gorodenkoff

Thesis

Aurora Innovation (NASDAQ:AUR) stock surged as much as 25% on Friday, 2nd September, after a company-internal memo hinted on Apple (AAPL) and Microsoft (MSFT) as potential acquirers of the company. Although the named potential suitors have yet to announce official interest in Aurora Innovation, I believe investors are right to speculate on a favorable M&A catalyst for AUR stock. In my opinion, as the market for self-driving technology is likely to enter commercialization stage, the sector will likely see increased consolidation. And Aurora Innovation appears like an attractive target – now being down about 85% from all-time highs (80% YTD) and valued at a market cap of only about $2.4 billion, despite $1.2 billion of net-cash.

About Aurora Innovation

Aurora Innovation is a California-based self-driving technology company, that was founded in 2017 by Chris Urmson, who previously led Google’s self-driving business Waymo. In late 2020, Aurora Innovation took over Uber’s (UBER) self-driving business and an investment from Uber of $400 million in exchange for an equity stake of about 26%. In addition, the deal incorporated the agreement that Aurora’s self-driving technology, if successful, will/may be used by Uber’s ride-hailing platform. Notably, Aurora Innovation has so far also partnered with Nvidia (NVDA), which will provide the necessary chip technology for Aurora’s self-driving technology, and Toyota. Aurora Innovation went public late 2021 though as SPAC deal that valued the business at more than $13 billion.

Challenging Market…

Investors should consider that although self-driving technology is still in its early stages, the competition is already very tough. Notably, Aurora Innovation competes with General Motor’s (GM) Cruise, Tesla (TSLA), Google’s (GOOG) (GOOGL) Waymo and Intel’s (INTC) Mobileye.

Moreover, in the current macro-environment, pressured by rising interest rates, slowing consumer confidence, international tensions, and falling asset prices, companies and individual investors are increasingly reluctant to speculate on emerging technologies and long-duration bets – as evident by the sharp sell-off of growth stocks YTD.

In June this year, Tesla (TSLA) made headline as the company decided to cut about 200 jobs in its autopilot business. Shortly afterwards, Tesla’s head of A.I., which includes the self-driving unit, resigned.

…But Approaching Commercialization

Despite the challenges, the commercialization of autonomous driving is not a question of ‘if’, but of ‘when’. And there are good reasons to be optimistic.

On August 8th, China’s tech/internet giant Baidu (BIDU) received a permit to operate China’s first-ever fully driverless robotaxis in the cities of Wuhan and Chongqing. Similarly, also Google’s Waymo has already started to offer fully driverless rides.

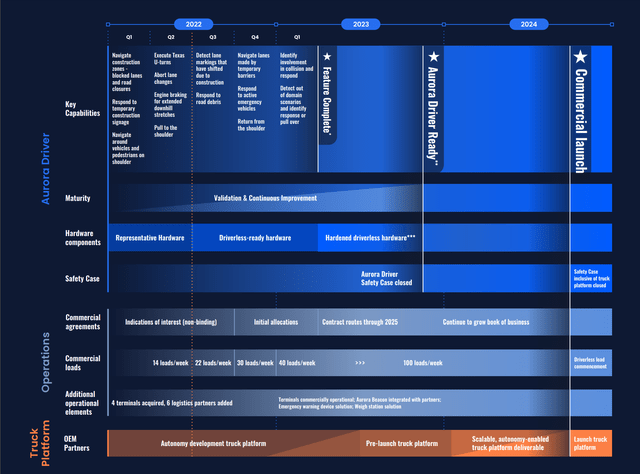

Aurora Innovation itself has said to ‘see a clear path to a driverless future’. And the company estimates that it may manage to deliver ‘Aurora Driver’ in the first quarter of 2023, a technology that is expected to incorporate all capabilities necessary to operate without policy intervention, whereby policy interventions are defined as:

An action our operators take to pre-emptively disengage the Aurora Driver when we know it is not yet capable of confidently navigating a particular scenario.

Commercialization is expected to start in late 2024.

Chris Urmson’s Memo

Aurora Innovation’s cash-burn rate is approximately $100 to $150 million per quarter. And thus, given the company’s net-cash position of about $1.24 billion, Aurora Innovation’s current business expenses (excluding any CAPEX or strategic investments) could conservatively be supported until late 2024. This is a very stretched calculation to plan until the business’ commercial launch of Aurora Driver, in my opinion, as there is little margin for error.

Accordingly, management has reflected on potential options to extend the company’s runway and ‘to stay competitive in a challenging marketplace‘. In a memo seen by Bloomberg, Urmson hinted on cutting costs (1) selling assets (2) and pursuing a small capital raise (3). But what the market focused on most was arguably the possibility of a sale to a strategic buyer (4). Reportedly, Urmson wrote:

Given our current stock price we should be an appealing target for any entity looking to own the future of automated driving. Of potentially appealing landing places, there are only a few: Apple, Microsoft, or potentially a Tier 1.

The trading day following the news, AUR stock closed more than +15%, while other growth assets sold-off sharply. For reference, Cathie Wood’s Ark Innovation ETF (ARKK) lost -2.71%.

Investor Implication

In my opinion, self-driving technology is one of the most exciting commercial opportunities of the next decade. Accordingly, I am not surprised that almost all major tech/auto companies have shown ambitions in this market, including Apple, Microsoft, Google, Tesla, General Motors (GM), Volkswagen (OTCPK:VWAGY), Nvidia, Intel, Baidu and Alibaba (BABA).

As the market for self-driving technology is likely to enter commercialization stage, the sector will likely see increased consolidation. Aurora Innovation is a smaller player, but an attractive asset for acquisition, I argue. With reference to CEO Urmson’s memo, the named potential acquirers Microsoft and Apple have yet to announce official interest in Aurora Innovation. But the memo highlighted that management is open for a sale. This, in my opinion, should justify investors speculating on a favorable M&A catalyst for AUR stock.

I recommend a speculative buy and set a $3.10/share target price, reflecting a 30% acquisition premium.

Be the first to comment