased volume). However, I still think the stock is potentially overvalued since the company has been increasing its debt by over 40% in the past FY and isn’t generating as much cash as it did in the previous year.

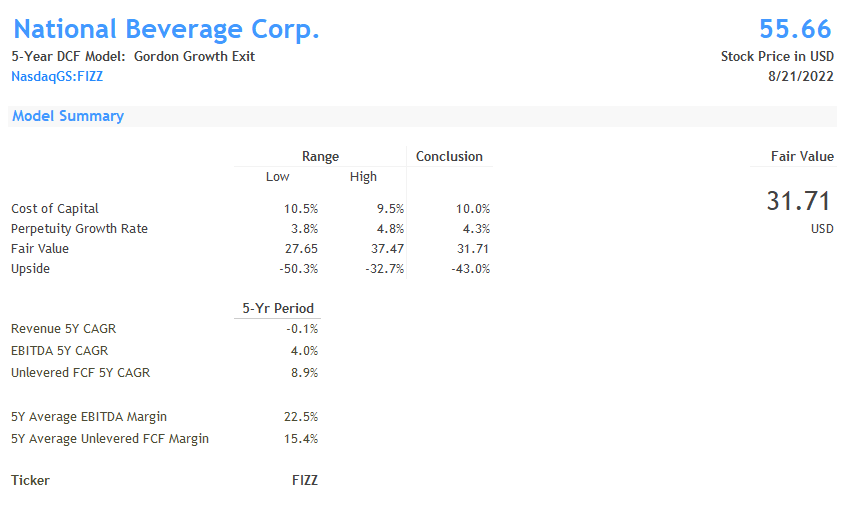

Source – Assumptions by Author Model from Finbox

The current fair value for FIZZ is $32, in my opinion, below FIZZ’s share price today, and can potentially mean that the stock is overvalued. Note that I used a 10% discount rate. If we use a discount rate of 7.5% (by calculating the WACC), the company’s fair value would be $53, which is still below what it’s currently being priced at today, leading me to rate the stock as a Sell.

Risks

I think the most crucial risk I can see with the company right now is the risk of weaker volumes. Beverage companies like FIZZ rely on their customers to spend money on their products. However, if the macroeconomic situation worsens, there might be a change in consumer spending caused by inflation which will significantly affect the company.

Investor Takeaway

I think FIZZ has much potential in the long run if the economic situation is much better. The company received an award for one of its products, but I don’t think it’s enough to say it’s worth investing in. The company has been growing its debt and hasn’t really been raising cash. The underlying risk of inflationary pressures can also negatively affect their business, similar to how it can affect the Beverage Industry as a whole. The current share price is above its fair value, leading me to rate the stock as a Sell. I’ll be glad to follow the stock for future updates and may have to revisit my rating if there are significant announcements, changes in the economic situation, or any updates that significantly affect the company.

Thank you so much for your reading, have a great day.

Be the first to comment