Andranik Hakobyan

Brazilian edtech company, Arco Platform (NASDAQ:ARCE), posted another quarter of solid operating results, featuring strong revenue growth and resilient EBITDA margins (excluding one-offs), as well as a positive sales cycle update for next year. While the inflationary environment in Brazil could weigh on future results, Arco will likely be one of the more resilient LatAm edtech players, given its pricing power and focus on operating efficiency.

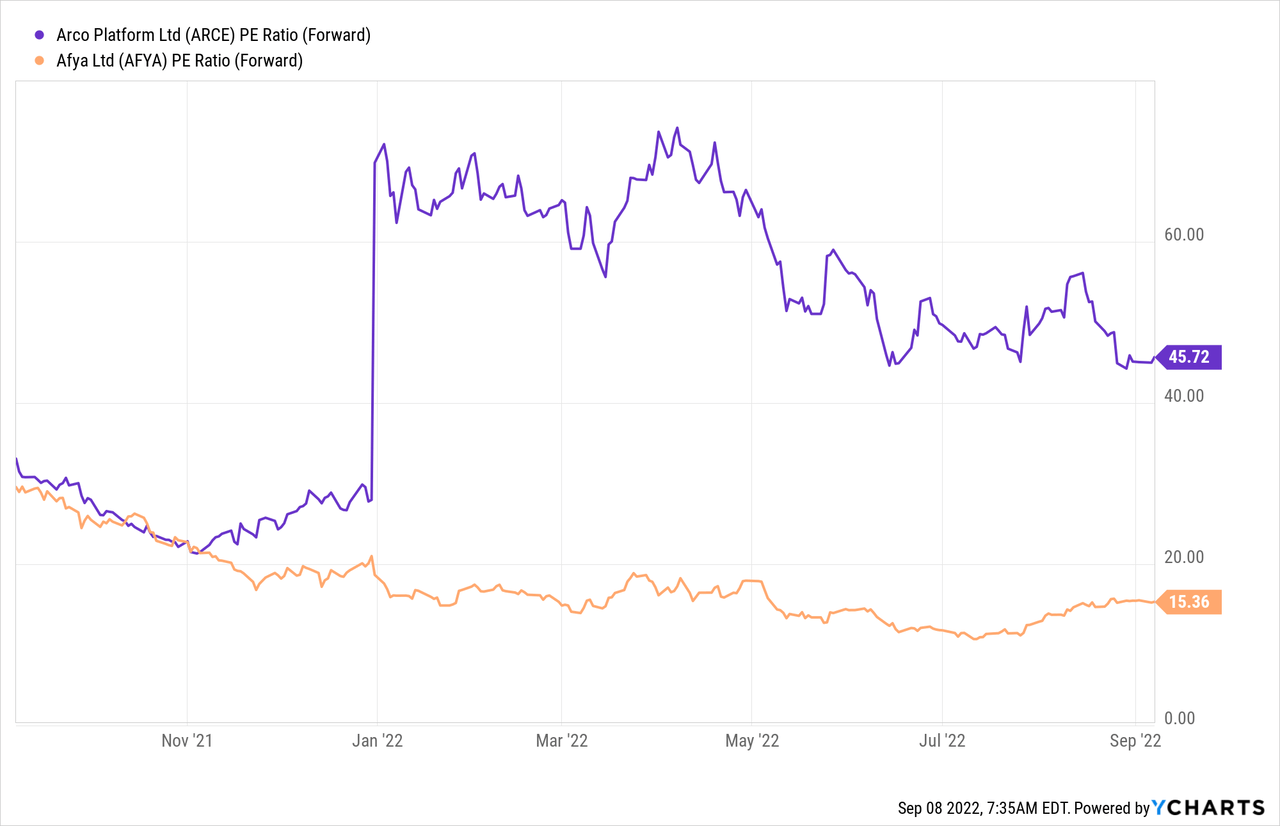

That said, I have concerns about its leveraged balance sheet, which could result in P&L headwinds in a prolonged high-interest rate backdrop. So even with the recent improvement in FCF generation, Arco could end up spending most of its cash flow on financial expenses in the coming years. On a YTD basis, Arco stock has sold off more than premium higher education peer Afya (AFYA), as well as peers in the mass category like Yduqs (OTCPK:YDUQY), but with the stock still at a lofty relative premium, I would hold off on valuation grounds for now.

Stronger ACV Recognition Drives Revenue Outperformance

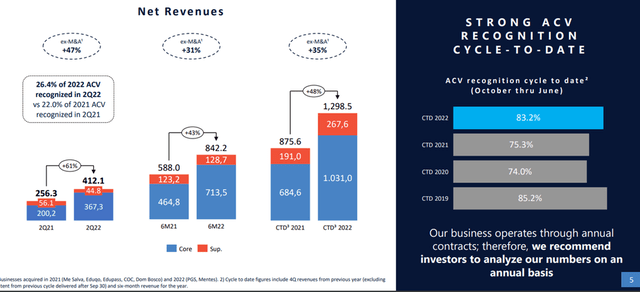

Coming off two pandemic-impacted years of weaker growth in 2020 and 2021, Arco’s recent results signal the start of a new growth cycle. In Q2 2022, net revenues came in well ahead of expectations at R$412mn (+61% YoY and +47% organic YoY). In turn, these numbers equate to an impressive ~26% of full-year annual contract value (ACV), well above the prior 20%-22% guidance range. The core solutions business was the key driver at R$367mn (+83% YoY), and while supplemental sales were down 20% YoY at R$45m, this was largely down to timing as most of the segment revenue is booked for Q4 2022.

On a cycle-to-date basis, the strong revenue numbers mean Arco has now recognized >80% of its full-year ACV. This implies the remainder of its revenues will be recognized over the next quarter or so, given the annual profile of Arco’s business (i.e., the school year from Q4 2021 to Q3 2022). In other words, Q3 will likely see lower expected revenues on a QoQ basis at ~R$260m or so, assuming full-cycle revenue approximates ACV (per guidance).

One-Offs Skew Headline Margins but Underlying Expansion Intact

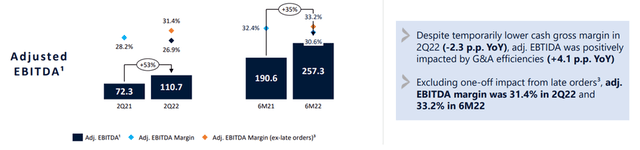

Despite the solid organic growth in Q2, Arco’s headline operating margins were well below expectations on a larger-than-usual volume of late orders from schools with late enrollments. This forced Arco to incur smaller and higher-cost printing lots as well as less efficient transportation shipping modes – hence, gross margin came down by ~230bps YoY.

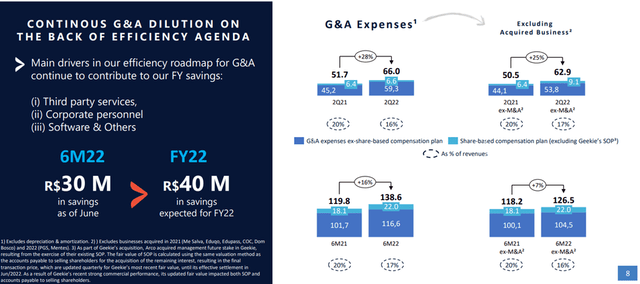

Elsewhere, selling expenses were also up ~54% YoY on more in-person events, offsetting any benefits from a net reversal of bad-debt provisions this quarter. G&A was a positive highlight, though, moving down ~410bps YoY to ~16% of revenue on increased back-office integration.

While the headline numbers were far from impressive, adjusting for the impact of negative one-offs (~R$8m in M&A expenses and ~R$4m in share-based compensation, along with the transitory impact of late orders this quarter) yields a different picture. On an adjusted basis, Arco’s EBITDA margin would have been a resilient 31.4% (+320bps YoY expansion) – a notable divergence from the R$100m accounting EBITDA and 24.4% margin for the quarter.

Operating cash flow numbers should give investors comfort as well – even after accounting for capex, cash flow would have been up on a YoY and QoQ basis. This wasn’t a light quarter for capex either – Arco’s organic capex reached ~R$43m in Q2 (up 10% YoY), although, at 10.5% of net revenues (vs. 15.4% last year), capex intensity is noticeably lower YoY. With the 2022 guidance calling for capex at 10-12% of net revenues as well, expect a consistent run-rate through year-end. This bodes well for the free cash flow outlook, which has more than doubled YoY and QoQ after accounting for organic capex.

That said, movements on the financing cash flow side will be worth watching, in particular, M&A disbursements and interest payments, both of which drove net debt (including leasing and M&A payables) up to R$2.43bn this quarter. Unless Arco de-levers quickly, upcoming rate hikes could result in higher interest payments, weighing on the P&L.

That said, Arco is making good progress in extracting synergies from recent acquisitions (~R$30m in G&A in H1 2022), with an incremental ~ R$10m in G&A synergies slated for H2 2022 as management further streamlines expenses related to third parties, corporate personnel, and software. On balance, the reiterated full-year guidance for an adj EBITDA margin of 36.5%-38.5% and capex of 10-12% of revenue looks very achievable (if not a tad conservative) as the post-pandemic growth engine picks up steam.

2023 Sales Cycle Gaining Traction

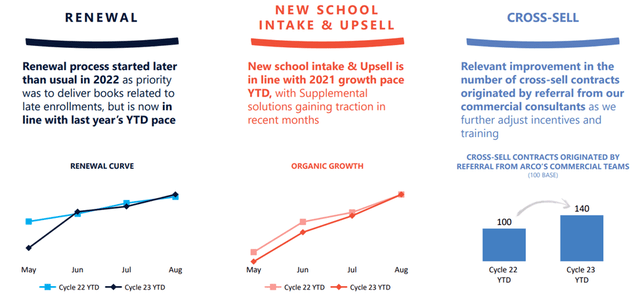

Building on the recent strength, the outlook for next year’s ACV cycle looks good as well. Per management, YTD renewals and core sales growth (from new schools and upselling) are largely within expectations (i.e., in line with 2022), but supplemental sales have shown signs of outperformance. Cross-selling contracts originated by referrals within Arco’s sales teams are another area to look out for, having risen +40% YoY.

Of note, management cited on the call (replay here) that about half of renewals have been completed at higher prices as well, indicating the underlying pricing power of the Arco model. Thus, it came as no surprise that management reaffirmed the guidance of fully delivering ACV bookings for the school year, with this cycle’s (Q4 2021-Q3 2022) revenue set to converge to ACV of R$1.56bn.

There could be incremental upside, though, given management did not rule out revenues surpassing ACV for the full year. While execution remains the key risk (after all, Arco is still in the middle of the process), the company is well on track with renewals; with organic ACV growth also at an impressive ~32%, I see a good chance 2023 growth numbers will surpass the 2022 cycle.

Still a Pricey EdTech Play

As Arco’s Q2 2022 results showcased, it has a lot going for it – the impressive revenue growth numbers (helped by the high volume of late orders) were the key highlight, pointing to the potential recognition of >100% of the ACV for this cycle. Headline margins were less impressive, but adjusted for non-recurring expenses (mainly related to the late orders), adj EBITDA margins would have expanded YoY. Arco is a company that follows a well-defined annual cycle as well, so the stronger Q2 (and potentially Q3 based on guidance) bode well for the upcoming sales cycle. Management commentary tallies with this view, citing strength in the 2023 ACV numbers, as half the selling cycle has already been closed at good rates.

Net, the company looks well-positioned to ride out any macro headwinds in the coming year, given its pricing power in the private K12 market and inflation pass-through capabilities. Yet, the stock still trades at a wide relative valuation premium at ~45x fwd P/E despite a steep YTD selloff; purely on valuation grounds, I would hold off for now, pending a better entry point.

Be the first to comment