Fahroni

Thesis

Applied Industrial Technologies, Inc. (NYSE:AIT) has had good top-line and bottom-line growth. Still, we expect potential balance sheet struggles, as their debt positions are too high going into a high-interest rate environment. This could lead to struggles with coverage ratio and reducing the cash balance as interest payments begin to rise. Expect the company to pay down the debt to manage these expenses, but risks remain.

Intro

AIT is an industrial distributor, precisely motion, power, control, and automation technology solutions across the world. Products include bearings, power transmission products, and fluid power components, among others. The company also operates shops and service field crews, including technical support services, via their service centers that act as its distribution network. The company is well diversified across industries, selling to sectors such as agriculture and chemicals to industrial machinery and life sciences. AIT is based in Cleveland, Ohio.

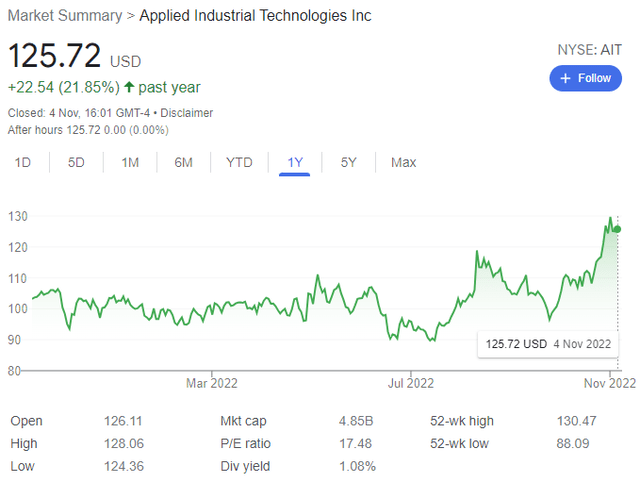

As expected from a value stock, the company’s share price has had success recently, outperforming the market significantly, being up over 21% in the past year, compared to a downturn in the overall stock market. The share price currently sits at around $125 dollars.

Top Line and Bottom Line Growth

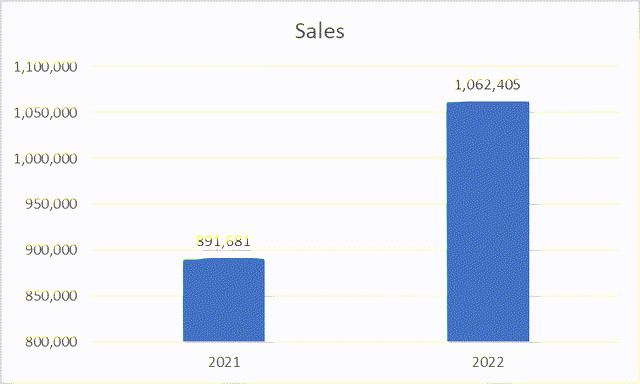

Consolidated sales for the last quarter (ending Sep-22) grew 19% compared to the prior year quarter, reaching $170m, driven by organic growth and outperforming the effects of the unfavorable FX translation (which was almost $5m in the quarter alone), given that the company’s sells product overseas. Sales growth was due to benefits from sales process initiatives, price increases, and overall secular growth (benefiting from recent inflation trends), as their main customers are across sectors such as food & beverage, energy, and metals/mining.

Sales, last 3 months ending September, in thousands.

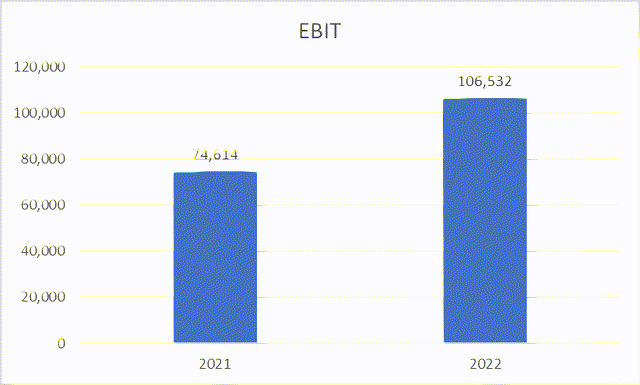

The bigger gain was seen in the bottom line, where EBIT grew 43% to $106m.

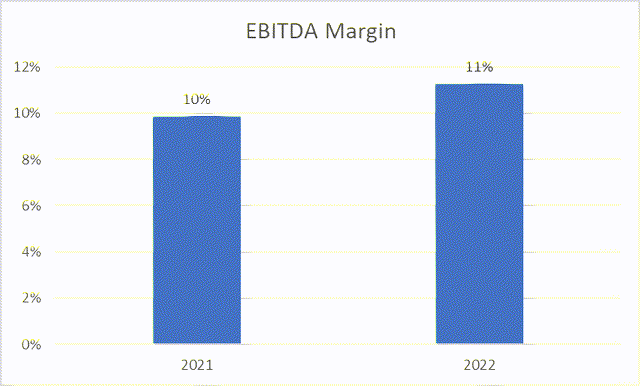

And EBITDA grew 36% to $120 million, resulting in an increase in the EBITDA margin from 10% to above 11%.

This increase was due to an improvement in SD&A costs, as SD&A as a % of sales decreased from 20.3% in 2021 to 18.8% in 2022

Balance Sheet Troubles

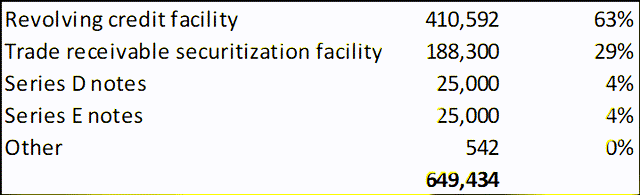

The company currently holds almost $650m in debt, primarily consisting of a revolver (around 63% of total debt) and a trade receivable facility, with a small portion going to Series D and E notes which account for less than 10% of the debt.

Data in thousands.

Normally this debt would not be an issue, but unfortunately, the figure puts AIT slightly into the danger zone. The issue is that while the company has successfully grown both the top and bottom line, the Debt to EBITDA ratio is a little high, at 5.4x. Taking into account the current cash position of around $150m, the Net Debt to EBITDA ratio is 4.2x, which is fairly high given that we are no longer in a low-interest rate environment, and cash interest payments are getting bigger. The last interest payment figure was $40m alone in the last quarter. This indicates that the interest coverage ratio is 3x. While this is currently not a red flag, it can turn into a messy situation very soon.

The issue is that the two primary debt facilities are linked to a variable interest rate, both interest rates are LIBOR plus several basis points. The revolver’s interest rate jumped significantly over only 3 months. It was at 2.81% in June 2022 but reached 4.04% in September 2022. While the trade receivable facility’s rate increased from 2.6% to 4.06%. These jumps are almost double, meaning the company’s interest payments almost doubled within a 3-month period, as they are linked to the base rate, which is currently increasing at a steep pace.

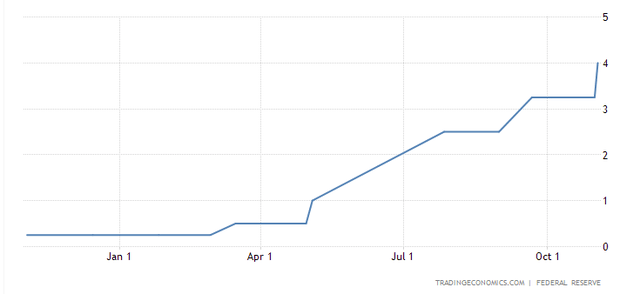

The Fed’s base rate recently jumped from almost 0 at the start of this year, reaching 4% this month. Bear in mind that the company’s interest rate on its debt jumped to 4% in September, when the base rate was at around 2.5%.

Global Rates

LIBOR – Overnight

The LIBOR also jumped substantially. The overnight LIBOR jumped from almost 0% at the start of this year, to 3% in October, and almost 4% today. The 12-month LIBOR rate is currently at around 5.5%.

This means that the company’s interest rate on their debt is no longer at 4% but is probably around 5.5% or higher, which means almost a 40% increase in interest payments alone, and the coverage ratio drops to nearly 2x. This is today.

If the 12-month LIBOR is around 5.5%, then the company’s interest rate on their debt could reach almost 7%, which would lead to drastic problems for their company as their coverage ratio drops to below 2 and their free cash flow position gets squeezed.

These scenarios all depend on what the forward-looking forecast is for the base rates. But given that inflation is currently at double digits with no end in sight, we could see interest rates continue increasing over the next couple of years, leading to further issues for the company unless the debt is paid down, EBITDA (and sales) is increased substantially, or the company somehow refinance to a lower rate (which I doubt the lenders would agree to).

Risks

- The main risk to this thesis would be the obvious solution of paying down debt before the interest payments get to a worrying level. As stated, the company is currently sitting on around $150m of cash, with a current ratio above 3x. EBITDA is at a good level, almost at $500m per year, so cash flow is good. This is the most likely scenario that the company will take.

- Another risk (albeit a very low risk) would be if there was a sudden reversal in the base rates. However, given that inflation is very hot right now, this is incredibly unlikely.

- A third risk would be a refinance of the debt, to a lower rate, but again this is unlikely.

- And fourth, a restructure, but again, an unlikely scenario.

Conclusion

Overall, AIT has been improving both its top and bottom line. It currently has a strong EBITDA margin of 11% and the share price has been outperforming the overall market. Their sales will benefit from the inflationary environment and are expected to continue to rise. However, the current issue is the debt level of the company.

The debt to EBITDA ratio is already high, and the coverage ratio, if taking the current interest rate into account, is too low. If this debt issue is not solved, then expect cash flow issues and a potential reversal of the share price.

However, given that Applied Industrial Technologies has strong free cash flow and a strong balance sheet, we could see a gradual debt paydown, leading to lower interest payments and an improving debt balance over the next 12 months.

Be the first to comment