pcess609

Thesis update

This is an update to my original Autodesk (NASDAQ:ADSK) thesis.

Autodesk’s cloud-based design and engineering software continues to be the industry standard, and I continue to view the company as a market leader. With its advantageous market position and high customer retention rate, I believe ADSK will eventually achieve operating margins in excess of 40%.

Having said that, I am aware that F24’s top line could see a significant decline due to the cyclical nature of its end-markets, such as manufacturing and commercial construction.

Earnings update

Autodesk’s revenue was roughly the same as expected in the third quarter, and the company’s operating margin was about 40 basis points higher than expected. The stock dropped by 9 percentage points after-hours at one point, indicating that the market did not like the 3Q22 report. This, I believe, is due to investors’ negative reaction to a reduction in F23 billings guidance from 19.5% growth in 2Q to 17% growth in 3Q (a reduction of more than 250 basis points). The decrease in billings guidance is the result of a combination of weakening FX headwinds and a shift toward cash conservation by customers toward annual contracts rather than multi-year upfront deals as a result of the deteriorating macro-environment, according to management.

I am concerned about the recession-sensitivity of Autodesk’s end-markets due to the potential for increased cyclicality in industries such as manufacturing and commercial/residential construction. Despite this, ADSK reported strong renewal rates and stable net expansion in the third quarter, despite slowing new business growth in Europe and APAC and some softening at the lower end of the market.

Given the potential for further demand deterioration in cyclical end-markets and the depressing effect of FX, I anticipate the share price will remain under pressure for the foreseeable future.

Strategic updates

Due to strong subscription renewal rates and expansion activity among the company’s installed base, Autodesk delivered total revenue of $1.28 billion, which was in line with or slightly below consensus. Third quarter results for ADSK’s Americas region showed growth of 17%, which was 17% faster than growth in both EMEA and APAC combined.

Management noted strong new business momentum in N.A. and a slight deceleration in APAC, with the most pronounced relative slowdown in demand happening in EMEA. I’d like to point out that worsening FX headwinds and the knock-on effect of slower new business activity in EMEA are likely to be the culprit to blame for the 4Q guidance for 8% revenue growth, a drop of more than 5 points from 3Q23 projections.

Operating margin for Autodesk came in at 36.3%, an increase of 400 basis points from the same period last year. This was achieved through a combination of stable gross margin and continued cost control. A positive is that Autodesk maintained its FY23 operating margin guidance of 36%. Management has signaled that operating margin expansion may be negligible in F24 due to the effect of foreign exchange headwinds, but it is still committed to hitting its 38-40% operating margin target by F26 (a key focus for me). This is significant because it shows that management is making progress toward their goal, and that any short-term difficulties caused by FX will be temporary.

In addition, Autodesk said it has received approval for a $5 billion buyback, which will help it mitigate the impact of the SBC dilution in the upcoming quarters.

Valuation

Price target update

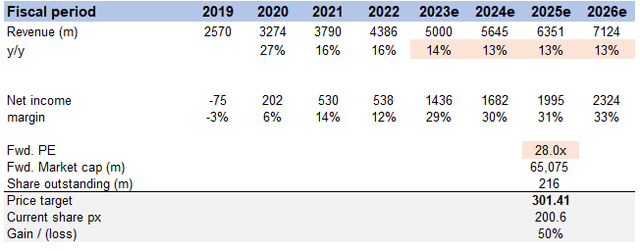

My updated model still suggests upside for ADSK – a price target of ~$301 or ~50% upside from today’s share price of $200.6. The key change to my model is to reflect the increase in valuation multiple.

Conclusion

As of right now, ADSK is still a promising investment opportunity in my book. In particular, the company is capitalizing on a growing sector of the economy that is experiencing robust secular tailwinds, namely the increasing digitization of the building sector. In a similar vein, I believe that Autodesk’s extensive portfolio of AEC applications and sizable installed base will provide the company with sustainable competitive advantages, eventually leading to operating margins in excess of 40%. However, in the wake of the global pandemic and an increase in interest rates, I am worried about the short-term health of the company’s end-markets, particularly commercial construction.

Be the first to comment