DNY59

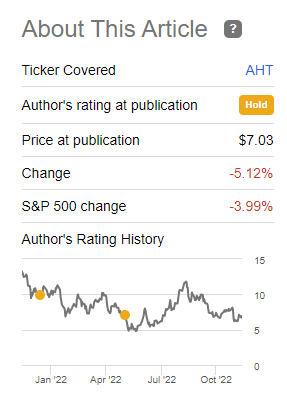

When we last covered Ashford Hospitality Trust (NYSE:AHT) we did not have any good news for the long-suffering bulls. Our outlook was based on a very leveraged balance sheet and a management that had shown ability to dilute at will. Specifically we said,

AHT’s leverage remains extreme, even as hotel traffic improves. The next few quarters will be challenging as AHT deals with high labor costs and possibly some demand stall from high gas prices. The interest rate hit will start to really bite in Q3-2022 and we don’t expect AHT to generate free cash flow this year. We remain neutral here and suggest investors focus on the underlying poor value per share rather than how far the stock has fallen since the pandemic.

Source: Flying Straight Into The Storm

AHT is actually down from the last article and even from the one before that.

Seeking Alpha

We look at the Q3-2022 results and tell you how our thesis is panning out.

Q3-2022

AHT’s press release looked like a blockbuster. It was hard not to be impressed with the daily rates or the Adjusted EBITDA numbers. The adjusted funds from operations (AFFO) reflected massive growth as well.

Comparable RevPAR for all hotels increased 29% to $127 during the quarter on a 14.5% increase in ADR and a 12.9% increase in Occupancy. Comparable RevPAR for all hotels decreased approximately 4% compared to the comparable period in 2019, which is the best quarterly performance compared to 2019 since the onset of the pandemic.

Adjusted EBITDAre was $82.1 million for the quarter, reflecting a growth rate of 75.2% over the prior year quarter.

Adjusted funds from operations (AFFO) was $0.52 per diluted share for the quarter, reflecting a growth rate of 373% over the prior year quarter.

Source: AHT Q3-2022 Press Release

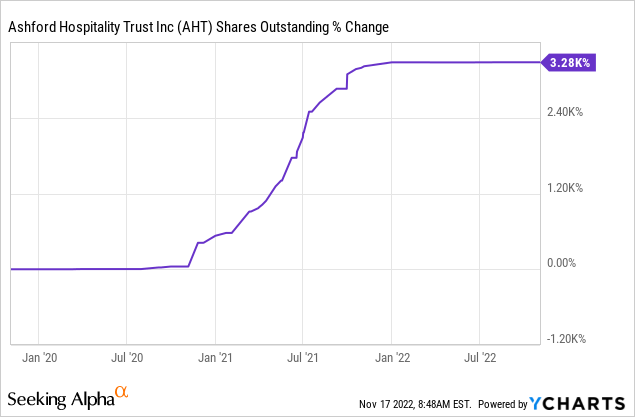

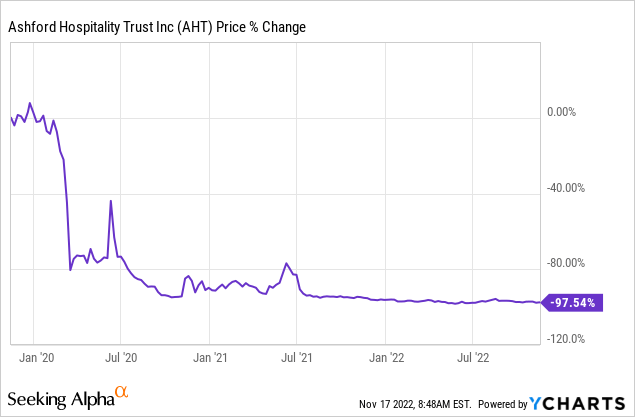

Of course, the poor suffering bulls know that reaching the 2019 benchmark, after diluting your share count 3,280% is not going to help much.

The stock is actually a perfect reflection of the dilution. If we divide one by 32 we get about 3%, and all other things being equal, the stock should be down to 3% of its original value (or down 97% from 2019) just based on the dilution.

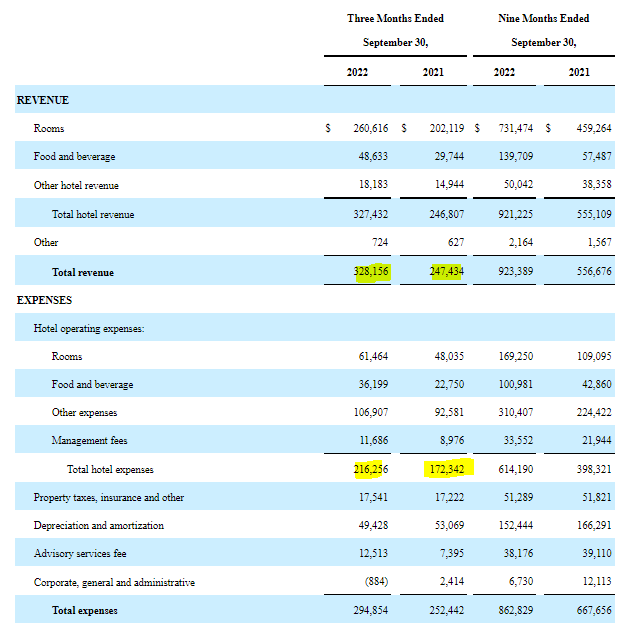

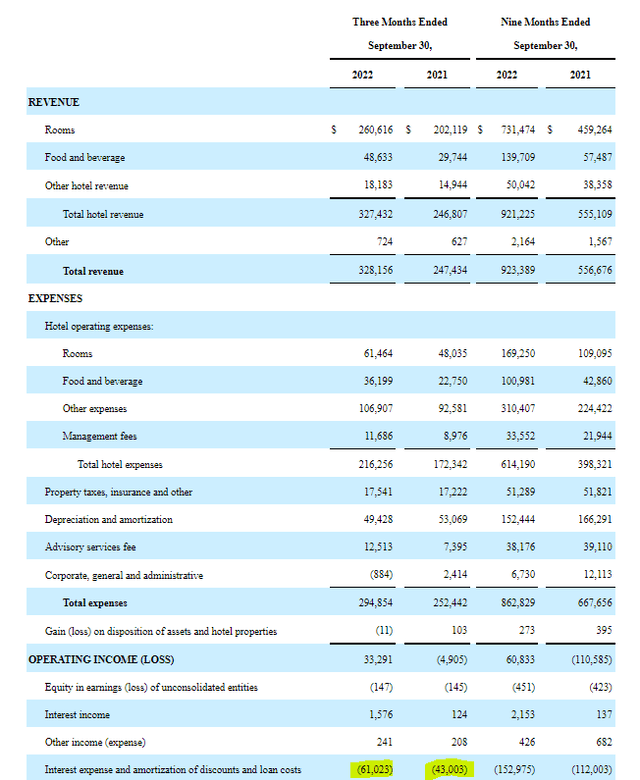

Getting back to the results though, AHT is executing quite nicely. Total revenues gained 32%, which outpaced hotel operating expenses (25% increase) increase by a fair chunk.

AHT Q3-2022 10-Q

We were a bit skeptical earlier in the year whether AHT would be able to manage expansion in their margins in the face of labor shortages, but they proved us wrong here. The main story for the fledgling AHT baby bull though, were the interest expenses.

AHT Q3-2022 10-Q

These jumped up to $61 million in the quarter and are now running close to $250 million on an annualized basis. The good news here is that the LIBOR based rates are about to hit their upward caps. Based on what is said below, we can conclude that interest expense should cap off at a $262.00 million annualized rate.

At the end of the third quarter, we had $3.8 billion of loans with a blended average interest rate of 6.7%. Our loans were approximately 8% fixed rate and 92% floating rate.

We utilized floating rate debt as we believe it is a better hedge of our operating cash flows. However, we do utilize caps on those floating rate loans to protect the company against significant interest rate increases. We currently have interest rate caps in place on all of our floating rate debt.

Taking into account the current level of LIBOR and the corresponding interest rate caps approximately 59% of our debt is now effectively fixed and approximately 41% is effectively floating.

If LIBOR, which is currently at 3.8% goes above 4% all of our debt would be effectively fixed as all of our interest rate caps would be in the money.

Source: AHT Q3-2022 Conference Call Transcript

But that was just the “shot” for the bears. Here is the “chaser”.

These caps are typically structured to expire simultaneously with the maturity dates of the underlying loans and the vast majority of these caps will expire during 2023 as we have several loans with initial maturity dates in 2023.

Most of these loans have extension options that include the requirement to purchase additional interest rate caps. We recently purchased forward starting interest rate caps in anticipation of these extension options. We have no final debt maturities for the remainder of the year and have only two loans with balances of approximately $98 million with final maturities in 2023.

Some of the company’s loans will be subject to extension tests. And with our significant cash balance we believe we are well prepared to meet any potential loan paydowns required to meet those tests. Our hotel loans are all non-recourse and currently 85% of our hotels are in cash traps. A cash trap means that we are currently unable to utilize property-level cash for corporate-related purposes.

Source: AHT Q3-2022 Conference Call Transcript

So, with the highest revenue run-rate, 85% of the hotels remain cash traps and according to management it should remain at that percentage for the foreseeable future.

Outlook & Verdict

It is easy to get seduced by the low AFFO multiple of AHT. Unfortunately, common stockholders are unlikely to see any of that AFFO any time soon.

Assuming yesterday’s closing stock price, our equity market cap is approximately $285 million. While we are currently paying our preferred dividends quarterly, we do not anticipate reinstating a common dividend for some time.

Source: AHT Q3-2022 Conference Call Transcript

There are three reasons for this. The first is that interest rate pressures are still on the way up and while these may top out in Q4-2022, we think the extensions will come at an even higher rate.

The second reason is that AHT’s margin of error is very small. AFFO can drop to zero or go negative pretty rapidly if we hit a recession. AFFO was under $19 million this quarter. Weight that against the $3.8 billion of debt that the company has.

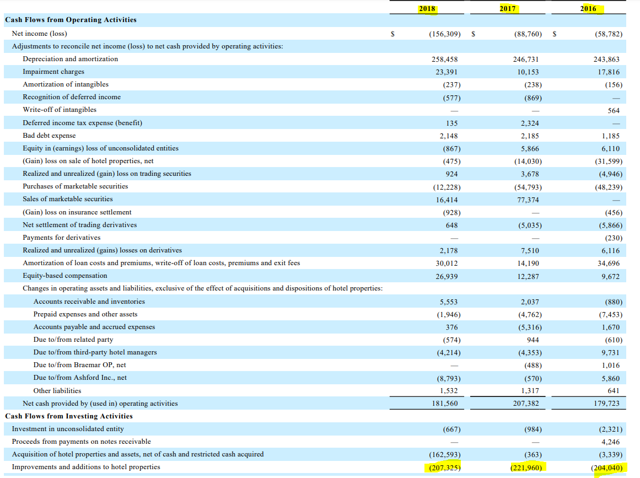

The final reason is that AHT is long overdue for its capex cycle. Between 2016-2018, AHT ran a $200 million a year capex cycle.

AHT 2018 10-K

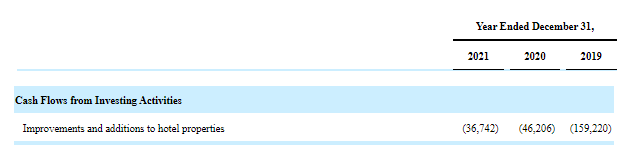

This was cut to the bone in 2020 and 2021.

AHT Q3-2022 10-Q

2022 capex is crawling up and we saw $68 million during the first three quarters. Assuming this moves to a normalized run-rate of the 2016-2018 era, we would need $250 million in today’s dollars, even ignoring any catching up. The biggest thing to keep in mind is that AFFO is before capex. Write that down and stick it above your computer screen. Any time you get the urge to speculate that AHT is cheap, make sure you read that. Even assuming they do $2.00 of AFFO on a consistent basis and find a way to handle all their problematic loan extensions, that works out to only a $70 million pre-capex run rate. Hence under no realistic scenario is AHT paying you a dividend and under no rational financial valuation measurement, is AHT “cheap”. We continue to rate the common shares a “hold”.

The preferred shares are a different story and present many more grounds for opportunistic trading. AHT has 5 preferred stocks,

1) Ashford Hospitality Trust, Inc. PFD Series D (NYSE:AHT.PD),

2) Ashford Hospitality Trust, Inc. PFD Series F (NYSE:AHT.PF),

3) Ashford Hospitality Trust, Inc. PFD Series G (NYSE:AHT.PG),

4) Ashford Hospitality Trust, Inc. PFD Series H (NYSE:AHT.PH), and

5) Ashford Hospitality Trust, Inc. PFD Series I (NYSE:AHT.PI).

All of them offer very high yields and are made safer by the fact that AHT’s external manager has no hesitation in diluting the common stock to generate cash. We think those offer better risk-reward scenarios relative to the common shares and are an excellent way to take advantage of the fact that all of AHT’s debt is at the property level.

Be the first to comment