Brandon Bell

(Note: This article was in the newsletter on October 20, 2022.)

The response to the AT&T (NYSE:T) third quarter report by the market shows just how overblown the worries were about the future of the company. Mr. Market tends to assume that a bad quarter will be followed by more bad quarters (especially with the history of this company). Then there is the additional part of the market that figures a stock has to be bad if it goes down. Combined these two groups and additional worries really made a bargain level stock for those that had the nerve to take advantage of the situation.

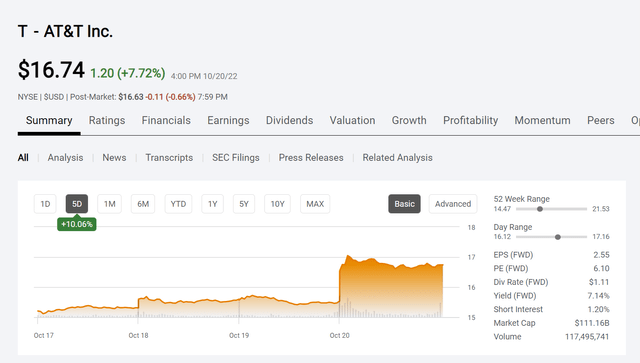

AT&T Inc. Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 20, 2022)

It takes a lot of volume from a slew of surprised large investors to make the kind of stock price movement that happened on October 20, 2022. It just goes to show how many large investors were expecting the worst. So, the surprise earnings announcement led to a complete re-evaluation of the future.

One of the things management emphasized during the conference call was that the capital budget was heading down. The initial budget previously surprised the market combined with lower-than-expected cash flow. So far, management is sticking with some of the original goals for next year despite market worries about a recession. There is likely to be more clarity at the yearend report.

All of this points to how Mr. Market can go overboard worrying about a turnaround early in the process before the various statements have had time to cleanup from whatever caused the turnaround in the first place. For individual investors that realize a company of this stature, with the debt rating it has, is very likely to turnaround. Therefore, there is a contrarian investment opportunity that is likely to prove to be very profitable.

Actions Behind The Numbers

Management has stressed that much of what the market will see actually began a few years back. Turnarounds in large companies take time. So, the initial moves may have been clouded by all the divestment news at the time.

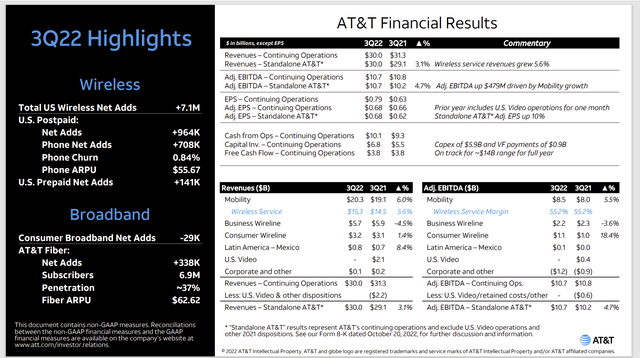

AT&T Operational Results Third Quarter 2022 (AT&T Operational Results Third Quarter 2022)

Management probably tried several things before coming up with the “winning formula” because quite a few things got ignored in the acquisition process. That meant that the turnaround probably was not noticeable for some time. The decision to focus the company on the remaining business (as well as deciding the remaining business to focus on) was made at the same time the decision was made to divest noncore businesses. The fact that it took this long to show results to shareholders shows the depth of the challenges faced by the company when the new CEO took over.

The other thing that management noted is that free cash flow should pick up the pace from here. That took considerable worries away about the future of the dividend. When cash flow decreased last quarter, the first thing that came out was debt worries and dividend cuts. But it really was much too early to be able to tell whether the cash flow issues were permanent or transitory. Right now, it appears the issues are transitory.

Free Cash Flow

Free cash flow is the remaining worry that may flare up again.

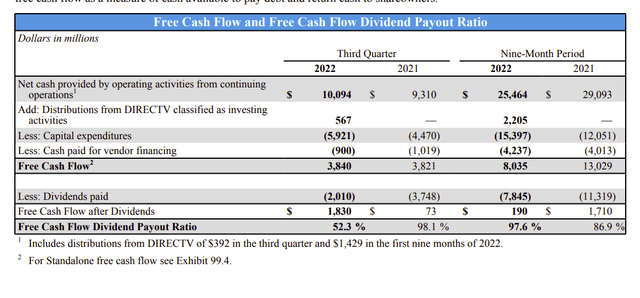

AT&T Free Cash Flow Calculation (AT&T Third Quarter 2022, Earnings Report)

The reason is shown above. The market has long been worried about repaying a considerable debt load. The year-to-date numbers do not exactly inspire confidence even though the quarterly number is headed in the right direction.

Therefore, management needs to demonstrate that free cash flow will continue to grow to not only provide the nice cushion for dividends shown above, but also to properly handle the debt balance. Obviously, Mr. Market wants a lower debt ratio and probably lower debt as well. But the nice thing about an upside surprise is the market will likely expect a continuation of the positive trend established above.

That should allow for the common stock price to be maintained at a more reasonable level. Management noted that the business can grow quite a bit in the future. But until that is demonstrated for a few quarters, the market is liable to be on pins and needles.

This is often why the beginning part of a turnaround story, or a cyclical recovery is volatile. The market has little to no faith in the future until there is a history that the market can rely upon. Expect Mr. Market to swing to extremes until there is a track record that the company will be meeting its new goals for what is left of the company.

The Future

Management expressed confidence in having the right formula to grow the wireless business. But the last quarter clearly caused a market scare and sent the stock price tumbling. Management admitted during the conference call that they have work to do to restore the market faith in their abilities.

Personally, I still believe that this stock has a bright future from the post-spinoff price. So, there is ground to be “made up” plus potential appreciation potential. I also think that there will be room to raise the dividend once the debt issues have been handled to the satisfaction of the market.

Management has repaid a fair amount of debt. But management also received a fair amount of cash in the divestment transactions. From here on in, management needs to prove the remaining business can be an investment grade going concern with a good future. This quarter erased a lot of market worries. But those worries are likely to return with the least little perceived stumble.

The major market worry now would be the effect of any potential recession on the company business. Management did feel that the business is recession resistant. This is yet another thing the market will want demonstrated now that only the core businesses remain.

Management has noted some joint venture deals and is exploring growth ideas for the future. For now, the company has a lot on its plate. But it is clear that revenue and profit can grow from current levels to provide decent cash flow.

At the current yield, shareholders receive a dividend that represents a yield just short of what the average investors makes long term. The stock price only needs to average about a 1% or 2% return to get to that average return. Yet this stock offers recovery potential to at least $20 and then probably some growth possibilities after that. The risk with a company this large is very low because the market really has assumed the worst for some time.

Mr. Market is only now beginning to hope for a better future. That is probably a very easy target for a management that began the turnaround story a few years back.

Be the first to comment