wundervisuals/E+ via Getty Images

Investment Thesis

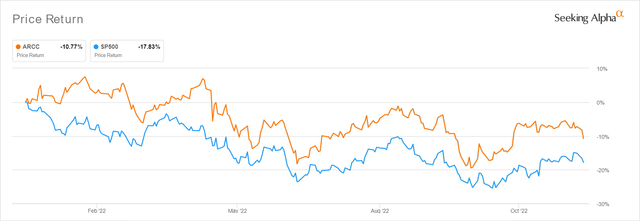

ARCC YTD Stock Price

The Ares Capital (NASDAQ:ARCC) stock is trading at $18.66, nearing its pre-pandemic peaks and down -18.86% from its 52 weeks high of $23.00. However, due to the recent 12.88% recovery from 52 weeks low of $16.53, it is apparent that the stock has already maxed out its forward potential, due to the minimal 11.14% upside against the consensus price target of $21.00.

Depending on the individual investors’ risk tolerance and investing trajectory, we reckon that the ARCC remains attractive at current levels, due to the stellar dividend yields of 10.2% through FY2024. It is important to note that the stock still offers a decent 5Y total price return of 83.4% and a 10Y return of 174.2%, despite the massive volatility in 2022. Furthermore, we may see most stocks rise further by 14 December, due to the Fed’s supposed 50-basis point hike, coupled with the market’s optimism so far. Thereby, potentially improving its minimal margin of safety. We’ll see, since the S&P 500 Index has also recorded an excellent 10.18% recovery since mid-October.

ARCC Management Continues To Execute Brilliantly, With Improved EPS Profitability

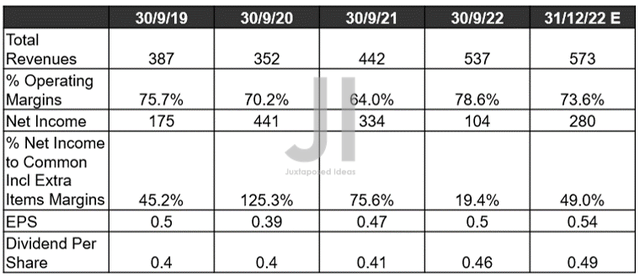

ARCC Revenue, Net Income (in million $)%, EBIT %, EPS, and Dividends

In its recent FQ3’22 earnings call, ARCC reported YoY growth in its revenues (investment income) by 21.49% and adj. EPS by 6.38%. Despite the net losses worth $235M, the management continues to report excellent operating efficiency at an improved EBIT margin of 78.6%. By the latest quarter, it reported only $115M of SG&A expenses, indicating a minimal increase of 3.6% QoQ and a massive decline of -27.67% YoY, despite the notable 1.1% QoQ and 15.09% growth in its total investments assets YoY.

The sustained growth in ARCC’s quarterly and special dividends also demonstrated the management’s growing confidence in its profitability ahead, precisely attributed to the rising interest rates and continued credit stability within its portfolio.

Therefore, it is not surprising to see market analysts bullishly project impressive revenues of $573M and EPS of $0.54 for FQ4’22, indicating further QoQ growth of 6.7% and 8%, respectively. ARCC’s quarterly dividend payouts are also expected to grow by 6.52% QoQ to $0.49 for the next quarter, triggering excellent returns to its long-term investors indeed.

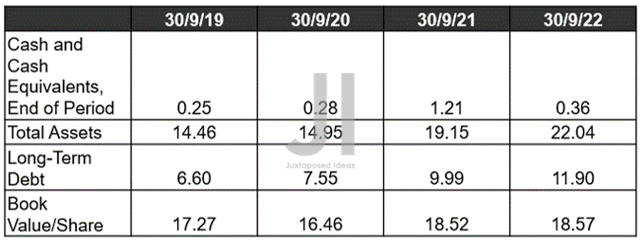

ARCC Cash/ Equivalents, Assets, and Debts (in million $)

By 08 November 2022, ARCC announced its third capital raise for the year for approximately $173.2M, to deleverage part of its long-term debts worth a total of $11.9B as of FQ3’22. This move will trigger a minimal share dilution of 1.75% to its current share count of 523M, worth approximately $4.41M in quarterly dividends or $17.64M in annual payouts, based on its latest $0.48 quarterly payouts. Not too bad indeed, since its share dilution remains relatively controlled at 22.48% since FQ3’19.

In the meantime, ARCC is also looking at $0.75B of long-term debts due 2023 and $1.3B due 2024, with the rest of its revolving facility only due 2025 through 2027 and the rest of the Notes well-laddered through 2031. Given its minimal cash and equivalents of $0.36B in FQ3’22 and annual dividend expense of $0.80B, we may see ARCC rely on more share dilution for expansion and funding in the short term, due to the reduced availability of capital financing in the stock market.

Nonetheless, with ARCC’s current book value of $18.57 per share, we reckon that investors are getting an extremely good deal at its current stock price of $19.40. Especially made sweeter with the sustained expansion in its assets and dividend payouts thus far. We also expect things to alleviate by the end of 2023, speculatively making equity markets more accessible then.

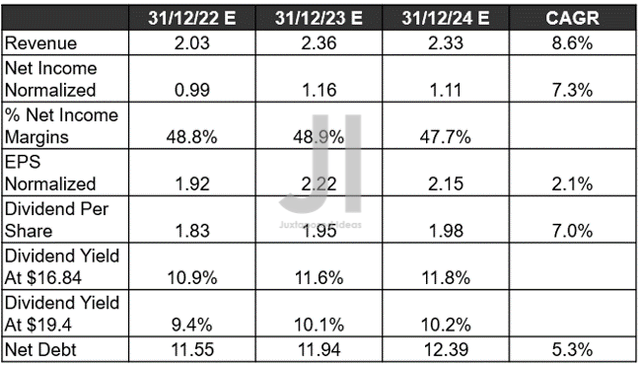

ARCC Projected Revenue, Net Income (in billion $) %, EPS, Dividends, and Debt

Nonetheless, ARCC is expected to report a notable deceleration in its revenue and EPS growth at a CAGR of 8.6% and 2.1% through 2024, against pre-pandemic levels of 14.7%/6.6% and hyper-pandemic levels of 9.1%/3.1%. Its net income margins will also underperform at 47.7% in 2024, against 53.1% in 2019 and 49.5% in 2021. However, investors need not fret, since the company is expected to post improved EPS of $2.15 in 2024, against $1.9 in FY2019 and $2.02 in FY2021.

Furthermore, ARCC’s dividend payouts have been expanded tremendously from $1.68 in 2019, to $1.62 in 2021, and finally to a projected $1.98 in 2024. Thereby, indicating an adj CAGR of 3.4% between 2019 and 2024, or a stellar CAGR of 7% between 2021 and 2024. Those who had loaded up the stock at the recent blood-bath levels of $16.84 in late September 2022 would also enjoy an enhanced dividend yield of 11.8% by 2024. Impressive indeed, against its 4Y average yield of 9.28% and sector median of 3%.

So, Is ARCC Stock A Buy, Sell, Or Hold?

ARCC 5Y EV/Revenue and P/E Valuations

ARCC is currently trading at an EV/NTM Revenue of 9.10x and NTM P/E of 8.46x, lower than its 5Y mean of 9.43x and 10.16x, respectively. Otherwise, still undervalued based on its YTD mean of 10.11x and 10.24x, respectively, despite the recent rally.

The critical question, naturally, depends on whether this market-wide optimism and recovery are sustainable through 2023, as the Feds also raise the terminal rates to over 6%. Thereby, pointing to this stock’s speculative nature, only for those comfortable with more short-term volatility and moderate share dilution. However, no pain lasts forever, and the rewards will be handsome once the inflation is tamped down, the Feds pivot, and the macroeconomics improve, speculatively by the end of 2023.

As a result, we chose to cautiously rate ARCC as a buy, though portfolios should also be sized appropriately in the event of volatility.

Be the first to comment