Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Applied Materials, Inc. (NASDAQ:AMAT) stock was also hit by the recent tech bear market. It’s down 18% from its January highs, as investors were concerned with the macroeconomic impact of the Russia-Ukraine conflict.

AMAT stock is not immune to the intensifying crisis, given its already tight supply chain. However, we think we had previously underestimated the secular drivers underpinning Applied Materials’ broad tech portfolio.

Consequently, it was able to notch a record quarter in its FQ1 card, with its topline up 21.5%. Therefore, we are assured that it doesn’t have a structural demand problem, which was the key factor for our previous Hold thesis.

Moreover, the company also telegraphed that it expects to be a key beneficiary of the increased localization/regionalization of the semiconductor supply chain. Therefore, we believe that investors can consider capitalizing on the current uncertainty to add exposure to a highly profitable semiconductor leader.

AMAT Stock Key Metrics

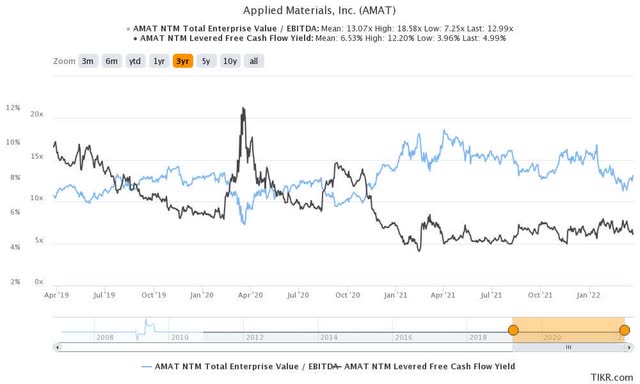

AMAT stock NTM EBITDA & NTM FCF yield % (TIKR)

AMAT stock consensus price targets Vs. stock performance (TIKR)

AMAT stock has been consolidating along its support level of $125 over the past year. Therefore, we have observed robust support by dip buyers when its price fell below its support, including during the recent bear market.

Moreover, we believe AMAT stock’s solid fundamentals and reasonable valuations would continue to support investors’ interest in its stock. For instance, AMAT stock is trading at an NTM EBITDA of 13x, in line with its 3Y mean of 13.1x. Nevertheless, its NTM FCF yield of 5% is markedly below its 3Y mean of 6.5%. However, it’s still well ahead of the EUV systems leader ASML Holding (ASML) stock’s 2.4%.

Furthermore, AMAT stock is also well-supported by its most conservative price targets ((PTs)). Notably, its most conservative PTs have supported its uptrend over the past three years. Therefore, we believe there are several confluences discussed above demonstrating the resilience and reasonable valuations of AMAT stock.

Where Is Applied Materials Heading in 2022?

AMAT stock’s price action over the past year has stubbornly resided within its tight consolidation range. We believe much of the market’s skittishness could be attributed to its supply chain challenges.

The word “supply” emerged no less than 40 times in its FQ1 earnings call, as management discussed the impact on its revenue growth. Nevertheless, Applied Materials was confident that these challenges are transitory, even though it takes time for them to moderate. Furthermore, we believe the market was concerned whether the Russia-Ukraine conflict could have exacerbated its topline growth further.

However, we have not observed any downward revisions to its guidance for FQ2. Notably, its guidance was provided before the start of the Russian invasion. However, the consensus estimates remain optimistic of the company’s ability to weather the supply chain disruptions. We observed that they are still broadly in line with Applied Materials’ guidance.

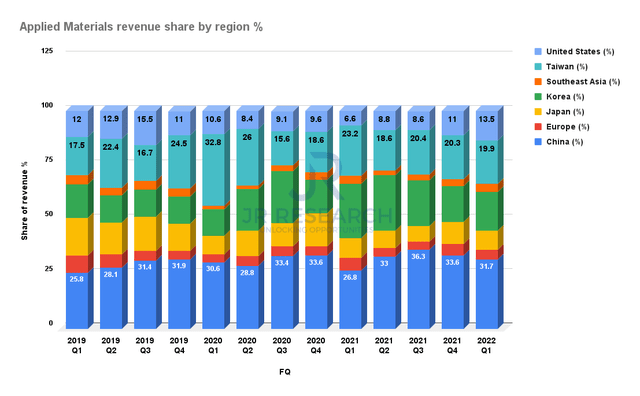

Applied Materials revenue share by region % (Company filings)

However, we believe that investors remain concerned with Applied Materials’ geographical exposure, given the recent geopolitical tensions with China/Taiwan.

Its customers in China and Taiwan accounted for 51.6% of its FQ1 revenue. Therefore, such exposure could continue to hamper investors’ confidence in allocating more exposure to the company. Investors need to understand that the current geopolitical climate and the “strategic ambiguity” over the China/Taiwan relations could take a turn for the worse. Applied Materials has also cautioned in its 10-Q filings (edited):

We sell a significant majority of our products into countries outside of the United States including China, Taiwan, Japan, and Korea. We also purchase a significant portion of equipment and supplies from suppliers outside of the United States. There is inherent risk, based on the complex relationships among the United States and the countries in which we conduct our business, that political, diplomatic and national security influences might lead to trade disputes, impacts and/or disruptions, in particular, with respect to those affecting the semiconductor industry. (Applied Materials 10-Q)

Nevertheless, we believe that the intent for the US and EU to localize/regionalize their semiconductor supply chains is immensely beneficial to help diversify Applied Materials’ revenue base. Furthermore, it should also lead to a more resilient revenue runway, given the critical role Applied Materials play in the value chain. CEO Gary Dickerson articulated (edited):

The strategic and economic importance of semiconductors is being recognized at a national level. In the coming years, government support and incentives in the US, Europe, and Japan will translate into regionalization of supply. As I’ve highlighted before, these regional supply chains will be more resilient but also less capital-efficient, which is an additional tailwind for us. Overall, our outlook for the next decade is very positive. We expect semiconductor and wafer fab equipment to grow significantly faster than the economy with outsized opportunities for Applied Materials. (Applied Materials’ FQ1’22 earnings call)

Is AMAT Stock A Buy, Sell, Or Hold?

We are confident that AMAT stock’s valuation represents a reasonable opportunity for investors to add exposure. It would require a significant impact on its top line and profitability for the stock to be hammered into “undervalued zones.”

Despite the supply chain challenges, we don’t expect Applied Materials to experience such an adverse impact. However, we encourage investors to continue monitoring the supply chain disruptions to assess any unexpected hit moving forward.

Furthermore, Applied Materials also renewed its stock repurchase authorization with a new $6B program recently. It enhanced its previous program with $3.2B remaining as of FQ1’22. Therefore, we believe that management saw attractive opportunities based on its current prices to defend it with its robust free cash flows.

As such, we revise our rating on AMAT stock from Hold to Buy.

Be the first to comment