Editor’s note: Seeking Alpha is proud to welcome Vader Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

shaunl

Recommendation

I recommend buying Core & Main (NYSE:CNM). Customers prefer working with CNM because of the company’s extensive product catalog, in-depth understanding of the industry, numerous accessible branch locations, familiarity with local specifications, and dependable, on-time shipping. These factors, combined with CNM’s market leadership due to its size and scale, supplier connections, and technical product expertise, make CNM an appealing investment target.

Business

CNM is a leading specialized distributor of products and services related to water, wastewater, storm drainage, and fire protection. The company provides products and services to private water companies, municipalities, and specialized contractors (across municipal, residential and non-residential markets nationwide). CNM products and services are used in the maintenance, repair, replacement, and building of water and fire protection infrastructure.

CNM has a leading position in the industry

Based on management’s projections in its S-1, CNM’s addressable market is worth about $27 billion per year, and CNM has a well-defined plan to expand its share of the market.

Customers and vendors, in my opinion, can benefit from working with distributors rather than going straight to manufacturers. The importance of the specialized distributor within the value chain is growing as a diverse customer base requires greater product availability from numerous suppliers. In this way, CNM’s value proposition shines because it offers specialized product selection as well as project scoping and management. This makes it an important part of how their customers plan and carry out their projects.

I think CNM’s long-term growth will be supported by the positive industry trends it is exposed to across its various end markets. Growth in CNM is primarily being driven by the municipal, non-residential, and residential construction industries. From what I can tell, CNM is positioned to profit from the anticipated acceleration of regulatory investments to repair and upgrade existing infrastructure or to promote water conservation. Population growth and suburbanization also bode well for CNM, allowing the company to capitalize on an uptick in both residential and non-residential construction activity.

Preferred choice of customers as a one-stop-shop

CNM is the go-to supplier for many because of the company’s familiarity with local specifications, speedy deliveries, numerous branch locations, and overall professionalism. Using its extensive supply chain relationships, CNM provides customers with a “one-stop-shop” experience and individualized support for the upkeep and construction of water, wastewater, storm drainage, and fire protection systems.

In addition, the company’s reach allows it to provide its services to customers of all sizes, both locally and nationally. Local sales associates consult with customers to come up with solutions that fit their needs. They do this by having a deep understanding of local regulatory requirements and product or service specifications.

In my opinion, CNM’s success can be attributed in large part to the company’s ability to support its customers by translating engineering drawings and specifications into detailed and precise material project plans. CNM’s proprietary digital technology tools for interacting with customers further enhance the company’s technical expertise and experience. Using the PowerScope bidding platform and the Online Advantage and Mobile Advantage customer portals, CNM is able to work closely and effectively with its clients on material management, buying inventory on time, quoting, and coordinating delivery to job sites.

In my opinion, CNM has a competitive advantage over smaller competitors who may not have the scale or resources to offer comparable technology or services, as the customer-facing technology tools they employ help to build customer loyalty and repeat business.

Broad geographical footprints to ensure maximum coverage

CNM uses a branch-based business model, with locations carefully chosen to be in close proximity to its clientele. Each location works hard to meet the needs of its customers by stocking a selection of products, brands, and quantities that are unique to their needs and preferences. Because of their proximity to customers, branch managers and sales representatives can provide value-added services and consultative sales strategies that are specifically designed to meet the demands of each individual market. CNM sets its pricing strategy on a national level and keeps a close eye on supply chain trends to make sure it stays competitive in local markets.

Thanks to their specialized fleet of equipment, CNM is able to provide timely and affordable material delivery to customer job sites. Because of their extensive branch network and well-maintained fleet, they are able to efficiently manage delivery to construction sites and supply clients with consistent, reliable service.

Strong partnership relationship with suppliers is a strong competitive advantage

CNM has built strong relationships with its suppliers thanks to its extensive history in the industry, large purchasing scale, national footprint, and ability to reach a dispersed customer base. It is the opinion of CNM’s management that the company’s size makes it the largest volume customer for many of their suppliers, a fact that has led to preferential purchasing arrangements. Additionally, CNM’s size enables the company to obtain restricted distribution rights in strategic product categories, as well as to offer customers access to strategic products that are unavailable from competitors.

To my knowledge, CNM is able to secure preferential access to specialized products and products during periods of material shortages or when shorter-than-usual lead times are required for certain projects because of their size and scale, supplier relationships, and technical knowledge of products and local specifications. When it comes to large and complex projects, CNMs have a significant advantage over their smaller competitors.

Internal team structured for success

CNM employs a sizable and seasoned group of sales and field managers. Field sales representatives work within local territories and maintain close relationships with individual customers; these include district and branch managers, as well as regional vice presidents who manage territories in multiple states. Associates participate in the industry through membership in relevant trade groups. There is a growing infrastructure gap that needs to be addressed, and these groups help educate CNM’s industry, legislators, and the general public on the needs of the nation’s water infrastructure, which in turn encourages investment in water infrastructure.

Managers at CNM have considerable leeway to run their branches in accordance with local conditions, and employees are rewarded for achieving growth and profitability, both of which contribute to the company’s entrepreneurial culture. In my opinion, this allows CNM to recruit and keep some of the best managers and sales representatives in the business, people who are dedicated to satisfying their clients while also maximizing the company’s bottom line. The incentive plans aim to strike a balance between growth, profitability, and investment at the local branches and are thus closely tied to overall financial performance and working capital optimization.

Valuation & model

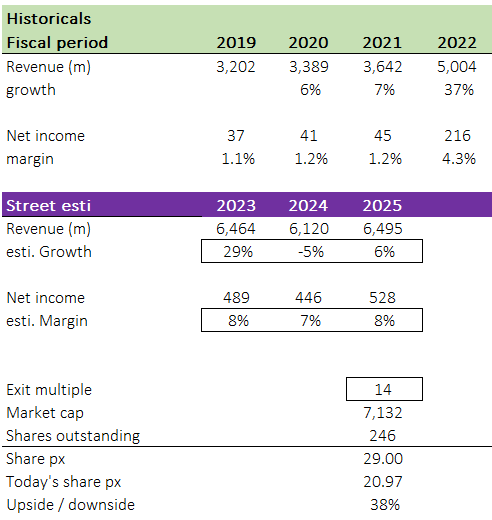

I believe there is a 40% upside over 3 years based on the streets estimates of revenue and net income. Similar to consensus, I believe revenue will see a huge year on year growth in FY23, a slowdown in FY24 due to the weak global macro environment, and recovery in FY25. The key thing to note is profitability. I expect net margin to sustain moving forward.

I used the streets estimates in this case as the stock is pretty well covered by the big banks (total of 11 analysts covering it), and hence the estimates should be roughly in line with what management is guiding.

My input is the exit multiple that CNM should trade at in FY25. CNM currently trades at a 11x TTM earnings, 3x below its average. I believe CNM should trade back to its average once the macroeconomic cycle turns for the better (i.e., interest rates goes down).

Author’s own calculation

Risks

Growth tied to municipal infrastructure spending

Across the board, regional and local decreases in municipal spending on waterworks infrastructure are having an effect on the transportation market. Products’ sales could suffer if local governments cut back on funding for infrastructure projects. When the economy is struggling, spending on infrastructure and construction slows, which can have a negative impact on revenue.

Consolidation within the industry

The industry has consolidated as a result of increased customer awareness of the full costs of fulfillment and the necessity of reliable sources of supply in numerous locations. Competition in the industry may heat up as a result of mergers and acquisitions if companies in the market are able to scale up and lower their operating costs, or if new, innovative transactional business models are introduced.

Summary

To conclude, I think CNM is underappreciated. CNM has a leading position because of its large purchasing power, widespread presence, diverse customer base, and extensive history in the water infrastructure industry. Using consensus estimates, we should expect a decent upside from here if CNM trades back to its average multiple.

Be the first to comment