Toby Jorrin/Getty Images News

Margins And Cash Flow Yet To Improve

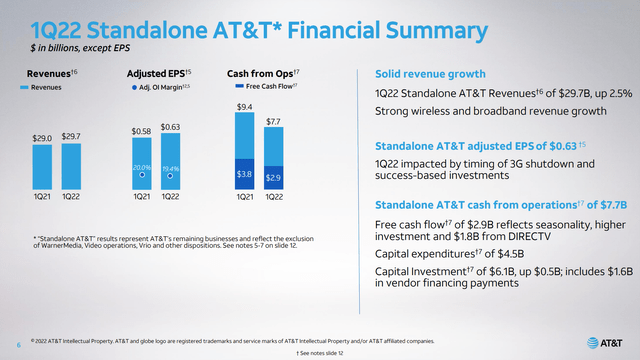

I last covered AT&T Inc. (NYSE:T) after their Analyst Day in March. At that time, the company provided 2022 guidance. The key numbers were EPS of $2.44 (1% growth vs. 2021), EBITDA of $41.5 billion (3% growth), and free cash flow of $16 billion (17% decline, due to higher capital spending). Note, all estimates here are midpoints of the stated range and exclude WarnerMedia for all periods. With the 1Q results recently out, AT&T made no updates to guidance. At first glance, the results look a little concerning as the 1Q numbers (except for revenue) came in at less than 25% of the yearly guidance.

AT&T 1Q 2022 Earnings Presentation

In addition to these numbers, EBITDA ex-WarnerMedia came in at $10.2 billion, also below 25% of the yearly forecast. Despite the improving revenues, costs continued to increase. Operating margin declined to 19.4% from 20% last year. Mathematically, AT&T must improve over the next 3 quarters to hit the full-year guidance.

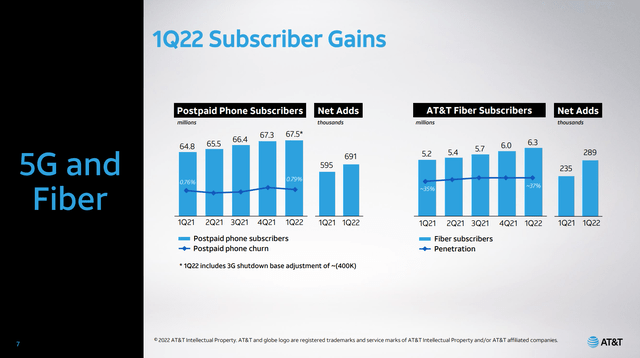

There is reason for optimism based on subscriber growth in wireless and fiber, both of which are being accomplished without using promotional pricing. This avoids shocking the customer with a big increase after a promotional period, keeping churn to a minimum. The growing customer count spreads fixed costs over a wider base which will improve margins. Additionally, some one-off expenses such as the shutdown of the 3G network will not recur in future quarters.

Given these likely improvements, it is not surprising for the stock to be up about 4% by the end of the earnings call. Still, at $20.25 it is valued at 8.3 times 2022 earnings compared to Verizon (VZ), which is now at about 10.2 times. Although some of the valuation gap has closed since my March article, AT&T is still about 18% cheaper despite its improving balance sheet, higher dividend yield, and similar growth prospects. This gap will probably not close all at once, but it provides a little capital gain potential on top of the dividend for long-term investors.

Subscriber Growth And Cost Savings

AT&T continues to benefit from their marketing strategy of “everyone gets the best deals” instead of offering discount prices to new customers only to raise them after the promotional period. In wireless, the 691,000 adds in 1Q is the best result in over 10 years. Since customers are not shocked by their promotional rate expiring, churn has been consistently low in the 0.7%-0.8% per month range. On the fiber side, in January the company rolled out simple pricing plans that also avoid promotional rates. As discussed on the earnings call, in many markets the price is about $10 per month higher than the promotional rate offered by cable companies, but without the massive price hike after 12 months:

We’re getting rid of promotional pricing; it is a pain point for customers. They hate it. They hate the 12-month mark. And when they’re using another service, that 12-month mark means their price is going up $15 or $20, and that’s just a really bad thing for a customer. And so now we put out a very simple, straightforward constant price, where the customer isn’t going to see that step up in 12 months. They know what the equipment pricing is on the front end. They’re getting the square deal. They’re getting a great product. And they’re (happy as) clams and it shows in the data.

Source: CEO John Stankey, AT&T 1Q 2022 Earnings Call

AT&T 1Q 2022 Earnings Presentation

The subscriber growth in wireless helped the Mobility segment (about 2/3 of total company sales ex-WarnerMedia) increase revenues by 5.5% compared to 1Q 2021. Margins declined in Mobility in 1Q and segment EBITDA declined from $8.1 billion to $7.9 billion. However, this is explained by the $0.3 billion cost of shutting down the 3G network. This cost will not recur in future quarters, so the revenue growth in Mobility will flow more to the bottom line. The company is also continuing its efforts to reduce operating costs by $6 billion per year by 2023 compared to 2020. As discussed at the March analyst day, these efforts include shutting down a significant portion of its legacy copper network, consolidating the number of services offered and billing systems, reducing the number of data centers, moving applications to the cloud, and reducing real estate footprint as more employees work from home. Management now expects to have delivered $4 billion of this $6 billion savings by the end of 2022.

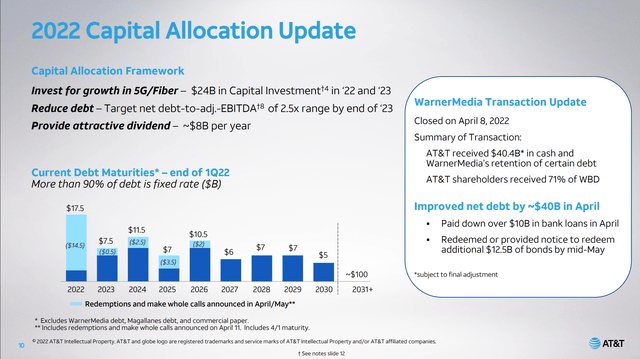

Capital Management

AT&T’s standalone free cash flow of $2.9 billion in 1Q is also below ratable delivery of the full year plan of $16 billion. 1Q is historically a seasonally low quarter for free cash flow and many of the factors impacting free cash are not expected to repeat. Management reiterated the Analyst Day guidance of free cash flow of around $16 billion for the year on a standalone basis. The new $0.2775 quarterly dividend amounts to $7.95 billion commitment for the next 4 quarters, or just under a 50% payout ratio. As revenue grows and the capital spending plan slows down in future years, FCF should increase to $20 billion in 2023 and $24 billion in 2024 based on the March analyst day presentation. This brought up the question of dividend growth on the earnings call, but management did not make any commitments, reserving the possibility to do buybacks or additional growth projects if those are the best options to increase total shareholder return.

Debt reduction is another metric that looks disappointing when viewing 1Q by itself. This is largely due to the $9.2 billion spent on spectrum in the quarter. Taken with last year’s $22 billion, AT&T now has the spectrum needed to expand mid-band 5G service. Looking forward, the picture looks much better as the company received $40.4 billion in the WarnerMedia spinoff. Already, the company has paid off $10 billion short-term bank loans and has begun early redemption of $12.5 billion of bonds. AT&T is on track to reach its 2.5 net debt/EBITDA ratio target by the end of 2023.

AT&T 1Q 2022 Earnings Presentation

Valuation

At a share price of $20.25 at the time of writing, AT&T stock is trading at a P/E of $20.25/$2.44, or 8.3. This is an increase from 7.14 at the time of the March Analyst Day. The dividend yield is $1.11/$20.25, or 5.5%.

Compared to Verizon’s share price of $55.33, annual dividend of $2.56, and EPS estimate of $5.44, Verizon has a dividend yield of 4.6% and a P/E of 10.2. AT&T is cheaper than Verizon by about 18%.

Verizon also has similarly low growth prospects based on consensus EPS estimates. EPS growth is forecast at 1% in 2022 and 3.5% in 2023. AT&T’s growth guidance from the analyst day is 1.2% in 2022 and 4.5% in 2023. AT&T’s relative debt picture has also improved. Verizon had net debt/EBITDA of 3.9 last quarter. Following the spinoff transaction, AT&T has net debt/EBITDA of $129/$41.5, or 3.1.

In March, I suggested the undervaluation of AT&T was mainly based on mistrust of forecasts based on poor historical performance. Since then, the valuation gap has begun to close, but with the 18% gap remaining, AT&T still looks attractive.

Conclusion

AT&T still has some work to do this year to increase margins and improve free cash flow. The continued subscriber additions in wireless and fiber provide optimism, along with the ongoing $6 billion cost savings program and absence of one-time expense to shut down the 3G network.

The company can easily cover the new dividend rate of $1.11 per share, which is about 50% of the free cash flow plan for 2022. FCF should improve in 2023 based on income growth and further in 2024 as the capex plan slows down. This gives the company flexibility to resume buybacks, do more growth projects, or increase the dividend.

AT&T’s EBITDA is now within 10% of Verizon’s, and leverage is lower as measured by net debt/EBITDA. AT&T’s projected 1.2% growth in 2022 and 4.5% in 2023 is nothing spectacular but still above what is expected for Verizon. The valuation discount to Verizon has improved to around 18% from 25% at last month’s analyst day. However, the stock is still cheap enough to own for its attractive dividend and potential for further closing of the valuation gap.

Be the first to comment