© Reuters.

By Ambar Warrick

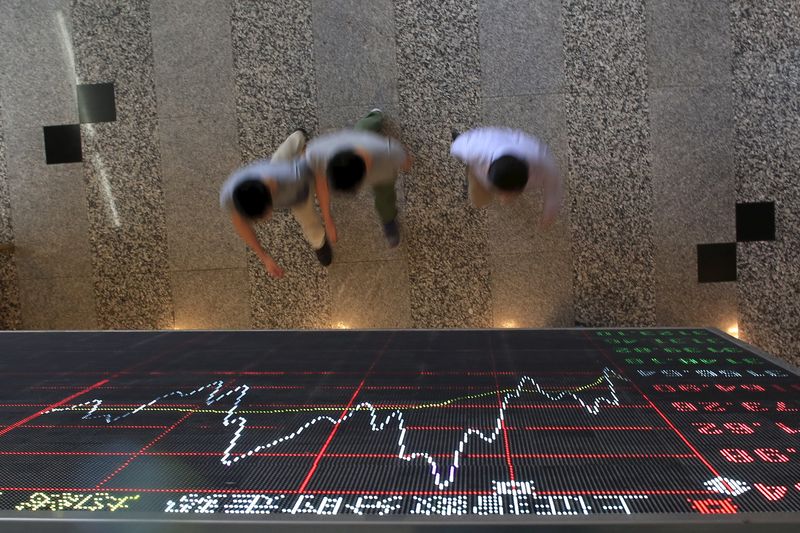

Investing.com– Asian stocks rose on Monday amid some hopes that the U.S. Federal Reserve will curb its pace of interest rate hikes this year, although bourses in China lagged after data showed a surprise fall in business activity.

Japan’s was among the best performers for the day, rising 1.6% despite data showing that fell further in September. But other readings showed that September grew more than expected, showing some resilience in the Japanese economy.

Australia’s index closed 1.2% higher on strong data, while South Korea’s rose nearly 1%.

But Chinese shares lagged their peers, with the blue-chip index down 1.1%, while the index fell 0.8%. Sentiment towards China worsened after showed China’s manufacturing sector contracted in September, as did .

The reading indicates that COVID-linked disruptions are likely to keep weighing on the world’s second-largest economy, particularly after Beijing recently reiterated its support for the strict zero-COVID policy.

The policy is at the heart of China’s economic woes this year, and is likely to keep foreign investors wary of the country. Chinese stocks have also suffered steep losses this year as economic growth slowed to a crawl under the policy.

Broader Asian stocks rose amid some speculation that the will soften its hawkish stance going into 2023. While a majority of traders are pricing in a (bps) hike by the central bank this week, markets are now almost evenly split over a 75 bps and 50 bps hike in December.

The conclusion of the Fed meeting on Wednesday will be closely watched for any cues on this end, as well as the bank’s stance on the U.S. economy. data recently showed that while the world’s largest economy dodged a recession, inflation headwinds remain.

Other central banks are also in focus this week. The and the are both expected to hike rates this week, as they move to curb rising inflation.

Tightening monetary policy has weighed heavily on Asian stocks this year by limiting liquidity for investment. Higher interest rates also saw investors pivot into relatively safer investments, such as government debt.

Be the first to comment