Thurtell

The Senate’s just-passed Inflation Reduction Act of 2022 provides significant incentives for utilities to expand green energy production. NextEra Energy (NYSE:NEE), the largest producer of solar and wind energy in the world, stands to benefit. The bill also expands incentives for electric cars, increasing demand for electricity. The House of Representatives is expected to vote on the bill as soon as Friday.

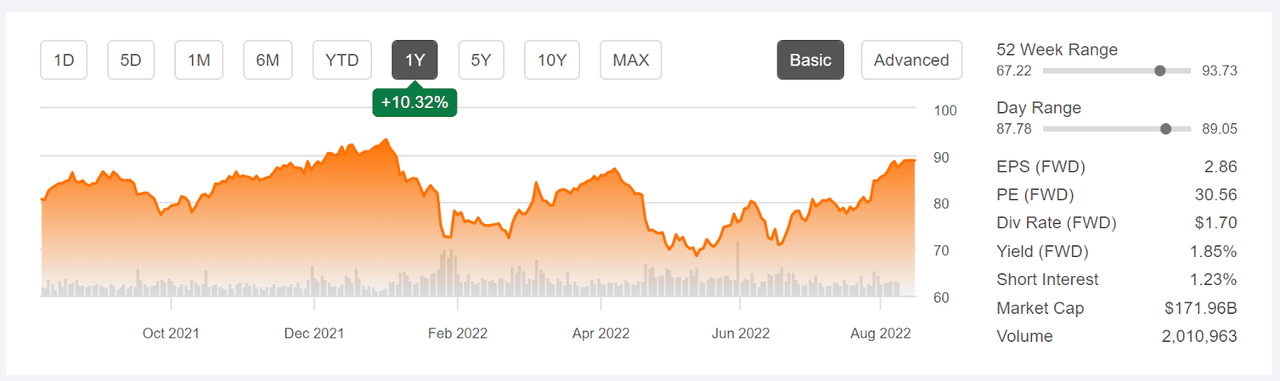

Along with the boost anticipated from the Inflation Reduction Act, high inflation is also positive for wind and solar energy assets because their cost of production is not impacted by high commodity prices. While NEE has rallied dramatically in the past 3 months, up 21.4%, the trailing 12-month return of 10.6%, lags those from utility index funds (XLU: 13.5%, IDU: 12.3%). Over the past 3-, 5-, 10- and 15-year periods, however, NEE has substantially outperformed. Rising interest rates are a greater concern for NEE than for the average utility because of NEE’s richer valuation. NEE has a high forward P/E compared to other utilities, which means that the valuation is more dependent on growth assumptions. Rising interest rates increase the discount factor applied to future earnings, so that the fair value of NEE tends to decline more with rising rates than the average utility. Rising interest rates are also disproportionately costly for NEE because of the company’s high variable rate debt load.

Seeking Alpha

12-Month price history and basic statistics for NEE (Source: Seeking Alpha)

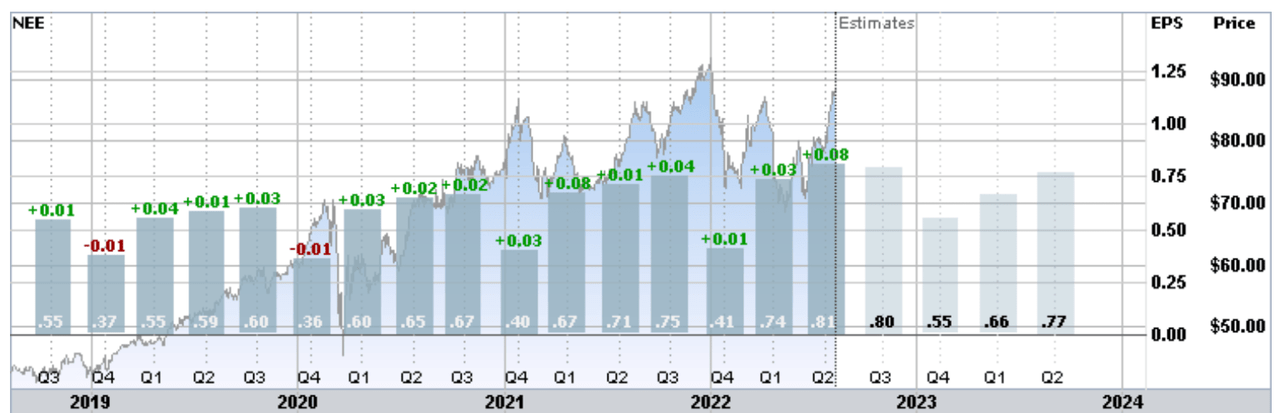

NEE reported Q2 results on July 22nd, beating the consensus estimate for quarterly EPS by 10.4%. Over the past 4 years, NEE has beaten the consensus on EPS in all but 2 quarters. Both of the misses were very small. The consensus outlook for EPS growth is +9.7% per year over the next 3 to 5 years, considerably higher growth than is expected for the utility sector as a whole. This higher expected growth rate is largely priced into the shares, however.

Etrade

Trailing (4 years) and estimated future quarterly EPS for NEE. Green (red) values are amounts by which EPS beat (missed) the consensus estimated value (Source: ETrade)

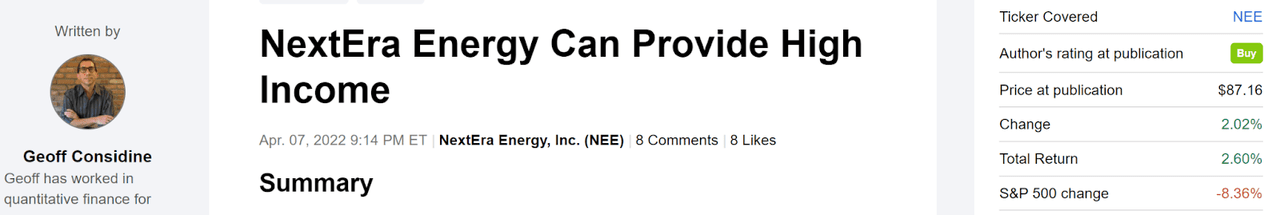

I last analyzed NEE on April 7th, about 4 months ago, at which time I maintained a buy rating on the shares. At that time, the major considerations were essentially the same as they are today, although the prospects of congress passing significant measures favoring clean energy looked dim. Even though the valuation was concerningly high, NEE appeared generally well-positioned. The Wall Street consensus rating was bullish, although the consensus 12-month price target implied a total return of 8.3%, less than half the annualized rate of return over the past 3-, 5-, and 10-year periods. The consensus view implied by options prices, the market-implied outlook, was bullish into early 2023. Since the publication of this post, NEE has substantially outperformed the broader market.

Seeking Alpha

Previous analysis of NEE and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With the pending congressional vote on the Inflation Reduction Act of 2022, along with the substantial outperformance of NEE over the past 4 months, I am revisiting my position on NEE. I have calculated an updated market-implied outlook to January of 2023 and I have compared this with the current Wall Street consensus outlook, as in my previous analyses.

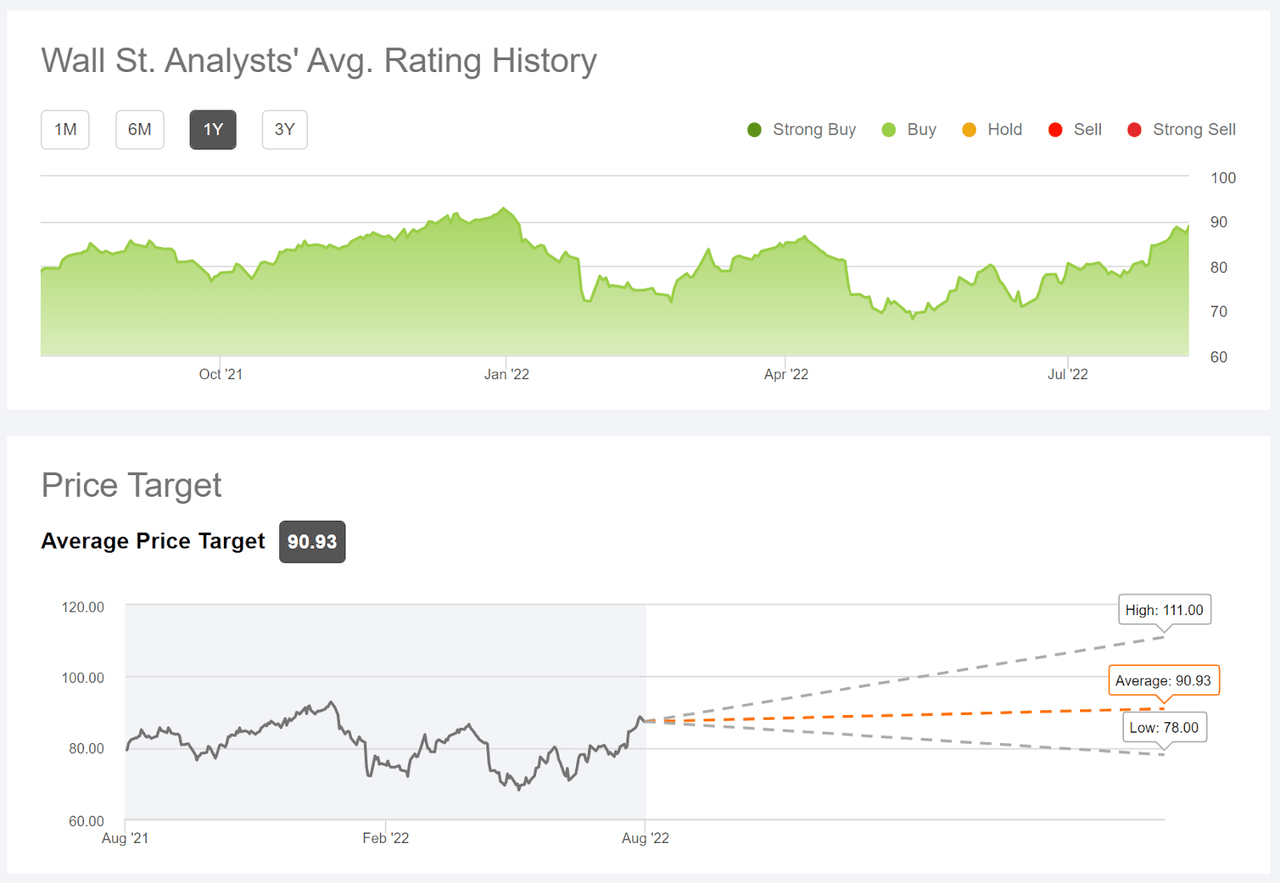

Wall Street Consensus Outlook for NEE

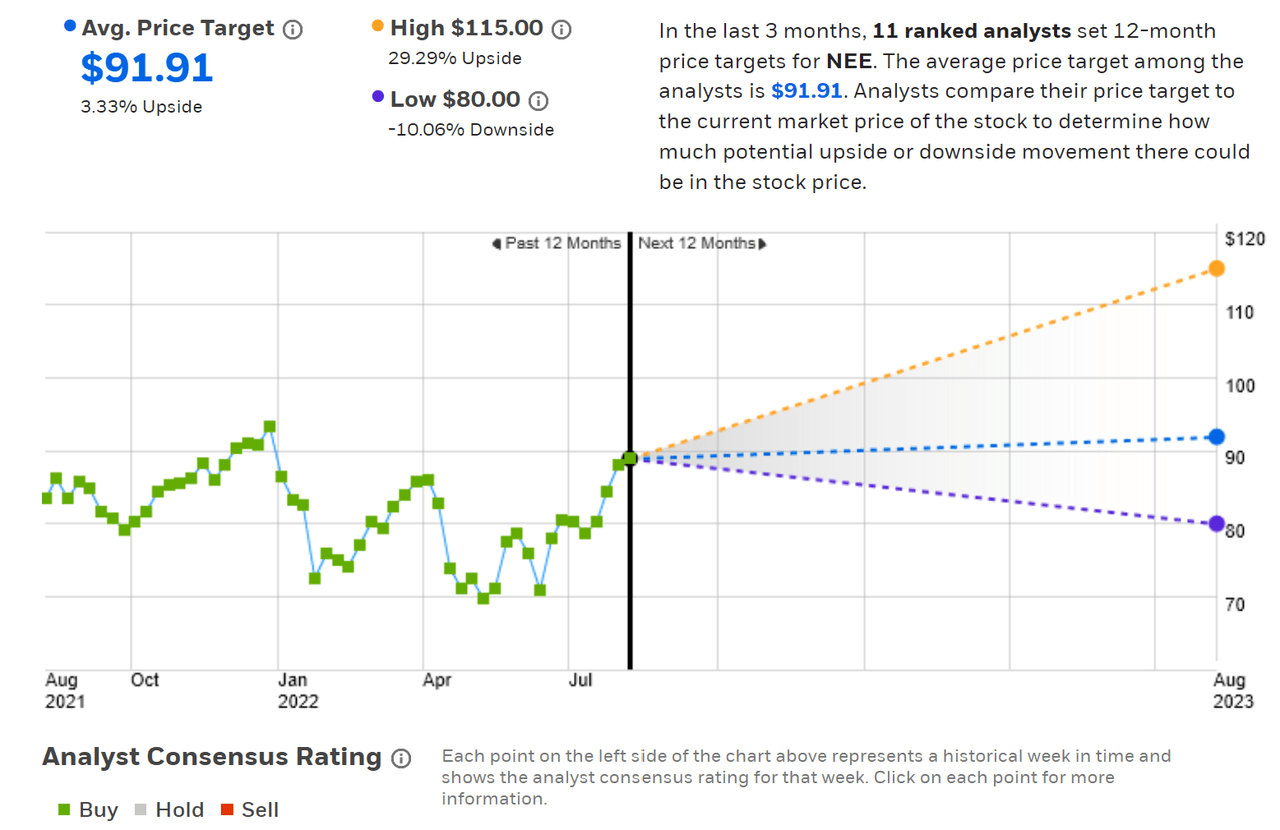

ETrade calculates the Wall Street consensus outlook for NEE using ratings and price targets from 11 ranked analysts who have published their views within the past 3 months. The consensus rating is bullish, as it has been for all of the past 12 months, and the consensus 12-month price target is 3.3% above the current share price. When you see a bullish rating with a price target that is not much above the current share price, this typically means that the share price has rallied in recent months, compressing the upside on the stock. This is the case for NEE, although it is also worth noting that the consensus 12-month price target has actually fallen in recent months. In my April analysis, ETrade calculated a 12-month consensus price target of $93.17. Of the 11 analyst views included in the consensus, only 1 has been updated since the Senate passed the Inflation Reduction Act and, as a result, do not reflect the improved outlook for government support of clean energy.

ETrade

Wall Street analyst consensus rating and 12-month price target for NEE (Source: ETrade)

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 20 analysts who have published opinions over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 2.22% above the current share price.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for NEE (Source: Seeking Alpha)

While the Wall Street analyst consensus rating continues to be bullish, the 21.4% gain in the shares over the past 3 months has reduced the potential price appreciation. The consensus price target (averaging the values from ETrade and Seeking Alpha) implies a total return of 4.6% over the next year. It is worth remembering, however, that the consensus calculated using analyst views from the past several months will, by definition, not be entirely responsive to the improved prospects for passage of the Inflation Reduction Act of 2022.

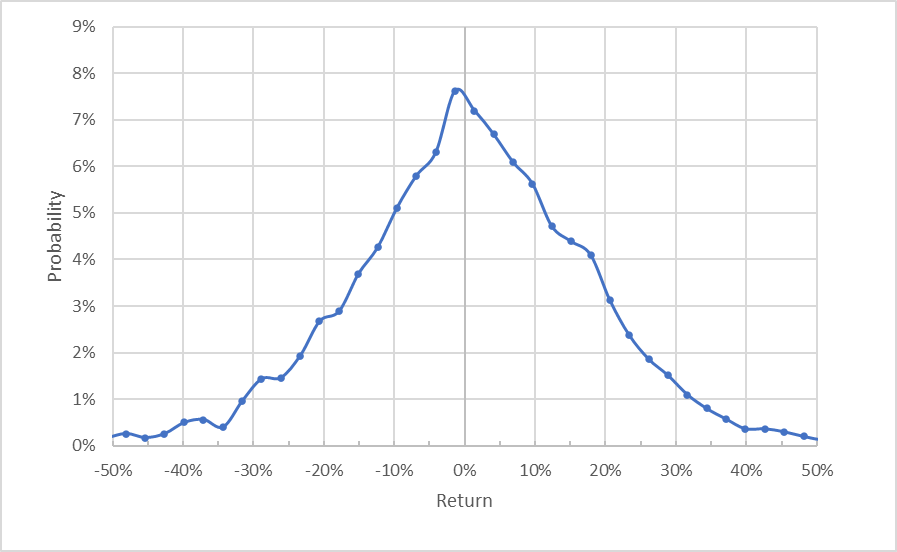

Market-Implied Outlook for NEE

I have calculated the market-implied outlook for NEE for the 5.4-month period from now until January 20, 2023, using the prices of call and put options that expire on this date. I analyzed this specific expiration date to provide a view through the end of 2022 and because these options are especially actively traded, as compared to other expiration dates. In addition, I created the market-implied outlook in April using this expiration date, which makes for an interesting comparison.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for NEE for the 5.4-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from ETrade)

At first glance, market-implied price return probabilities look quite symmetric, with comparable probabilities of positive and negative returns of the same magnitude. The peak in probability is very slightly tilted to favor negative returns. The expected volatility calculated from this outlook is 29% annualized, which is quite high for a utility. This reflects elevated uncertainties due to the high valuation, interest rates, and the potential upside from increased government support for wind and solar energy. The expected volatility from my April analysis was 27.7%.

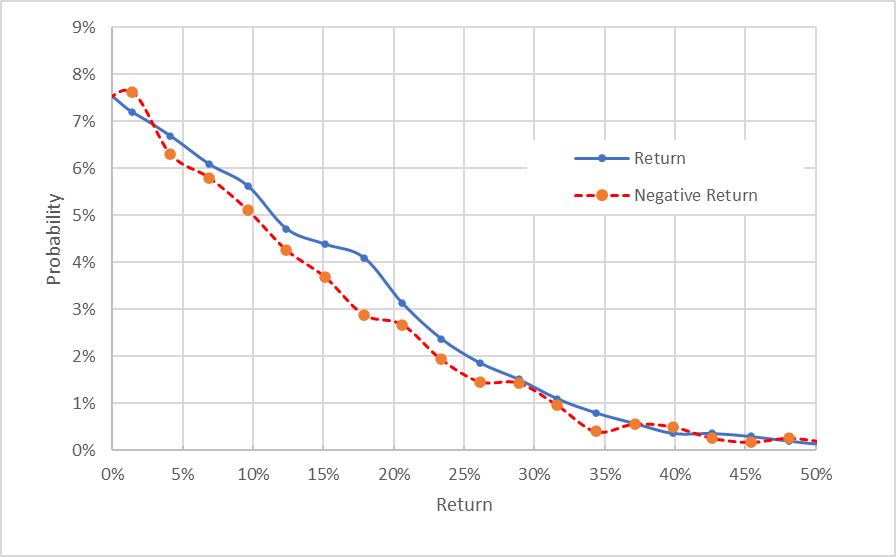

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for NEE for the 5.4-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows that there is a small but persistent tilt in the probabilities that favors price gains over declines. At almost every possible return, the probability of having a positive return is at or above the probability of having a negative return of the same magnitude (the solid blue line is on or above the dashed red line across almost all of the chart above). This is a moderately bullish outlook. This outlook is qualitatively similar to the one from my April post.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. This potential bias reinforces the bullish interpretation of the market-implied outlook to January of 2023.

With the high expected volatility, income-oriented investors may want to consider selling covered calls on NEE.

Summary

NEE continues to be priced at a premium, with a forward valuation that is more similar to those of large tech stocks than other major utilities. That said, the company is particularly well-positioned for an inflationary environment in which the government is supporting clean energy. The recent quarters’ earnings are encouraging, too. The question is whether the potential upside is already fully reflected in the current share price. The Wall Street consensus rating is bullish, but the consensus 12-month price target suggests that the shares have very little price appreciation potential. The consensus 12-month price target implies a total return of only 4.6%. As a rule of thumb for an attractive risk-adjusted return, I want to see an expected 12-month total return that is at least ½ the expected volatility (29%). NEE falls far short of this threshold. The market-implied outlook to early 2023 continues to be bullish, however. The Wall Street consensus outlook may be considered somewhat stale because so many of the opinions pre-date the recent passage of the Inflation Reduction Act in the Senate. I am maintaining my bullish / buy rating on NEE, although I have sold covered calls against my long position because of valuation concerns.

Be the first to comment