Tom Werner/DigitalVision via Getty Images

Investment Overview

I gave Aravive (NASDAQ:ARAV) – a bullish recommendation when I last covered the Houston, Texas based biotech for Seeking Alpha back in April last year, based on the promise of its lead candidate AVB-500, involved in studies for ovarian, kidney, and pancreatic cancers.

Unfortunately, since my note Aravive’s market cap has fallen from >$160m, to just over $100m at the time of writing, as the share price has declined from >$8, to $1.7.

Back in 2021 I had hoped to see the share price challenge former highs of >$15, but Aravive has experienced funding issues, at the same time as being caught up in a devastating biotech bear market, which broadly explains the declines.

Aravive’s share count has grown from 17.4m, to nearly 60m, which has inevitably diluted investors, as the company has fought to secure the funding it needs to progress AVB-500 – now called Batiraxcept – through a pivotal study in platinum resistant ovarian cancer, expected to read out data in mid-2023, a Phase 2 study in 1st and 2nd line Clear Cell Renal Cancer (“CCRC”), and a Phase 1 in 1st line Pancreatic Adenocarcinoma.

Aravive stock sank as low as $0.6 in August this year and was in danger of being delisted from the Nasdaq (which it joined in 2018 via a merger with practically defunct biotech Versatis), but according to its Q322 10Q submission it was able to raise $10m from Eshelman Ventures in January 2022 at $2.2 per share plus warrants, another $9.3m in March at $2 per share plus warrants from the same source, and $41.5m in October – via a private placement deal with biotech investors at $0.9 per share, announcing re-compliance with the Nasdaq in November.

Funding concerns aside, not much has changed in relation to Aravive’s core investment thesis. Batiraxcept has a unique mechanism of action (MoA) – described in detail in my previous note – targeting the GAS6/AXL signalling pathway.

GAS6/AXL promotes tumor progression and metastasis in a number of cancers, in several different ways, regulating downstream signalling, whilst upregulating pro-tumorigenic functions. Studies have shown that expression in ovarian, pancreatic, kidney and breast is >70%.

As explained in a recent Aravive corporate presentation, Batiraxcept is a “high affinity decoy” that mimics the AXL receptor and is able to bind to GAS6 with high affinity, inhibiting its signalling capabilities.

In a Phase 1b study of Batiraxcept and the chemotherapy Paclitaxel in platinum resistant ovarian cancer (“PROC”) patients, amongst patients who achieved minimal efficacious concentration (“MEC”) of Batiraxcept, the objective response rate (“ORR”) was 50% (5 of 10 patients), with 2 complete responses – an excellent result in an indication as difficult as PROC, and superior to Paclitaxel alone.

Now Aravive says it has the funds it needs to complete its Phase 3 study of Batiraxcept + Paclitaxel in PROC, and if results are positive, submit a biologics license application (“BLA”) to the FDA for approval of the drug before the end of next year.

In late November, the company was also able to announce that Batiraxcept had been awarded a Fast Track Designation for later stage kidney cancer patients by the FDA, enabling a potentially smoother path to approval in that indication.

The approval was granted on the basis of a study of the drug in combo with Exelixis’ Tyrosine Kinase Inhibitor (“TKI”) drug Cabozantinib which showed an ORR of 57% and Progression Free Survival of 11.4m in patients with metastatic ccRCC who have progressed following IO- and VEGF-TKI-based therapies.

As far as the updated investment thesis on Aravive goes we can say that Aravive’s strategy is a bold one since it is developing a drug with an MoA that is unique, and that is not without risk.

It may be harder for the company to attract funding with an outlying drug, and the burden of proving that this class of drug can work rests entirely on Aravive – it’s share price will not bump on news of other companies’ success using a similar product, as many biotech’s share price often do.

Later stage clinical trial failures are also commonplace in Batiraxcept’s hard-to-treat indications and some of Aravive’s data – notably when patients have not achieved MEC – have been underwhelming, suggesting that definitive Proof of Concept (“PoC”) still eludes the company.

Although CEO and Board Director Gail McIntyre has been with Aravive since 2016, when she joined as head of R&D, Chief Operating Officer Scott Dove has been in his role less than 9 months, as has Chief Financial Officer Rudy Howard and Chief Medical Officer Robert Geller.

With $73m of cash reported as of Q322, and a net loss across the year to date of $47m, Aravive is still in a financially perilous position and with there being no other clinical candidates in its pipeline, should Batiraxcept fail its Phase 3 in PROC study it is doubtful if the company would be able to continue to develop the drug in kidney or pancreatic cancers.

Despite all these risks, however, a trial win in PROC would surely send the market cap valuation and share price of Aravive soaring, and there is some reasonably good evidence to suggest that may happen.

At the time of my last note analysts were setting price targets of >$25 for Aravive stock, and estimating peak sales of $900m for Batiraxcept, and a 30% chance of trial success. The odds may be against Aravive, but the opportunity is at least very clear, as is the path to approval should the Phase 3 be successful.

Let’s take a look at all of the company’s upcoming milestones and evaluate chances of a positive result.

Aravive’s Upcoming Milestones

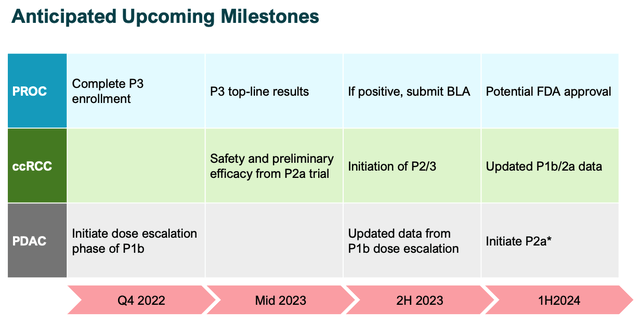

Aravive milestones (investor presentation)

The above slide from a recent Aravive investor presentation highlights its most impactful upcoming milestones. Clearly, the Phase 3 PROC is the major catalyst in play, but both the kidney and pancreatic opportunities are worth discussing.

The ccRCC Opportunity

In the case of ccRCC, it is three opportunities in one, with the Fast Track designation applying to the Phase 2 study alongside cabozantinib, but trials also underway for Batiraxcept as a 1st line therapy alongside Cabo and nivolumab – better known as Bristol Myers Squibb’s (BMY) >$7bn per annum immune checkpoint inhibitor (“ICI”) Opdivo – and potentially as a monotherapy for patients who are ineligible for curative intent therapy.

One benefit of the Phase 1b/2 cabo study – besides the positive results mentioned above – was the discovery that Pretreatment Serum sAXL/GAS6 could be a 100% negative biomarker for the use of Batiraxcept in patients. The study apparently showed that patients with low sAXL/GAS6 had little or no response to therapy, whilst those with high sAXL/GAS6 showed a progressive response (“PR”) of 55% (11 of 20 patients).

In some ways this is similar to the Phase 1b of Batiraxcept in PROC except in that case patients with higher exposure to the drug responded better – a 50% ORR and 7.5 month progression free survival (“PFS”) in those achieving MEC, versus 22% ORR and 2.8 months PFS in those that did not.

This could be considered a potential red flag, but equally, it seems to indicate that Batiraxcept can make a substantial difference to the survival chances of patients that respond to treatment, which seems to be >50% of patients.

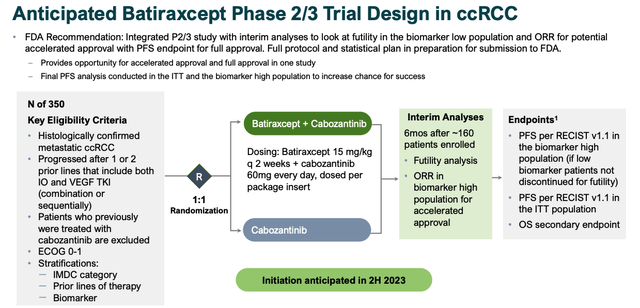

Anticipated P2/3 study design for ccRCC (investor presentation)

As per the above slide, Aravive is already planning for a 350-patient study Phase 2/3 study while enrolling for the monotherapy and cabo / opdivo elements of its Phase 2 (20 patients and 10 patients respectively), expected to initiate in 2H23.

The issue of funding immediately springs to mind, given this is the same study population as the Phase 3 in PROC, again emphasising how important that study is to Aravive’s prospects of raising further finances to pay for clinical trials.

Pancreatic Adenocarcinoma

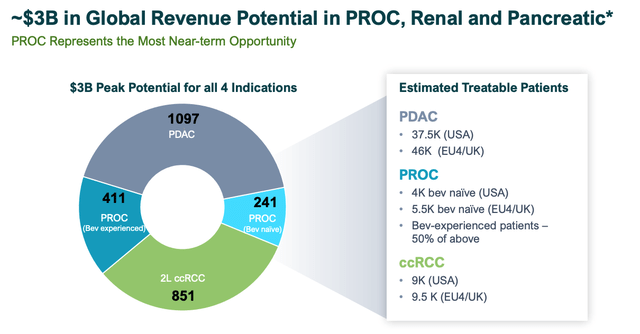

This is another potential first line therapy opportunity and Aravive’s largest potential market opportunity based on management’s research, as shown below.

Aravive estimated market opportunities (investor presentation)

Enrollment in the Phase 1b study completed in Q222, with 15mg/kg of Batiraxcept nab-paclitaxel and gemcitabine administered alongside 125mg/m2 of chemotherapy drugs nab-paclitaxel and 1000 mg/m2 of gemcitabine.

A dose escalation is expected to begin before the end of this year, with the Batiraxcept dose potentially upped to 20 or 25mg/kg – a potentially important difference, given how important it seems to be for the drug’s efficacy for patients to reach MEC.

The 15mg/kg safety data appears to be promising, with only 6 grade 3 adverse events (“AEs”) out of 21 patients, and 2 AEs leading to treatment discontinuation, although patients may be put under greater stress by a higher dose.

The efficacy data, although limited, appears promising also, with a confirmed partial response of 29% – superior to a Phase 3 study of gemcitabine + nab-paclitaxel only, according to Aravive, in which the confirmed response rate was 23%.

Once again, patients achieving MEC – ~50% of the study population – benefitted most from treatment, implying a higher dose, provided if does not impact safety, could yield better results.

The PROC Phase 3

To finish with the study that is pivotal for the company in more ways than one.

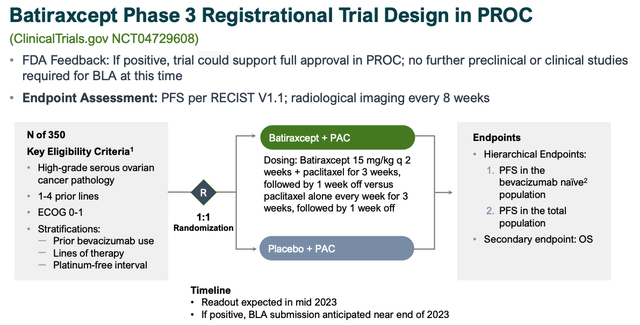

Batiraxcept Phase 3 PROC design (investor presentation)

As we can see above the key endpoint is Progression Free Survival, with a secondary endpoint of Overall Survival.

To give some idea of a what a benchmark for approval might look like, according to an article reproduced online by the Society for Endocrinology:

Platinum-sensitive ovarian cancer has a median survival of 2 years, with a range of 3 months to over 10 years. Platinum-resistant ovarian cancer has a median survival of 9–12 months and less than 15% respond to subsequent chemotherapy

Additionally, according to Translational Cancer Research, a Phase 3 AURELIA study of Bevacizumab versus standard chemotherapy:

revealed a significant increase of 3.3 months in PFS when BEV was added to all subgroups of chemotherapeutics.

According to a summary of Aravive’s Phase 1b study in PROC:

Subgroup analyses showed AVB-500 + PAC patients who had no prior bevacizumab or whose AVB-500 trough levels were >13.8 mg/L exhibited the best clinical response. The ORR and median PFS and OS in patients with these characteristics were ≥50%, ≥7.5 months, and ≥19 months, respectively.

I am speculating, but if the pivotal study could show an increase of >5 months PFS for Batiraxcept / Paclitaxel against placebo + Paclitaxel, then perhaps Aravive may have genuine hope of securing an unlikely approval in early 2024.

To obtain that level of vindication for its drug candidate would doubtless have a transformative impact on Aravive’s valuation and share price. Batiraxcept’s target markets are underserved and although it is fundamentally a complementary therapy, revenues in the triple-digit millions do not seem unlikely, based on prior estimates and sales expectations for similar therapies (see my prior note for more detail), making a mockery of Aravive’s current valuation.

Conclusion – An Undoubtedly Risky, But Nonetheless Intriguing Opportunity

The biotech bear market in 2022 has been especially crushing for smaller biotechs with limited data as investors have relentlessly pulled money out of such companies in search of safer havens.

Some companies fully deserved the share price corrections they have experienced, but Aravive at least is pursuing a unique opportunity for which it has some arguably compelling evidence of efficacy, and an apparently good safety profile.

Financing seems to have been at the heart of most of Aravive’s problems but a new management team has managed to raise the funding required to give the company a great shot at a Phase 3 study win, and a subsequent BLA submission.

By no means does that make Aravive a “slam dunk” investment. The issues with patients not achieving MEC, or not having a sufficiently high dose of Batiraxcept hints at underlying issues that could tip the scales towards failure in a larger study. And if the pivotal trial in PROC fails, can the company afford to complete its studies in ccRCC and Pancreatic cancer?

Personally, I have certainly seen worse data than that presented by Aravive in such hard to treat diseases, and I think Aravive’s progress is worth following. It is not often an entirely new approach to targeting solid tumor cancers presents itself, and it should finally be noted that Aravive has been earning some collaboration revenues – $4.9m in Q322 – as a result of a partnership with 3D Medicines, to develop and commercialise its lead drug in China.

Investors holding Aravive stock have been heavily diluted and suffered significant losses in 2022, and things could get worse in 2023 if PROC data is negative. On the other hand, there is still evidence to suggest that their patience may finally be rewarded.

As for Aravive as an investment opportunity today, with stock priced at $1.8, creeping up 95% across the past 3 months, with a Fast Track designation and pivotal data potentially less than 6 months away, the risk reward – by impoverished biotech standards – looks better than average in my view at least.

Be the first to comment