andresr

A Quick Take On Arhaus

Arhaus (NASDAQ:ARHS) went public in November 2021, raising approximately $168 million in gross proceeds from an IPO that priced at $13.00 per share.

The firm is an omni-channel retailer of premium quality home furnishings.

While management has guided net income higher for the remainder of 2022, I’m cautious about the company’s prospects in 2023 from elevated inventories and a slowing economy.

As a result, I’m on Hold for ARHS in the near term.

Arhaus Overview

Boston Heights, Ohio,-based Arhaus was founded to sell “heirloom quality, artisan-made furniture and decor” products via an omni-channel approach.

Management is headed by co-founder and CEO John Reed, who has been with the firm since inception and had previously stepped out of the CEO role only to have to step back in when new CEO Adrian Mitchell resigned in 2019 after only one year on the job.

The company’s primary offerings include:

-

Furniture

-

Accessories

-

In-Home Design Services

-

Digital Tools

The firm pursues an omni-channel business model, with over 75 retail stores and online direct-to-consumer website and ordering capabilities.

Management has said it intends to open “between five and seven new stores per year for the foreseeable future.”

Arhaus’ Market and Competition

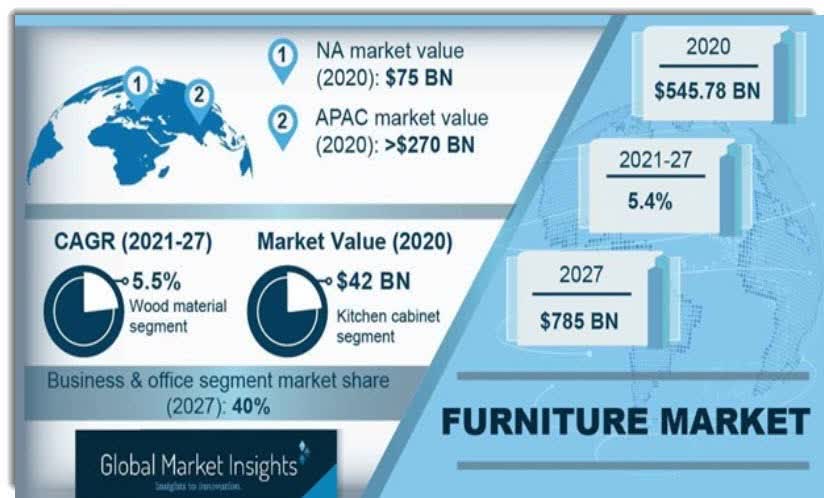

According to a 2021 market research report by Global Market Insights, the global market for furniture was an estimated $546 billion in 2020 and is expected to reach $785 billion by 2027.

This represents a forecast CAGR of 5.4% from 2021 to 2027.

The main drivers for this expected growth are a continued growth in development of new residential projects and “ongoing smart city developments.’

Also, below is a chart showing the global furniture market at a glance:

Global Furniture Market (Global Market Insights)

The U.S. furniture market is highly fragmented, with more than 23,000 retail furniture establishments.

The company competes with a wide variety of national and regional retailers, department showrooms, mail order catalogs, interior design trade showrooms and others.

Arhaus’ Recent Financial Performance

-

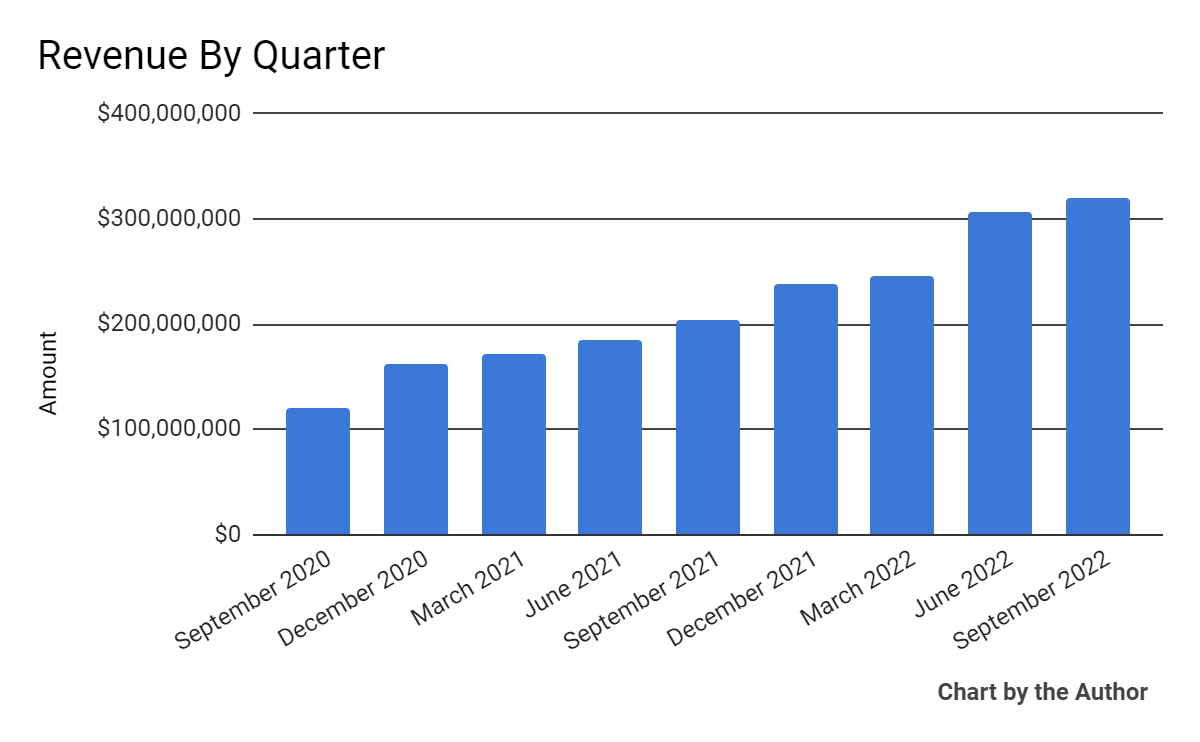

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

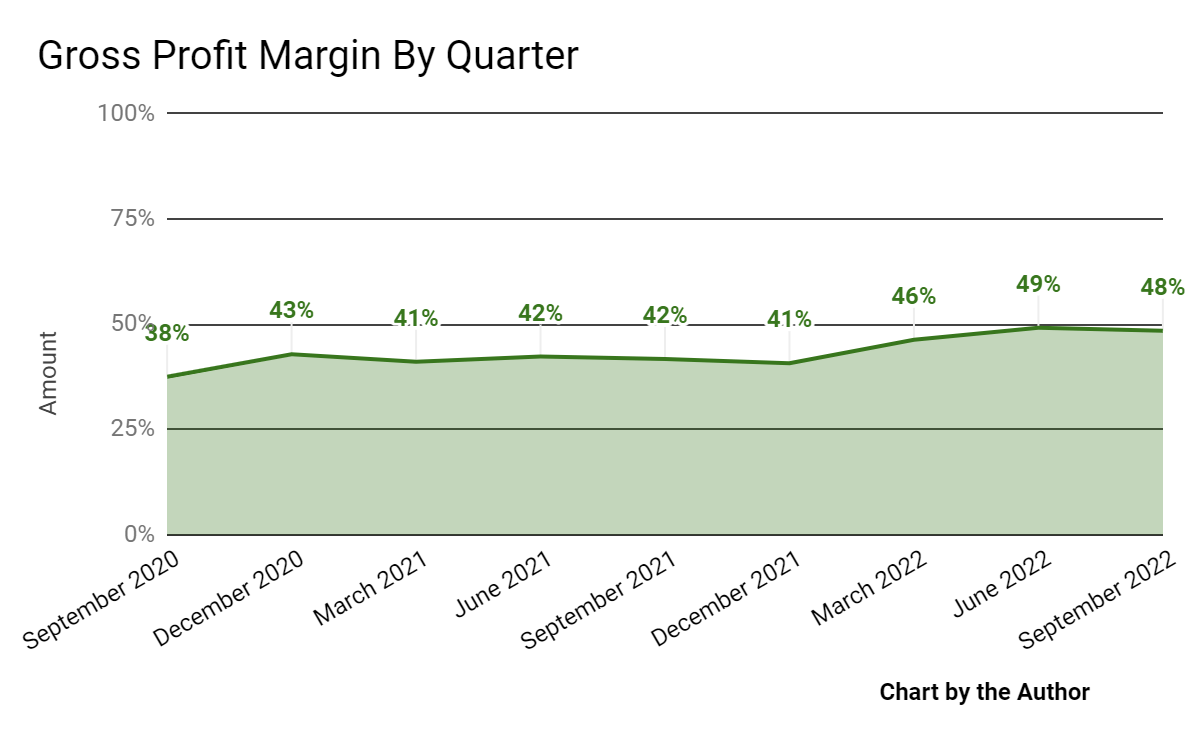

Gross profit margin by quarter has trended higher in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

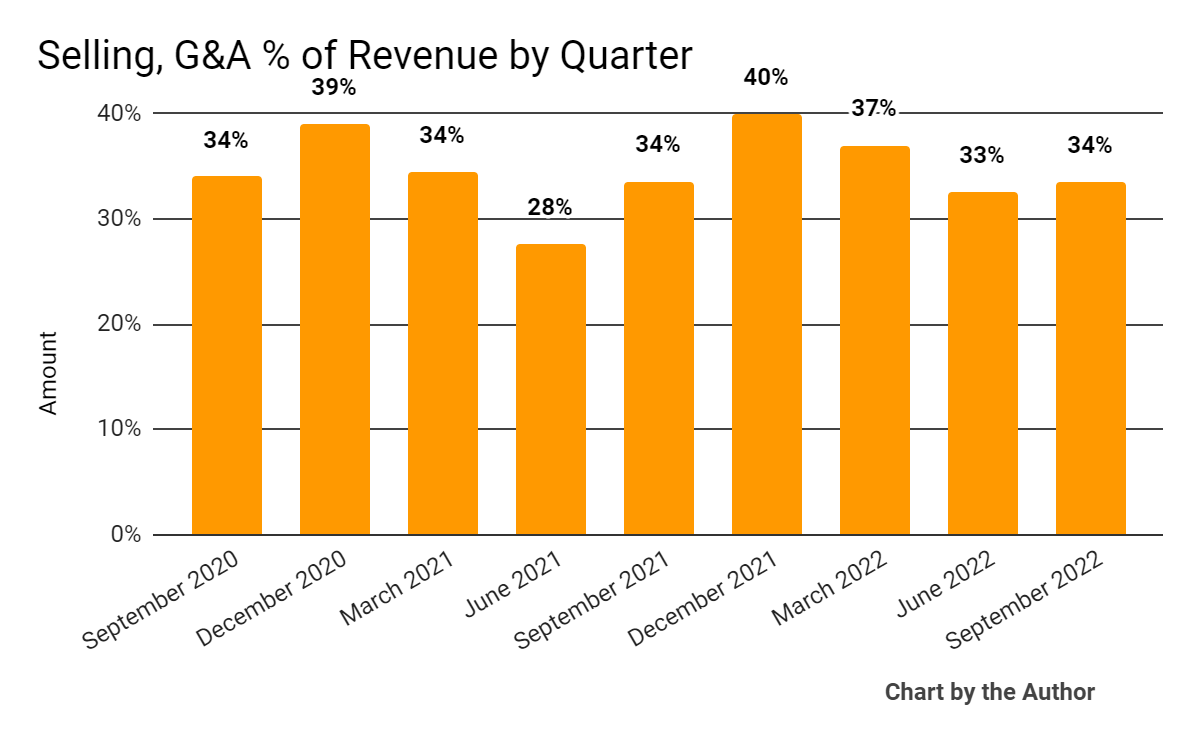

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated within a relatively narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

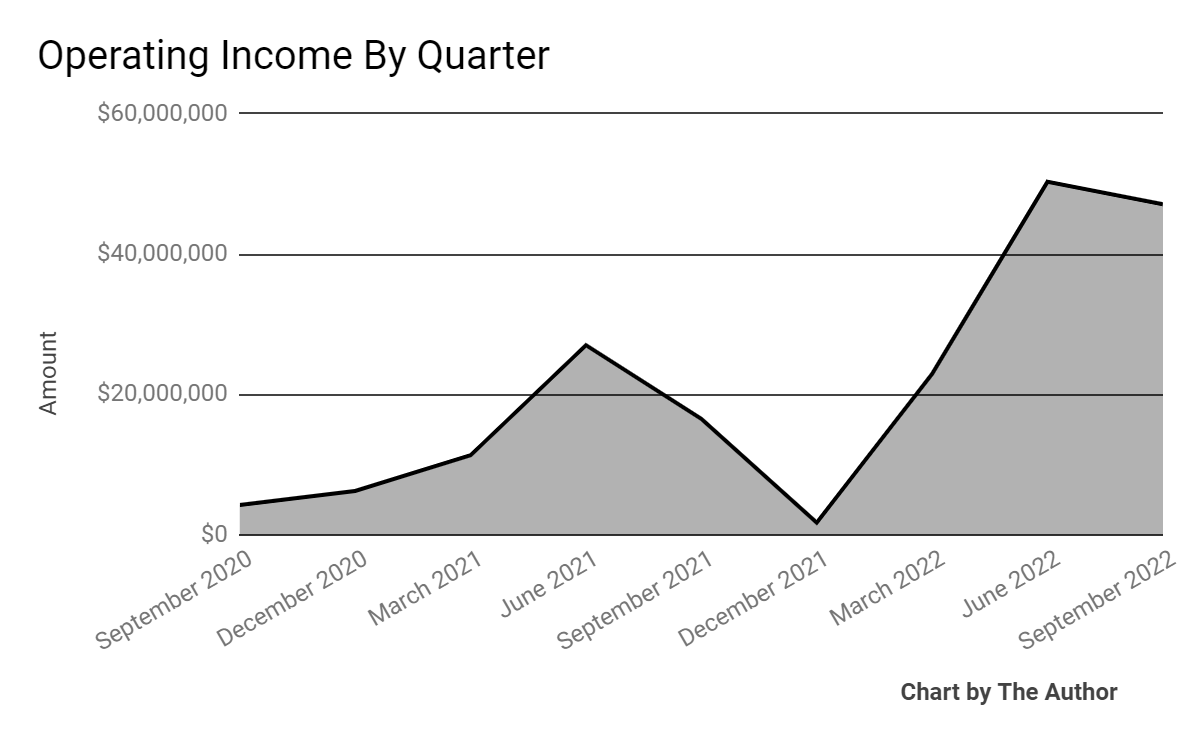

Operating income by quarter has risen substantially in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

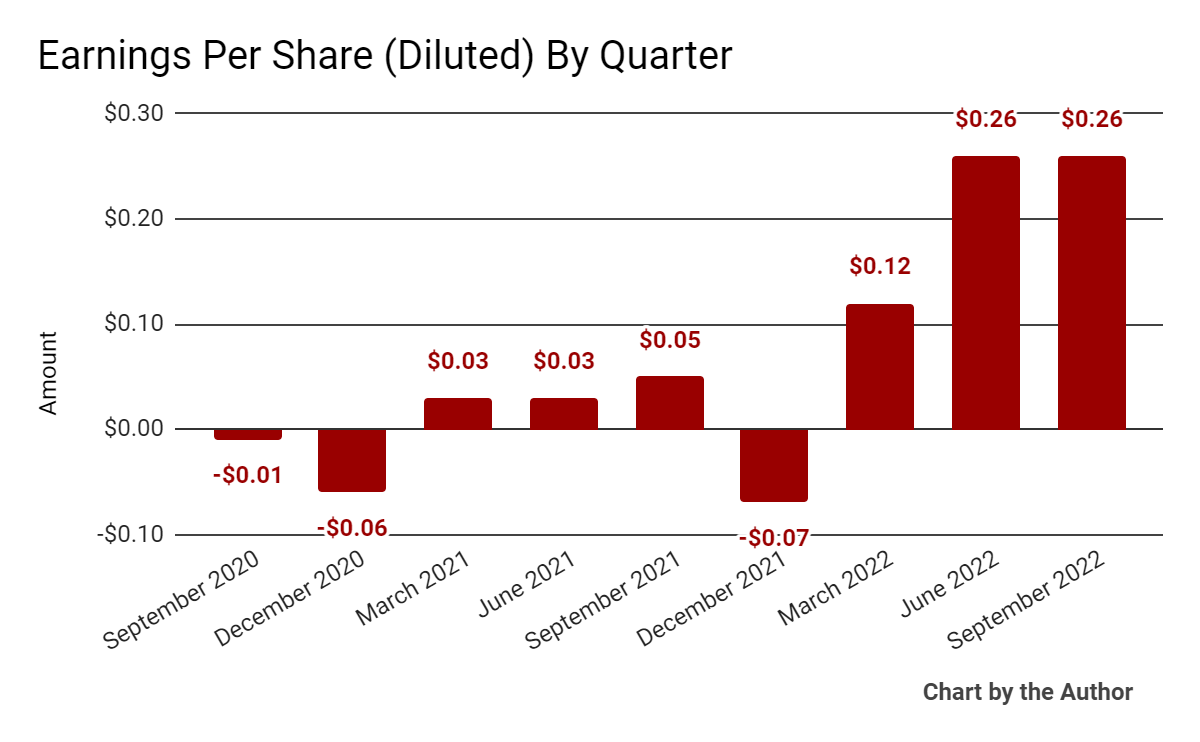

Earnings per share (Diluted) have grown markedly recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

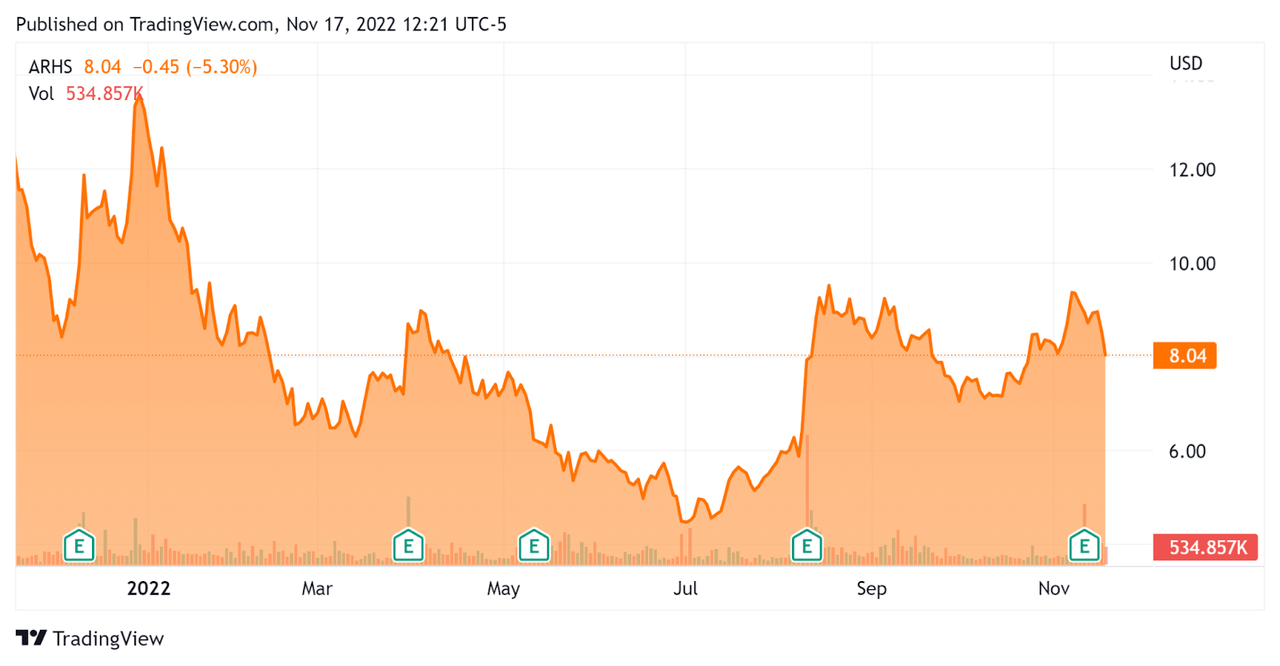

Since its IPO, ARHS’s stock price has fallen 32.3% vs. the U.S. S&P 500 index drop of around 16.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Arhaus

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.3 |

|

Enterprise Value / EBITDA |

9.6 |

|

Revenue Growth Rate |

53.0% |

|

Net Income Margin |

8.8% |

|

GAAP EBITDA % |

13.7% |

|

Market Capitalization |

$1,250,000,000 |

|

Enterprise Value |

$1,460,000,000 |

|

Operating Cash Flow |

$63,290,000 |

|

Earnings Per Share (Fully Diluted) |

$0.57 |

(Source – Seeking Alpha)

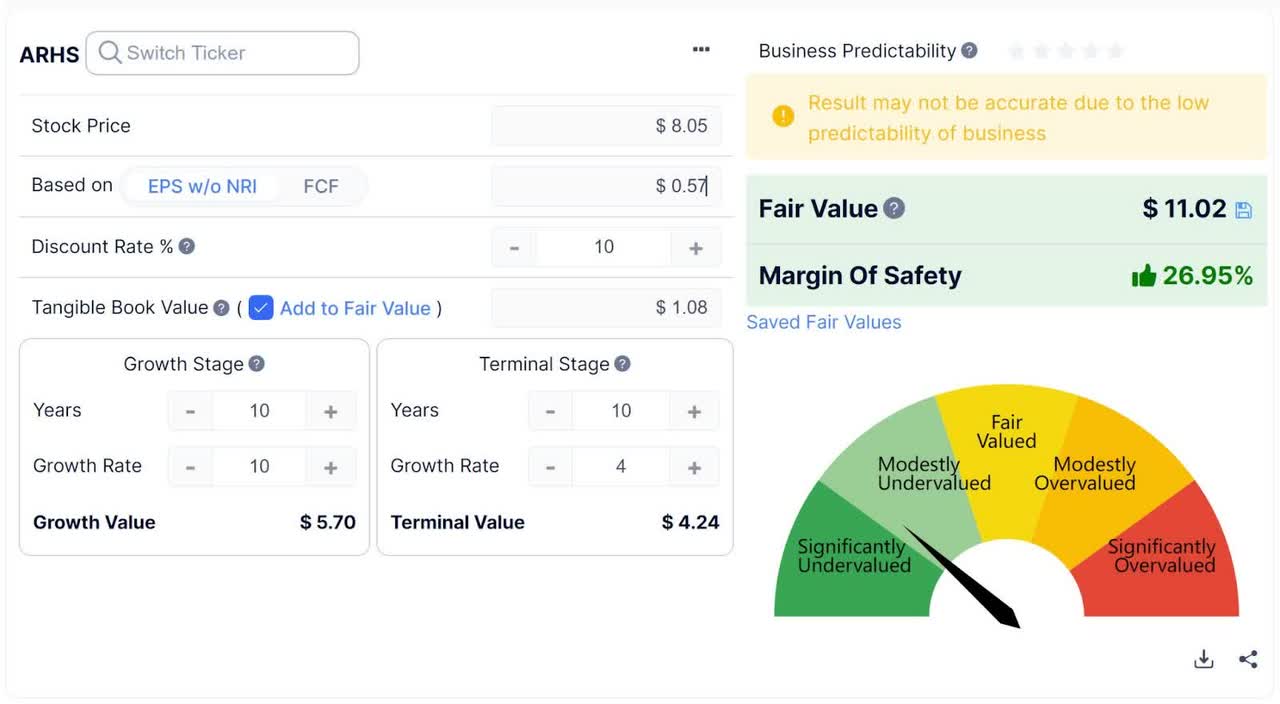

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Arhaus Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $11.02 versus the current price of $8.05, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Arhaus

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted a positive response to the beginning of its fall marketing campaign and improving supply chain results.

Its retail showroom plans are “very robust,” with an expected opening of a design studio in Park City, Utah and two more openings scheduled for the coming months.

Management is planning to add five to seven new showrooms annually.

As to its financial results, revenue rose 57% year-over-year, while adjusted EBITDA grew by 87%.

Gross margin percentage increased 90 basis points due to higher margins in its showroom segment as it sells more products through a fixed occupancy cost structure.

However, SG&A expenses increased due to “higher corporate and warehouse expenses as new showrooms open.”

For the balance sheet, the company finished the quarter with cash and equivalents of $146 million with no long-term debt.

Over the trailing twelve months, free cash flow was only $8 million and capital expenditures were $55.3 million.

Looking ahead, management reiterated its previous revenue growth guidance at 45.5% at the midpoint of the range and raised its full-year 2022 net income outlook to $112 million and adjusted EBITDA of $189 million at the midpoint.

Regarding valuation, my discounted cash flow indicates the stock may be undervalued at its current price level.

However, the primary risk to the company’s outlook is a high inventory position going into an economic slowdown, which may expose it to the need for greater “promotion” during the holiday season as retailers seek to reduce bloated inventory levels through discounting.

A potential upside catalyst to the stock could include a “short and shallow economic slowdown in 2023.”

While management has guided net income higher for the remainder of 2022, I’m cautious about the company’s prospects in 2023 from a slowing economy.

As a result, I’m on Hold for ARHS in the near term.

Be the first to comment