Solskin

This morning, one of our stocks in the pharma coverage was highlighted by Quant Ratings as being at risk of a potential dividend cut. With this analysis, we are deep-diving into Roche Holding AG (OTCQX:RHHBY) (OTCQX:RHHBF) and commenting on the latest company’s development thanks to its Pharma Day recently held in London.

Source: Seeking Alpha – Roche Holding AG page

Roche is at high risk of cutting its dividend

Source: Seeking Alpha – Warning

Firstly, Roche has one of the most knowledgeable and competent Research & Development engines globally. In the past, despite new drug developments, the company has been challenged by the investor community for margin erosion and a lower growth trajectory.

What the market is still missing?

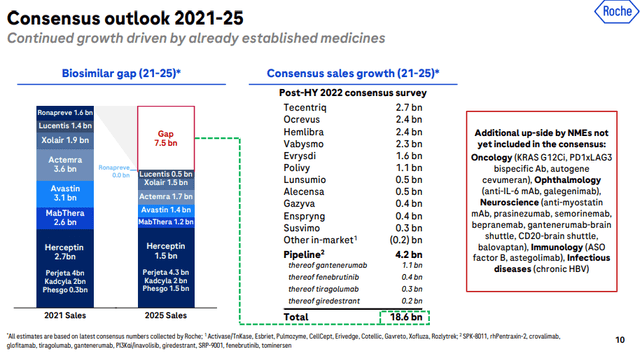

Thanks to the latest presentation with a consensus survey, we can clearly see the missing puzzle of Wall Street expectations until 2025.

7.5 billion gap in Roche Survey

Source: Roche Investor Day

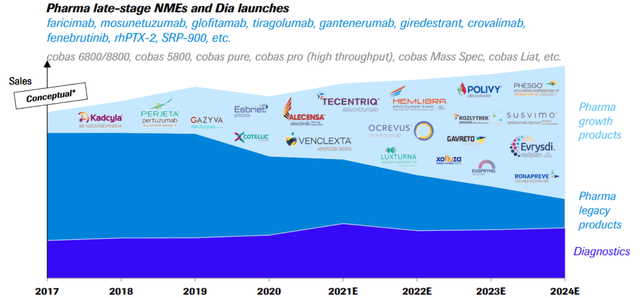

In addition, as already explained in our initiation of coverage, the company is rejuvenating its product mix offsetting and outpacing biosimilar competition and margin erosion.

Source: JPM healthcare conference

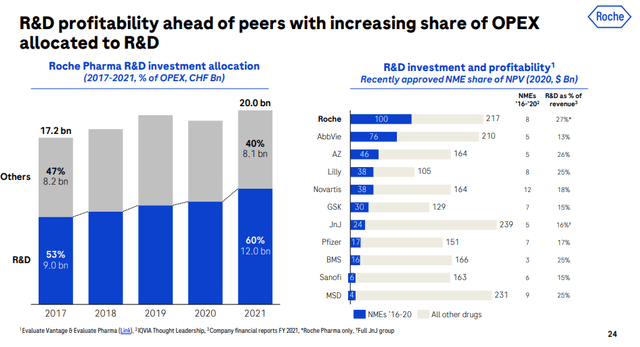

With industry-leading profitability, Roche is able to allocate more and more profit to new drug development, increasing year-on-year opex allocation in its internal R&D department to sustain revenue growth over the medium/long term horizon. Cross-checking our numbers versus consensus expectations, here at the Lab, we are confident that the Swiss pharmaceutical giant has a sales potential of top-line growth of more than 5% CAGR to 2026. We recognized that Wall Street needs to look through the lower COVID turnover expected in 2023. As a memo, during the pandemic outbreak, Roche was a key beneficiary thanks to its diagnostic division sales; and even if we estimate a lower COVID-19 revenue contribution in 2023, we still believe that many Governments understood the importance to invest more capital in Roche’s machinery products dedicated to the diagnosis.

Source: Roche Investor Day

Conclusion and Valuation

During the investor day, Roche reaffirmed its 2022 guidance with a positive outlook for the years to come.

Is Roche’s dividend at risk? We don’t believe so. According to our estimates, we are forecasting a DPS increase in line with EPS guidance, set at a low/mid-single digit. As a reminder, the Swiss pharma giant already increased the DPS this year. Roche is one of the few European dividend aristocrats companies, having raised the dividend for the 35th consecutive time.

Having recently analyzed the Q2 results, even if the whole sector de-rated for an economic slowdown, on a P/E basis, Roche is still trading at a premium valuation compared to its closest peers. Thus, we reaffirm our neutral rating with a price target of CHF 350 per share.

Here at the Lab, we extensively cover the Pharma sector:

- Novartis (NVS): Comments On Q2 Earnings Results

- Lonza (OTCPK:LZAGY): Growth Is Undervalued

- AstraZeneca (AZN): Our Next Growth Pick

- Grifols (GRFS): Long Only

- Sanofi (SNY) Is Delivering Value And Growth

Be the first to comment