Darren415

This article was first released to Systematic Income subscribers and free trials on Sep. 20.

In this article, we take a look at the Ares Dynamic Credit Allocation Fund (NYSE:ARDC). The fund has recently released its latest semi-annual shareholder report and we take this opportunity to highlight some of its features. Our key takeaway is that apart from historic outperformance and attractive valuation the fund has two features that make it a good fit for the current environment. Specifically, it has a significant allocation to floating-rate assets while half of its liabilities are fixed-rate. And it also has a relatively wide mandate in the credit space, holding bonds, loans and CLOs. This gives it an unusually wide remit to pursue attractive corporate credit opportunities. We continue to hold the fund in our High Income Portfolio. ARDC is trading at a 9.9% current yield and an 11.4% discount.

Quick Overview

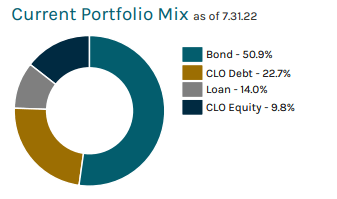

The fund’s portfolio is roughly evenly split between floating-rate and fixed-rate corporate assets. The floating-rate side is composed of individual loans as well as both CLO Equity and CLO Debt securities.

ARDC

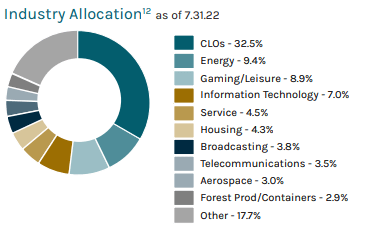

In its bond/loan allocation, it is overweight Energy, Leisure and Technology sectors.

ARDC

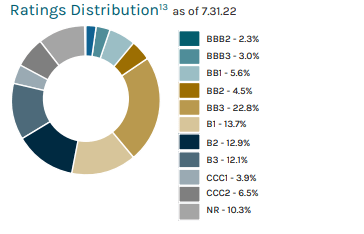

Its rating profile is shown below. The allocation to the CCC bucket is at around 10% which is slightly above the sector average.

ARDC

Finally, the fund has a duration of around 2. Given its mixed bond/loan allocation, this is below the duration profile of bond funds and above that of loan funds.

Income Profile

ARDC has an attractive income profile for the current market environment.

First, roughly half of the portfolio is in floating-rate assets such as individual loans and CLOs. With the market consensus now expecting the Fed to move the policy rate to 4%, that will provide a big boost to the fund’s income.

One downside of loans is that while an increase in short-term rates does lead to a boost in loan coupons and, hence, fund income, it also puts pressure on loan borrowers via a higher level of interest expense. This is why an allocation to CLO Debt which makes up 23% of the fund is an attractive one as it features a significant amount of subordination, i.e. it is not on the hook for the first few defaults in the portfolio. That said, it’s important to remember that in an unusually high default wave CLO Debt will underperform a strictly individual loan portfolio.

Second, along with a significant allocation to floating-rate securities, the fund has about half of its liabilities in fixed-rate term preferreds. These preferreds have a weighted-average rate of around 2.6% with maturities in 2026 through 2028. This is a fantastic liability profile since the typical floating-rate leverage instrument used by CEFs such as repo or credit facilities have an interest expense of around 4% which will rise further to around 5% at the expected 4% Fed Fund peak. Needless to say, paying 5% on a facility on top of a 1% management fee does not leave a lot of room for the leveraged portion of the CEF to generate yield. This relatively low cost of leverage allows ARDC to pass on more of its income to shareholders.

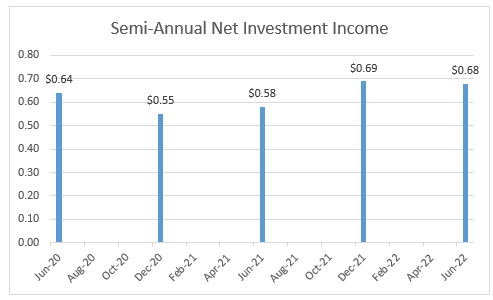

The fund’s net income for the first six months of the year was fairly flat to the previous six months period despite a rise in short-term rates. This is likely for three reasons. First, short-term rates get passed through to income only with a lag as it takes time for the Libor underlying loan coupons to accrue and reset. Secondly, CLO Equity positions initially suffer from higher Libor since CLO Equity assets (i.e. loans) have Libor floors while CLO Equity liabilities (i.e. CLO Debt securities) do not feature Libor floors. Finally, ARDC cut its credit facility slightly i.e. sold some of its assets to partially repay the facility. We expect the next semi-annual period to see a significant net income boost.

Systematic Income

ARDC is likely thinking along the same lines as it raised the fund’s distribution 5% in August to $0.1025. This number is well below its latest net income run rate of $0.1133 which is itself understated as we just discussed. For these reasons we expect further hikes in the distribution.

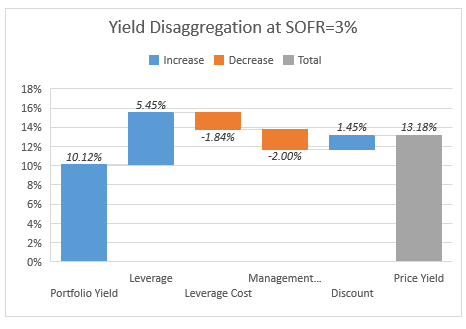

There are a lot of moving parts in the ARDC income “sausage factory”, so to speak, so we use the following chart to disaggregate the various components of its price yield. By yield we mean the fund’s underlying portfolio yield-to-worst rather than its distribution rate or its net income yield, both of which are poor proxies.

We start with a portfolio yield of 10.12% which is a weighted-average yield based on the figures helpfully provided by the fund in its fact sheet. We then use the fund’s leverage, fees, leverage cost and discount to come up with its price yield of around 13%. This number is fairly high as far as credit CEF yields go for a number of reasons such as the fund’s relatively low leverage cost, its wide discount and its allocation to CLO Equity which boasts double-digit yields. The fund’s yield will go up as short-term rates continue to rise.

Systematic Income

In terms of historical performance, ARDC has outperformed the loan sector slightly over the last 5 years and significantly outperformed the HY bond sector over the same period in total NAV terms.

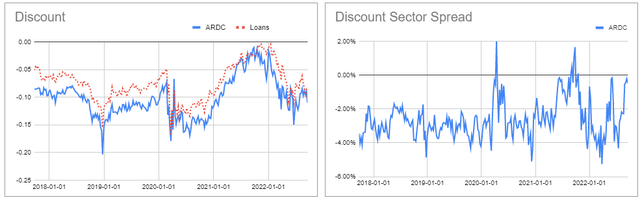

The fund has often traded at a wider discount than the sector average despite its historical outperformance and attractive profile. Recently its discount has converged closer to the Loan sector average discount so it is less compelling at the moment in relative terms. That said, it still trades at a significantly wider discount than the HY bond CEF sector.

Takeaways

ARDC offers an attractive profile in the current market environment. Its significant floating-rate allocation, wide allocation mandate, partly fixed-rate liabilities and decent valuation makes for a very attractive combination. We expect the fund’s net income to continue to rise over the coming quarters which should lead to further distribution raises.

Be the first to comment