Kevin Dietsch/Getty Images News

Article Thesis

Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) combines a compelling track record, an inexpensive valuation, and an above-average recession resilience. Buying it a year ago would have been a better idea, but buying shares at current valuations still should result in a healthy performance over the coming years. In any case, holding onto shares seems like a good idea for those that want to continue to benefit from Warren Buffett’s capital allocation skills.

Why Has Berkshire Hathaway Stock Been Rising?

Berkshire Hathaway has seen its shares perform well over the last year. In the most recent twelve months, Berkshire Hathaway stock rose by 37%, easily outperforming the broad market, which rose 17% over the same time frame. Berkshire Hathaway even managed to outperform the broad market over the last five years with a 113% gain versus a 96% gain for the S&P 500. This performance is even more remarkable when we consider that Berkshire’s shares are generally less volatile than the broad market, making BRK the better pick from a risk-reward perspective — at least historically.

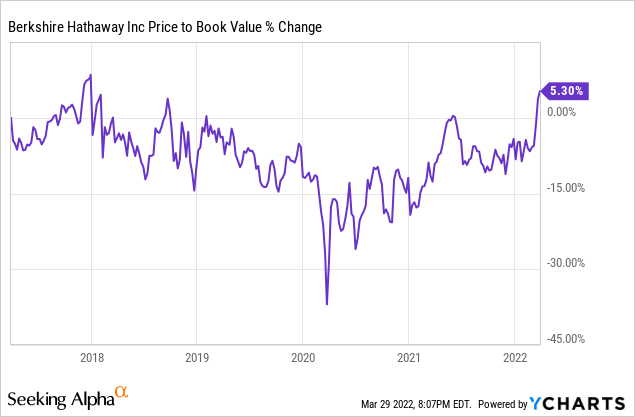

Over the last five years, Berkshire’s performance was almost entirely driven by underlying growth. The company’s price to book value multiple rose by just 5%, which means that almost all of the gains seen in that time frame were driven by an increase in BRK’s book value. Book value per share rose due to several factors. This includes gains in stocks Berkshire has invested in, such as Apple (AAPL), Bank of America (BAC), Coca-Cola (KO), and Occidental Petroleum (OXY). Cash piling up on the balance sheet, due to profits from its operating companies and dividend proceeds from its equity investments played a role in Berkshire’s rising book value as well. Last but not least, Berkshire has also bought back shares regularly in the recent past. This has resulted in company-wide book value being distributed over a steadily declining number of shares, thereby leading to a rising per-share book value. All in all, those factors explain most of the gains Berkshire has experienced over the last couple of years.

When we take a shorter-term view, e.g. when we look at 2022 only, book value growth has not been the most important factor, however. Instead, the market liked some of Berkshire’s deals, such as the recent buying of Occidental Petroleum stock. On top of that, exposure to other inflation-resistant commodity investments, e.g. through its fully-owned and operated Berkshire Energy business, also attracted investors. Berkshire also announced that it will acquire Alleghany, sometimes deemed a mini-Berkshire, in a $12 billion deal. Investors of both companies reacted positively to that deal, which also played a role in Berkshire’s highly compelling performance so far this year.

Berkshire Hathaway Key Metrics

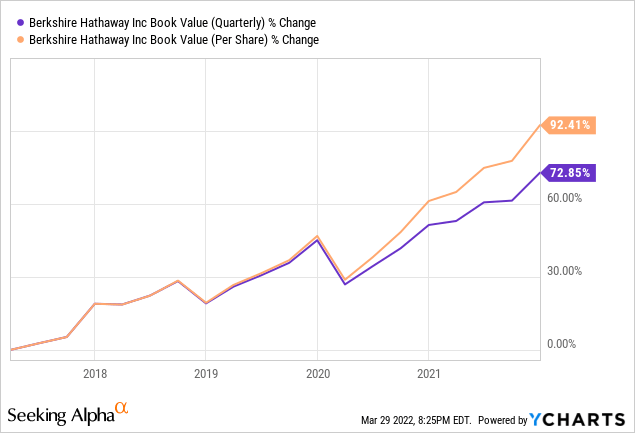

As indicated above, Berkshire Hathaway’s book value per share has risen at an attractive pace in recent years:

Book value experienced a dip during the first quarter of 2020, caused by the equity market sell-off about two years ago. Apart from that, book value has mostly moved upwards, however. Over the last five years, book value rose by more than 70%. For a Behemoth such as Berkshire, that’s quite an accomplishment — in fact, many analysts and investors wouldn’t have predicted a growth rate this high five years ago. Thanks to Berkshire’s buybacks, book value per share rose even stronger, by more than 90% in five years. This pencils out to a 14% annual growth rate. We see in the above chart that the gap between book value growth and book value per share growth only started widening meaningfully about two years ago when Buffett decided to ramp up the company’s buyback pace considerably. Prior to that, buybacks had only been made at a low level, whereas Berkshire has bought back a pretty huge $7 billion in Q4 alone, or $28 billion annualized.

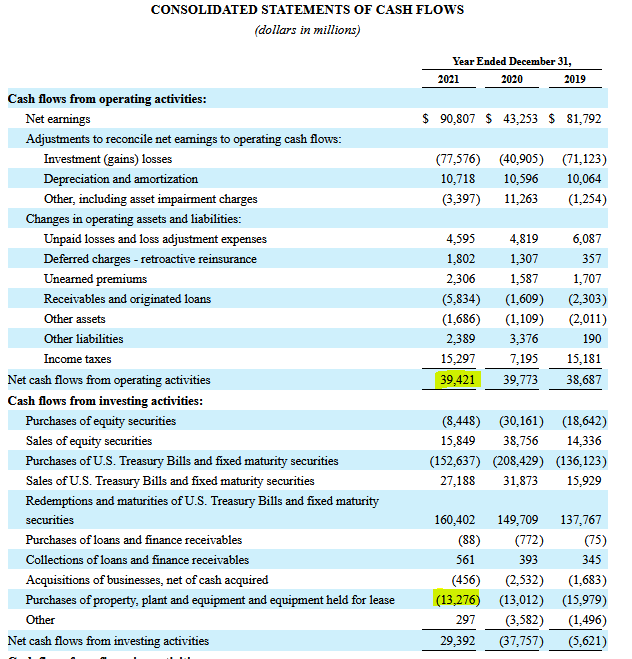

It should be very easy for Berkshire to continue buybacks at the recent pace in case Buffett deems the current valuation reasonably attractive (which isn’t guaranteed, however). According to its 10-K filing, Berkshire Hathaway Inc. generated free cash flows of $26 billion in 2021:

BRK 10-K

This was relatively unchanged from 2020 and slightly higher than in 2019. At the current buyback run rate of ~$28 billion, Berkshire should thus experience a small cash shortfall of $2 billion a year. Berkshire has a cash position of $160 billion, including debt investments such as treasuries. The company could thus theoretically maintain its current buyback pace for 80 years between its cash position and its vast free cash flows. This does not yet account for free cash flow growth that should be expected for 2022 and beyond. Berkshire should see higher profits in some of its operating businesses, such as its railroad BNSF, which should benefit from economic reopening and rising GDP. Berkshire Energy should also be more profitable this year, compared to 2021 and 2020, due to higher energy prices and higher energy demand.

Last but not least, Berkshire’s equity portfolio will likely generate larger cash flows for the company in the future, too. Stocks such as Coca-Cola, Apple, and Bank of America have a history of raising their dividends. Even if Berkshire does not buy additional shares, the income stream Berkshire generates from these holdings should continue to grow over time. Occidental Petroleum is another great example of what dividend growth in BRK’s equity portfolio could do for Berkshire in the future. OXY has just raised its dividend by 1,200%, albeit from a very low level. With deleveraging progress at OXY and thanks to a strong macro picture for oil, OXY could easily raise its dividend meaningfully in 2023 and beyond as well, thereby driving Berkshire’s cash flow over the years.

Thanks to a vast cash pile and strong free cash generation, it thus seems likely that Berkshire will be able to maintain or grow its buyback spending. Depending on where Berkshire trades in the future, Buffett might become less aggressive with buybacks, however. After all, Berkshire currently trades at a higher valuation compared to where BRK traded during the pandemic.

Is Berkshire Hathaway Overvalued Now?

Berkshire Hathaway Inc. currently trades at roughly 1.5x its book value. This is, as we have seen earlier, relatively in line with how Berkshire was valued in the past. In 2020 and 2021, Berkshire was cheaper, however. One year ago, Berkshire traded at around 1.3x book value, which means that shares are currently around 15% more expensive than they were twelve months ago.

It seems pretty clear that Berkshire was a better buy one year ago compared to today, but that doesn’t mean that the stock must necessarily be overvalued today. Instead, I do believe that shares are relatively reasonably valued right now. In the past, shares were quite undervalued at times, but that is not the case any longer I’d say. But when we account for the fact that the longer-term (5-year) median book value multiple is around 1.4, the current valuation does not seem overly high at all. BRK trades at a small premium to the average valuation over the last five years, but that difference isn’t large enough to call Berkshire overvalued, I believe. We should also consider that Q1 has essentially ended and that Berkshire’s actual book value is most likely higher than the number from the Q4 report that we have to calculate with, as Q1 results have not yet been reported.

Berkshire looks more pricey on an earnings multiple basis, as the forward P/E ratio stands at around 26. But that does not fully account for the value of Berkshire’s equity portfolio and cash position, thus I do not believe that looking at Berkshire’s reported profits is the best way to value Berkshire. The book value view does give a more complete picture, I believe.

Can Berkshire Hathaway Stock Go Up Further?

In the short run, the stock could continue to climb as long as sentiment remains positive, which includes sentiment for the broad market due to BRK’s exposure to stocks such as AAPL, KO, etc.

I do not believe that investors will benefit from multiple expansion tailwinds in the long run, however. The good news is that multiple expansion isn’t really needed for BRK to be a solid investment. Instead, even with some multiple compression, e.g. from a price/book multiple of 1.5 to one of 1.4, Berkshire could deliver healthy gains. If Berkshire’s book value per share climbs by 8% a year over the next five years, while the valuation compresses towards a 1.4x book value multiple, Berkshire would trade at $470 by the end of 2027. That makes for annual total returns of 6%-7%. That’s not outrageous, but coming from a steady low-risk performer such as Berkshire, returns in that range wouldn’t be bad at all. It is also possible that Berkshire’s book value grows by more than 8% a year going forward — it has done so in the past. Since equity investments such as AAPL will likely not deliver a similar performance compared to the last five years going forward, I do believe that Berkshire will not deliver 13% annual book value gains going forward. Still, the 8% book value growth rate might be too conservative, which means that BRK’s total returns could be higher than 6%-7% a year going forward.

Is Berkshire Stock A Buy, Sell, Or Hold?

I do not at all believe that BRK is a sell right here. The total return outlook is far from bad, and the company’s large cash position and Buffett’s capital allocation skills mean that Berkshire could be an outperforming investment during a potential market downturn or recession.

Whether one sees Berkshire as a buy or a hold today depends on one’s investment goals. Those that are happy with annual returns in the high-single-digits may want to buy shares today, while those that seek higher annual returns might be better off waiting for a sell-off, which would allow them to (potentially) enter a position at a more favorable valuation. Depending on your investment horizon and investment goals, BRK is thus either a buy or a hold today, but not a sell.

Be the first to comment