Khanchit Khirisutchalual

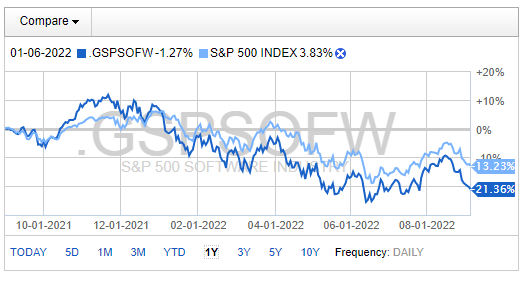

The S&P Software Index is down more than 21% over the last year, underperforming the S&P 500 index’s 13.2% drop. So many of the industry’s tech names were priced for perfection late last year before the Fed began to tighten monetary policy. Price-to-sales ratios were at nosebleed levels, but some of these firms with decent fundamental businesses now trade at down-to-earth valuations. One name with an earnings date Wednesday looks attractive from a ‘growth at a reasonable price’ perspective, and the technicals suggest a bottom is forming.

S&P Software Industry Hurt By The Broad Growth Selloff

Fidelity Investments

Asana, Inc. (NYSE:ASAN), together with its subsidiaries, operates a work management platform for individuals, team leads, and executives in the United States and internationally. The company’s platform enables teams to orchestrate work from daily tasks to cross-functional strategic initiatives; and manages product launches, marketing campaigns, and organization-wide goal settings. It serves customers in industries, such as technology, retail, education, non-profit, government, healthcare, media, and financial services.

The $3.5 billion market cap California-based Software industry company in the Information Technology sector has negative earnings over the trailing 12 months and does not pay a dividend, according to The Wall Street Journal. Importantly, ahead of earnings on Wednesday, ASAN has an extremely high 17.9% short float. Just last week, Citigroup initiated coverage on Asana with a $23 price target.

The company now trades at just six times next year’s sales, a far cry from the incredibly high sales multiple seen late last year north of 60. The current price-to-sales valuation looks intriguing given its growth prospects.

ASAN: A Much Better Sales Valuation Today

Looking back, the stock cratered after its previous earnings release, despite the CEO buying a large sum of shares earlier in the year. Downward share price momentum was simply too strong to offset a string of earnings beats and insider buying. Are there any signs of life for this beaten-down speculative software name?

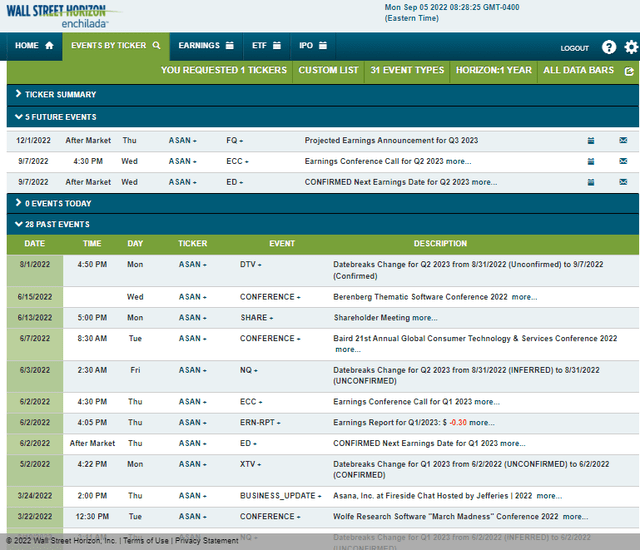

A major catalyst to move the stock takes place this Wednesday afternoon when the firm reports its Q2 2023 results. An earnings call follows immediately after the release. You can listen live here. After that event, the next reporting date, according to Wall Street Horizon, is Thursday, December 1 AMC.

Corporate Event Calendar

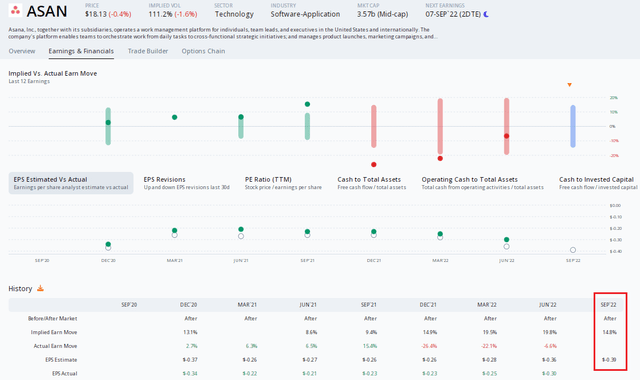

The Options Angle

Looking closer at the earnings situation, Option Research & Technology Services (ORATS) data show a strong earnings beat rate history on Asana and some huge share price reactions after reporting quarterly numbers in the past. The consensus earnings estimate is for a loss of $0.39 this time around. The options market has priced in an implied stock price move of 14.8% after Wednesday night’s report. That’s below the implied percentage change of the previous two quarters, so being long options this week could make sense. The bulls can point to a pair of earnings upgrades since the June quarterly report.

Asana: A Solid EPS Beat Rate History

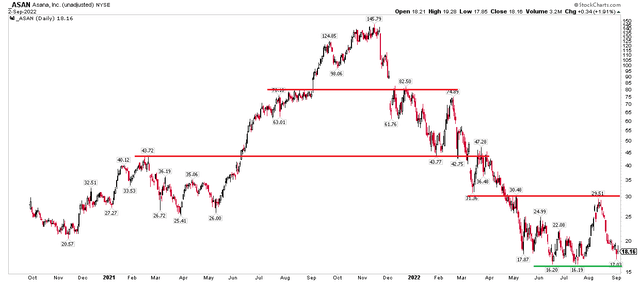

The Technical Take

Shares of Asana jumped in late July through mid-August amid a renewed speculative fervor in markets. Recall how meme stocks and many Cathie Wood-type plays rallied then. Unfortunately for the bulls, another significant selling wave hit the market over the past few weeks. ASAN sellers appeared at the $30 level – which had been a key pivot spot from March through early May this year. The stock is now below the IPO price.

There’s support in the $16 to $18 range, and further upside resistance is seen at $43 and in the low $80s. Being long here into earnings looks like a favorable risk/reward setup, but a stop under $16 makes sense technically.

ASAN: A Tradeable Low, Resistance at $30

The Bottom Line

Asana looks to be putting in a bottom and the valuation is much better after a huge 89% drawdown. With a better price-to-sales ratio and support in the $16-$17 range, the stock looks like a buy into earnings. And don’t forget about that significant short interest. Look for resistance near $30.

Be the first to comment