Schroptschop/E+ via Getty Images

Introduction

After falling off the radar of income investors many years ago, the first quarter of 2022 saw king coal back with a massive potentially 20%+ dividend yield over at Arch Resources (NYSE:ARCH), as my previous article discussed. Even though the second quarter subsequently saw another massive dividend declared, it nevertheless remains a dividend of last resort for good reasons, as discussed within this follow-up analysis that also reviews their recently released results for the second quarter of 2022.

Executive Summary & Ratings

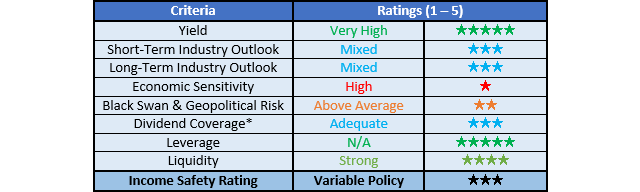

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

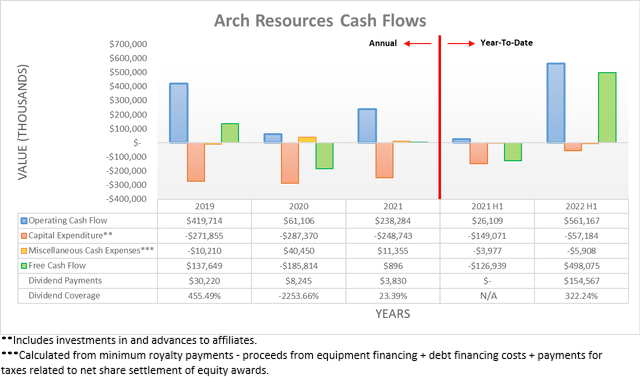

Following their extremely strong cash flow performance during the first quarter of 2021, thanks to the persistently booming coal prices, this continued into the second quarter with their operating cash flow landing at $561.2m for the first half of 2022. If zooming into the second quarter in isolation, it saw operating cash flow of $268.3m, which once again even beat their full-year result of $238.3m during 2021, despite only being one-fourth the length of time. To make this even more impressive, their operating cash flow was actually held back by a large working capital build of $124m during the second quarter, thereby meaning that their underlying result was even higher at $392.3m. When looking ahead, thankfully this is expected to unwind as soon as the third quarter with their shareholders poised to receive this via dividends, as per the commentary from management included below.

“I should note that this figure while significant would have been higher if not for $138 million build in our Q2 accounts receivable balance that was precipitated by heavy June shipping schedule to overseas customers. Fortunately, the impact of this is simply a timing issue, which is to say, we expect those funds as the cash is received will be returned to shareholders via future dividends or other capital return mechanisms. “

-Arch Resources Q2 2022 Conference Call.

Despite sounding very desirable and extremely positive, there are good reasons why investors should not simply become blinded by their massive 20%+ yield. Even if we ignore the obvious thermal coal-related ESG issues, it still remains a fuel of last resort and thus by extension, it sees their shares offering a dividend of last resort. Energy markets are very tight right now with limited supply across the board from virtually any source, thereby seeing thermal coal prices skyrocket on the back of resurgent demand, it should be remembered that no one is burning climate polluting coal because they necessarily ‘want’ to burn coal. Rather, they are only doing it out of necessity in the short-term and as a result, when the tide changes, as it will one day because energy markets always see surpluses and deficits fluctuate, thermal coal will almost certainly find itself the first to be discarded as governments push towards clean energy.

Whilst the biggest contributor to their extremely strong financial performance so far into 2022 has been metallurgical coal, when 2021 ended, thermal coal saw proven and probable reserves totaling 775.5 million tons, whereas their equivalent metallurgical coal reserves totaled only 223.5 million tons, as per their 2021 10-K. This means that their medium to long-term future and thus intrinsic value remains significantly influenced by the outlook for thermal coal, despite their adjusted EBITDA of $655.4m from metallurgical coal far outpacing their result of $193.8m from thermal coal during the first half of 2022, as per their Q2 2022 10-Q. Even in the short-term, the growing prospects of a recession on the horizon will place downwards pressure on metallurgical coal, which already started the third quarter of 2022 on a downtrend, as per the S&P Global report. I expect to see their metallurgical coal earnings ease as interest rates are pushed higher and economic activity inevitably slows, thereby leaving thermal coal comprising more of their overall earnings in the short-term, not just the medium to long-term.

When moving forwards, prices for both types of coal will naturally continue fluctuating along with their separate supply and demand balances but apart from the questionable medium to long-term future of thermal coal, other reasons still hinder the appeal of their dividends. The second quarter of 2022 saw costs blow out for their metallurgical coal production, which did not receive much attention due to being masked by their booming operating conditions. If looking into their results, they saw production costs blow out for metallurgical coal, as their cash cost landed at $98.95 per ton versus its more common level one year prior that was only $59.37 per ton, as per their previously linked Q2 2022 10-Q. This represents an increase of two-thirds and was primarily driven by unexpected geological issues with a mine, as per the commentary from management included below.

“…the largest component of our cost increase for the segment stemmed from our tougher than anticipated cutting conditions we encountered Leer South.”

“…we fully expect those conditions to improve significantly in late August, which should lead to an improving cost performance in our metallurgical segment as the year proceed.”

-Arch Resources Q2 2022 Conference Call (previously linked).

The additional costs were independent of these booming operating conditions, which means that if not for a turbocharged market, they would have had a randomly terrible quarter and thus possibly even declared no dividends. Even though these additional costs are expected to ease, this situation nevertheless still highlights another unattractive attribute of their industry, which further hinders the appeal of their dividends. A final point to remember before moving onwards, their shares will almost certainly always seem cheap relative to the prevailing operating conditions, as they are a coal miner with volatile financial performance.

No matter how much money a coal company makes, realistically, they are never going to trade anywhere near the premiums often seen by high-growth technology companies or steady consumer staples companies. This means that as operating conditions weaken, their share price should follow suit, despite the value and thus safety that their massive dividend yield would otherwise normally indicate. I expect this has already started with their share price down nearly one-third since late May when conducting the previous analysis, although it still sits 80%+ higher versus twelve months ago and thus in my eyes, the outlook is far more skewed to the downside as central banks tighten monetary policy.

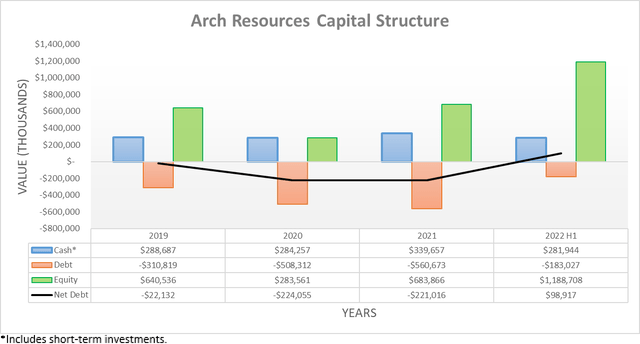

Despite paying their record dividend during the second quarter of 2022 and seeing a large working capital build, their net cash position still grew even larger to $98.9m versus its previous level of $3.8m after the first quarter. Once again, this leaves them with no leverage and thus assessing their historical leverage in detail would be pointless.

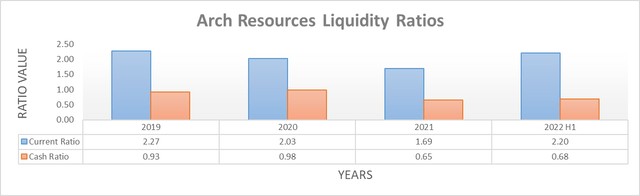

Since their cash balance remains relatively large at $281.9m, it would be redundant to reassess their liquidity in detail, as little changed during the second quarter of 2022 with it easily remaining strong with their respective current and cash ratios at 2.20 and 0.68, versus their previous respective results of 1.78 and 0.63 at the end of the first quarter. The relevant graph has still been included below to provide context for any new readers, if interested in further details regarding this topic, please refer to my previously linked article.

Conclusion

Even though they have zero leverage, they still offer a dividend of last resort, largely stemming from their thermal coal being similarly a fuel of last resort in a world moving towards clean energy. Whilst it enjoyed resurgent demand on the back of this global energy shortage, when markets rebalance, it will find itself the first to be discarded. Due to the outlook for economic conditions deteriorating since the previous analysis with higher risks of a recession coming, I now believe that downgrading my rating from hold to sell is appropriate with their metallurgical coal earnings that were the biggest contributor to their recent results looking vulnerable. Despite a massive 20%+ dividend yield normally offering sufficient value to compensate, given the undesirable nature of their industry, I expect their shares to remain relatively cheap for the prevailing operating conditions and thus slide lower in tandem.

Notes: Unless specified otherwise, all figures in this article were taken from Arch Resources’ SEC filings, all calculated figures were performed by the author.

Be the first to comment