undefined undefined/iStock via Getty Images

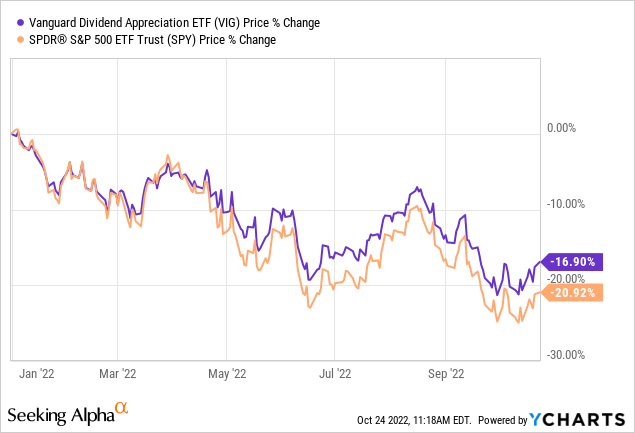

2022 has been a challenging year for investors as virtually all financial assets have seen moderate to significant declines in value. Thus far, drawdowns have been largest for interest-rate sensitive assets such as bonds, preferred equities, and growth stocks. More recently, as economic data has trended considerably lower, many cyclical stocks have taken a hit as many face large declines in earnings expectations. One of the few equity havens has been in older companies with stable and rising dividends, such as those in Vanguard’s popular Dividend Appreciation ETF (NYSEARCA:VIG). VIG has outperformed the S&P 500 ETF (SPY) this year by about 4%. See below:

While 4% in outperformance is not massive, it is notable considering VIG’s high correlation to the S&P 500. VIG owns many of the same stocks as the S&P 500 index and is heavily weighted toward the largest companies on the market. That said, its holdings are slightly less concentrated in both growth and cyclical stocks, with greater exposure to “quality” companies with more stable dividends and cash flows.

I believe the stock market is on the verge of another critical transition. Leading economic data now clearly points toward a negative outlook, meaning the Fed may soon become slightly less hawkish – potentially ending the trend of higher real interest rates. VIG’s outperformance is partially attributable to its “real interest rate” exposure, so it may benefit if real interest rates reverse. That said, many of its holdings have economic risk factors that investors may want to consider potential downside over the months to come if the economy deflates further.

Factor Performance and The Economic Cycle

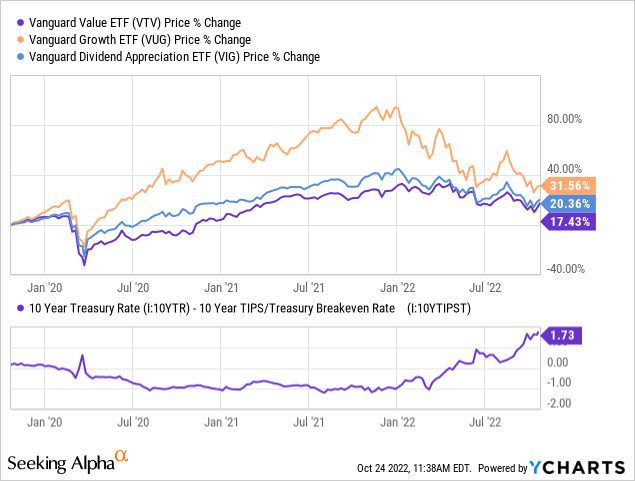

Certain investing “factors” perform best in differing parts of the economic cycle. However, rising interest rates create a matter of complexity that alters standard historical patterns. Typically, growth stocks perform well mid-to-late cycle as their earnings grow with some resistance to economic shocks. Conversely, value stocks normally outperform just after a large drawdown, as that is when the best discounts are found. A fund like VIG, focusing on dividends, often operates more similarly to value stocks since it focuses more on current earnings. The key difference is that VIG’s holdings are often of a higher valuation due to their greater earnings stability or “quality.”

Changes in real interest rates (interest rates minus expected inflation) have largely driven the “mini-cycle” from 2020 to today as opposed to earnings outlooks. Initially, in 2020 and 2021, growth stocks performed extremely well, while VTV and VIG underperformed as the present value of future cash-flows rose dramatically with ultra-low rates. See below:

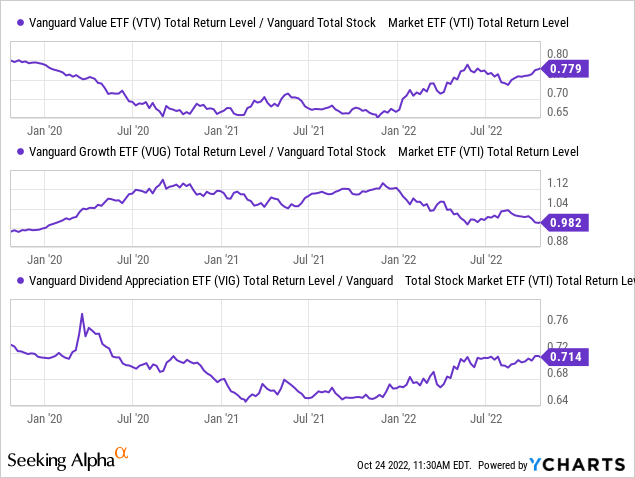

The direct outperformance pattern of VUG, VTV, and VIG, compared to all US stocks (VTI), is made clearer by looking at the total return ratios of each:

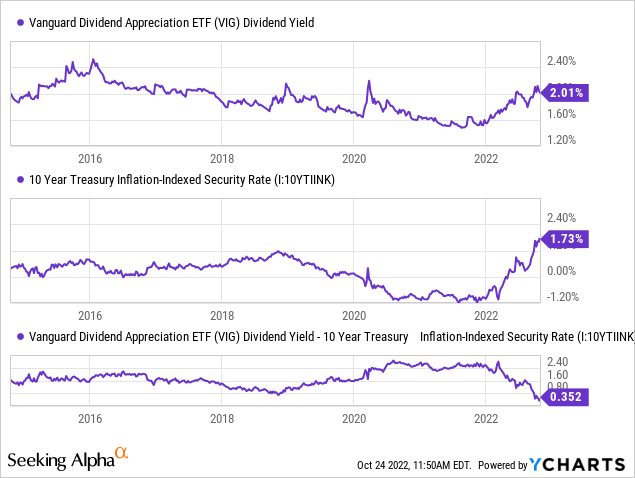

As you can see, both VTV and particularly VIG’s outperformance pattern have generally been correlated to the US real interest rate. One reason for this is that growth stock valuations depend on interest rates, so as interest rates rise and growth stock valuations decline, dividend appreciation stocks tend to outperform. Secondly, VIG is, in a sense, like an “inflation-indexed” bond since its dividend is expected to rise with inflation, partially protecting investors from that risk factor. This fact is made evident by the strong relationship between VIG’s dividend yield and that of the 10-year inflation-indexed Treasury bond. See below:

VIG’s dividend yield has tracked the inflation-indexed bond rate over recent years, declining substantially in 2020 and rising considerably this year. However, as shown in the spread chart above, VIG’s dividend yield is the lowest it has ever been compared to the 10-year inflation-indexed bond. In my view, this is a strong indication that VIG has some overvaluation risk since investors could opt for a lower-risk inflation-indexed Treasury bond fund like (TIP) for a nearly equal yield.

I strongly expect real interest rates, specifically those paid on inflation-indexed Treasury bonds, will stop rising soon and likely decline. The chief reason I expect real yields to reverse is the impact of negative economic trends on the Federal Reserve’s hiking cycle. Since VIG is correlated to inflation-protected bonds, this change may further benefit the fund and improve its outperformance. VIG’s holdings have lower valuations than growth stocks but higher earnings quality than value stocks, making them a potential “goldilocks” factor in the current phase economic cycle.

Outperformance vs. Absolute Performance

Overall, I believe the macroeconomic trend supports VIG’s ability to outperform the S&P 500 and most other stock market indices and factors. However, that potential does not mean VIG will rise in value, nor is it a particularly safe investment today. When virtually all stocks carry high risk, being “the best of the worst” does not equate to being a “good” investment.

First of all, as discussed earlier, VIG’s yield is very low compared to inflation-indexed bonds, signaling potential overvaluation. Further, VIG has a weighted-average “P/E” ratio of 18.5X with 15.6% earnings growth compared to the S&P 500 at 18.1X (20.2% earnings growth) and all US stocks at 17.1X (19.9% earnings growth). In my view, the current economic outlook suggests most companies will face large declines in EPS growth over the coming year, so VIG’s lower earnings growth is not necessarily an issue. However, its valuation is higher than the major indices, while its historical earnings growth is lower, strongly indicating overvaluation. VIG’s holdings benefit from better “earnings quality” than most from their dividend growth, but investors are paying a premium for it that may not be sustained.

Looking through the fundamentals of the top ten firms in VIG, it is apparent most carry strong earnings quality. Virtually all have maintained nearly constant dividend payout ratios over recent years and have seen moderate cash-flow growth. Further, most have maintained profit margin levels despite rising inflation. Most of these companies, such as UnitedHealth (UNH), Microsoft (MSFT), JPMorgan (JPM), Home Depot (HD), Visa (V), and Coca-Cola (KO), operate within oligopolistic industries and have only a small handful of competitors. This factor gives most of these firms great earnings moats that are not easily compromised under moderate economic strain. As such, given the strain, VIG’s higher valuation premium may be justified.

The Bottom Line

For now, I believe VIG will continue to outperform most other stock indices; however, I am slightly bearish on the ETF since its strong factors are not so large that they can entirely overcome an economic storm. Most of the companies in the ETF are not “recession-proof”, but are “recession-resistant,” and most are unlikely to face cash-flow declines unless there is a relatively large and lasting economic recession.

As detailed in many of my recent articles, I strongly believe the economy will continue along a negative trend for the next one to two years. The upcoming Q3 GDP report may be positive as most data I watch (such as the PMI) was nearly constant during Q3 but has shown clear deterioration during the beginning of Q4. Inflation and interest rates continue to weigh on the ability of people and companies to spend money on discretionary items and services. Until the supply of key resources and labor is normalized, I do not believe the economic trend can be positive, straining most companies’ profit margins.

VIG is, in my view, better than most major ETF funds today, given its recession resistance. It may be a solid option for investors with 5-10+ year investment horizons. However, as someone who watches the markets more closely, I strongly prefer inflation-indexed Treasury bonds, such as (TIP) and (VTIP) as a “haven trade” compared to VIG. Inflation-protected Treasuries have a similar yield to VIG, are directly hedged against inflation, and have considerably lower cyclical risk than VIG. Further, while a decline in real rates may boost VIG’s outperformance, it would cause TIP to appreciate, while I expect almost all equities to depreciate over the coming months.

Be the first to comment