BING-JHEN HONG

After the bell on Wednesday, we received fiscal third quarter results from semiconductor giant Nvidia (NASDAQ:NVDA). Despite being a tough time for chip names, and the company’s weak guidance for the Q3 period, shares had recently surged more than 57% from their 52-week low. While the company’s report was not the greatest by any means, the lack of a major negative catalyst was good news for long term investors.

For Q3, revenues came in at $5.93 billion, down 17% over the prior year period. This number was a little ahead of the company’s guidance midpoint, but it beat street estimates by a little more than $100 million. Of course, one must realize that expectations had dropped tremendously after the company’s weak guidance a few months back, but at least we didn’t see a miss here. Data Center revenue was up 31% year over year, while Automotive and Embedded sales were up 86%. Unfortunately, Gaming revenues dropped 51% over the prior year period, while Professional Visualization sales plunged 65%.

Perhaps the worst part of the report was the bottom line result. Nvidia came in with non-GAAP EPS of $0.58, which missed estimates by more than a dime. In the CFO commentary document, an inventory charge of more than $700 million was detailed, largely relating to lower Data Center demand in China. This resulted in non-GAAP gross margins of 56.1%, which was about 9 percentage points below management’s forecast. Things further down the income statement were a little better than previously expected, but definitely nowhere near enough to offset that major margin shortfall.

In my most recent article on the name, I stated that I wanted to see street estimates come down a bit more before I could truly turn bullish for the medium to long term. Investors in this space know that things are very cyclical, so you usually don’t get just one set of weak guidance and then things quickly turn around. In the table below, you can see how revenue estimates have trended much lower throughout this year.

Nvidia Revenue Estimates (Seeking Alpha)

This six quarter period has gone from an expected total of $58.90 billion in sales in late May to $42.09 billion going into Wednesday’s report. One could make the argument that the first couple of street averages here could have gone down even more. This is because some of the high estimates don’t seem to have been updated, like a $6.92 billion figure for the October 2022 quarter when management’s guidance midpoint called for just $5.9 billion, and that was before the impact of potential restrictions on China exports.

For the fourth fiscal quarter, management guided to revenues of $6 billion, plus or minus 2%. This forecast was a little weaker than expected, as the street was at $6.14 billion, but the difference was only a little more in absolute terms than the company beat on for Q3. Also, if you take out probably one or two stale estimates that were just too high, guidance was mostly in-line. The key here is that Nvidia guided to a sequential rise in revenues and not a further decline, and we didn’t see a major disappointment like $5.5 billion or worse for the top line. Margins are also expected to bounce back, with the company calling for non-GAAP gross margins of 66% for Q4.

The slightly lower than expected guide will likely bring estimates in the short term down a tick, but I think the key here is that we are getting closer to see them find a bottom. As the table above shows, it probably will be another couple of quarters before revenues grow again, but by this time next year we certainly will have much lower base numbers to work off of. It’s also good to see a down cycle where the company doesn’t swing into the red, although there was a small amount of cash burn in Q3. During the third quarter of fiscal 2023, $3.75 billion was returned to shareholders between share repurchases and cash dividends.

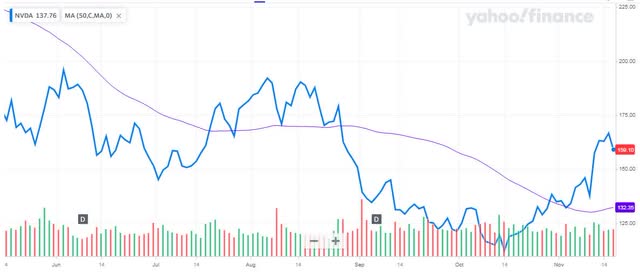

As I mentioned in my opening, Nvidia shares had recently seen a major rally on a percentage basis. While the stock had gone from a peak of nearly $350 to a low of around $108, Tuesday’s high was just under $170. Shares have still lost more than half of their value since the peak, but as the chart below shows, the recent rally at least got the 50-day moving average to level off and start trending a little higher.

NVDA Last 6 Months (Yahoo! Finance)

In the end, Nvidia announced a mixed set of results, but things certainly could have been a lot worse. Q3 revenues were better than feared, but a large inventory charge did hurt the bottom line. Q4 guidance wasn’t great, but it wasn’t way below the street like we saw at the last quarterly report. While estimates may need to come down a little more, and growth isn’t going to return quite yet, the situation looks to be a lot better than it could have been, and that’s why the stock is well off its recent lows.

Be the first to comment