Don White

Thesis: Resurgence of Growth Not Priced In

ATCO Ltd. (OTCPK:ACLLF) is an over-the-counter stock that also trades as ACO.X on the Toronto Stock Exchange. It is a holding company that owns a controlling share of Calgary, Canada-based Canadian Utilities (OTCPK:CDUAF) and also has several other business lines. About 81% of earnings come from Canadian Utilities, while the various other business lines generate the other 19%.

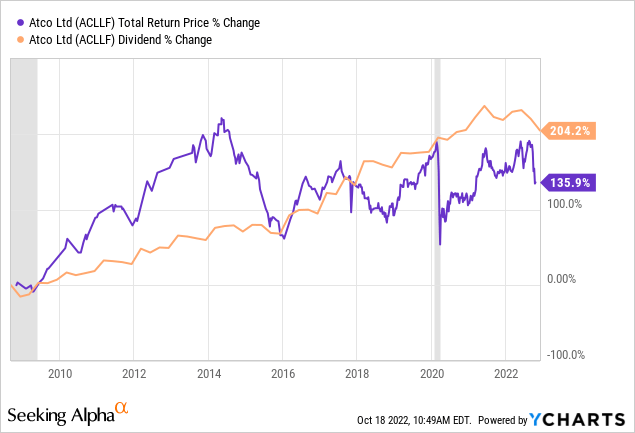

In recent years, ATCO has suffered from stagnant earnings as its legacy utilities business has struggled to find growth. But that seems to have definitively changed this year, as earnings have surged by double-digits and Canadian Utilities has made a recent renewable energy acquisition that could improve its growth prospects.

Though ATCO’s fundamentals seem to have rounded a corner, the stock price does not reflect this newfound strength.

Nor does the stock price reflect ATCO’s 29 consecutive years of dividend increases (in Canadian dollars). Of course, ACLLF pays dividends to US-based investors in USD, which obviously requires currency exchange from CAD to USD. That explains the decrease in USD dividends from ACLLF this year – the USD has been strengthening against most other currencies, including the CAD.

At the current conversion rate, ACLLF offers a dividend yield of 4.5% that based on a well-covered dividend that has enjoyed strong growth of around 8% per year over the past five-year and ten-year periods. That makes ATCO’s OTC-traded ACLLF stock a worthy addition to a dividend growth investor’s portfolio.

Update On ATCO

ATCO is a longstanding family business that was founded in 1947 when Ron Southern and his father invested in a business called Alberta Trailer Hire Co. The founding Southern family still retains control of the company, with Ron’s daughter, Nancy Southern, now in the role of Board Chair and CEO, a spot she’s held since 2003.

As I explained way back in March 2019 in an article titled “Invest in the Family Business,” multigenerational family businesses tend to perform better than the average company because interests are well-aligned between management and shareholders and also because management tends to be more farsighted and financially conservative.

I find that to be the case with ATCO.

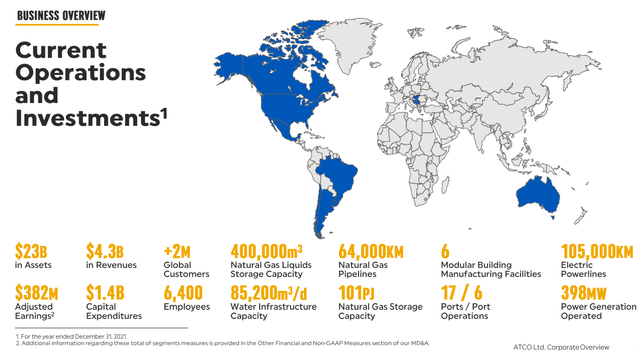

Though the company’s primary operations are in Calgary and Alberta, Canada, they do own assets or have some operations in other parts of the world as well.

Perhaps most notably, ATCO owns a minority stake in Neltume Ports, an operator of South American ports in Brazil, Uruguay, Argentina, and Chile.

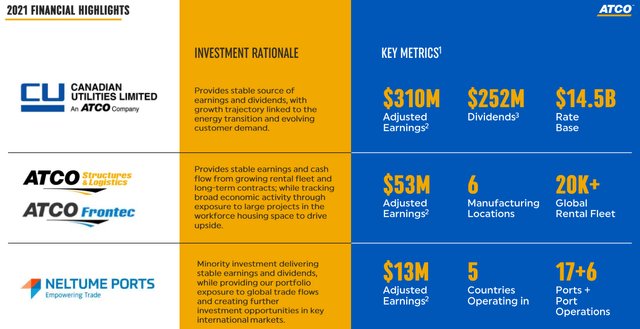

Primarily, the business can be separated into three segments: Canadian Utilities, Structures & Logistics, and Neltume Ports.

“Structures” refers to the construction and assembly of modular structures at various locations around the world, typically used for temporary workforce housing. One usage would be housing for workers in a remote location who are building a pipeline or energy storage facility.

“Logistics” refers to Frontec, a business that provides catering and other operations management of workforce housing, disaster relief camps, etc.

These are niche businesses without much competition.

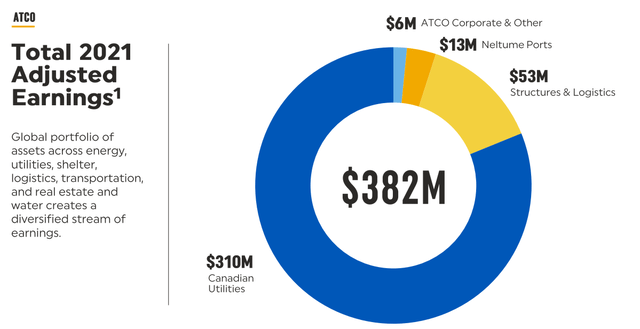

Of course, Canadian Utilities makes up the vast majority of ATCO’s earnings at around 81% (in 2021), but the other businesses are growing much faster than CU.

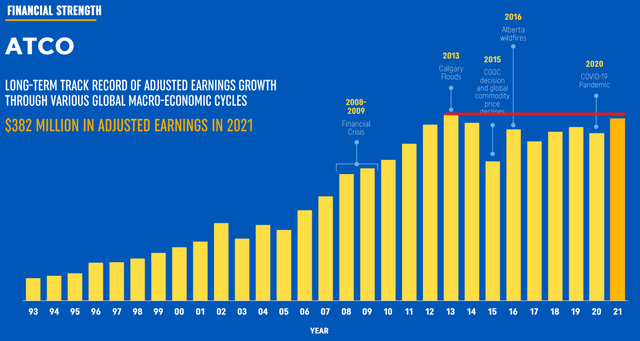

Even so, as previously mentioned, total adjusted earnings have been stagnant at ATCO for a number of years, largely because of sluggish growth at Canadian Utilities. In the following chart, I drew a red line at 2013’s earnings level to show that, even as of 2021, ATCO still had not grown its earnings to a new record beyond that level.

While the legacy Canadian Utilities segment that accounts for most of earnings is stagnant and has been so for years, ATCO does have its faster growing business lines like “Structures & Logistics” that grew at a CAGR of 72% from 2017 to 2021.

However, the stagnancy of ATCO’s earnings appears to have finally ended this year, at least so far (in the first half).

In Q2 2022, for instance, adjusted EPS rose 15.7% year-over-year. In the first half of 2022, adjusted EPS rose 13.8%. And that is with weighted average shares outstanding staying roughly flat. Total adjusted earnings were up about 13.5% YoY in the first half of 2022.

Compared to $382 million in adjusted earnings in 2021, ATCO has generated $226 million in the first half of 2022 alone. If this pace of growth continues, ATCO should produce adjusted earnings growth of 15-20% this year.

Whether the second half of 2022 will be a bit weaker than the first half, as it was last year, is unknown to me. But I think ATCO is in a strong position to deliver at least 10% adjusted EPS growth this year, probably more.

It helps also that ATCO and CU both have strong balance sheets. ATCO has a BBB+ credit rating, while Canadian Utilities enjoys an A- credit rating. That is a great differentiator in a period of rising interest rates, and it will help these companies invest in growth projects accretively going forward.

Renewable Energy Acquisition

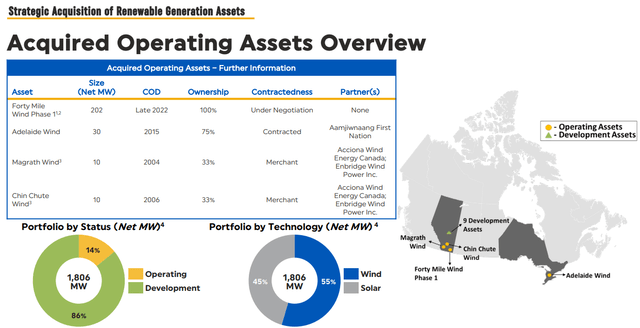

On October 5th, ATCO announced that its partially owned (but fully controlled) subsidiary, Canadian Utilities, would acquire the renewable energy infrastructure assets and development arm of Suncor Energy Inc. (SU). It’s a portfolio of 252 megawatts of operating wind assets plus a wind and solar development pipeline over 1.5 gigawatts (1,500 MW+) in size.

The deal is expected to close in early 2023 and be cash flow and earnings accretive in the first year of ownership.

The acquired wind assets are all in Canada, and most of the development pipeline is located in Alberta, where three of the currently operational assets are concentrated.

This strikes me as a smart bolt-on acquisition for Canadian Utilities and ATCO, as it will act as a big leap toward renewables and give the companies plenty of profitable investment opportunities in the decades ahead.

Bottom Line

Though the over-the-counter nature of ACLLF will be off-putting for many investors, it’s helpful to think of ATCO as a strong company with a long-running dividend growth streak that just so happens to trade OTC rather than on a major US exchange. Trading OTC does not, in itself, signify weakness or risk.

The resurgence of adjusted earnings growth this year is a great sign for ATCO and a signal that the 29-year dividend growth streak is likely to continue for a long time to come. At a 4.5% dividend yield (based on USD dividends), this Canadian gem is a worthy addition to any dividend growth portfolio.

The strength of the US dollar is probably also pushing ACLLF lower and creating an even better buying opportunity in the case that the relationship between the CAD and USD reverts to the mean.

Be the first to comment