simpson33/iStock via Getty Images

Introduction

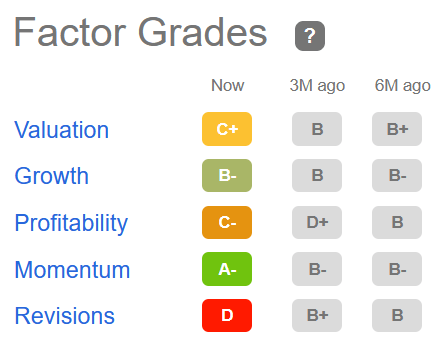

I found Cronos Group (NASDAQ:CRON) (TSX:CRON:CA) through my investing screens, which includes consideration of Seeking Alpha’s Quant Ratings and Factor Grades:

CRON Seeking Alpha Quant Rating (Seeking Alpha)

CRON Seeking Alpha Factor Grade (Seeking Alpha)

The Seeking Alpha ratings along with my sentiment-based screens suggesting bullishness on this stock on Monday this week (December 5 2022). I initiated a small starter position, believing the stock would fly after last Friday’s news of easing regulations on marijuana.

But as I conducted my research, I found red flag after red flag, especially when I dug into the backgrounds of management and the details of prior acquisitions.

On December 6, 2022, I exited my starter long position. And today, I am ready to initiate a short position on Cronos Group as I rate this stock a strong sell on grounds of corporate governance concerns and weak business execution.

I very rarely short stocks, even in a downward market. But I think this short opportunity is too compelling to resist…

Makeup of Cronos’ Business

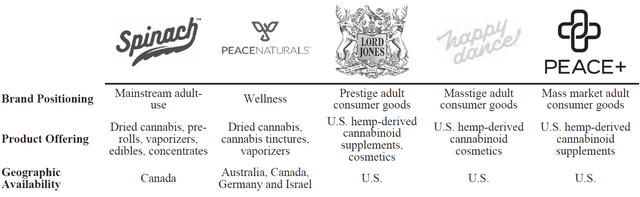

Cronos manufactures, markets and distributes cannabis products across Canada, Israel and the United States. It operates four key brands across the consumer and wellness spectrum:

Cronos Brands (Cronos FY21 10-K)

Consumer brands relate to recreational use marijuana; dried flower, pre-rolls, vaporizers, edibles and concentrates. Wellness brands relate to marijuana used for medical and personal care purposes such as skin care.

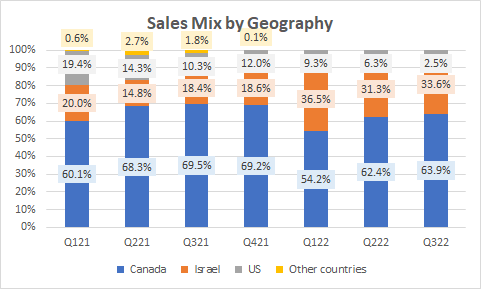

The company has been recently scaling out of the US and as of the latest quarter, it has derived most of its sales from operations in Canada and Israel:

Sales Mix by Geography (Company Filings, Author’s Analysis)

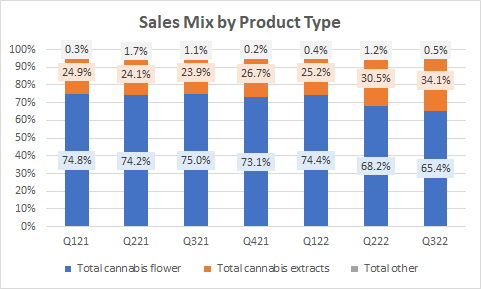

In terms of product mix, despite the premium positioning narratives in the company’s filings and investor presentations, the numbers show that Cronos’ portfolio is geared more toward cannabis flowers, which is a lower-margin mass-market product:

Sales Mix by Product Type (Company Filings, Author’s Analysis)

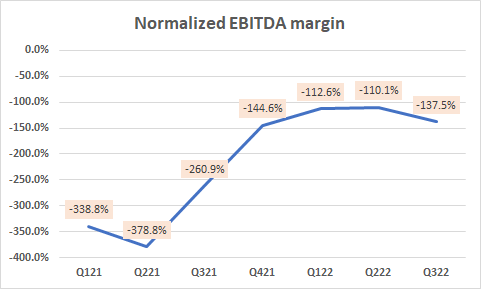

Cronos is well capitalized with USD 887 million of net cash, which corresponds to 77.4% of its market capitalization. However, the company poor cost structure is leading to it bleeding cash at a far higher rate than what it makes in revenues. Profitability is nowhere in sight:

Normalized EBITDA margin (Company Filings, Author’s Analysis)

My calculation of normalized EBITDA excludes restructuring and impairment costs, but includes stock-based compensation (SBC) expense. SBC is a real operating expense for Cronos and hence it must be included in assessment of operating profitability. This is a technical detail that does not matter in the overall assessment since even based on the company’s and Wall St’s adjusted EBITDA (excluding SBC), the company is haemorrhaging money beyond what its sales can support.

Why I think Cronos is a Strong Short Sell Candidate

My bearish view on Cronos is based on four key beliefs:

- Doubts on Cronos’ corporate governance

- Cronos faces high competition and pricing pressures from a crowded cannabis market

- Cronos is badly positioned to benefit from the enactment of the Medical Marijuana Research bill

- Cannibalization of Cronos cannabis segments is a structural overhang

Here’s the discussion explaining the reason for these beliefs:

Doubts on Cronos’ corporate governance

Some aspects of Cronos make me very cautious:

Conflicts of interest?

Doubt on whether the controlling shareholder is aligned to minority shareholder interests

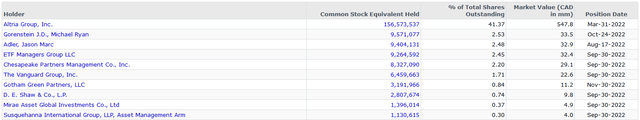

Cronos’ largest shareholder is the tobacco company Altria Group (MO), with a 41.37% stake:

Cronos shareholding (Capital IQ)

Through a warrant, Altria has the optionality to increase its stake in Cronos to 52% by March 8 2023 at a per share exercise price of CAD 19.00. This is much higher than the current share price of CAD 4.11. Hence, it is unlikely that this option would be exercised.

However, as the majority shareholder, I note that it is possible that it is in Altria’s best interest for Cronos’ market valuation to be low in case a new warrant optionality is issued based on current market valuations. This would be at odds with minority shareholders’ interests.

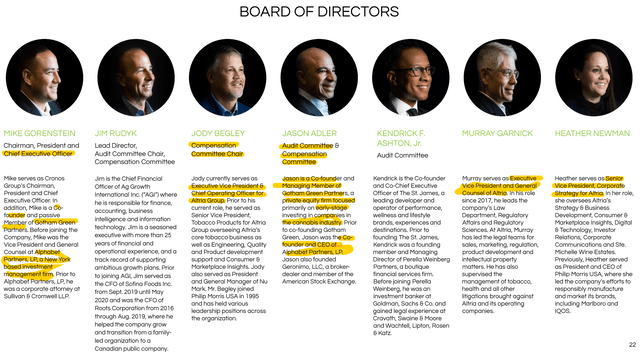

Furthermore, there appears to be some potential conflicts of interest among the board of directors of Cronos:

Cronos Group’s Board of Directors (Cronos November 21 Investor Presentation)

As the image above shows, the Cronos board has four existing executives from Altria. According to the National Instrument 58-101 (NI 58-101) Disclosure of Corporate Governance Practices under Canadian Securities Law, these board members from Altria are not considered independent directors. Cronos’ FORM DEF 14A filing also acknowledges that:

… the majority of directors of the Company are not independent…

An undisclosed related party transaction?

But more importantly, two members of the board; CEO Mike Gorenstein and Jason Adler from the Audit and Compensation committee, were co-founders of Gotham Green Partners, which is a private equity firm that invests in companies in the cannabis industry. This initially raised my eyebrows and upon digging a bit further, I discovered some evidence that cast reasonable doubt in my mind about Cronos’ alignment of interests with minority shareholders:

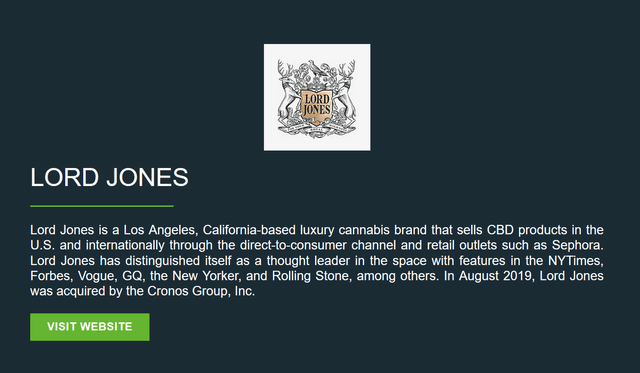

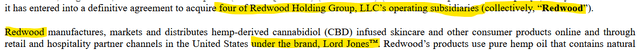

One of Gotham Green Partners’ investee companies was Lord Jones. Gotham Green Partners had paid $12.8 million for a 40% stake in Lord Jones. The private equity firm exited this investment in August 2019, selling the stake to the Cronos Group:

Lord Jones exit from Gotham Green Partners Portfolio (Gotham Green Partners Website)

The shareholders of Cronos paid USD 283 million to buy four Redwood subsidiaries, collectively called Redwood. Redwood operates under the Lord Jones brand:

Redwood subsidiaries are collectively called Redwood. Redwood operates under the Lord Jones Brand (Cronos – Redwood Holdings Membership Interest Purchase Agreement)

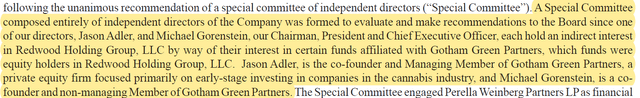

In its FY19 Annual Report, Cronos noted that a “Special Committee” of independent directors was formed to evaluate and make recommendations on this deal due to Gorenstein and Adler holding indirect interest stakes in Redwood:

Special Committee for Redwood Acquisition (Cronos FY19 Annual Report)

However, I believe it is wise to interpret such claims with a grain of salt that it is more useful to look at the hard facts in order to ascertain whether the deal was indeed fair:

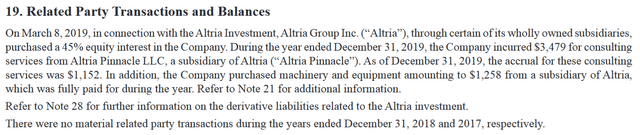

Firstly, to me, this deal clearly seems to be a related party transaction for Cronos. Yet, it was not disclosed as such in the FY19 Annual Report:

No related party transaction mentioned for the Redwood acquisition (Cronos FY19 Annual Report)

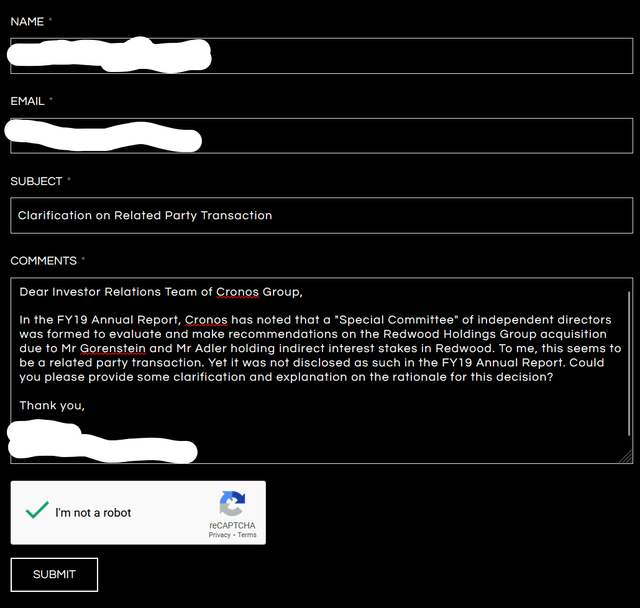

I have contacted the IR team of Cronos Group to receive clarification on this matter on December 7 2022:

Author’s Message to IR Team (Author)

I have yet to receive a reply.

Secondly, I analyze the transaction multiples behind this deal to get some more clues:

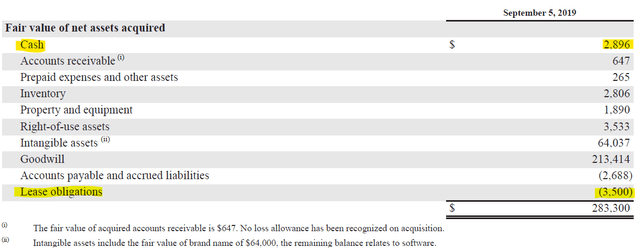

Fair value of Redwood’s Net Assets Acquired (Cronos FY19 Annual Report)

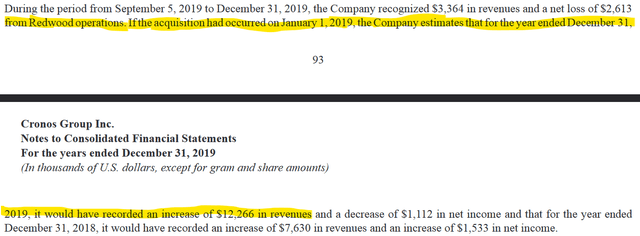

Considering the acquired entity’s lease obligations less cash to represent the net debt, and adding this to the purchase consideration, I arrive at a purchase EV of USD 283.904 million. In the same filing, Cronos suggests that the revenue contribution of all of Redwood’s operations would have been USD 12.266 million for the FY19 financial year:

FY19 Revenue Contribution of Redwood Operations (Cronos FY19 Annual Report)

This implies an EV/Sales transaction multiple of 23.1x!

In other words, the revenue multiple paid for the Redwood business is akin to a typical earnings multiple, which I say is a very steep price to pay. So I wonder: Was this deal really a good decision for the minority shareholders in the business? Was the assessment of this deal truly independent without consideration of management’s vested interests in Gotham Green Partners?

Well, as Marc Antony from Shakespeare’s Julius Caesar would have expressed:

I write not to disprove what management wrote, but here I am to write what I do doubt…

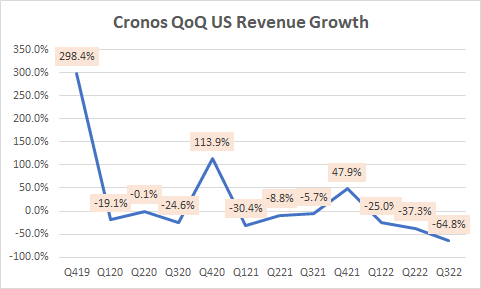

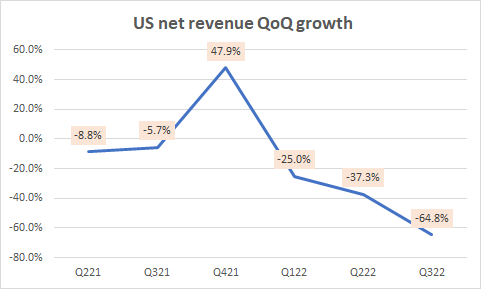

In any case, this was a very material acquisition for Cronos as its own market capitalization is only $1.1 billion currently. I believe this acquisition has been a failure given the lacklustre growth profile of Cronos:

Cronos QoQ US Revenue Growth (Company Filings, Author’s Analysis)

32.4% is the revenue CAGR from Q3 FY19 when Cronos entered the US market via Redwood till Q2 FY19 before Cronos started scaling out of this market. This seems high but I think this business ought to have done much better to justify a 23.1x revenue multiple paid for Redwood. Note that this analysis is valid because Cronos’ exposure in the US is primarily via Redwood and its Lord Jones brand.

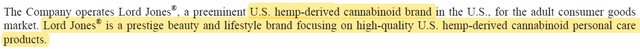

Now I highlight that the Lord Jones’ brand is focused on selling hemp-derived beauty and personal care products in the United States:

Lord Jones Business Description (Cronos FY21 10-K)

After this expensive acquisition 3 years ago, Cronos seems to be pivoting away from business associated with the Lord Jones brand:

Scaling out of Lord Jones’ beauty products (Cronos 3Q FY22 10-Q)

Altogether, these signs of potential conflict of interests and strategic pivots raise serious questions in my mind about whether Cronos is a good investment for minority shareholders.

Questionable accounting controls?

Accounting fraud

In October 2022, the SEC charged Cronos with accounting fraud. Allegedly, Cronos incorrectly recognized USD 7.6 million in revenue in its Q1 FY19, Q2 FY19 and Q3 FY19 financials. Based on the restated filings, I deduce that this corresponded to reporting more than double or triple actual revenue during those quarters. It also allegedly overstated goodwill and intangibles by almost USD 235 million, which again from the restated financials, I deduce that it inflated the assets base by 11%.

The main person charged with wrongdoing was Cronos’ former Chief Commercial Officer, William Hilson. Specifically, Hilson was charged with:

…fraud and aiding and abetting the company’s violations.

It was discovered that:

Hilson entered into an undisclosed oral agreement to sell cannabis raw material and to repurchase cannabis product in the following quarter.

Cronos claims that this agreement was neither known nor accounted for by the company as it discovered the $2.3 million accounting error during an internal investigation. After discovering the accounting errors, Cronos reported the misconduct to the SEC and cooperated with all investigations that ensued.

In the investigations, the SEC’s findings revealed that:

[Hilson] violated the antifraud provisions of the federal securities laws and further aided and abetted and caused Cronos’s violations of the reporting, books and records, and internal controls provisions.

Neither Cronos nor Hilson admitted or denied the SEC filings and both offered to settle the matter by agreeing to cease and desist from future violations of the charged provisions. Yet, Hilson is debarred from holding accountant related positions for at least 3 years. Additionally, the US SEC decided not to impose a financial penalty on Hilson as he had already consented to pay CAD 70,000 or approximately USD 54,000 to the Ontario Securities Commission to settle similar charges.

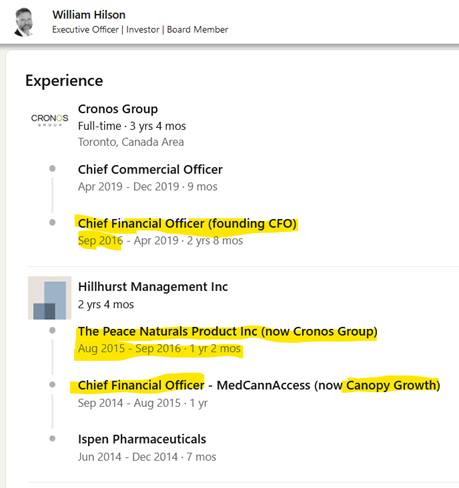

A Deeper Dive into William Hilson

William Hilson experience (LinkedIn)

As seen above, Hilson was former CFO of Cronos since September 2016. More interestingly, Hilson was previously involved with The Peace Naturals Product Inc at his company, Hillhurst Management Inc.

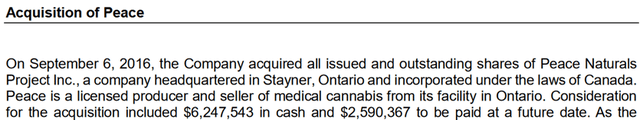

Peace Naturals was acquired by Cronos Group in September 2016; right when Hilson became the CFO of Cronos. The acquisition price was for a total of CAD 8.9 million:

Cronos Acquisition of Peace Naturals (Cronos Q2 FY17 MD&A)

As is the case in Cronos’ Lord Jones acquisition’s beauty segment, Cronos is phasing an exit out of the Peace Naturals business headquarted in Stayner, Ontario in Canada after 5.5 years, highlighting yet another strategic pivot:

Phased exit of Peace Naturals in Canada (Chronos 3Q FY22 10-Q)

That’s two major strategic pivots arising from two acquisitions over the last 5-6 years. I believe at the very least, this pattern of inconsistency in strategic direction makes it difficult to have a clear, optimistic view about the future of the business.

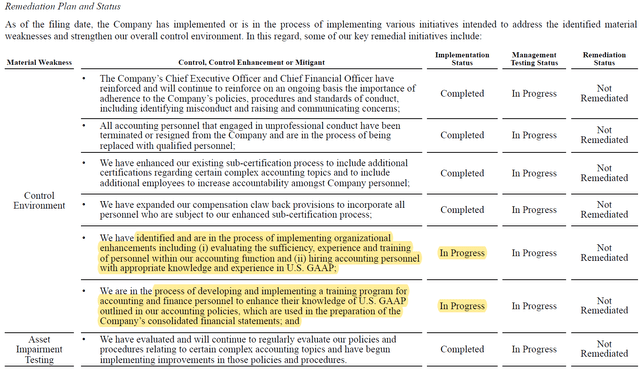

Present Status of Accounting Controls

According to the company’s Q3 FY22 10-Q, the company has made some progress in improving its internal accounting controls. However, the most important reform of having competent accounting personnel is not yet implemented fully:

Accounting Controls Remediation Plan and Status (Cronos 3Q FY22 10-Q)

Until this reform is implemented fully, lingering doubts on the reporting accuracy of Cronos will make it difficult for me to have a sufficient degree of trust in the company’s financials.

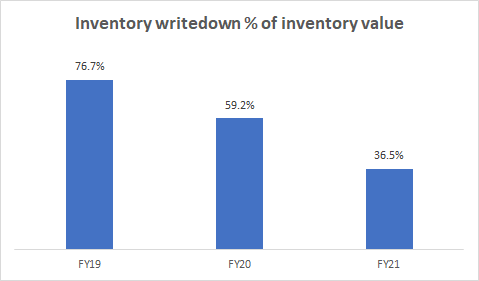

Cronos faces high competition and pricing pressures from a crowded cannabis market

The cannabis market is highly competitive with many fragmented suppliers, including from illegal market participants that can operate at much lower costs. Moreoever, according to CEO Michael Ryan Gorenstein’s commentary in the Q3 FY22 earnings call:

every category in cannabis either is crowded or will quickly become crowded until there is ultimately differentiation…

Given this, it is unsurprising then that the FY21 10-K mentioned continued pricing pressures particularly in the Canadian market. This has translated to large inventory write-downs historically and the supply-demand dynamics imply further risks of this continuing:

Inventory writedown % of inventory value (Company Filings, Author’s Analysis)

Typically, I believe the opportune time for investment is when early signs of normalization are present in the industry’s demand – supply dynamic. This is when reliable signs of stable market leadership can be more clearly determined. Currently, Cronos does not show any signs of supply glut normalization.

Cronos is badly positioned to benefit from the enactment of the Medical Marijuana Research bill

On December 2 2022, Biden signed the “Medical Marijuana and Cannabidiol Research Expansion Act”, which eases restrictions on cannabis related research, particularly for medicinal purposes. Like other pot stocks, Cronos’ stock price rose almost 9% on that day.

However, Cronos seems poorly positioned to capitalize on whatever opportunities may open up with the enactment of this bill. This is because the company has been scaling back on its US operations since Q1 FY22 over the past few quarters as it restructures its portfolio. In Q3 FY22, the company announced another leg of restructuring as it initiated a phased exit of the wholesale beauty category business in the US since Q2 FY22 to focus solely on adult-use products. This has low overlap with medicinal usage related cannabis products and hence is unlikely to materially benefit from the marijuana research bill.

As a result of this restructuring, the US business has been shrinking:

US net revenue QoQ growth (Company Filings, Author’s Analysis)

In the Q3 FY22 earnings call, management indicated that de-growth in the US business is expected to continue:

it’s [US business] is still something you’ll see in transition… going to be focused on continuing to skinny down and get to a place where we’re focused on just the adult-use product formats.

Thus, I believe Cronos will not be a meaningful beneficiary of the recent supportive legislation, which adds to the risk of its market position falling behind its peers.

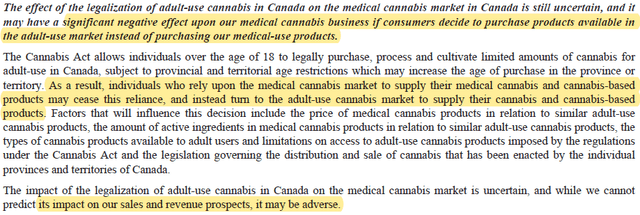

Cannibalization of Cronos’ cannabis segments is a structural overhang

If adult-use consumable cannabis receives regulatory clearances, then customers are more likely to use that form of the drug as a substitute for the pricier medicinal cannabis forms. This may cause sales erosion of Cronos’ more premium cannabis segments. The company’s FY21 10-K noted this risk too:

Cannibalization of Cannabis Risk (Cronos FY21 10-K)

I believe the chance of this cannibalization risk playing out is significant due to the price sensitivity of the core cannabis users. My argument here is composed of 3 parts:

1. Cronos has a lower margin product mix

This is because Cronos’ product mix reveals that 65% of all sales come primarily from cannabis flower type products. And the company’s incremental growth strategy is on launching pre-rolled cannabis products. According to the company’s Q3 FY22 10-Q filing, the cannabis flower and pre-rolled products carry lower gross margins compared to cannabis extracts:

Gross margin profile of cannabis product types (Q3 FY22 10-Q)

2. Age demographic users that are economically worse off make up most of cannabis consumption

Millenials and Gen Z make up 64% of overall cannabis consumption. Numerous wealth gap studies and anectodal evidences suggest that these age demographics are more likely to be among the lower income group in society due to wide generational wealth gaps.

3. Low income consumers are more likely to consume low margin products

It is unsurprising then, that market research from Visual Capitalist indicates that lower income (less than USD 49,000) consumers are 59% more likely to consume cannabis flower and pre-rolled products. This is mostly because they are highly price-sensitive consumers.

Valuation

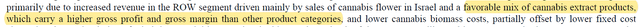

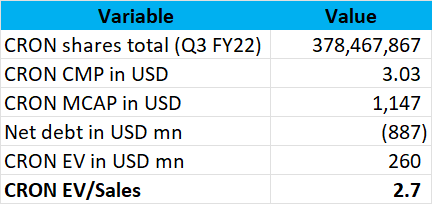

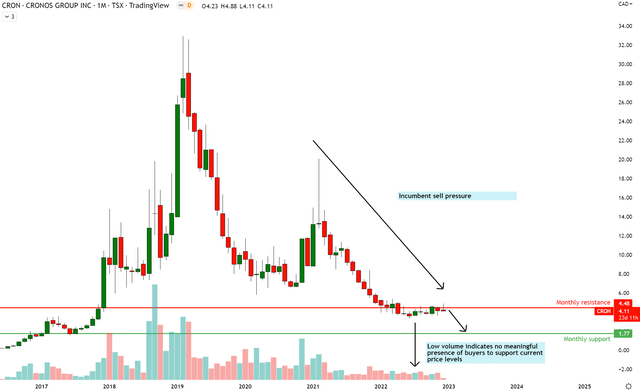

Cronos Valuation Multiple (Company Filings, Author’s Analysis)

Cronos is currently trading at a LTM EV/Sales multiple of 2.7x. This above both the median valuation of 2.3x LTM EV/Sales and close to the mean valuation of 2.7x EV/Sales:

Cannabis Stocks EV/Sales Comps (Capital IQ)

Peerset companies include Auxly Cannabis (XLY:CA), Canopy (WEED:CA), Organigram (OGI) (OGI:CA), Tilray Brands (TLRY), Aurora Cannabis (ACB) (ACB:CA), HEXO Corp (HEXO) (HEXO:CA), Statehouse Holdings (OTCQX:STHZF), Delta 9 Cannabis (DN:CA) (OTCQX:DLTNF), Red White & Bloom Brands (OTCQX:RWBYF)

Given my doubts on the company’s corporate governance and operational execution weaknesses, I believe Cronos ought to be valued materially lower than industry-wide multiples. It is difficult to arrive at a fundamentals-based target price when:

- I find it hard to trust the accuracy of the financial reporting upon which all valuation is based, as the company sorts out its accounting control issues

- The company is deep in losses and I can’t realistically envision a clear route to profitability

- I have a lack of clarity on revenue growth amid the company’s restructuring activities and volatile regulatory environment

I think there is a reasonable chance that Chronos’ stock can go to 0 if these red flags on its corporate governance are more widely discovered without being sufficiently addressed and clarified by management. Note that according to MarketWatch, neither Altria nor Cronos agreed to comment on some of the governance concerns.

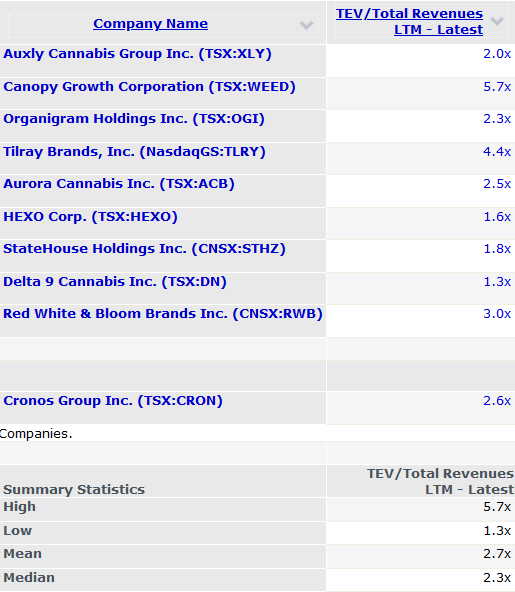

Technical Analysis

CRON Technical Analysis (Trading View, Author’s Analysis)

CRON is currently reacting off a monthly resistance at CAD 4.48 amid an overall downtrend. Although prices are basing, the volumes are low, suggesting no meaningful presence of buyers to support the stock at current levels. I anticipate price to make sharp moves down towards monthly support.

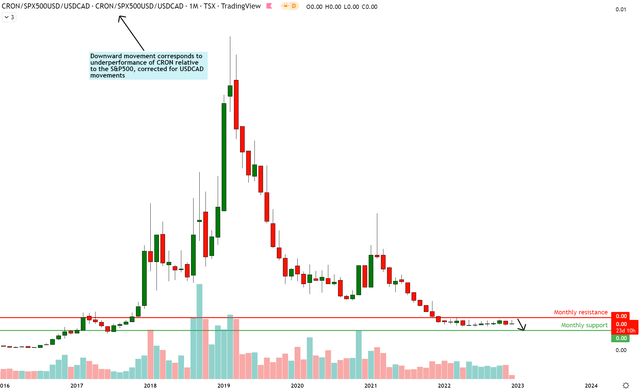

CRON vs S&P500 Technical Analysis (TradingView, Author’s Analysis)

On the relative chart of CRON vs the S&P500 (SPY), the setup is very similar. Price is basing amid an incumbent downtrend but with low volume. I anticipate a journey downwards to the monthly support region identified.

Key Risks and Monitorables

A key risk and monitorable to my bearish thesis is Cronos improving its corporate governance practices and/or assuring and providing clarification to the market about the issues identified.

In terms of execution risks associated with a short position in CRON, the short interest currently stands at 8.8 million shares, which corresponds to a 2.3% short interest of the overall shares outstanding and a 4.5% short interest of the free float, which primarily excludes Altria’s stake in the stock. I view the free float short interest as the more relevant measure.

I deem a 4.5% short interest to be reasonable and not sufficiently high to warrant a short squeeze in the stock. I would be more watchful for these shakeout concerns if the free float short interest climbs to double digits.

From a trade management perspective, the short borrow fee rate is a key monitorable. Currently, the borrow rates for CRON are at an annual interest cost of 0.90%.

A Compelling Short for 2023

As I mentioned in the beginning, I was initially bullish on Cronos as my screens identified it as a good buy. But upon deeper research, it became apparent to me that Cronos is an operationally weak business with many corporate governance red flags. I think it is a highly compelling short that will play out in 2023.

Although I believe the stock’s move downwards is imminent, I view this more as a structural longer term short. I personally do not want to complicate my bet by taking on expiration or volatility related risks that come with put options. However, more risk-averse investors may prefer to utilize put options to play a bearish view on Cronos.

Regarding time horizons of the trade, I will assess my position at key checkpoints based on technical levels and progress on key monitorables. But so long as the governance concerns remain insufficiently addressed, I believe the stock may continually drop gradually, especially in 2023. I would be inclined to ride as much of this move as possible, although I may trade in and out based on technical levels.

Again, I rarely short stocks as I run a long-only fully invested strategy. Yet, I am making an exception in this case. Perhaps I am missing something obvious due to a blind spot. I would be keen to discuss your views in the comment section below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment