alenkadr

The vast majority of my readers – even my fairly new ones – know how much I like the term “SWAN.” It stands for “Sleep Well at Night,” a goal I want all of you to achieve.

Even in this market, which isn’t the most tranquil place to be, to say the least.

Even when it’s up, so many mom-and-pop investors are just wondering when it will shift. “It’s going to go down eventually,” seems to be a common market assessment. “I’m just waiting for it to crash.”

Again, hardly the most happy, go-lucky, sleep-like-a-baby outlook to live by.

I don’t say that to mock the pessimists, for the record. I get it. There’s a lot to be concerned about with the current economic outlooks.

To quote a recent Markets Insider article, “The stock market could be set up for another rocky year in 2023 if earnings estimates from Goldman Sachs and Bank of America pan out.” Apparently, the former just downgraded its outlook for the S&P 500 to 0% – “and that’s only if a recession doesn’t hit the U.S. economy.”

Further down, it reads:

“‘Pricing is peaking, demand is slowing, yet costs are sticky. Our Corporate Misery Indicator remains well off its highs (more miserable), pointing to increased margin pressure. Demand is key, which was the main driver of pricing power post-Covid. Weakening demand should translate to weaker pricing and margin pressure,’ [Bank of America’s Savita] Subramanian said in a Monday note.”

That’s not a nice place to be.

Analyzing the Economic Outlook

Subramanian added that much of the expected earnings weakness will probably come from tech companies and discretionary spending. That makes sense considering the trends we’ve been seeing in Big Tech and elsewhere.

Meanwhile, an earlier Markets Insider piece quotes Rosenberg Research founder David Rosenberg as saying that individuals’ bank balances are “subsiding at a very quick rate.” He also pointed out these factors as fueling his negative expectations:

- Inflation’s continuing erosion of the dollar’s purchasing power

- The fact that real U.S. retail sales shrunk 2% year-over-year in the third quarter

- Credit card balances surging

- Consumer trends moving away from nonessential items.

Then again, for all the negative news fueling bearish opinions and behavior, there’s also plenty to bolster the markets. If that wasn’t the case, why would they be rising as much as they are?

Sure, the Nasdaq is down since October 18, when the piece was published – at last check anyway. But the S&P 500 and Dow have climbed a noticeable amount.

Again… at last check. Who knows what could happen from here.

But that’s the thing…

Who knows?

The positive possibilities have some people piling into the markets. Others are too scared to do anything but pull their money out and sit on the sidelines until things start making sense again.

But as for me, I have a better suggestion to work with.

The Next Best Thing

I began this article by mentioning SWANs, and I did that for a reason.

Dividend-paying sleep-well-at-night stocks are true treasures – even if they might not feel like it when the economic sun is shining. During times when the market birdies are sweetly singing, it’s tempting to get involved in high-risk, high-reward companies instead.

Those shares shoot up like crazy, after all, showing that while a rising tide does lift all boats – some rise really far and really fast.

That’s just not the case with SWANs. They make share-price gains, mind you. Just more along the slow and steady lines, all while paying you reliable dividends every quarter (or month).

It’s not until the hard times hit that they really shine in immediately obvious ways. Because once the markets replace greed with fear, they’re still paying out reliable dividends on schedule.

And while their share prices are still susceptible to volatility in a downturn, they tend to bounce back more quickly. (It’s important to mention that a shocking number of stocks don’t bounce back at all.)

The main problem with SWANs is their rarity. That and they don’t go on sale easily, which means I don’t recommend them nearly as much as I’d prefer.

That’s why, today, I’m going to switch focus to SALSA stocks. Standing for “safe and lasting seeking alpha,” they’re still solid, promising investments.

They don’t offer the same top-rung management, balance sheets, and competitive advantages as SWANs. But they’re the next step down, which means:

- There are more of them to choose from at any given time.

- They tend to feature more affordable buy-in prices.

- They’re still very well worth considering for your portfolio at any time.

Here are three I’m particularly interested in today that should do well no matter what’s up ahead.

SALSA Pick #1: NewLake Capital (OTCQX:NLCP)

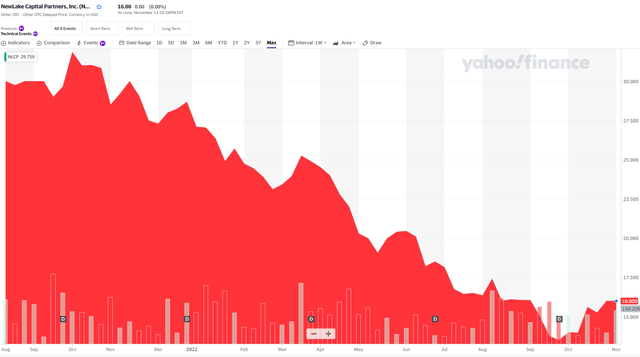

NLCP is a cannabis REIT that iREIT began covering back in 2021 (company was founded in 2019) and today owns 31 properties in 12 states (1.7M square feet). Since the company listed shares (‘OTC’), it has traded down around 46%.

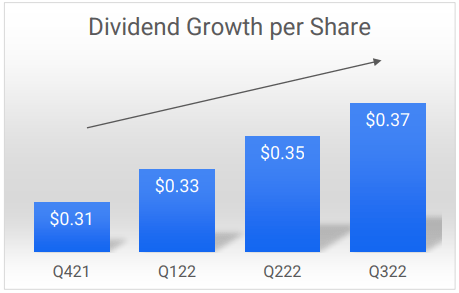

NLCP is seemingly an outlier, because the company has no listing on NYSE or NASDAQ, and also because the company is generating eye-popping growth. As viewed below, NLCP has increased its dividend in every single quarter since its listing (sixth consecutive quarterly dividend increases).

NLCP Investor Presentation

In Q3-21, NLCP generated strong year-over-year growth in revenue and AFFO. Total revenue for the quarter increased 50% year-over-year to $12.1 million compared to $8 million from the prior year quarter. And Q3 2022 AFFO increased approximately 75% year-over-year to $10.6 million as compared to $6.1 million from Q3 -21.

NLCP collected 100% of contractual rent and reported revenue of $32.6 million, a 71% increase from $19.1 million in the first nine months of 2021. The company increased its quarterly dividend for Q3-22 to $0.37 a share or $1.48 annualized and its long-term expected target AFFO payout ratio is between 80% and 90%.

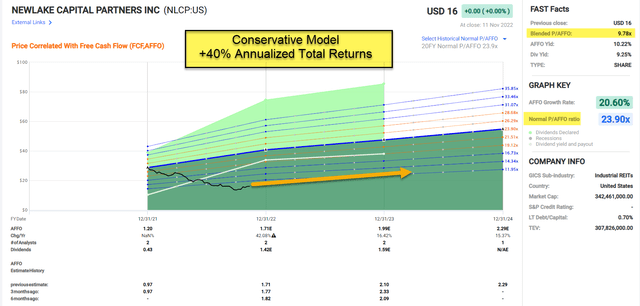

The reason I included NLCP on the SALSA list is because of the compelling growth, in which analysts are estimating AFFO/sh to grow by 16% in 2023, on top of the 42% growth (forecast) for 2022. And when you combine the ultra-cheap valuation – 9.8x P/AFFO and dividend yield of 9.3% – you’re looking at “conservative” returns of 40% in 12 months.

SALSA Pick #2: UMH Properties (UMH)

UMH is a manufacturing housing REIT that owns 132 manufactured home communities containing approximately 25,000 developed home sites located across NJ, NY, OH, PA, TN, IN, MI, MD, AL, and SC.

The company’s rental portfolio contains approximately 9,000 units and anticipates an additional 500 homes per year. It also has a wholly-owned taxable REIT subsidiary, selling homes to residents; 312 homes sold over past 12 months.

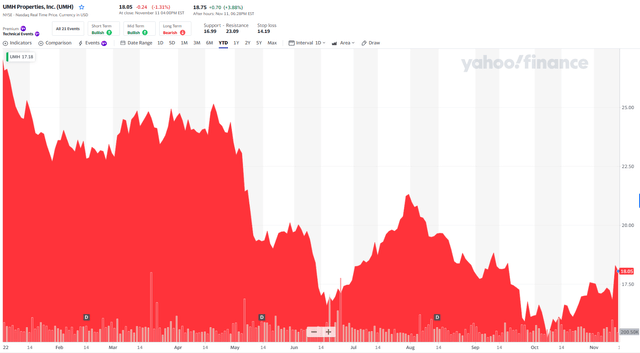

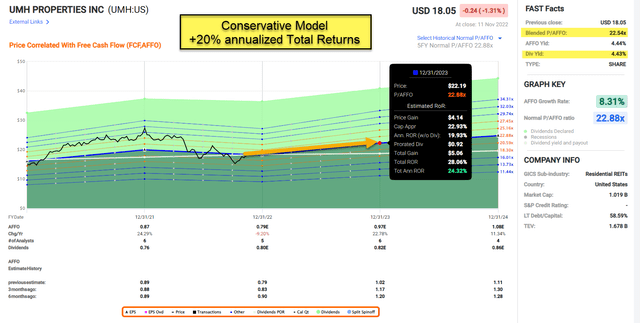

As viewed below, UMH shares have tumbled by over 34% year-to-date:

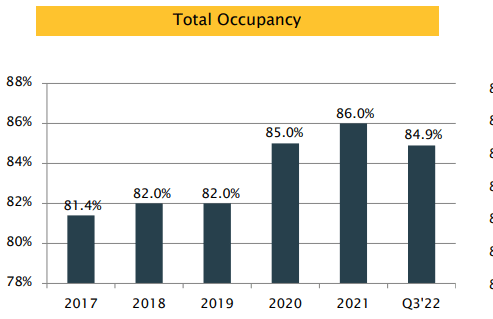

UMH is also uniquely positioned because it has 3,600 existing vacant lots to fill, and nearly 1,900 vacant acres on which to build approximately 7,600 future lots. Total occupancy has been trending upwards, a strong sign that earnings growth follows the same path.

UMH Investor Presentation

Furthermore, UMH has a development pipeline of over 1,000 sites and is uniquely positioned to expand profit margins by lowering its cost of borrowing. It recently issued 4.72% Series A bonds and 83% of total debt is fixed rate with a weighted average interest rate on mortgage debt of 3.87%. The weighted average maturity on the mortgage debt is 5.1 years.

UMH also has a total of $215 million in perpetual preferred equity and it was able to recapitalize a 6.75% Series C preferred, that should increase FFO by approximately $0.12 per share annually.

The reason I included UMH on the SALSA list is because of the exceptional growth forecasted by analysts – of 23% in 2023 and 11% in 2024. In addition, shares are trading at a modest discount of 22x P/AFFO (normal is 23x) and a well-covered dividend that yields 4.4%.

Salsa Pick #3: Clipper Realty (CLPR)

CLPR is a “pure play” New York City-focused on stable multifamily properties with a portfolio of 66 Buildings, representing 3.3 million Leasable Square Feet. The multifamily portfolio consists of 2.6 million square feet, in addition to two office buildings (550,000 square feet) and retail/parking assets (~100,000 square feet).

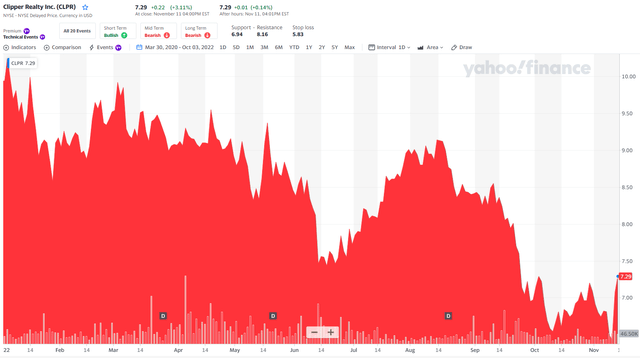

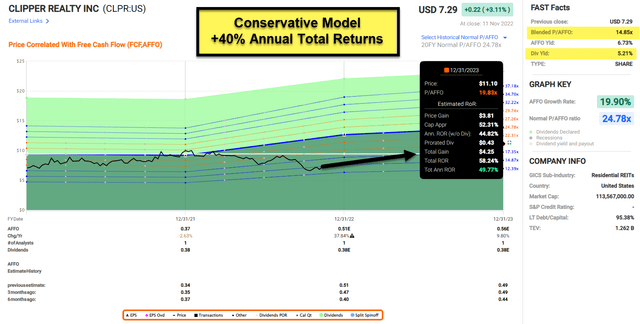

I was recently in New York attending my oldest daughter’s wedding celebration, and I can vouch for the acceleration in demand, especially in Brooklyn where many of CLPR’s residential assets are located. As viewed below, CLPR shares have declined by around 26% year-to-date:

Consider CLPR the New York sharpshooter in which the small cap (~$113 million) REIT acquires high-quality properties at a discount to private market value, with opportunities to re-develop and lease up the buildings.

One of the key advantages with this pick is the significant insider ownership in which the founders own 67% of the company, with significant public company experience.

At the end of Q3-22, the properties were 99% leased and new leases at all properties were exceeding pre-pandemic levels. At one of the largest properties, Tribeca House, new leases in Q3-22 exceeded $83 per square foot, more than 23% better than the previous rents.

Although CLPR has higher leverage than most REITs (in our coverage spectrum), the average duration of the secured debt is 6.87 years and 95% is fixed at 3.72% (and non-recourse).

At the end of Q3-22, CLPR had approximately $34.5 million of cash, consisting of $20 million of unrestricted cash and $15.5 million of restricted cash.

CLPR has one development underway, 1010 Pacific which is in close proximity to Barclays Center in Brooklyn. The land was purchased in 2019 (for $31 million) and CLPR is constructing a 9-story 119,000 square feet apartment building (175 total units). On the recent earnings call, the management team said,

“The essentially ground-up development of our 1010 Pacific acquisition is moving along very well. We are targeting substantial completion in the fourth quarter and completion of long-term financing in the first quarter of 2023.

The properties located in Prospect Heights, Brooklyn, about one mile from the Atlantic Terminal, Barclays Center Hub, we estimate the project to cost $85 million, which is on budget and developed to a 7.2% stabilized cap rate and improved leasing environment.”

Also, in Q3-22, CLPR generated record quarterly revenue of $32.8 million, net operating income of $17.4 million, both exceeding pre-pandemic levels and AFFO of $5 million as a result of improved leasing.

As viewed below, CLPR is trading at a cheap multiple of just 14.2x P/AFFO and a well-covered dividend yield of 5.2%. We have only one analyst estimate for the company, which forecasts AFFO per share growth of 37% in 2022 and 10% in 2023. For another opinion (also bullish), take a look at Paul Drake’s piece back in April (his take was that CLPR was ~40% undervalued).

In Closing…

I hope you enjoyed my SALSA article, and, in the future, I’ll make sure to provide a few more “flying under the radar” picks.

As much as a love owning (and writing on) SWANs, I think it’s important to occasionally screen for some of the REITs that are not getting much Wall Street attention.

As you know, these SALSA picks are a bit riskier than the SWANs, but this means that there is also enhanced opportunity to deliver above average returns. And of course, the best way to mitigate risk in the stock market is to insist on a wide margin of safety and to always practice responsible diversification.

So, let me ask you this question…

Are you ready for some SALSA?

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment