Dmytro Varavin/iStock via Getty Images

Investment Thesis

Atkore (NYSE:ATKR) is a leading manufacturer of electrical products and safety products. Their product lines include electrical power systems, conduit, cable, installation accessories, metal framing, mechanical pipe, and perimeter security. Most of their products hold #1 or #2 positions in the market. As demand for electrical and safety systems increases, Atkore has been growing at a rapid pace, and I expect this will continue in the foreseeable future. I believe Atkore is a great investment option because:

- Atkore’s high quality products, economy of scale, and distribution network provide a great economic moat, and this will be the case for the foreseeable future.

- Demand for electrical and safety systems will continue to grow, and the recently passed Inflation Reduction Act will boost their growth rate further.

- Profitability, balance sheet, and liquidity are all very strong for Atkore.

Strong Economic Moat

Atkore has a very strong economic moat with high quality products, economies of scale, highly complementary products, and a tightly organized distribution network. The majority of their products are #1 or #2 on the market, and their customers have been using their products for several years. Both of these are strong testaments to the high quality of their products. Also, Atkore has a very well-established raw material (steel, copper, and PVC) network with multiple suppliers to ensure minimal disruption for their operation.

Recent acquisitions will make the economic moat even deeper going forward. The acquisitions of Talon Products (injection molded cable cleats), Four Star (HDPE conduit, serving the telecommunications, utility, infrastructure, and data communication markets), and United Poly Systems (HDPE pressure pipe and conduit, serving the telecommunications, water infrastructure, renewables, and energy markets) meaningfully expand their product line, and more importantly, they will expand the customer base even further.

Growing Demand for the Products

Demand for electrical systems and related safety systems is growing rapidly. Electricity is central to modern life, and economic growth and greater demand for power are increasing. Atkore is riding this demand trend to new highs, and their revenue and profit has been increasing at a rapid pace. Additionally, the recently passed Inflation Reduction Act contains plans for large investment ($369 B) in energy security and climate change, and I expect Atkore will be one of the beneficiaries of the bill.

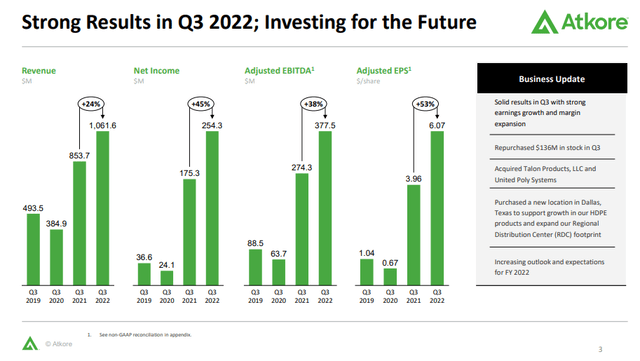

For the most recent quarter, Atkore’s sales increased by 24% and EBITDA increased by 38% (EBITDA margin increased to 36%). The Electrical segment and Safety & Infrastructure segment achieved particularly strong performance, and contributed to increasing EBITDA margin. Based on these strong results, management increased their guidance for the rest of 2022 (adjusted EBITDA between $1,322 M and $1342 M and net sales increase by 32% YoY). I expect this strong performance to continue well into the future.

Atkore financial result (Atkore Investor Relations)

Outstanding Fundamentals

Atkore has healthy operating cash flow, a strong balance sheet, and nice liquidity. Operating cash flow grew from $58 M in 2012 to $626 M in 2022, and I expect it will see steady growth going forward. With a current ratio of 2.77x and quick ratio of 1.78x, Atkore has great liquidity, and with a covered ratio of 40x, they are managing their debt very well. Whether we are in an economic boom or bust, Atkore should have enough money to keep operations going and be in a position to deploy capital expenditure to support growth.

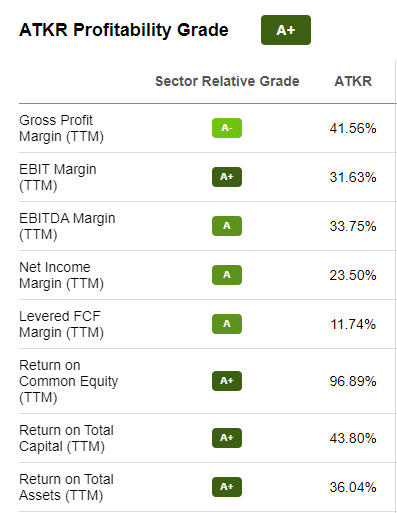

Atkore Profitability (Seeking Alpha)

Intrinsic Value Estimation

I used the DCF model to estimate the intrinsic value. For the estimation, I utilized free cash flow ($447 M) and the current WACC of 8.0% as the discount rate. For the base case, I assumed cash flow growth of 17% (5-year average revenue growth) for the next 5 years and zero growth afterward (zero terminal growth). For the bullish and very bullish case, I assumed cash flow growth of 19% and 21%, respectively, for the next 5 years and zero growth afterward.

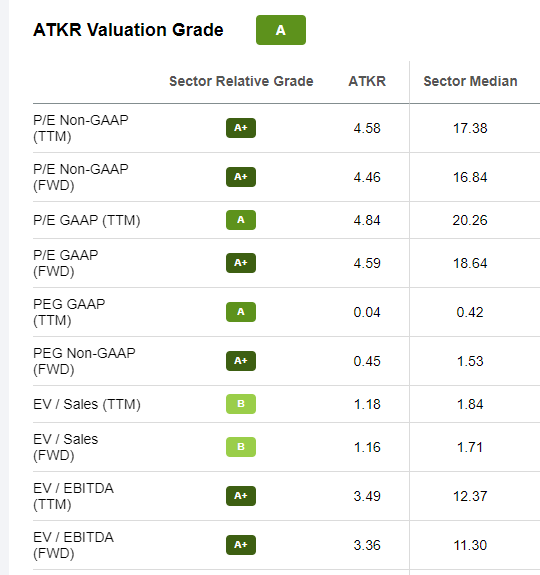

The DCF calculation revealed that the current stock price is severely undervalued. Atkore is basically being treated like a declining company. This is a clear mispricing by the market, and I expect the market to realize the mistake soon. Looking at the valuation, P/E ratio and EV/Sales are below their historic level and sector median, and they also indicate severe undervaluation by the market.

|

Price Target |

Upside |

|

|

Base Case |

$291.32 | 211% |

|

Bullish Case |

$313.73 | 235% |

|

Very Bullish Case |

$337.61 | 261% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Free Cash Flow Growth Rate: 17% (Base Case), 19% (Bullish Case), 21% (Very Bullish Case)

- Current Free Cash Flow: $447 M

- Current Stock Price: $93.57 (08/18/2022)

- Tax rate: 20%

Atkore Valuation (Seeking Alpha)

Cappuccino Stock Rating

| Weighting | ATKR | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 4 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 5 |

| Sector Outlook | 10% | 4 |

| Overall | 4.5 |

Economic Moat

Atkore holds a pretty strong economic moat with technological superiority, switching cost, consumer loyalty, and network effect. Most of their products are #1 or #2 in their respective markets. Also, Atkore is making key acquisitions to maintain this moat.

Financial Strength

Atkore is a financially very strong company. They generate positive operating cash flow consistently, and the strong cash flow allows them to service their debt very comfortably (coverage ratio of 40x). Also, their liquidity is above the industry average.

Growth Rate

I expect the demand for electrical and related safety systems will continue to grow. The infrastructure bill will boost this growth, and the EV transition should also bring a tailwind to Atkore.

Margin of Safety

Based on intrinsic value calculation and valuation metric, Atkore is severely undervalued at this point. I expect strong organic growth from capital expenditure and synergy from acquisitions. The market will realize its mispricing soon enough, and the stock price will find its appropriate value.

Sector Outlook

Buildings and structures are needing more electric cables. We need more and more electric systems to support increasing demand. Also, the demand for safety systems related to electricity also continue to grow.

Risk

The current administration is pushing hard to improve infrastructure and transition to clean renewable energy. Even though moves towards environmental and climate change will continue regardless of the political environment, the degree of support and funding may differ depending on which parties hold the majority in government. Therefore, the investor should monitor government spending on infrastructure and renewables.

Upgrading buildings and installation of new electrical system is cyclical, and it is affected by the overall level of economic activity. With a hawkish Federal Reserve stance and high inflation rate, a mild recession remains a strong possibility. If slower economic growth materializes, the growth trajectory of Atkore will be impacted. Therefore, the investor should monitor the economic indicators.

Conclusion

Atkore has been growing rapidly in the past several years as more buildings and structures are getting electrified. With an ever-growing need for electric systems, I believe Atkore will continue its solid growth trajectory. The company’s strong capital expenditure decisions and key acquisitions will continue to support growth. Atkore’s stock price is severely undervalued at this point, and I expect the stock price to grow nicely in the future.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment