Justin Sullivan/Getty Images News

AT&T (NYSE:T) has announced an annual dividend of $1.11 after the spin-off which is mostly in line with prior estimates. After taking into account the new shares in Warner Bros. Discovery, the dividend yield for AT&T stock could be close to 6%. Many analysts have made the argument that this alone is a strong incentive to invest in AT&T as the fundamentals of the core telecommunication company are stable.

However, despite the high dividend yield, investing in AT&T has seldom helped in providing total returns which beat the wider S&P 500 index. With the current debt levels, the enterprise value of the company is $350 billion compared to market cap of $170 billion. Even after the spin-off, the debt levels will be too high which can be a major headwind for the company as it tries to improve its 5G network.

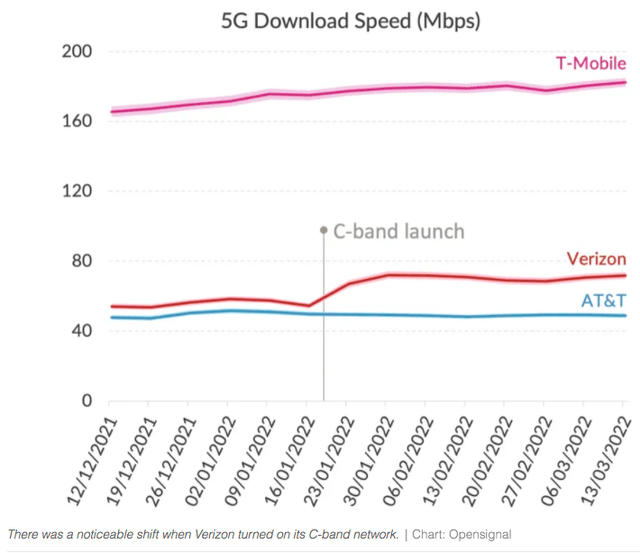

Verizon (VZ) and AT&T have recently rolled out C-Band across a number of regions. Despite this effort, they are significantly behind T-Mobile (TMUS) in terms of speed and users covered. Unless major progress is made on this front, investors should be very cautious about investing in AT&T stock.

Total returns have been dismal

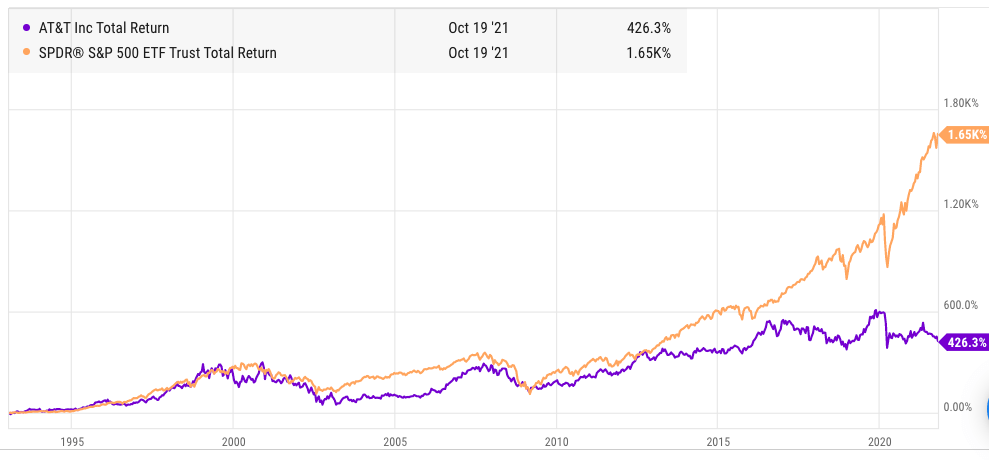

Investing solely for the sake of dividends in AT&T has not given investors a good return over the last few decades. Even if we look as back as 1990 to the period prior to the merger with WarnerMedia, AT&T has never been able to beat the total returns of S&P 500 on a sustainable basis. At the same time, investors have had to deal with a lot of corporate shenanigans over this time.

YCharts

Figure 1: AT&T’s poor total returns compared to broader market over the last few decades. Source: YCharts

From the early 1990s to 2016, the total returns of AT&T stock have been quite dismal. The gap between S&P 500 and AT&T’s total returns became even more extreme after the merger with WarnerMedia.

Figure 2: The yield for AT&T has always been much higher than S&P 500 but it has not helped the overall total returns for investors. Source: YCharts

Betting on future dividends

After the recent announcement, investors would get annual dividends of $1.11. Based on average estimates, the value within Warner Bros. Discovery will equate to $4.5 per AT&T share. Hence, the new value of AT&T stock would be close to $19. This will give a dividend yield of close to 6%. The management has gone so far to say that “it will remain among the best dividend-yielding stocks in the United States and in the Fortune 500.”

By all accounts, a 6% yield is quite healthy even if investors want to sell their share in Warner Bros. Discovery. However, as mentioned above, a high dividend yield does not result in a good total return over the long run. AT&T continues to face challenges in the near term which should be very concerning for all investors. The biggest challenge is the lack of progress in the 5G rollout. AT&T has tried everything including giving huge discounts to lock in cust3omers, asking the regulators to add “guardrails” to limit competition, preventing T-Mobile to advertise its 5G as the “most reliable 5G” network and more.

Figure 3: No improvement in 5G network coverage of AT&T after turning on its C-Band network. Source: Verge, Opensignal

AT&T has poured in billions of dollars in improving its 5G network but it is still far behind T-Mobile. It is possible that there is a strong shift in customer perception where T-Mobile becomes the de facto market leader in 5G coverage. This will put further pressure on AT&T in terms of pricing.

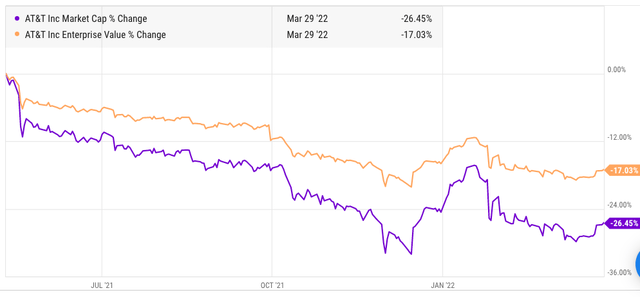

Possibility of further decline in stock price

AT&T’s stock price has declined by over 26% since hitting a peak in May 2021. It has seen an even bigger decline of 40% since January 2020, prior to the pandemic. However, during this time, the enterprise value of the company which takes into account the debt has declined by only 18%. This shows that a smaller decline in enterprise value can lead to a much bigger swing in the stock price level.

Figure 4: Decline in enterprise value is much lower than the decline in stock price. Source: YCharts

Dividend investors are usually more conservative and do not want bigger speculative swings in the stock price. However, given the current relationship between the market cap and enterprise value, we could see a bigger decline in stock price at any minor negative news from the company. This will affect the total returns of the stock.

Investors looking to hold onto their shares in Warner Bros. Discovery should look at the changing condition in streaming business. In addition to this, the new company will have another $55 billion in debt. While the streaming business is viewed as a high-growth industry, the massive debt levels can limit the ability of the company to ramp up investments when big players like Netflix (NFLX), Disney (DIS), Amazon (AMZN), and others are increasing their own content budget. The higher debt levels will also make the new company more prone to big swings which won’t be particularly attractive to dividend investors.

Hence, investing solely to gain access to AT&T’s dividends does not seem a very good bet considering the past track record and the future uncertainties faced by the company.

Investor takeaway

AT&T has had a poor record in beating the total returns of S&P 500 despite giving massive dividends. The entire period from mid-1990s to 2016 saw AT&T stock lag S&P 500 in total returns. After the merger with WarnerMedia, things went completely downhill. Currently, AT&T’s stock gives a dividend of over 8% and post spinoff it will still give close to 6% dividend yield at current price. But AT&T and the new Warner Bros. Discovery will have to deal with massive debt which will limit the ability of the management to be generous to investors.

The uncertainties in the near and medium-term can further dampen Wall Street’s sentiment towards AT&T which will reduce the total returns for the stock. Dividend investors are looking for conservative investments with few swings. AT&T stock is going to be the complete opposite of that in the near term which makes it not an attractive dividend bet.

Be the first to comment