Justin Sullivan/Getty Images News

Despite a rough couple of years for investors in entertainment and telecommunications conglomerate AT&T (NYSE:T), the market finally seems to believe that the worst for the company is past it. I say this because, following the final spinoff and merger of WarnerMedia with Discovery to create Warner Bros. Discovery (NASDAQ:WBD), shares of both companies appreciated nicely. Shares of AT&T, adjusted for the spinoff, increased by 7.7% in just one day. And shares of WarnerMedia increased by 1.4%. This enthusiasm could very well wane in the near term. But when evaluating the fundamental condition of both entities, it’s clear that value still exists for long-term investors. This is not to say that the value opportunity is the same for both businesses. Clearly, the greatest opportunity seems to be with those focusing on AT&T. But now that we have a better understanding of what Warner Bros. Discovery will look like and how the market received the new standalone entertainment business, it appears as though some upside might exist there as well.

AT&T stock is still drastically undervalued

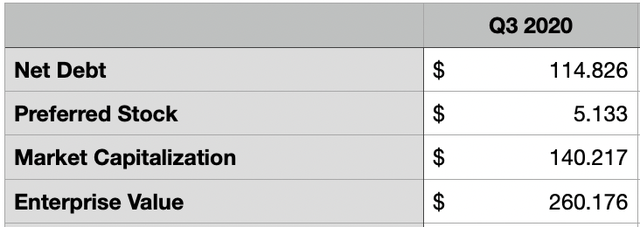

As I wrote in a prior article, AT&T still looks to be a significantly undervalued business following its spinoff of WarnerMedia. Drawing on some analysis I conducted following the release of the company’s 2021 financial results, I have come to conclude that shares offer tremendous upside for long-term investors. Based on the current data available, adjusting for the compensation the business received from its spinoff, it should have net debt on hand of about $114.83 billion. The business has another $5.13 billion in preferred stock and its market capitalization as of this writing is $140.22 billion. Combined, this gives us an enterprise value for the company of $260.18 billion.

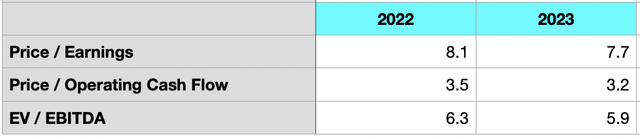

As management detailed previously, the business should generate EBITDA of around $41.5 billion for its 2022 fiscal year. This should increase to $44 billion in 2023. Meanwhile, operating cash flow should be about $40 billion this year and it should climb up to $44 billion next year. Taking these figures, shares of the conglomerate look to be quite cheap. Even after experiencing some upside following the completion of the spinoff, the business is trading at a price to operating cash flow multiple, using its 2022 estimates, of just 3.5. This drops to 3.2 if we rely on 2023 estimates. Meanwhile, the EV to EBITDA multiple for the company should be about 6.3 for 2022, with that figure dropping to 5.9 next year.

Perhaps the best company to compare AT&T to right now would be Verizon Communications (VZ). At present, Verizon is trading at a price to operating cash flow multiple of 5.7. This number is actually forecasted to increase to 5.8 on a forward basis. Meanwhile, the EV to EBITDA multiple of the company looks to be 8.9. The forward reading for this is 8.1. To put this in perspective, using the 2022 forecasts for AT&T and comparing them with the more conservative multiples for Verizon, we would get implied upside for shareholders of AT&T of between 54.2% and 62.6%.

Warner Bros. Discovery isn’t bad either

Although I firmly believe that AT&T is where the true opportunity lies, I have become more bullish on Warner Bros. Discovery. For starters, shares at the company don’t look all that pricey. In documents prepared leading up to the spinoff and merger, it was calculated that pro forma revenue for Warner Bros. Discovery would be $45.53 billion. Although the company would generate a net loss of $3.01 billion, its EBITDA would be $10.85 billion. Using EBITDA less interest expense as a proxy for operating cash flow, this metric would be about $8.26 billion on a pro forma, normalized basis.

At present, the net debt of the business should be about $46.68 billion, while its current market capitalization is $59.45 billion. This implies an enterprise value of $106.13 billion for the company. Using the aforementioned estimates, Warner Bros. Discovery is trading at a price to operating cash flow multiple of 7.2 and at an EV to EBITDA multiple of 9.8. Comparing it to other companies in this space is a bit challenging. For instance, we need to only look at two firms to illustrate how difficult a relative valuation is. One of these examples would be Netflix (NFLX). This pure-play streamer has done well for itself over the past several years. Having said that, operating cash flows are inconsistent. What becomes a little easier to look at though is EBITDA. Based on my calculations, this figure totaled $18.63 billion last year. That implies an EV to EBITDA multiple on the company of 8.8. Another player that has done extremely well in the streaming space has been The Walt Disney Company (DIS). But it acts as a diversified entertainment business with theme parks and other assets that are unrelated to streaming. It’s also recovering still from the COVID-19 pandemic, so cash flows and EBITDA are not exactly what I would call normalized at this time. Even so, the price to operating cash flow multiple of the company should be 47, while the EV to EBITDA multiple is 32.9.

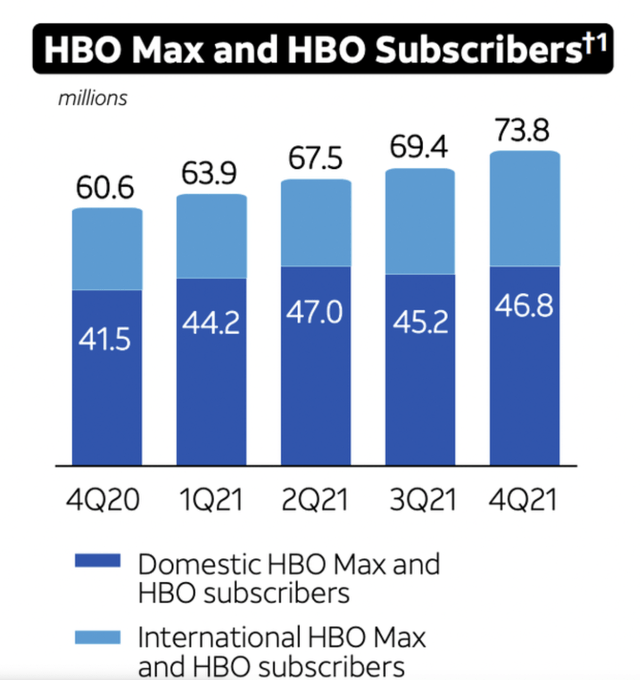

Ignoring the relative valuation, as a general rule of thumb, the current multiples that Warner Bros. Discovery is trading at should be considered attractive. On top of this, while I do not expect the company’s HBO and HBO Max streaming operations to be anywhere near as attractive as what Disney and Netflix have, there is a clear path forward to additional value creation. Back in the final quarter of the 2020 fiscal year, HBO and HBO Max had 60.6 million global subscribers, with 41.5 million of them in the domestic market. By the end of 2021, these numbers had grown to 73.8 million and 46.8 million, respectively. Prior to spinning off the asset, AT&T forecasted that they would have between 120 million and 150 million subscribers on the platform by the end of 2025. This was up from a prior expected range of between 75 million and 90 million. Deutsche Bank, meanwhile, estimates that the service could have as many as 194 million by the end of 2026.

It’s also important to note that Discovery seemed to be doing well even before the merger with WarnerMedia. Between 2017 and 2021, the company grew its revenue from $6.87 billion to $12.19 billion. This came despite revenue declining from $11.14 billion in 2019 to $10.67 billion in 2020. The company went from generating a net loss of $337 million in 2017 to generating a profit of $1.01 billion last year. Though it is worth noting that 2021 marked the third year in a row in which profits dropped. Operating cash flow grew over the past five years from $1.63 billion to $2.80 billion, while this figure, excluding changes in working capital, grew from $3.52 billion to $6.04 billion. But again, the company has not quite fully recovered from the pandemic, with 2019 marking the high year for both of those metrics. For better or worse, investors in Warner Bros. Discovery should anticipate the same management that drove some of these actions to remain in control of the business now. Reportedly, Andy Forssell, the head of HBO Max, and Ann Sarnoff, WarnerMedia’s head of studio/networks operations, have both left the combined business. This largely leaves Discovery personnel in charge of the business.

Takeaway

As an opening salvo to a new day, investors should be pleased with the performance achieved by AT&T and Warner Bros. Discovery. However, future volatility will almost certainly occur just like it will for any other business. Having said that, I do believe that value still exists with both of these businesses. Though investors may be tempted by the growth prospects of Warner Bros. Discovery, I do think that the strongest value proposition still exists with AT&T. That is why I intend to sell off my shares of Warner Bros. Discovery and buy additional shares of AT&T.

Be the first to comment