wdstock

AT&T’s (NYSE:T) stock has been battered since the WarnerMedia spinoff. After an initial pop, shares are now down by more than 30% from AT&T’s post-spinoff high. The broad market selloff has decreased AT&T’s stock price to absurdly low levels. Remarkably, AT&T’s badly beaten stock is trading at just 5.8 times this year’s EPS estimates. Moreover, the company’s dividend yield of 7.45% now greatly exceeds its P/E ratio, making AT&T’s valuation ridiculous. While the company faces several hurdles in the near term, AT&T has long-term growth prospects and significant earnings potential. As one of my favorite investors, Benjamin Graham, said – “In the short run, the market is a voting machine, but it’s a weighing machine in the long run.” AT&T should show significant progress in the coming years, and its share price will likely appreciate considerably as the company advances.

Trading Like It’s Going Out of Business

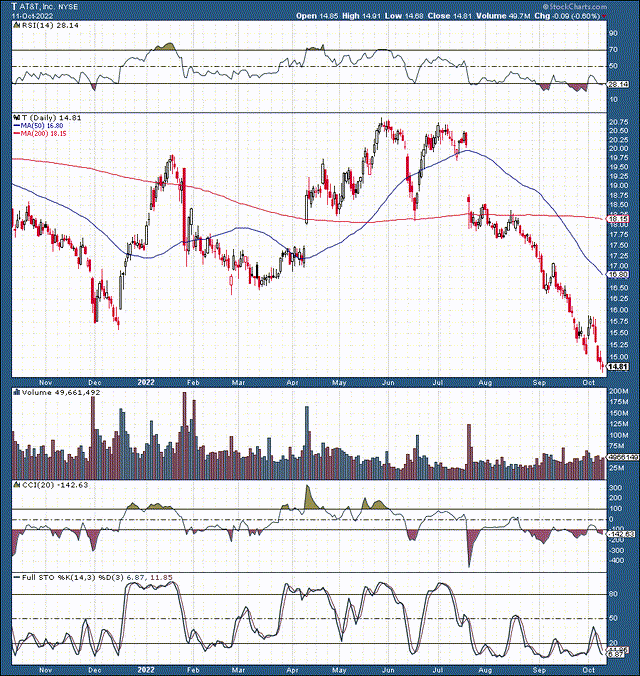

AT&T 1-Year Chart

I didn’t get the memo if AT&T is going out of business. Yet, the stock is trading like the company is going under soon. We see a sharp move lower post the mid-August broad market top. Investors are selling AT&T off as if it is an unprofitable growth stock, but AT&T generates billions in profits and now pays a dividend of roughly 7.5%. The stock is remarkably oversold, as the RSI has been around or below 30 for nearly three months. However, we are seeing the CCI make higher lows, implying that technical momentum is improving and stabilization followed by a bullish reversal could come soon. The full stochastic has also been depressed for months and appears ready to turn higher, suggesting a change to a more positive momentum flow.

WarnerMedia Spinoff A Big Relief for AT&T

Since the post-WarnerMedia spinoff highs, enthusiasm has faded, and AT&T has dropped by more than 30%. However, during all of the broad market pessimism in recent months, the benefits of the spinoff got lost. I never understood a telecom giant’s business in running an entertainment empire. There was an enormous corporate culture gap between the two companies, and the merger became a disaster for AT&T shareholders. AT&T disregarded WarnerMedia’s management efforts to improve the situation and spun off the media empire for about half of what it paid in 2018. While that’s abysmal management on AT&T’s behalf, this story has a positive side.

AT&T no longer needs to worry about managing a complicated merger with a media giant like Time Warner. AT&T has a relatively simple business and should stick to what it knows. Now that the WarnerMedia distraction is out of the picture, AT&T can focus more on providing wireless networks, cell phone services, internet, digital television, and landline communications to its nearly 200 million customers worldwide. While AT&T is present in numerous countries, its primary business remains in the U.S., and AT&T remains King.

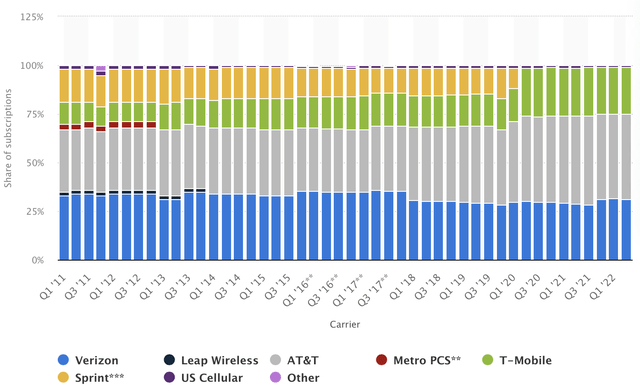

Wireless Subscriptions Market Share by Carrier in the U.S.

AT&T market share (Statista.com)

AT&T used to trail Verizon (VZ) in its core wireless segment, but not anymore. Today, AT&T is the clear leader in the U.S. with a whopping 44% market share vs. Verizon’s 31%. AT&T’s market share has expanded considerably in recent years, and this positive could persist as the company moves on. Moreover, AT&T has significant growth plans, and the company’s strategy should pay off in the coming years. Also, I want to highlight that Verizon trades at a forward P/E ratio of 7 here, also ultra-low but roughly 21% higher than AT&T’s now. If AT&T had a forward P/E ratio of 7, its stock would be at $18 now. If AT&T’s P/E ratio expands to a more typical 9-10 range, the stock will be trading at around the $23-26 range.

Long-Term Growth Potential

AT&T is entering a new era where the company is not burdened by the crushing weight of the Time Warner deal. AT&T is now a more straightforward, leaner, and more efficient company. The company can now focus on becoming America’s top broadband provider. Moreover, AT&T can increase focus on the most significant growth areas, 5G and fiber. AT&T plans to double its fiber footprint to 30-plus million locations and intends to add 3.5-4 million customer locations each year. AT&T wants to expand the nation’s best and most reliable 5G network to cover more than 200 million people by 2023.

AT&T is also focusing on cutting costs. By year-end 2023, the company expects to reach $6 billion in run-rate cost savings. In 2022 and 2023, AT&T expects an additional $2.5 billion in cost savings, which will increasingly fall to its bottom line. AT&T will increase investment to deploy fiber and 5G, which should drive sustainable earnings growth. AT&T expects capital investment in the $24 billion range in 2022 and 2023. In 2024 capital investment should decrease to the $20 billion range and lower in future years. For 2023 the company expects EBITDA of approximately $44 billion and adjusted EPS of $2.50-2.60.

The Valuation – Now Ridiculous

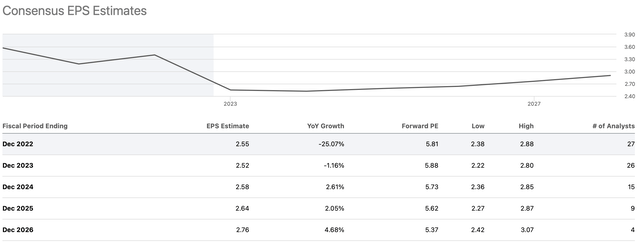

If we take the mid-point of AT&T’s 2023 EPS estimates, we arrive at an EPS of $2.55. Consensus analysts’ forecasts for the 2023 midpoint estimate is $2.52. Higher-end analysts’ EPS estimates go up to $2.80 next year.

Here’s a snapshot of what kind of earnings we may see ahead:

EPS Estimates

EPS estimates (seekingalpha.com)

Don’t mind the slope or the 25% EPS decline. This disconnect is due to the WarnerMedia spinoff and is not indicative of AT&T’s core business performance or profitability. Looking at the estimates, we see that $2.60 is a realistic EPS goal for next year. AT&T’s stock was trading at $14.80 recently, implying that its forward P/E multiple may be around 5.7/5.8. This valuation is remarkably low and provided that the broader market recovers or that AT&T illustrates a degree of outperformance, its multiple can expand, and the stock price can go much higher. I also need to outline that provided this ultra-low valuation the downside is probably minimal here.

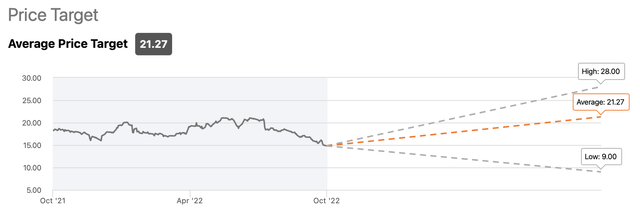

What The Analysts Think

Wall St. Price Targets

Price targets (seekingalpha.com )

The consensus 1-year price target for AT&T’s stock is $21.27, roughly 44% above current levels. My one-year price target is $20, roughly in the consensus range, representing considerable upside from current depressed, undervalued levels. Additionally, as the company advances and becomes more efficient in future years, it can increase revenues and improve profitability, enabling its multiple to expand and potentially driving the stock price considerably higher. However, a management shake-up could be one key driver of a leaner and more efficient AT&T.

A Note For The Board – Stankey Should Go

It’s no secret that I am not a fan of John Stankey. Would you believe that John Stankey took home $25 million in compensation from AT&T last year? How about retired CEO Randall Stephenson taking home $16.3 million last year, down from $29 million in 2020? Other top managers also made many millions in recent years. What are these guys getting paid so much money for? $25-30 million a year are huge compensations, and as a shareholder, you’d expect something in return (positive). Instead, we get a botched Time Warner deal and a stock price down by 45% over the last five and ten years.

In my view, Stephenson’s showing as CEO was disgraceful. He presided over the mismanaged Time Warner merger and showed no ability to innovate for many years. Stankey has been a top manager at AT&T for years and has held various top management positions in the telecom industry since about 2000. What innovation can he bring to the company besides maintaining the status quo?

AT&T needs some new blood at the top, and I think an outside management change would be highly welcomed. If AT&T can bring in a new CEO that has managed to turn a big company around in the past, the stock would probably react very favorably. We can probably see notable multiple expansion and a significant rally if a top-level management change occurs at AT&T. How much longer can shareholders stand it? AT&T has considerable potential, but the heaviest element weighing down the stock may be the arguably ineffective management team running the stock price down for decades. I think the AT&T guys need to get their act together, or AT&T should find better management and move on without Stankey and his team. Moreover, I think AT&T’s valuation and stock price are this low because the market doesn’t believe in AT&T’s management.

Be the first to comment