Viorika

Focus of Article:

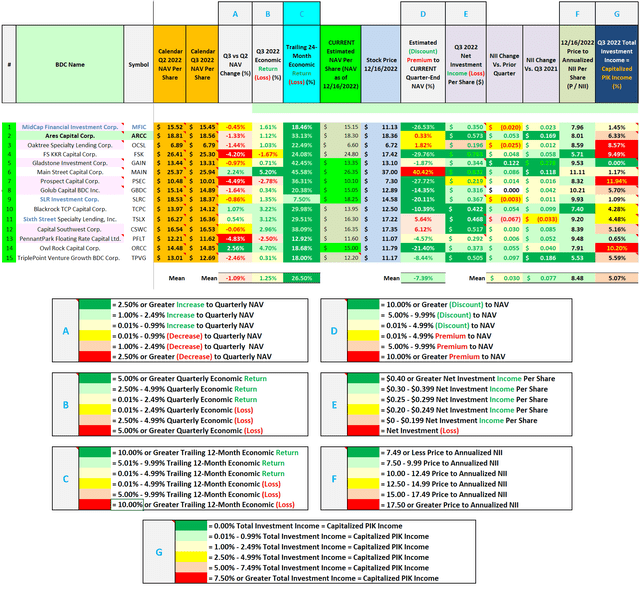

The focus of PART 1 of this article is to analyze Ares Capital Corp.’s (NASDAQ:ARCC) recent results and compare a handful of the company’s metrics to 14 business development company (“BDC”) peers. This analysis will show past and current data with supporting documentation within two detailed tables. Table 1 will compare ARCC’s recent net asset value (“NAV”) economic return (loss), net investment income (“NII”), stock price to annualized NII ratio, and percentage of total investment income attributable to capitalized payment-in-kind (“PIK”) income to the 14 BDC peers. Table 1 will also provide a premium (discount) to estimated CURRENT NAV analysis using stock prices as of 12/16/2022. Table 2 will compare ARCC’s investment portfolio (including several additional metrics) as of 6/30/2022 and 9/30/2022 to the 14 BDC peers.

I am writing this two-part article due to the continued requests that such an analysis be specifically performed on ARCC and some of the company’s BDC peers at periodic intervals. These BDC peers include Capital Southwest Corp. (CSWC), FS KKR Capital Corp. (FSK), Gladstone Investment Corp. (GAIN), Golub Capital BDC Inc. (GBDC), Main Street Capital Corp. (MAIN), MidCap Financial Investment Corp. (MFIC) (formerly Apollo Investment Corp.; AINV), Oaktree Specialty Lending Corp. (OCSL), Owl Rock Capital Corp. (ORCC), PennantPark Floating Rate Capital Ltd. (PFLT), Prospect Capital Corp. (PSEC), SLR Investment Corp. (SLRC), BlackRock TCP Capital Corp. (TCPC), TriplePoint Venture Growth BDC Corp. (TPVG), and Sixth Street Specialty Lending Corp. (TSLX).

Understanding the characteristics of a company’s investment portfolio and operating performance can shed some light on which companies are overvalued or undervalued strictly per a “numbers” analysis. This is not the only data that should be examined to initiate a position within a particular stock/sector. However, I believe this analysis would be a good “starting-point” to begin a discussion on the topic. My BUY, SELL, or HOLD recommendation and current price target for ARCC will be in the “Conclusions Drawn” section of the article. This includes providing a list of the BDC stocks I currently believe are undervalued (a buy recommendation), overvalued (a sell recommendation), or appropriately valued (a hold recommendation).

Side Note: Starting on 7/1/2022, I/we dropped coverage of NEWTEK Business Services Corp. (NEWT) as this company previously received shareholder approval to de-list from being a Regulated Investment Company (“RIC”) (a technical term for being a BDC) per the Internal Revenue Code (“IRC”) to become a Bank Holding Company (“BHC”). There are some important distinctions between these 2 types of entities. Through The REIT Forum voting, subscribers ultimately selected CSWC as the new BDC stock to be fully covered on a go-forward basis.

NAV, Economic Return (Loss), Current Premium (Discount) to NAV, and NII Analysis – Overview:

Let us start this analysis by getting accustomed to the information provided in Table 1 below. This will be beneficial when explaining how ARCC compares to the company’s 14 BDC peers regarding the metrics stated above. Due to the fact several BDC peers listed in Table 1 have a different fiscal year-end, all quarterly results are based on a calendar year-end. For instance, all metrics below are stated “Q3 2022” even though this does not correspond to every company’s fiscal year-end. Readers should be aware as such when the analysis is presented below.

Table 1a – NAV, Economic Return (Loss), Current Premium (Discount) to NAV, NII, and Capitalized PIK Analysis

(Source: Table created by me, obtaining historical stock prices from NASDAQ and each company’s NAV per share figures from the SEC’s EDGAR Database)

Table 1a above provides the following information on ARCC and the 14 BDC peers (see each corresponding column): 1) NAV per share at the end of the calendar second quarter of 2022; 2) NAV per share at the end of the calendar third quarter of 2022; 3) NAV per share change during the calendar third quarter of 2022 (percentage); 4) economic return (loss) (change in NAV and accrued dividend) during the calendar third quarter of 2022 (percentage); 5) economic return (loss) during the trailing 24-months (percentage); 6) my estimated CURRENT NAV per share (NAV as of 12/16/2022); 7) stock price as of 12/16/2022; 8) 12/16/2022 premium (discount) to my estimated CURRENT NAV (percentage); 8) NII per share during the calendar third quarter of 2022; 9) NII per share change versus the prior quarter; 10) NII per share change versus the third quarter of 2021; 11) 12/16/2022 stock price to annualized NII ratio; and 12) percentage of total investment income attributable to capitalized PIK (deferred) income.

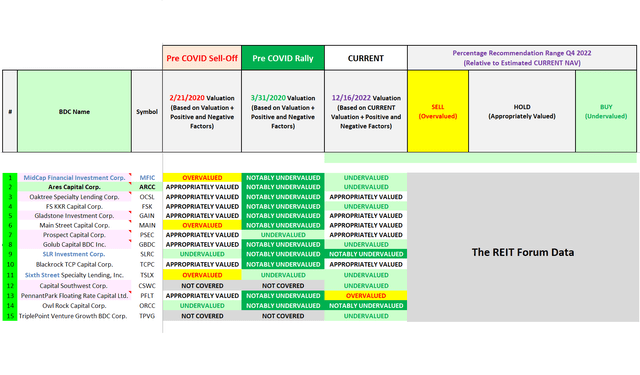

Table 1b – Past and Current BDC Recommendation Analysis

(Source: Table created by me, including all past and present recommendations based on data obtained from the SEC’s EDGAR Database [link provided below Table 1a])

Table 1b above provides the following information on ARCC and the 14 BDC peers (see each corresponding column): 1) 2/21/2020 BUY, SELL, or HOLD recommendation (pre COVID-19 sell-off);2) 3/31/2020 BUY, SELL, or HOLD recommendation (pre COVID-19 rally); 3) 12/16/2022 BUY, SELL, or HOLD recommendation; and 4) CURRENT BUY, SELL, and HOLD recommendation range, relative to my estimated CURRENT NAV. Now that an overview has been provided, let us start the comparative analysis.

Analysis of ARCC:

Using Table 1 above as a reference, ARCC had a NAV of $18.81 per share at the end of the calendar second quarter of 2022. ARCC had a NAV of $18.56 per share at the end of the calendar third quarter of 2022. This calculates to a quarterly NAV decrease of ($0.25) per share or (1.33%). When including ARCC’s quarterly dividend of $0.43 per share and special periodic dividend of $0.03 per share, the company had an economic return (change in NAV and accrued dividend) of $0.21 per share or 1.12% for the calendar third quarter of 2022. It should also be noted ARCC had a trailing 24-month economic return of $5.46 per share or 33.13%.

ARCC’s performance during the past four quarters was mainly attributable to the following three factors: 1) modest net underpayment of dividends when compared to the company’s NII/core earnings; 2) minor net realized gains/appreciation within a handful of exited portfolio companies (;and 3) minor net unrealized losses/depreciation within a majority of the company’s active investment portfolio. This is a good transition to the next topic of discussion, an analysis of ARCC’s investment portfolio (including several additional metrics) as of 6/30/2022 and 9/30/2022. To begin this analysis, Table 2 is provided below.

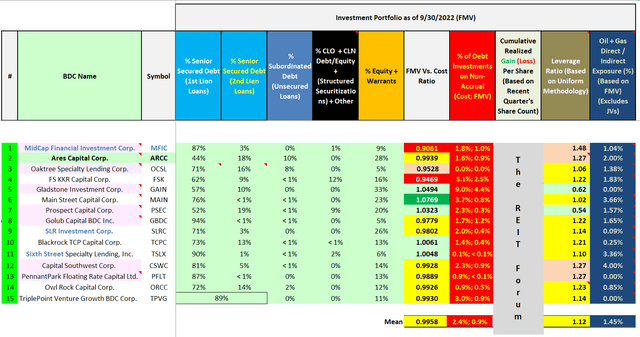

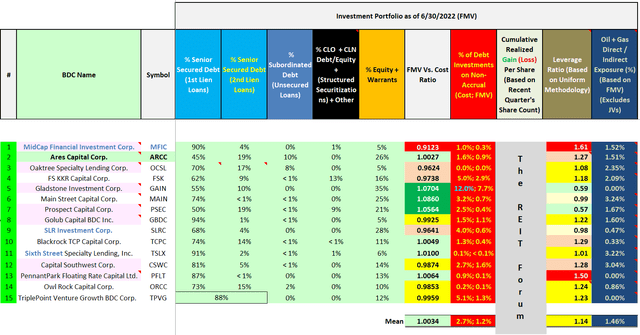

Tables 2a + 2b – Investment Portfolio Composition Analysis (Including Several Additional Metrics; 9/30/2022 Versus 6/30/2022)

(Source: Tables created by me, directly obtaining some figures/percentages from the SEC’s EDGAR Database [link provided below Table 1]. All remaining figures/percentages were calculated using data obtained within the SEC’s EDGAR Database)

Using Tables 2a and 2b above as a reference, ARCC had 44% and 18% of the company’s investment portfolio in senior secured first- and second-lien loans as of 9/30/2022, respectively. As such, these types of loans comprised the majority of ARCC’s investment portfolio. When compared to the prior quarter, ARCC’s percentage of both senior secured first- and second-lien loans decreased (1%). ARCC also had 10%, 0%, and 28% of the company’s investment portfolio in subordinated debt (unsecured loans), collateralized loan obligations (“CLO”)/credit-linked notes (“CLN”) (structured securitizations) + other, and equity/warrants, respectively. When compared to the prior quarter, ARCC’s percentage of subordinated debt (unsecured loans), CLO/CLN (structured securitizations) + other, and equity/warrants remained unchanged, remained unchanged, and increased 2%, respectively. As such, there was not a notable shift in investment portfolio composition during the calendar third quarter of 2022.

I would also point out while ARCC’s proportion of second-lien loans and subordinated debt are high when compared to the company’s 14 BDC peers, the vast majority of underlying portfolio companies are classified as “middle market” (“MM”) or “upper middle market” (“UMM”) investments. Simply put, ARCC typically invests in more “established” companies with higher earnings before interest, taxes, depreciation, and amortization (“EBITDA”) which inherently lowers overall credit risk versus companies classified as “lower middle market” (“LMM”) investments. While, yes, LMM investments have the potential reward of notable capital appreciation in the long-term (higher equity multiples over time), these portfolio companies also have inherently higher credit risk (including throughout the entire credit hierarchy). So, a bit of a “give and take” with this specific characteristic/comparison; especially when recessionary risk is elevated/rises.

As of 9/30/2022, ARCC’s investment portfolio had a “fair market value (“FMV”) versus cost” ratio of 0.9939x. When compared to the 14 other BDC peers within this analysis, this ratio was basically at the mean of 0.9958x. When compared to a ratio of 1.0027x as of 6/30/2022, ARCC’s ratio slightly decreased during the calendar third quarter of 2022 which was mainly due to the fact ARCC, like most BDC peers, generally experienced a minor-modest widening in quarterly credit spreads; including continued heightened credit risk within a handful of portfolio companies (some portion a direct result of the COVID-19 pandemic and looming recessionary risk). A more detailed “breakdown” of ARCC’s quarterly performance was recently provided to the REIT Forum subscribers.

ARCC had 1.6% and 0.9% of the company’s investment portfolio on “non-accrual” status as of 9/30/2022; based on its amortized cost basis and FMV, respectively. When compared to the 14 BDC peers as of 9/30/2022, ARCC’s amortized cost and FMV non-accrual percentage were at-slightly below the mean of 2.4% and 0.9%, respectively (a slightly positive catalyst/trend).

Since the company’s initial public offering (“IPO”) in 2004, ARCC’s investment portfolio as of 9/30/2022 has generated a cumulative realized loss of ($0.03) per share (when based on a per share count as of 9/30/2022). ARCC’s cumulative realized loss figure was modestly more attractive when compared to the mean loss of ($0.87) per share (a positive catalyst/trend). I believe calculating a BDC’s cumulative realized gain (loss) per share amount provides an extremely useful metric when analyzing the long-term performance of management’s underwriting abilities, due diligence, expertise, and operational performance. This metric provides direct evidence ARCC’s management team has, regarding a majority of instances, continued to find attractive debt/equity investments over a long period of time which, more times than not, have ultimately delivered attractive risk-adjusted returns. I am the only contributor on Seeking Alpha to provide this specific metric (includes reconciling all necessary cumulative adjustments within this account to provide a “proper/ true” per share amount). This holds especially true due to the past Generally Accepted Accounting Principles (“GAAP”) disclosure changes regarding equity presentation.

As of 9/30/2022, 2.00% of ARCC’s portfolio had debt and equity investments within the oil and gas sector (based on FMV; including certain investments in the energy sector which had “oil and gas” characteristics and/or services closely linked to the sector). When compared to the 14 other BDC peers within this analysis, ARCC’s oil and gas exposure was slightly above the mean of 1.45%. When compared to the prior quarter, ARCC’s exposure to the oil and gas sector slightly increased; mainly due to more favorable sector valuation fluctuations when compared to the rest of the company’s investment portfolio and a couple new portfolio companies in this sector. Even though larger oil and gas companies have benefited during 2022 from a net increase to commodity prices (tied to inflation and the recent Russia/Ukraine conflict; though most sector prices have partially retraced during the past several months), I would point out smaller/private oil and gas companies are still not “out of the woods” yet (still high-cost outlays making breakeven prices higher). This could be a short- or long-term event dependent upon many unknown geopolitical/macroeconomic variables. As such, I would remain a bit cautious considering the ramifications of this specific sector regarding high-yield/speculative-grade credit. I believe ARCC’s continued low percentage attributed to oil and gas companies is a positive catalyst/trend.

Once again using Table 1 as a reference, ARCC’s NII of $0.573 per share during the calendar third quarter of 2022 ranked 3rd highest out of BDC peers within this analysis. When comparing each company’s stock price as of 12/16/2022 to its annualized NII, ARCC had the 6th lowest ratio at 8.01x (a slightly positive factor/trend). ARCC’s annualized NII ratio was slightly more attractive when compared to the 15-peer ratio of 8.48x as of 12/16/2022.

During the calendar third quarter of 2022, 6.33% of ARCC’s total investment income was attributable to capitalized PIK income which was a decrease of (0.56%) when compared to the prior quarter. As such, relatively unchanged. When compared to the 14 other BDC peers within this analysis, this remained slightly (less than 2.5%) above the mean of 5.07% (more recently a positive factor/trend). I believe it is never a positive catalyst/trend when a BDC has any portion of its accrued income classified as being capitalized/deferred. Simply put, under GAAP, capitalized PIK income is revenue that is currently being “booked” but has not actually been received in cash yet (deferred). In a majority of cases, capitalized PIK income is paid in cash at the maturity of that particular loan/when a sale occurs. However, in my experience, more times than not capitalized PIK income is a contractual amendment regarding a specific portfolio company who is, at the time, having operational difficulties (which increases the probably of the eventual inability of paying its loan obligations). This is especially the case when a specific debt investment had no PIK-attached feature at the origination of said loan but is currently accruing 100% capitalized PIK income.

Simply put, in a majority of cases, it is a “slick” strategy of continuing to record accrued interest income only to write-off this capitalized interest income at a later date; usually at loan maturity by classifying that “lost deferred interest” as a reduction in the debt investment’s proceeds (a realized loss) as opposed to lowering previously accrued income by the accumulated capitalized PIK balance. I am not stating this occurs all the time but certain BDC peers tend to utilize this “phantom income” strategy regularly. PSEC has been particularly prone to this strategy to a greater degree over the years versus the other BDC peers within this analysis which should continue to be pointed out. As such, it could be the case capitalized PIK income is never “completely” received in cash upon maturity/when a sale occurs. In my professional opinion, if a BDC has a large/above average portion of its investment income classified/accrued as capitalized PIK income, it should be seen as a potential concern regarding future performance/credit quality. In the end, one really just has to go “case-by-case” to determine the overall “viability” of a BDC actually eventually receiving this capitalized PIK income in the future. Something I continually monitor/track.

As of 12/16/2022, ARCC’s stock price traded at $18.36 per share. When calculated, ARCC’s stock price was trading at a premium to my estimated CURRENT NAV (NAV as of 12/16/2022; $18.30 per share) of $0.06 per share or 0.33%. This was very slightly less attractive than the 15-BDC average of a discount of (7.39%) (a slightly negative factor/trend). However, I continue to believe ARCC should trade at a modest-notable premium to the company’s CURRENT NAV. As such, based on my proven valuation methodology over various interest rate/economic cycles, ARCC is currently one of a handful of BDC peers that is undervalued in my professional opinion.

Comparison of ARCC’s NAV, Economic Return, Valuation, NII, and Other Metrics to 14 BDC Peers in Ranking Order:

The REIT Forum Feature

Conclusions Drawn (PART 1):

PART 1 of this article has analyzed ARCC and 14 other BDC peers in regards to the following metrics: 1) trailing 24-month economic return (loss) (good indicator of recent overall performance); 2) percentage of investments on non-accrual status as of 9/30/2022 (good indicator of overall portfolio health/credit risk); 3) cumulative gain (loss) per share as of 9/30/2022 (great indicator of long-term performance); 4) current premium (discount) to my estimated CURRENT NAV per share (NAV as of 12/16/2022) (great indicator of overall valuation); 5) current stock price to annualized NII ratio (good indicator of overall valuation);and 6) percentage of total investment income attributable to capitalized PIK (deferred) income (good indicator of overall portfolio health/credit risk).

When compared to the 14 other BDC peers within this analysis, I believe ARCC continues to outperform a majority of the company’s BDC peers I currently cover. This includes, but is not limited to, ARCC’s NII per share (including core earnings), a slightly below average percentage of investments on non-accrual status as of 9/30/2022, a modestly more attractive cumulative realized gain (loss) per share amount as of 9/30/2022, a below average stock price to annualized NII ratio, and an above average trailing 24-month economic return percentage (all positive catalysts/trends).

That said, to remain non-bias, this article also highlighted ARCC had an average FMV versus cost ratio, an average exposure to the oil and gas sector (including certain investments in the energy sector which had oil and gas characteristics and/or services closely linked to the sector), and a slightly above average capitalized PIK income percentage (all neutral/negative factors/trends). In my opinion, ARCC’s PIK percentage is the company’s biggest negative factor/trend (although there was a slight-modest decrease over the past several quarters which was a step in the right direction).

Along with recent historically low U.S. London Interbank Offered Rate (LIBOR) continuing to quickly rise (which has a direct impact on floating-rate debt investments with no/a low LIBOR floor; discussed in PART 2), ARCC’s “cushion” to maintain the company’s recently increased quarterly dividend per share rate of $0.48 per share remains better (in most cases much better) than most peers. Also, as previously correctly stated back in 2021, I continued to believe there was the potential for either another minor-modest increase to ARCC’s quarterly dividend per share rate or a special periodic dividend being declared over the foreseeable future (within the next 4 quarters). When ARCC disclosed the company’s results for the fourth quarter of 2021, it was also revealed the Board of Directors (“BoD”) declared a quarterly regular dividend of $0.42 per share ($0.01 per share increase when compared to the fourth quarter of 2021), along with a special periodic dividend of $0.03 per share for each quarter during 2022. When ARCC disclosed the company’s results for the second quarter of 2022, the BoD declared a quarterly regular dividend of $0.43 per share ($0.01 per share increase when compared to the second quarter of 2022). When ARCC disclosed the company’s results for the third quarter of 2022, the BoD declared a quarterly regular dividend of $0.48 per share ($0.05 per share increase when compared to the third quarter of 2022). Simply put, I previously correctly identified the high-very high probability of multiple ARCC dividend increases and/or special periodic dividends over the foreseeable future.

As LIBOR has very quickly moved past basically all floors on the asset side of the balance sheet, along with various sector peers refinancing outstanding borrowings with longer-term, lower cost debt on the liability side of the balance sheet during 2020-2021, I continue to believe we have recently experienced a general bottom form in earnings metrics across the broader BDC sector (as long as credit risk within each peer remains relatively subdued). One will have to continue to monitor the weighted average annualized yield on new loan originations versus exiting debt investments as there remains a pretty good “lag” in this specific metric. Something I continually track. Also, to remain non-bias, credit risk will almost certainly rise throughout the sector during 2023. That said, I believe ARCC is better positioned to weather a minor-modest recession when compared to most sector peers.

My BUY, SELL, or HOLD Recommendation:

From the analysis provided above, including additional factors not discussed within this article, I currently rate ARCC as a SELL when I believe the company’s stock price is trading at or greater than a 15% premium to my projected CURRENT NAV (NAV as of 12/16/2022; $18.30 per share), a HOLD when trading at greater than a 5% premium but less than a 15% premium to my projected CURRENT NAV, and a BUY when trading at or less than a 5% premium to my projected CURRENT NAV.

Therefore, with a closing price of $18.38 per common share as of 12/20/2022, I currently rate ARCC as a UNDERVALUED from a stock price perspective.

As such, I currently believe ARCC is a BUY recommendation. My current price target for ARCC is approximately $21.05 per share. This is currently the price where my recommendation would change to a SELL. The current price where my BUY recommendation would change to a HOLD is approximately $19.20 per share. Put another way, the following are my CURRENT BUY, SELL, or HOLD per share recommendation ranges (the REIT Forum subscribers get this type of data on all 15 BDC stocks I currently cover on a weekly basis):

$21.05 per share or above = SELL

$19.21 – $21.04 per share = HOLD

$17.41 – $19.20 per share = BUY

$17.40 per share or below = STRONG BUY

BDC Sector Recommendations as of 2/21/2020, 3/31/2020, and 12/16/2022:

Once again using Table 1 above as a reference, I want to highlight to readers what I/we conveyed to readers when it came to sector recommendations as of 2/21/2020 (pre COVID-19 sell-off), 3/31/2020 (post COVID-19 sell-off), and 12/16/2022 (very recently).

As of 2/21/2020, I had a BUY recommendation on the following BDC stocks analyzed above (in no particular order): 1) ARCC; 2) NEWT; and 3) ORCC.

As of 2/21/2020, I had a HOLD recommendation on the following BDC stocks analyzed above (in no particular order): 1) ARCC; 2) OCSL; 3) FSK; 4) GAIN; 5) PSEC; 6) GBDC; 7) TCPC; 8) OCSI; and 9) PFLT.

As of 2/21/2020, I had a SELL recommendation on the following BDC stocks analyzed above (in no particular order): 1) MFIC; 2) MAIN; and 3) TSLX.

So, prior to the COVID-19 sell-off, as of 2/21/2020 I/we had 0 BDCs rated as a STRONG BUY, only 3 rated as a BUY, 9 rated as a HOLD, 3 rated as a SELL, and 0 rated as a STRONG SELL. While these recommendations were certainly not the most “bearish” sentiment possible (had more bearish sentiment regarding the mREIT stocks I cover), I still believe they were somewhat “cautious” in nature; especially when compared to most contributors back in January/February 2020.Investors who “heeded” this advice were, at least, able to “lock-in” some notable gains (as sector valuations “ran up”) which helped offset sector/market losses in March 2020 (myself included). At the time, this was in direct contradiction to most contributors that cover the BDC sector.

As of 3/31/2020, I had a STRONG BUY recommendation on the following BDC stocks analyzed above (in no particular order): 1) MFIC; 2) ARCC; 3) OCSL; 4) FSK; 5) GAIN; 6) MAIN; 7) GBDC; 8) ARCC; 9) TCPC; 10) NEWT; 11) PFLT; and 12) ORCC.

As of 3/31/2020, I had a BUY recommendation on the following BDC stocks analyzed above (in no particular order): 1) PSEC; 2) TSLX; and 3) OCSI.

So, after the quick, severe COVID-19 sell-off, as of 3/31/2020 I/we had 12 BDCs rated as a STRONG BUY, 3 rated as a BUY, 0 rated as a HOLD, 0 rated as a SELL, and 0 rated as a STRONG SELL. Simply put, these were the most bullish ratings I have ever had within the BDC sector since I began covering this sector back in 2013.Again, at the time, this was in direct contradiction to most contributors that cover the BDC sector (most were in “panic mode”).

Still using Table 1 above as a reference, I want to highlight to readers what I/we are conveying to subscribers when it comes to sector recommendations as of 12/16/2022.

As of 12/16/2022, I had a notably undervalued/STRONG BUY recommendation on the following BDC stock analyzed above: 1) SLRC; and 2) ORCC.

As of 12/16/2022, I had an undervalued/BUY recommendation on the following BDC stocks analyzed above (in no particular order): 1) MFIC; 2) ARCC; 3) FSK; 4) GBDC; 5) TSLX; 6) CSWC; and 7) TPVG.

As of 12/16/2022, I had an appropriately valued/HOLD recommendation on the following BDC stocks analyzed above (in no particular order): 1) OCSL; 2) GAIN; 3) MAIN; 4) PSEC; and 5) TCPC.

As of 12/16/2022, I had an overvalued/SELL recommendation on the following BDC stocks analyzed above (in no particular order): 1) PFLT.

So, as of 12/16/2022 I/we now had 2 BDCs rated as a STRONG BUY, 7 rated as a BUY, 5 rated as a HOLD, and 1 rated as a SELL. Simply put, not as bearish as leading up to the initial onset of the COVID-19 “pandemic panic” but not as bullish as March-April 2020 either. That said, I believe there are some more attractive valuations within the BDC sector when compared to earlier in 2022 when I/we were more bearish (which turned out to be justified). This is based on my/our specific valuation methodology. That said, I would just be mindful knowing high-yield/speculative-grade credit spreads directly impact broader asset valuations. I continue to project a net widening of spreads during 2023. This is something I have continued to discuss with subscribers. Important to understand.

The analysis performed above does not provide “every” catalyst/factor to consider when choosing a BDC investment. However, I believe this analysis is a good starting point to begin a discussion on the topic. Additional metrics will be analyzed in PART 2 of this article. PART 2 will take a look at ARCC’s past and current dividend rates, yields, and other similar metrics and compare the results to the 14 other BDC peers. Several of these metrics have a direct impact on future operations/results as events unfold.

Current Sector/Recent ARCC Stock Disclosures:

On 10/12/2018, I initiated a position in ARCC at a weighted average purchase price of $16.40 per share. On 12/10/2018, 12/18/2018, 12/21/2018, and 4/8/2020, I increased my position in ARCC at a weighted average purchase price of $16.195, $15.305, $14.924, and $11.345 per share, respectively. When combined, my ARCC position had a weighted average purchase price of $13.256 per share. This weighted average per share price excluded all dividends received/reinvested. On 4/16/2021, I sold my entire ARCC position at a weighted average sales price of $19.598 per share as my price target, at the time, of $19.50 per share was surpassed. This calculates to a weighted average realized gain and total return of 47.8% and 67.8%, respectively. I held this weighted average position for approximately 20 months. This calculates to an annualized total return of 41.1%. Readers who have pointed out in the past that ARCC’s current stock price is approximately $0.25 per common share higher versus my 4/16/2021 sell price should consider the notion I redeployed my ARCC proceeds into another sector covered here on Seeking Alpha at basically the same annualized yield. This investment delivered an even higher total return when compared to merely keeping my previous ARCC position (important notion to point out).

On 3/15/2022, I once again initiated a position in ARCC at a weighted average purchase price of $19.586 per share. On 4/21/2022, I sold my entire ARCC position at a weighted average sales price of $22.560 per share as my price target, at the time, of $22.55 per share was surpassed. This calculates to a weighted average realized gain and total return of 15.2%. I held this weighted average position for approximately 1 month.

On 5/20/2022, I once again initiated a position in ARCC at a weighted average purchase price of $17.860 per share. On 6/17/2022 and 9/30/2022, I increased my position in ARCC at a weighted average purchase price of $17.19 and $16.89 per share, respectively. When combined, my ARCC position has a weighted average purchase price of $17.114 per share. This weighted average per share price excludes all dividends received/reinvested.

On 10/12/2018, I initiated a position in SLRC at a weighted average purchase price of $20.655 per share. On 12/18/2018, 2/24/2020, 7/9/2020, 1/28/2021, 12/16/2021, 3/2/2022, 5/20/2022, 6/22/2022, and 11/3/2022, I increased my position in SLRC at a weighted average purchase price of $19.66, $19.498, $15.355, $17.195, $17.845, $17.445, $14.620, $14.455, and $13.16 per share, respectively. When combined, my SLRC position has a weighted average purchase price of $15.295 per share. This weighted average per share price excludes all dividends received/reinvested.

On 12/10/2021, I initiated a position in FSK at a weighted average purchase price of $21.431 per share. On 12/14/2021 and 6/22/2022, I increased my position in FSK at a weighted average purchase price of $20.10 and $18.64 per share, respectively. When combined, my FSK position has a weighted average purchase price of $19.263 per share. This weighted average per share price excludes all dividends received/reinvested.

On 9/30/2022, I once again initiated a position in MAIN at a weighted average purchase price of $33.24 per share. On 11/4/2022, I sold my entire MAIN position at a weighted average sales price of $39.50 per share as my price target, at the time, was surpassed. This calculates to a weighted average realized gain and total return of 18.2% and 19.5%, respectively. I held this position for approximately 1 month.

On 12/15/2022, I initiated a position in TPVG at a weighted average purchase price of $11.07 per share. This weighted average per share price excludes all dividends received/reinvested.

Final Note: All trades/investments I have performed over the past several years have been disclosed to readers in “real time” (that day at the latest) via either the StockTalks feature of Seeking Alpha or, more recently, the “live chat” feature of the Marketplace Service the REIT Forum (which cannot be changed/altered). Through these resources, readers can look up all my prior disclosures (buys/sells) regarding all companies I cover here at Seeking Alpha (see my profile page for a list of all stocks covered). Through StockTalk disclosures and/or the live chat feature of the REIT Forum, at the end of November 2022 I had an unrealized/realized gain “success rate” of 84.4% and a total return (includes dividends received) success rate of 89.1% out of 64 total past and present mREIT and BDC positions (updated monthly; multiple purchases/sales in one stock count as one overall position until fully closed out). I encourage other Seeking Alpha contributors to provide real time buy and sell updates for their readers/subscribers which would ultimately lead to greater transparency/credibility. Starting in January 2020, I have transitioned all my real-time purchase and sale disclosures solely to members of the REIT Forum. All applicable public articles will still have my purchase and sale disclosures (just not real-time alerts).

Understanding My/Our Valuation Methodology Regarding mREIT Common and BDC Stocks:

The basic “premise” around my/our recommendations in the mREIT common and BDC sectors is value. Regarding operational performance over the long-term, there are above average, average, and below average mREIT and BDC stocks. That said, better-performing mREIT and BDC peers can be expensive to own, as well as being cheap. Just because a well-performing stock outperforms the company’s sector peers over the long-term, this does not mean this stock should be owned at any price. As with any stock, there is a price range where the valuation is cheap, a price where the valuation is expensive, and a price where the valuation is appropriate. The same holds true with all mREIT common and BDC peers. As such, regarding my/our investing methodology, each mREIT common and BDC peer has their own unique BUY, SELL, or HOLD recommendation range (relative to estimated CURRENT BV/NAV). The better-performing mREITs and BDCs typically have a recommendation range at a premium to BV/NAV (varying percentages based on overall outperformance) and vice versa with the average/underperforming mREITs and BDCs (typically at a discount to estimated CURRENT BV/NAV).

Each company’s recommendation range is “pegged” to estimated CURRENT BV/NAV because this way subscribers/readers can track when each mREIT and BDC peer moves within the assigned recommendation ranges (daily if desired). That said, the underlying reasoning why I/we place each mREIT and BDC recommendation range at a different premium or (discount) to estimated CURRENT BV/NAV is based on roughly 15-20 catalysts which include both macroeconomic catalysts/factors and company-specific catalysts/factors (both positive and negative). This investing strategy is not for all market participants. For instance, not likely a “good fit” for extremely passive investors. For example, investors holding a position in a particular stock, no matter the price, for say a period of 5+ years. However, as shown throughout my articles written here at Seeking Alpha since 2013, in the vast majority of instances I have been able to enhance my personal total returns and/or minimize my personal total losses from specifically implementing this particular investing valuation methodology. I hope this provides some added clarity/understanding for new subscribers/readers regarding my valuation methodology utilized in the mREIT common and BDC sectors.

Each investor’s BUY, SELL, or HOLD decision is based on one’s risk tolerance, time horizon, and dividend income goals. My personal recommendation will not fit each reader’s current investing strategy. The factual information provided within this article is intended to help assist readers when it comes to investing strategies/decisions. Please disregard any minor “cosmetic” typos if/when applicable.

Be the first to comment