DNY59

I have said for most of 2022 that I plan to buy a small position in the ProShares UltraPro QQQ ETF (NASDAQ:TQQQ), the 3x leveraged Nasdaq 100 ETF, if I saw capitulation and panic in the markets. I haven’t seen it yet, so I haven’t started a position. I received a comment this week on a previous article asking when my buy signal was coming. When I wrote that article in August, it was after a 25% rally in a month. More recently, the Indexes staged a massive rally on Thursday and Friday to end last week which led to a move over 25% in the last week. After the recent jump, I figured it was time to write an update on the most popular leveraged ETF.

Investment Thesis

TQQQ might not be suitable for every investor with its volatility and huge short term price swings, but I have been looking for a chance to add a small position to my portfolio. Like I have mentioned in previous articles, I am looking for a large selloff accompanied by fear, capitulation, and panic. If the valuations on the major index components were more attractive, I might ignore the day-to-day fluctuations and buy shares anyway. With valuations where they are at today, TQQQ remains on my watchlist for now.

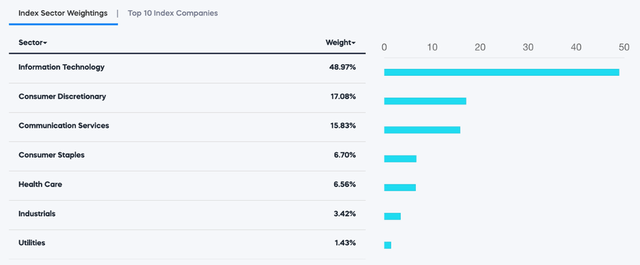

TQQQ Sector Weights (proshares.com)

The Nasdaq index has always been heavy on technology companies. Right now, the index is approximately two thirds in technology, with about half of the index made up by the big tech companies in the top 10. While tech companies have had a long bull market until the end of 2021, I have a sneaking suspicion that the sector will not continue to outperform the way it has over the past two decades.

Apple & Microsoft

Apple (AAPL) and Microsoft (MSFT) combined make up nearly a quarter of the index (as of 9/30). I’m not bullish on either company at current prices, so it makes it hard to be bullish on the index, and more specifically the levered version of the index. Apple has a market cap of $2.3T, and I have read several well-argued articles recently explaining that margins will likely compress and that their Chinese manufacturing could create problems over the next year.

Microsoft doesn’t have the same manufacturing issues, but with a market cap of $1.8T, I see the same problem that I see with Apple. I don’t see how the forward returns will be anywhere near the last five years with the massive size of both companies. As they say, trees don’t grow to the sky, and that applies to giants like Apple and Microsoft. However, I do think Microsoft is in a better position than Apple with their product/service mix, and I do like the pending Activision (ATVI) deal, which I think will go through.

Amazon

While I haven’t owned Apple or Microsoft since last year, I am still holding onto a small Amazon (AMZN) position. I think the AWS and advertising segments will continue to post impressive results, even if the ecommerce segment struggles to deal with higher costs. While I’m not adding here, I find Amazon below a $1T market cap to be a much more attractive proposition than Microsoft or Apple, especially considering the company’s leading position in cloud services. Throw in the fact that the advertising segment has been taking market share over the last couple years, and I’m still bullish on Amazon. As long as the high margin segments keep posting solid results, I will hang onto my shares.

Tesla, Google, and Meta

These three companies account for approximately 15% of the index, but I’m not interested in owning any of them, for various reasons. I explained my reasoning on why I’m avoiding Meta (META) in an article last week, so I will point readers to that one for a more in-depth breakdown of my opinion on the company. Tesla (TSLA) has its own risks, and I have questions on some of the numbers, but the biggest question mark is the valuation. I still don’t understand why Tesla is worth more than $600B, and that is after being down over 50% YTD.

Google (GOOG) (GOOGL) is more attractive when it comes to valuation (P/E near 20x), but the market cap is still huge at $1.2T. I think the advertising core business will likely struggle over the next year or two. For many businesses, advertising is the first cut in a downturn. Microsoft and Amazon seem to have a huge head start when it comes to the cloud segment, and the Other Bets piece makes question the company’s capital allocation strategy. I would rather see dividends, but that’s just me.

Nvidia

This is another one I sold in 2021 when shares went parabolic, and the valuation just got too expensive for me. NVIDIA (NVDA) is widely regarded as one of the best, if not the best, operator in the semiconductor industry. The valuation has kept me on the sidelines for now, but it’s still on my watchlist. I think the gaming and data center pieces will continue to grow over the long term, but I am curious to see what happens with crypto and how it impacts Nvidia’s business. FTX has been imploding over the last week, and if bitcoin keeps heading lower, I think we will see more bodies start to float to the surface.

Pepsi & Costco

The top 10 is rounded out by PepsiCo (PEP) and Costco (COST). Neither of these are high growth tech companies, but the same problems I have with the valuations of most of the other top 10 components apply here. Pepsi has a forward P/E over 26x, and Costco’s is over 35x. Like I said in the previous article on TQQQ, you can count on stable and growing dividends from both, but I would rather be a seller than a buyer of these two stocks.

Conclusion

While leverage can create problems if it is used irresponsibly, it can also create impressive returns in small doses. We certainly saw that in the last week with TQQQ, which had a 27% jump in the last week. The problem for me is that I still haven’t seen the widespread fear and capitulation that I’m looking for as a contrarian buy signal, and the valuations on the largest companies in the index are not that attractive in my opinion. I want to add a small chunk of TQQQ to my portfolio, but the ETF remains on my watchlist for now.

Be the first to comment