sdlgzps/E+ via Getty Images

Instead Of An Investment Thesis

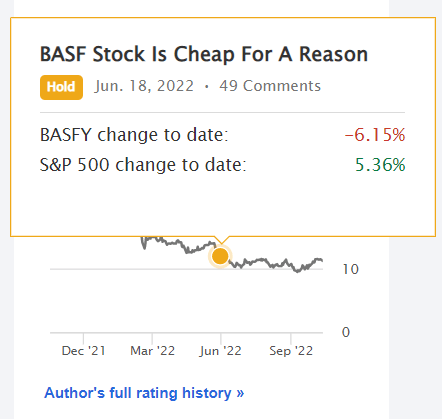

I have already written an article about how BASF SE (OTCQX:BASFY), Germany’s largest chemical company, is suffering from geopolitics and how it is likely to continue to suffer in the foreseeable future – the problems that have arisen are ongoing. A little over a month has passed since then, and against the backdrop of a growing market, my predictions seem to be coming true:

Seeking Alpha, my article on BASF

Not long ago, my eyes fell on another company from a different industry, suffering for similar reasons – I am talking about ArcelorMittal S.A. (NYSE:MT), the biggest steelmaker in Europe.

My thesis is quite simple and is as follows: If we acknowledge the inevitability of a recession in Europe (and such a probability is now the highest possible), then ArcelorMittal’s undervaluation may speak not to a profitable buying opportunity, but to a value trap. The possible tailwind that could come from China’s return from lockdowns seems unlikely due to the higher supply (restructuring of Russian supplies) in this market.

My Reasoning

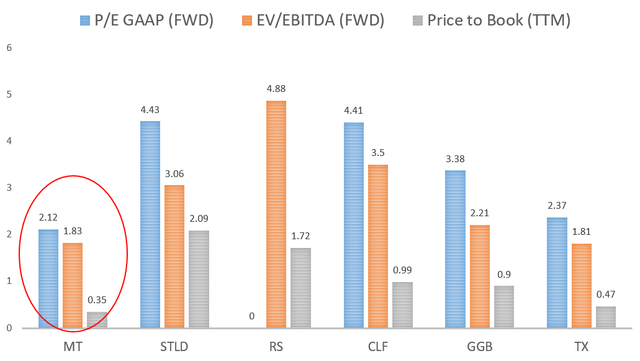

As in the case of BASF, ArcelorMittal’s stock appears quite undervalued based on key valuation multiples when we compare the company to its U.S. peers (and not only) with roughly the same market capitalization:

Author’s calculations, based on SA data

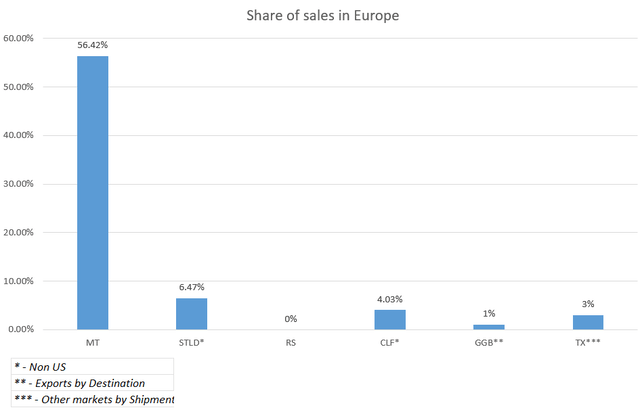

However, such a high valuation discount can easily be explained by the geographic location of the operations and sales destinations:

Author’s calculations, based on companies’ fillings, FY2021

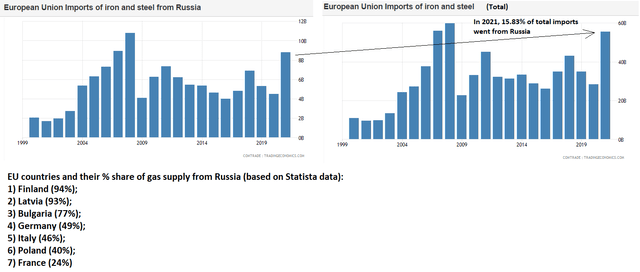

In the ranking of the largest steel producers (by volume), MT ranks 2nd in the world and is the only European company in the top 20. According to Euroref, in 2021 the European steel market was 79.1% dependent on domestic supplies and only 20.9% on imports. Europe’s self-sufficiency in steel was provided by ArcelorMittal and some smaller companies. They were able to operate effectively thanks to the availability of cheap iron ore and gas from Russia – the comparison of statistical data shows this.

Author’s calculations, based on TradingView and Statista

Russia’s aggression against Ukraine at the end of February 2022 has provoked a strong reaction among Europeans and the entire civilized world. The decision to cut off supplies of iron ore and metals from Russia and to create a smooth transition from gas dependence was ethically and strategically correct, but tactically, in my opinion, completely fatal. Today we see that the German economy, which accounts for nearly 30% of the European Union’s GDP (excluding the UK), is in a pre-recessionary state due to extremely high energy prices.

A couple of weeks ago, Piper Sandler published a report titled “Germany’s Recession: When, Not If,” which is hard to disagree with. As the largest country in Europe, analysts believe Germany will inevitably slip into recession in the coming quarters – the key question now is when and how badly it will hurt. Widening spreads on loans and government bonds suggest increasing trouble ahead.

So, against the backdrop of the deteriorating economic situation in Europe’s largest countries, the steel demand side is likely to come under enormous pressure going forward – that’s the 1st red flag for anyone who was planning to buy the dip in ArcelorMittal’s stock today.

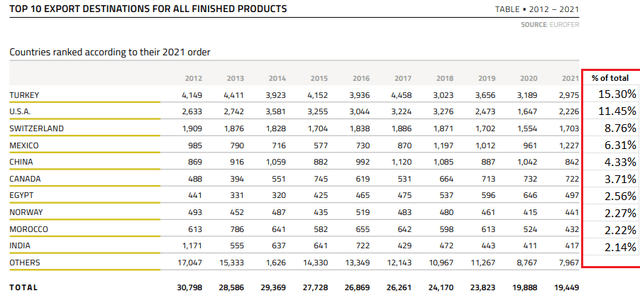

In addition, it is necessary to consider the export side, which can also suffer greatly. The EU has exported most of its flat & long finished steel products to Turkey, the US, Switzerland, Mexico, and China, and given the restructuring of Russian steel supplies to “friendly countries“, the volume of European exports will be more expensive than Russian ones due to higher energy prices.

Author’s calculations, based on Eurofer

In my recent article on Antofagasta (OTC:ANFGF), I already gave an example of how the development of Russian copper deposits in Udokan affects Chilean companies. And now, in analyzing ArcelorMittal, I noticed something similar.

One of the world’s largest iron ore producers from Russia with more than 40 million tons in annual output, was sending the bulk of its exports to Europe last year. After the Russian military operation in Ukraine, the company started to move supplies to China, as it became unsafe from the point of view of operational risk to continue supplying to Europe:

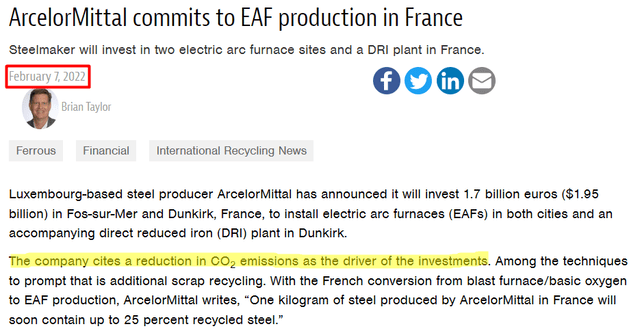

The Russian company also produces direct reduced iron (DRI), a premium product with 95% content of iron, which can be used in electric arc furnaces instead of steel scrap. Thanks to this feature, DRI has been a popular product in Europe, which has a large share of steel production with the use of electric arc furnaces, which are considered more environmentally friendly than blast furnaces that use coking coal. For this reason, before the outbreak of war, ArcelorMittal had committed $1.95 billion in investments to build electric arc furnaces (EAFs) and an associated direct reduced iron plant at Dunkirk.

Recycling Today with author’s notes

Russian DRI shipments are now likely to shift to China, which is moving toward “greener” steelmaking. So Europe risks losing a significant portion of quality imports while exporting fewer finished products to developing countries (as it used to) – the 2nd red flag for ArcelorMittal’s dip buyers.

In almost every situation there are winners and losers. According to what I have described above, it can be assumed that only China will emerge as the winner – if the recession that is looming in that region will be milder than it seems to unfold.

While ESG has been an issue in the past when investing in Chinese steel producers, the situation is now changing. Xi Jinping has pledged to achieve zero net CO2 emissions by 2060, and the Chinese steel industry – one of the worst polluters – is about to become greener. Companies like Baosteel (a part of the largest steel producer in the world, Baowu Group) are building electric arc furnaces that use scrap or DRI instead of polluting coking coal with iron ore.

In the long run, additional DRI supplies from Russia will enable China to produce steel cheaper and better (from an environmental and operational perspective). Minimizing external supplies, especially from Australia, seems an obvious outcome – I have written repeatedly about the difficult relationship between China and Australia in my earlier articles on bulk shipping.

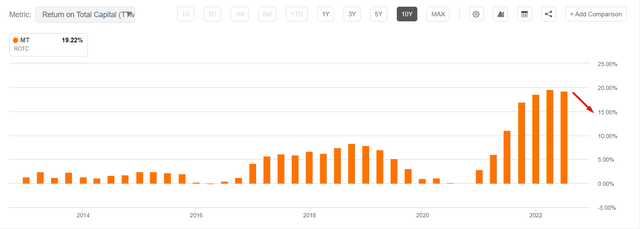

From this, I conclude that ArcelorMittal is likely to feel pressure on its margins and selling volumes, which will immediately interrupt its recovery cycle over several quarters.

Seeking Alpha charting, author’s note

Risks and Takeaway

There is a great risk in my conclusions. When I argue that Chinese companies will benefit from what is happening, I am assuming that their businesses will not be greatly affected by the real estate crisis that is unfolding in the country. Recent economic data suggest that such an assumption may prove to be wrong and China’s heavy industry will enter a severe recession shortly.

In addition, MT has very low valuation multiples compared to its U.S. peers, which may mean that most of the risks are already priced in.

In any case, the macroeconomic picture that has developed in Europe does not allow me to be optimistic about the prospects for ArcelorMittal. The war in Eastern Europe has hit the company hard, and the sanctions imposed, while ethically necessary, will probably lead to an economic recession soon. In my opinion, it is better to pay attention to Chinese steel producers when the opportunity arises to buy their liquid shares in Hong Kong – they also take into account the risks of global/local recession, but at the same time have more prospects for quality growth in the long term.

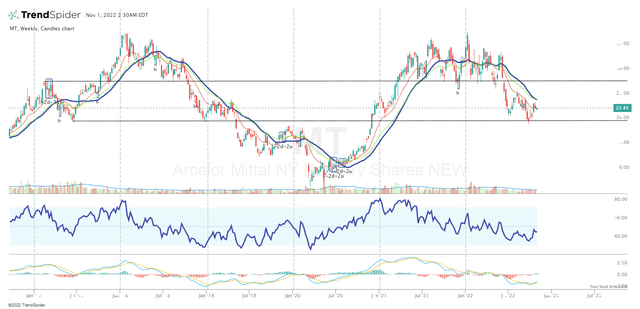

Given the severely oversold levels and the high probability of a relief rally (based on MACD, see below), I rate ArcelorMittal’s stock Neutral, as I do not see how the company can overcome the current situation without pain. In the medium term, I think the company could turn out to be a classic value trap.

TrendSpider, MT (weekly), author’s inputs & notes

Please share your opinion in the comments below.

Be the first to comment