StefanoZaccaria/iStock Editorial via Getty Images

Introduction

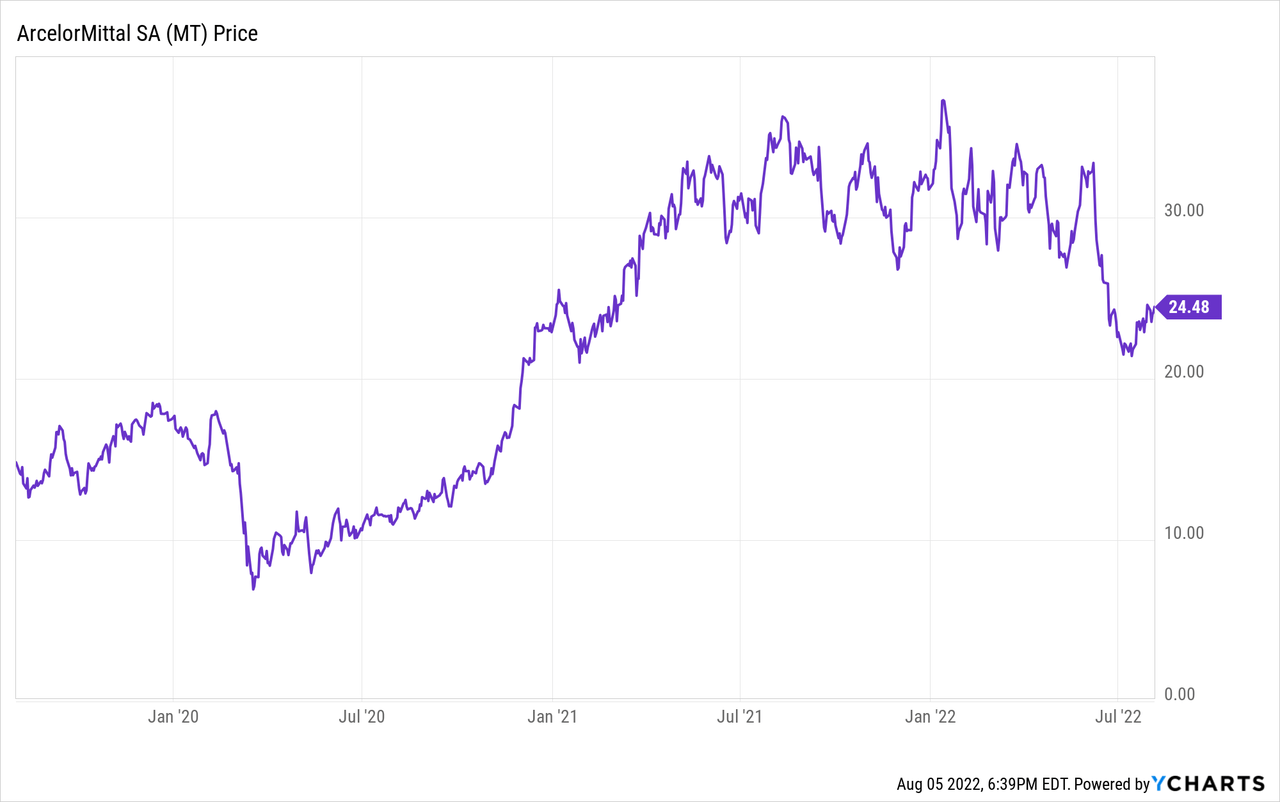

As one of the largest steel producing companies in the world, ArcelorMittal (NYSE:MT) could be seen as an important gauge for the world economy as the company is uniquely positioned across almost all continents. As the steel prices were extraordinarily high in the first half of the year, Arcelor was basically printing cash. This helped to whip the balance sheet into shape and get ready for a down-cycle in the steel sector. Subsequent to the end of the second quarter, Arcelor announced a $2.2B acquisition and a $1.4B share repurchase program and those are two robust commitments given the uncertainty when it comes to the world economy. The share price is down since my previous article on Arcelor was published, but as I explained in my Ternium article, that’s hardly a surprise as the financial markets are getting a bit more cautious.

Arcelor’s first semester was excellent, but expect a pullback in H2 2022

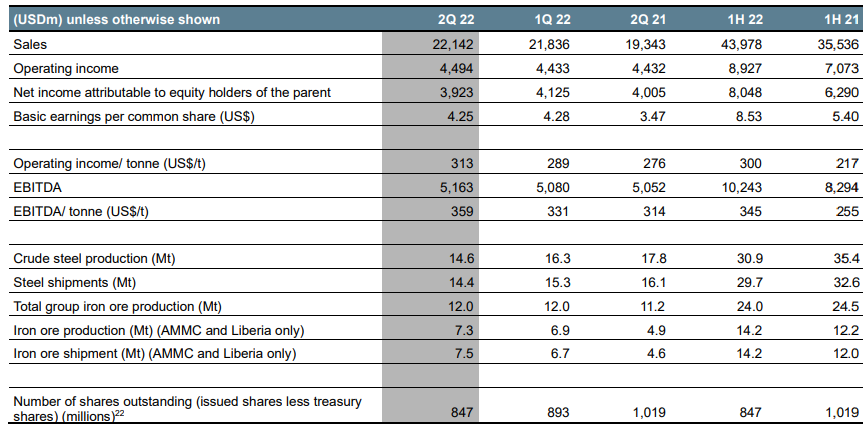

Although Arcelor shipped less steel in the second quarter (14.4 million tonnes), the stronger pricing and margins allowed it to increase the EBITDA to approximately $5.2B. This marks the fifth consecutive quarter the EBITDA exceeds $5B, and this brought the H1 EBITDA to $10.2B. That’s an increase of almost a quarter compared to the H1 2021 EBITDA.

ArcelorMittal Investor Relations

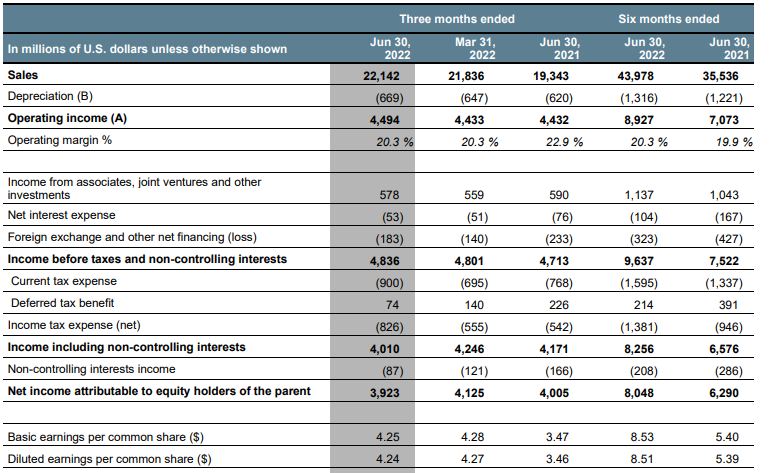

In the first half of the year, total revenue came in at approximately $44B, resulting in an operating income of $8.9B. As you can see below, the associates and joint ventures also performed well, contributing an additional $1.14B to the pre-tax income while the rapid decrease of the net debt and gross debt sharply reduced the interest expenses. While the attributable net income of $8.05B represented an EPS of $8.53, I would like to make two remarks.

ArcelorMittal Investor Relations

First of all, the EPS was based on an average share count of 944M shares. The current share count is 847M shares which would have resulted in an EPS of $9.50. Secondly, the net income includes a $323M FX loss, so on a normalized basis, the net income would likely have been a bit higher as well.

This doesn’t really matter much in the greater scheme of things as the future is more important than the past performance but it just shows what a great money making machine ArcelorMittal was.

Of course the net income represents just an accounting profit and I wanted to make sure Arcelor also is generating a strong enough operating and free cash flow to fund its $3.6B M&A and share repurchase program expected in the next few months and quarters.

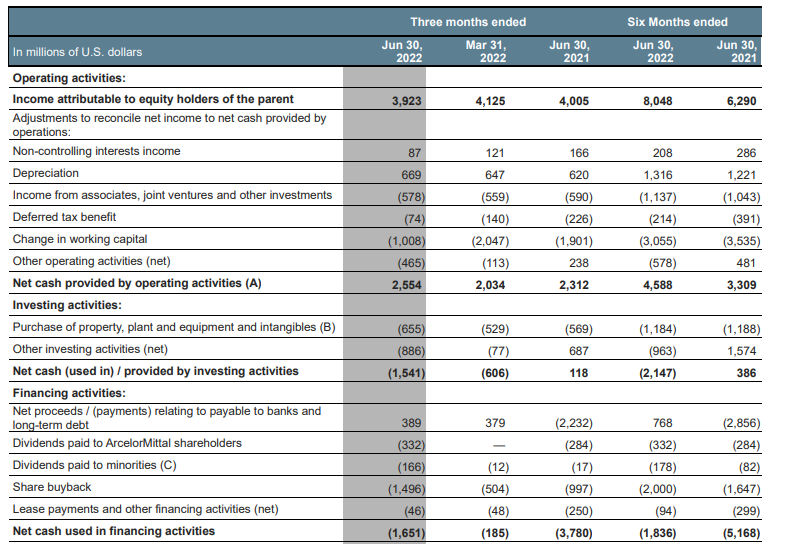

Looking at the cash flow statement, I see a reported operating cash flow of $4.6B and after adding back the $3.06B in working capital changes and the $270M paid to minorities and lease payments, the adjusted operating cash flow was approximately $7.4B. This excludes the impact of “other” operating cash outflow and excludes the $1.1B in income from associates.

ArcelorMittal Investor Relations

The total capex was just $1.2B resulting in a $6.2B free cash flow. Including the “other investment activities,” Arcelor was able to add about $5.2B to its bank account.

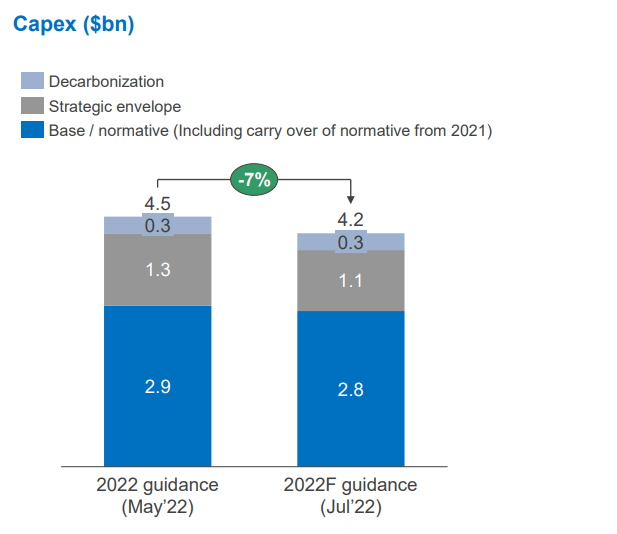

As Arcelor confirmed its full-year capex spend of $4.2B (a decrease of $0.3B compared to a previous guidance), the second semester will see about $3B in capital expenditures. This, in combination with a lower operating cash flow, means we likely should not expect an additional reduction in net debt beyond potential working capital changes. And that’s OK as the net debt had dropped to just over $4.2B which is just about 0.2 times the EBITDA on a LTM basis.

ArcelorMittal Investor Relations

Arcelor will spend almost $4B on M&A and buying back stock

On the day it announced its financial results, ArcelorMittal also confirmed it entered into an agreement to acquire CSP, a Brazil-based slab producer. CSP has a production capacity of 3 million tonnes which would increase Arcelor’s exposure in the Brazilian and Argentina region by in excess of 20% to 16.3 million tonnes. Even more important than just adding production, Arcelor expects the future production of CSP to be “green” as the state of Ceara where the plant is located is investing in green energy. This would reduce the carbon footprint per tonne of steel and help Arcelor’s ESG profile.

ArcelorMittal Investor Relations

As the plant is relatively new (construction was completed in 2016) and next to a deepwater port, the acquisition makes sense from Arcelor’s point of view, especially when you see the plant has plenty of growth capacity as the steel shop for instance already is prepared to handle double the current steel production.

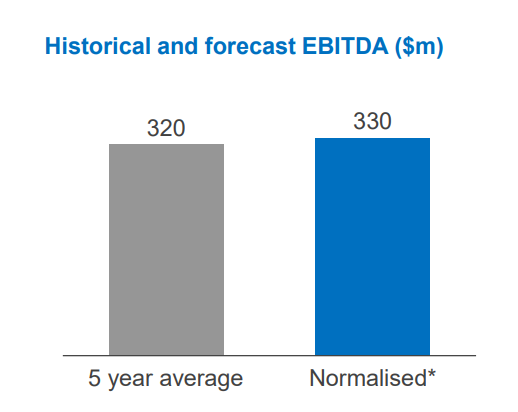

The average EBITDA of the plant was approximately $320-330M and Arcelor expects to generate $50M per year in synergy benefits. This means it’s purchasing the plant at about 7 times EBITDA and about 6-6.25 times the EBITDA including synergy benefits.

ArcelorMittal Investor Relations

The company also announced a $1.4B share buyback program and this shouldn’t come as a surprise as Arcelor has been aggressively buying back its shares in the past twelve months. And when looking at the metrics, MT really couldn’t make a better investment than in itself. The total share count decreased by approximately 15% in just one year, and the book value per share has increased to in excess of $60.

As of the end of June, the total equity attributable to the shareholders of ArcelorMittal stood at $54B. Divided over 847M shares outstanding, the book value per share was $63.75. And even if you would deduct the $4.3B in goodwill and intangible assets, the adjusted book value of $49.7B represents a tangible book value per share of just under $59. And just to make a fair comparison, just three years ago, at the end of June 2019, the tangible book value per share was just $36.5. And in the past three years, the tangible equity increased by “just” 36% while the tangible book value on a per-share basis increased by 61%.

Assuming an average repurchase price of $25/share, the company can repurchase an additional 56M shares, thereby reducing the share count to less than 800M shares. This should boost the tangible book value per share to in excess of $60 in no time.

Investment thesis

While ArcelorMittal has been performing at a high level in the past few quarters, we should expect a slowdown over the next few quarters as steel prices are decreasing while energy costs are increasing. So although the H1 EBITDA of in excess of $10B is excellent, we just cannot annualize that.

For 2023, I’m using an EBITDA of less than $9B. This should still allow the company to generate about $4-4.5B in profits for an EPS of $5/share. So although it’s very counter-intuitive to buy a steel company after what may have been a peak quarter, I have a long-term vision and I’m prepared to continuously buy small tranches if the share price continues to move south. Meanwhile, Arcelor will continue to buy back stock which will further reduce the per-share impact of a slowing economy.

I currently have no position in ArcelorMittal but may be interested in writing (out of the money) put options as the recent volatility makes the premiums quite appealing.

Be the first to comment