stevecoleimages/E+ via Getty Images

Introduction

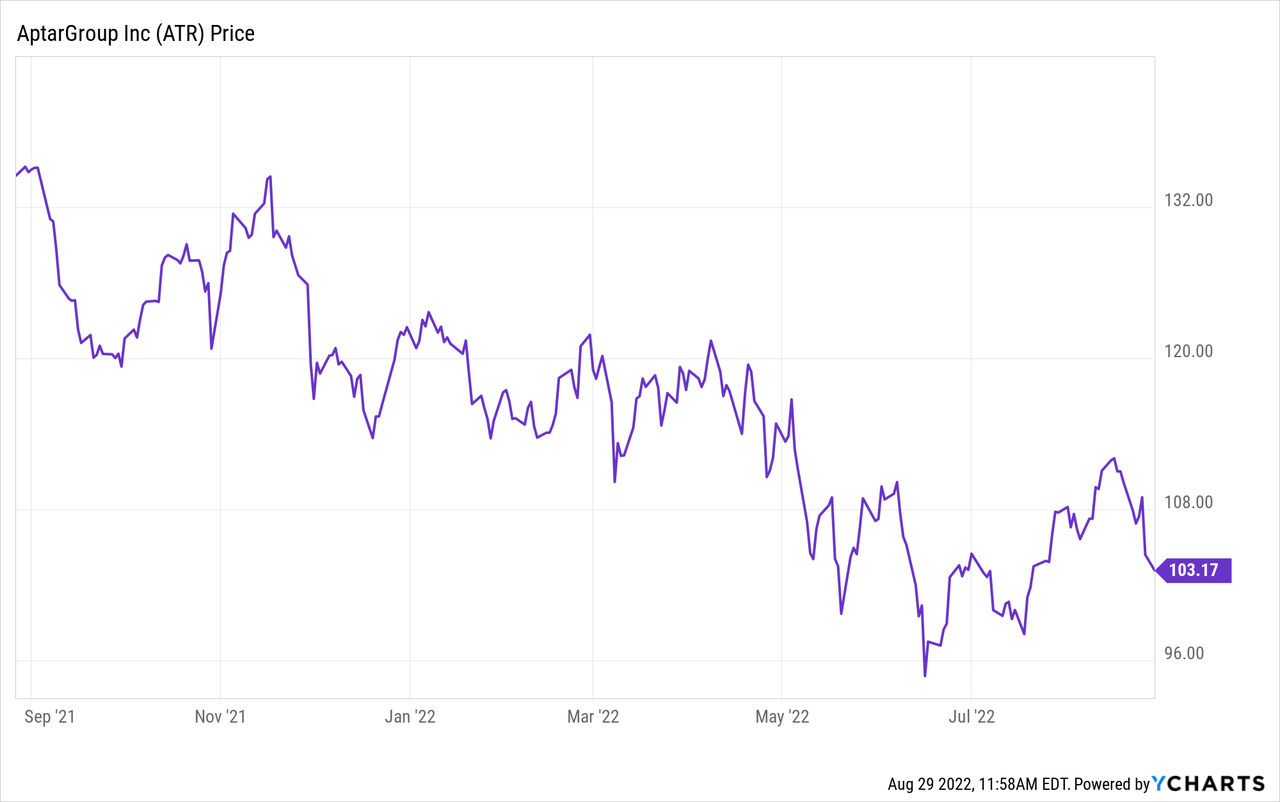

It’s been more than 16 months since I thought the AptarGroup (NYSE:ATR) was too expensive when the stock was trading close to $150/share. My timing was right, and just four months later, in October 2021, the share price had already dropped to just over $122 which I thought was more reasonable. Fast forward to August 2022 and we see the share price is currently trading at just over $100. Down more than 30% in the past 16 months. So this seems to be a good moment to have another look at the stock.

The H1 results: Satisfying but not impressive

For an overview of what this packaging company does I’d like to refer you to my older articles as I will solely focus on the current performance of the company to determine if I should consider establishing a long position.

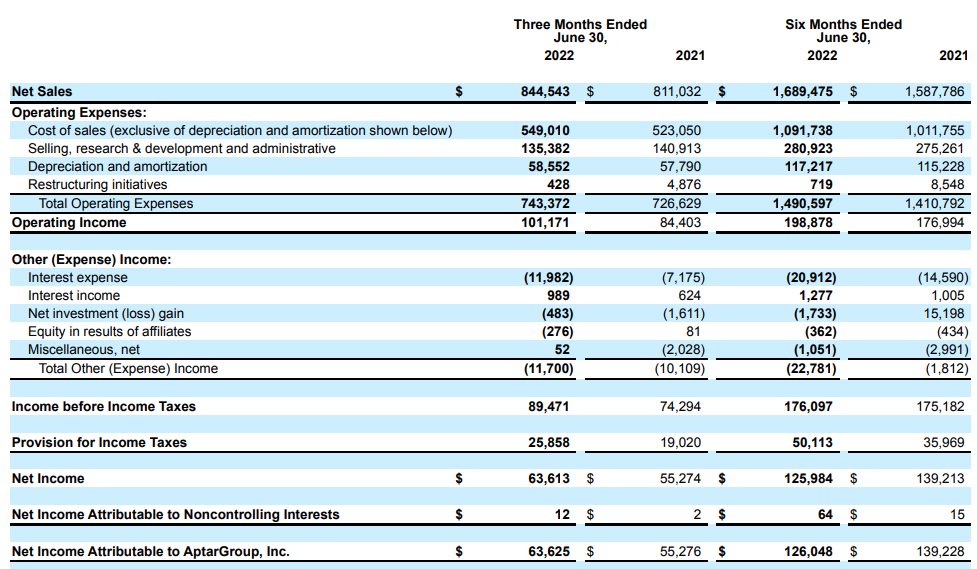

The AptaGroup seems to be heading in the right direction as the company was able to increase its revenue while expanding its margin and that’s a rare sight in the current inflationary environment. In the second quarter of the year, Aptar reported a revenue increase from $811M to almost $845M, and while that’s just 4% higher compared to Q2 last year, the total operating expenses increased by just 2%. As you can see below the 5% increase in the COGS was countered by lower SG&A and R&D expenses while the lack of restructuring expenses also helped.

AptarGroup Investor Relations

The result is a 20% increase in the operating income which also means the operating margin jumped from 10.4% to almost 12% and that’s a pretty impressive achievement.

The interest expenses remain elevated as the gross debt remains high (Aptar completed two acquisitions in 2021) and the gross debt currently stands at $1.35B. This means the average cost of debt is just over 3% which obviously still is very reasonable, but interest rates will increase going forward so I would like to see Aptar doing an effort to reduce its gross debt.

In any case, with a pre-tax income of almost $90M and a net income of almost $64M, the company is performing better than I had expected. The EPS came in at $0.97 for the second quarter while the H1 earnings per share were a very respectable $1.92. That’s lower than the $2.12 EPS generated in the first half of 2021 but keep in mind that result was fueled by a$15.2M investment gain whereas the company recorded a $1.7M investment loss in the first semester of this year.

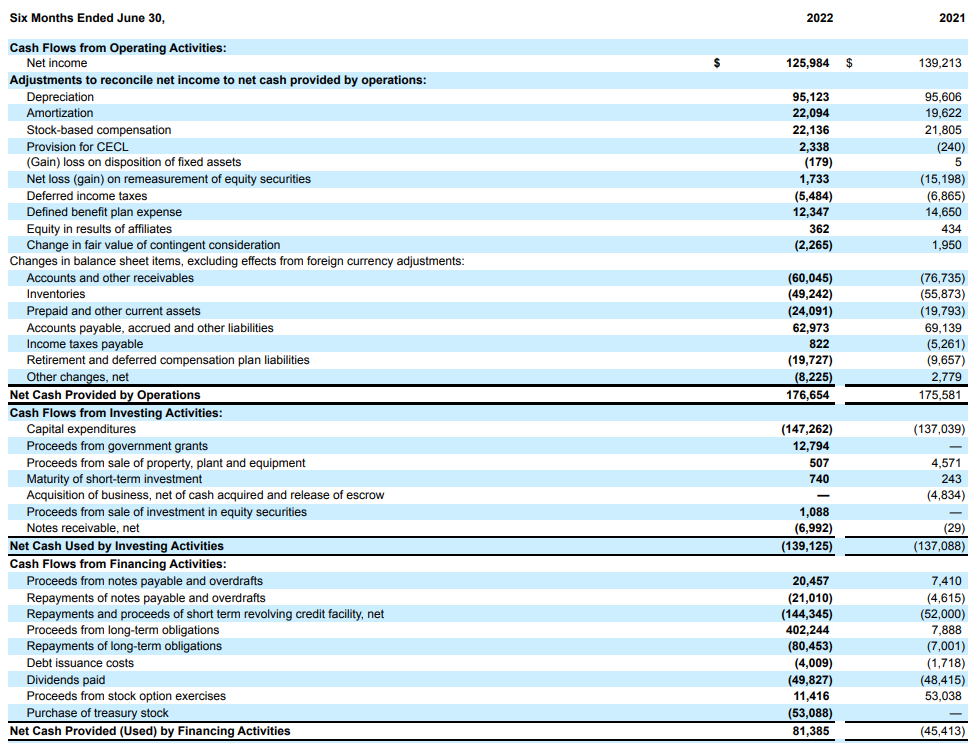

My previous articles and analyses on Aptar were focusing on the free cash flow result, and that obviously still is a very important part of my thesis here. The reported operating cash flow came in just under $177M, but as you can see below, there was a net working capital investment of approximately $70M (excluding the retirement benefits payments). This also excludes the $5.5M payment of deferred income taxes to the adjusted operating cash flow before changes in the working capital but including the almost $20M payment for pension liabilities was approximately $253M.

AptarGroup Investor Relations

The total capital expenditures were just over $147M resulting in a free cash flow result of $106M. Keep in mind Aptar is still investing in its expansion plans. As you can see above, the H1 capex was more than 50% higher than the depreciation expenses. Even if you would add the amortization expenses back to the mix, the capital expenditures exceeded the D&A expenses by in excess of 25%.

Dissecting the capex bill

For this year, Aptar expects to spend about $290-320M on capital expenditures while the total D&A expenses will come in at just around $230-240M. According to the FY 2021 conference call wherein the management looked forward to 2022, it mentioned about $109M of the total 2022 capex bill would be spent on growth. This means the underlying sustaining capex is just around $190M which compares pretty favorable to the depreciation expenses.

This also means the sustaining free cash flow comes in higher than the reported net income due to the difference between the sustaining capex and the depreciation and amortization expenses. Additionally, the share-based payments also are weighing on the net income but have no impact on the cash flow result (although the case could be made that an expanded share count increases the need for Aptar to buy back shares but that’s more a capital allocation decision than anything else).

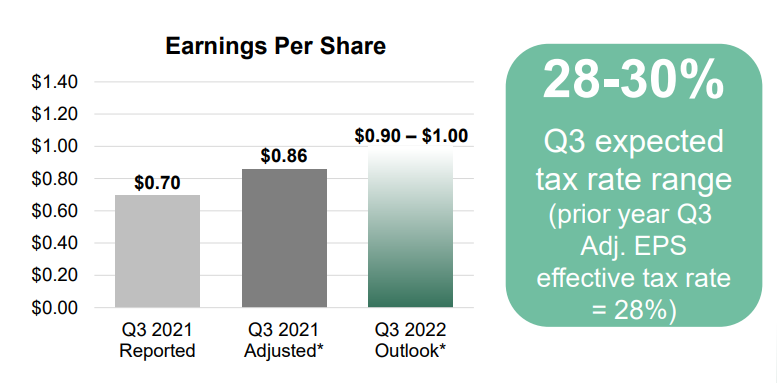

In the near term, Aptar appears to be pretty optimistic about the next few quarters as its pharma segment should continue its strong momentum. That doesn’t mean the company is immune to the turmoil in the world, but with an EPS guidance of $0.90-1.00 for the current quarter, it looks like Q3 will be business as usual.

AptarGroup Investor Relations

This now also allows us to calculate the sustaining free cash flow. If we assume the full-year EPS will come in at around $4/share and considering we know the sustaining capex is about $50M below the depreciation and amortization expenses, we can start to do some backward engineering to end up with a free cash flow per share of approximately $4.75-4.80 per share. This still includes the share-based payments which could add an additional 60 cents to the free cash flow equation.

Investment thesis

This still doesn’t make Aptar cheap but keep in mind the growth investments will start to pay off in the near future and the cash flows will increase.

Rather than buying the stock, I think the bonds could be more appealing here as the 2032 bonds are trading at 88 cents on the dollar while offering a 3.6% coupon. This means the yield to maturity is almost 5.2% which is pretty decent for a robust cash flow generator. So if I would do anything with Aptar I would likely be a bond buyer rather than a buyer of the common shares.

Be the first to comment