Sundry Photography

For the first time in a long time, the tech sector is hurting in 2022. And while a lot of the YTD declines we’ve seen in the sector have been due to weakening sentiment and overreaching valuations, many companies are also starting to report that enterprise spend is down, hurting enterprise software and IT vendors.

Yet there is one bright spot among the turmoil, at least from a fundamental perspective: Arista Networks (NYSE:ANET). This cloud-friendly data networking leader has managed deftly through a tough supply chain environment, while also maintaining solid demand from the cloud titans that make up the majority of its business. It is also penetrating into new market segments, especially campus routing.

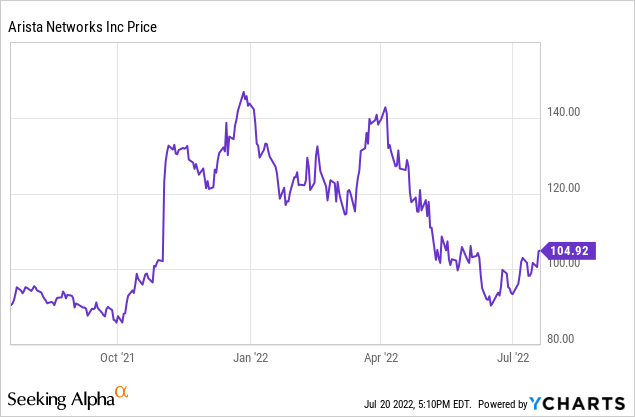

Year to date, shares of Arista have lost approximately 25% of their value:

Arista is great, but with the market so full of beaten-down tech stocks, it’s too expensive to consider

Evaluating where the market is today and what all my buying options are to deploy capital, I remain neutral on Arista, though I am edging Arista up slightly on my watch list. Two things have happened since I last wrote on the stock: first, the share price has reduced by roughly 15% from the low ~$120s in March; second, the company executed tremendously well in its first-quarter earnings.

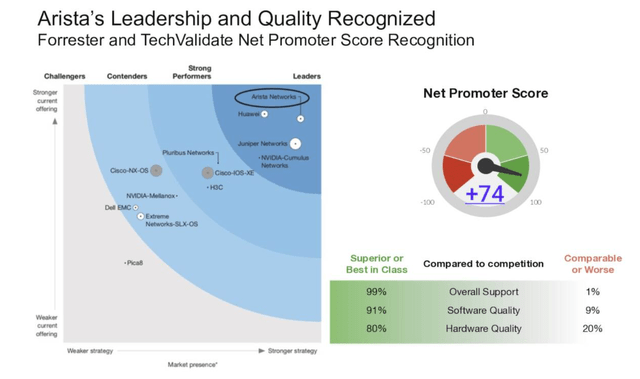

There is little doubt that Arista remains a top-notch, product-oriented company. The fact that Arista has continually nabbed market share from legacy giant Cisco (CSCO) remains one strong positive indicator. Between Cisco and Arista, these two giants hold roughly half of the data center switching market. In 2021, Arista notes that while Arista gained two points of share to 19%, Cisco lost three points and ended at 31%.

Forrester, a leading tech industry analyst and ranking system, also ranks Arista as the leading vendor in its market:

Arista rankings (Arista Q1 investor presentation)

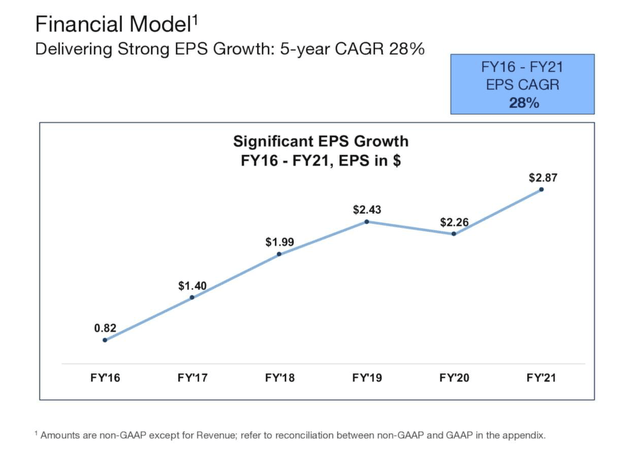

This strong product-market alignment, especially with Arista’s popularity among cloud titans, has driven very consistent earnings growth through the years, as shown in the chart below:

Arista EPS growth trend (Arista Q1 investor presentation)

2022, so far, appears to be a continuation of this narrative, with record revenue in Q1 and robust EPS growth. Yet at the same time, I think a lot of Arista’s high quality is already reflected in its current share price.

For the current fiscal year, Wall Street is expecting $3.70 in pro forma EPS, representing 29% y/y EPS growth; for FY23, the company is expected to put out $4.25 in EPS, or 15% y/y growth. Against these expectations (data from Yahoo Finance), Arista trades at:

- 28.4x FY22 P/E

- 24.7x FY23 P/E

Considering these multiples are now well ahead of the broader market, I hesitate to invest in Arista with a clear conscience. At the moment, I prefer buying much more beaten-down small/mid-cap tech names to deploy my excess cash – but Arista, in my view, will either market perform or underperform the S&P 500 given its existing premium.

Adopt a “watch and wait” stance here – either Arista’s fundamentals and EPS outlook change dramatically to the upside, or its stock price needs to come down. At current levels, Arista is not a buy.

Q1 download

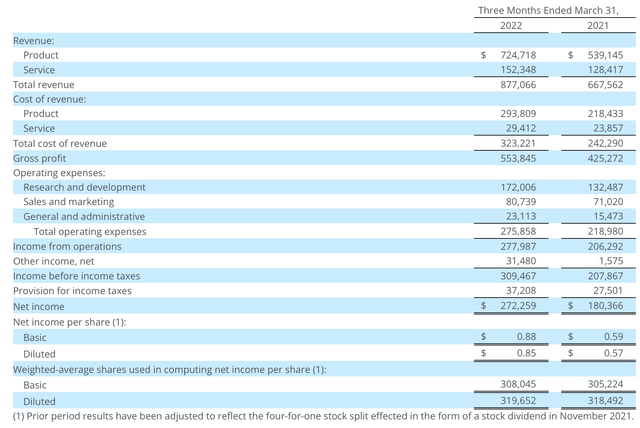

This being said, we will acknowledge the tremendous strength in Arista’s Q1 results. Take a look at the Q1 earnings summary below:

Arista Q1 results (Arista Q1 investor presentation)

Arista’s revenue in Q1 grew at a stunning 31% y/y pace to $877.1 million. This is impressive on a number of counts. First of all, it beat Wall Street’s expectations of $856.4 million (+28% y/y) by a three point margin. Second, revenue also accelerated from 28% y/y growth in Q4. Third, it was also an all-time quarterly revenue record for the company.

Now, the other remarkable piece on these results is that it reflects performance within an incredibly tight supply environment. The company noted that it faced heavy supplier decommits within the quarter, and it boosted its forward purchases in anticipation of both continued tightness in supply as well as consistently strong demand from its cloud titan customers. Per CFO Ita Brennan’s prepared remarks on the Q1 earnings call:

Supply remained constrained in the quarter with supplier decommits resulting in higher broker purchases and expedite fees in the period […]

Our purchase commitment number for the quarter was $4.3 billion, up from $2.8 billion in Q4. The significant increase in commitments largely represents orders for 2023 and beyond, reflecting overall strength and demand for those periods and our expectation that this long lead time supply environment continues. As a reminder, we continue to prioritize newer, early life-cycled products for inclusion of these strategies in order to help mitigate the risk of excess or obsolescence.”

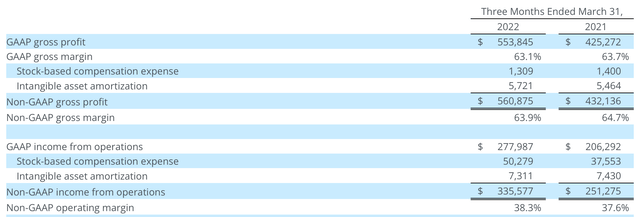

In spite of intensified supply constraints and higher logistics costs, however, Arista’s margin performance remained quite healthy. Pro forma gross margins fell 80bps to 63.9%. The primary reason for this is due to supplier recommits, which has forced Arista to source components from other vendors (and expedite to meet customer orders).

Arista margin trends (Arista Q1 investor presentation)

Regardless of the gross margin hit, Arista was able to boost pro forma operating margins by 70bps to 38.3%, and pro forma operating income saw a healthy 34% y/y increase to $335.6 million.

Pro forma EPS of $0.85 also came in ahead of Wall Street’s $0.82 expectations, and grew at 49% y/y.

Key takeaways

To me, Arista remains a very mixed bag. On the one hand, the company is producing great fundamentals amid tough macro conditions. It’s one of the few tech companies to cite positive enterprise demand from its buyers, and to guide 2022 above expectations accordingly. Margins have remained high despite rampant supply constraints, and earnings growth is following a yearlong trend of double-digit expansion. Yet at the same time, the market seems to have already rewarded Arista for its strengths with a healthy valuation premium over the S&P 500. Considering valuation as the main factor above all as the key catalyst for a year-end rebound, I’m content to sit on the sidelines here.

Be the first to comment