South_agency

Apple Inc. (NASDAQ:AAPL) designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. In July 2022, we published an article on Seeking Alpha, titled: “3 Reasons Why We Think Apple Could Be Attractive At Current Valuations” and we rated Apple’s stock as “buy”.

The reasons for our buy rating were:

- Apple has performed historically well during times of low consumer confidence, due to its loyal customer base, its strong brand recognition, and its diversified product portfolio.

- Easing of COVID-19 restrictions in China may fuel demand growth in the future.

- Strong track record of paying safe and sustainable quarterly dividends, while the firm has also purchased back a substantial portion of its shares.

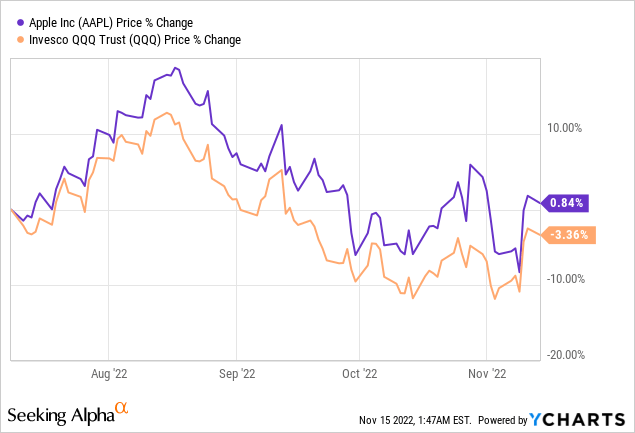

Since our last writing, Apple’s stock price has remained relatively flat, however, it slightly outperformed the QQQ.

Today, we have decided to revisit our analysis on Apple, as there have been significant developments recently related to the manufacturing capabilities of the firm, especially related to the operations in China. Also, our previous point related to the easing Covid restrictions in China may not be valid anymore. In this article, we are going to give an updated view, why we still believe that Apple’s stock could be a good buy today.

But, let us first start with the recent developments.

Recent developments

The recent developments that we are going to focus on here are the ones related to Apple’s production capabilities in China. Important to understand that production capacity in China is mainly influenced by political decisions related to containing Covid-19 outbreaks and not by technical limitations.

Last month, Chinese President Xi has reiterated his intention to keep the country’s zero Covid policy in place. This development has two potential impacts on Apple’s business:

1.) Demand for Apple’s products may not grow as fast as expected, due to potential lockdowns.

2.) Production of Apple devices may be hurt due to potential factory shutdowns.

In fact, the second point has already materialized to a certain extent. Earlier in November, the largest iPhone manufacturing plant has been subject to Covid-19 restrictions. Foxconn is responsible for the production of 70% of iPhones globally. It also assembles devices in India, but its Zhengzhou factory builds the largest part of its global output. In the Zhengzhou complex, 200,000 employees work and live, as it contains also a dormitory, which enables workers to live at their workplaces. The aim of this scheme is to limit outside contact and reduce the likelihood of Covid outbreaks. This measure however did not appeal to the workers, and thousands were trying to flee the facilities.

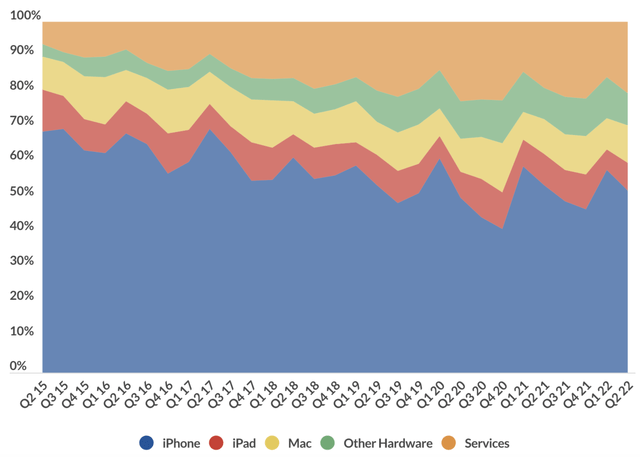

In our opinion, it is key that the production of iPhones remains uninterrupted as this product accounts for more than 50% of Apple’s total revenue.

Revenue by source (businessofapps.com)

While the portion of revenue has been gradually decreasing over time (which we believe is beneficial), it still makes up a very significant percentage. Any interruption to iPhone manufacturing or declining iPhone demand could have a material impact on the firm’s financial results.

Several analysts and Apple themselves have already acknowledged the negative impacts of the lockdowns in China. Earlier in November, Apple announced that their iPhone shipments will be lower than previously thought. They “now expect lower iPhone 14 Pro and iPhone 14 Pro Max shipments than we previously anticipated, and customers will experience longer wait times to receive their new products”.

J.P. Morgan has also lowered the forecast for iPhone shipments in the December quarter. This lowered forecast would result in a declining revenue year-over-over.

We believe that in the near future, as long as the Chinese Covid policies are in place, such news can have a material impact on Apple’s business and its share price. The share price has shown a significant reaction to all of the above-mentioned news.

So why are we still optimistic?

First of all, despite the tough economic environment, the demand for Apple products remains high, due to the exceptional customer loyalty. In our opinion, as long as the demand is there, Apple will be able to find a way to supply enough products. In fact, they are already working on moving away a substantial portion of the iPhone production from China to India, which has more reasonable Covid policies. We see this as an opportunity in the long term, as Apple is now forced to diversify its manufacturing, which may result in a much more robust business and supply chain in the future.

What is exactly being done by Apple and Foxconn?

Apple has partnered with a Taiwan-based firm, called Pegatron, to manufacture iPhones in India, in an effort to reduce the dependency on China. This factory will be focusing on making iPhone 14 and iPhone 12 models primarily.

On the other hand, Foxconn has also started a substantial expansion of its manufacturing capabilities in India. The firm announced that they are planning to raise the workforce by as much as four times in the coming two years. With this move, the number of workers would reach 70,000 in Tamil Nadu in India, which is still substantially less than the 200,000 employed in Zhengzhou.

Further, Foxconn has announced that they have been working on tweaking the production in order to meet the demand for the holiday season.

Moving away from China, however, is not a quick process. J.P. Morgan suggested Apple may be able to shift about 25% of its iPhone production to India by 2025 and anticipated 5% of its iPhone production this year to move to the country.

All in all, we believe that Apple and its suppliers are making significant efforts to keep satisfying the demand for iPhones and other Apple products around the world, despite the Covid related disruptions in China. Investors must keep in mind however that moving away from Chinese manufacturing may take years, and the road to reaching the final goal is likely to be bumpy.

The move away from China is however not the only factor that could improve Apple’s financial performance in the long term.

Increasing revenue from services

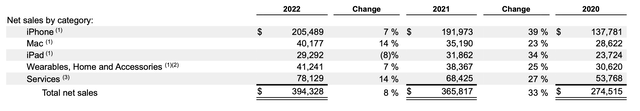

In Apple’s latest earnings results, we can see a double-digit growth of annual revenue in the “Services” category.

Net sales (million dollars) by category (Apple)

This increase has been primarily driven by the increasing revenue from advertising, cloud services, and the App Store. While the growth has slowed from 27% to 14%, we believe that it is mainly caused by the current macroeconomic environment, and it is likely to be temporary. Revenue from advertising and the App Store is likely to be directly impacted by the poor consumer sentiment observed in the United States and around the globe.

But why do we care so much about the growth of the services segment?

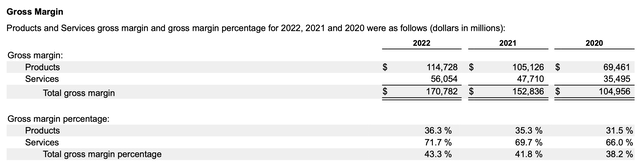

Because the “Services” segment has the highest gross margin.

While products have had gross margins between 31-37%, “Services” have had a significantly higher range of 66-72%, gradually increasing each year in the last 3 years. With increasing revenue from the “Services” category, we expect the total gross margin to expand, resulting in an increase in net income in the long run, which could potentially unlock substantial value for the investors.

Valuation

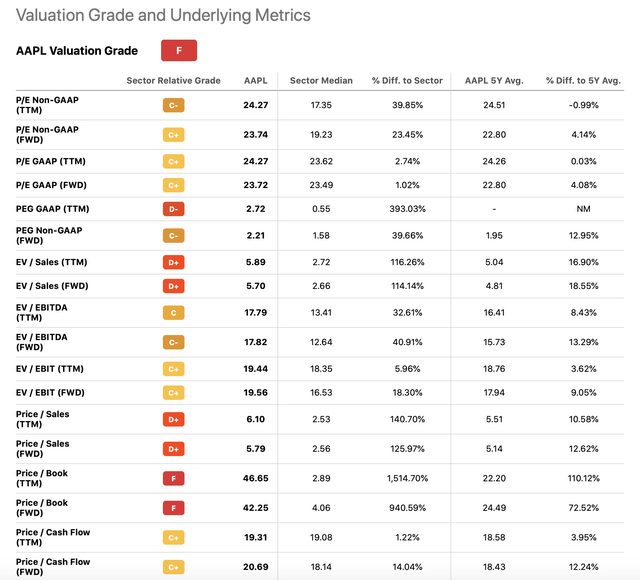

According to the traditional price multiples, Apple is trading at a valuation substantially above the sector median.

On the other hand, the current multiples are about in line with the firm’s own 5Y averages.

In our opinion, the current premium to the sector median is justified. The gradual move away from Chinese manufacturing and the increasing revenue from the “Services” segment are all factors that we believe will make Apple’s business more robust in the long term, even if near-term headwinds related to the macroeconomic environment are slowing their growth now.

Key takeaways

China’s Covid policy has a significant impact on both the supply and demand for iPhones. Recently, the largest iPhone manufacturing complex in China has been put under lockdown, which is likely to cause the iPhone output for the December quarter to be substantially below expectations, leading to a year-over-year revenue decline.

On the other hand, Apple and its partners and suppliers are working hard to reduce the dependency on the manufacturing in China. Foxconn has announced a significant workforce growth in India during the coming two years, while Apple has further strengthened its partnership with Pegatron to increase iPhone production volumes.

While we believe that Apple’s stock price may be volatile due to the Covid-related news in the near term, we expect the firm to benefit from the current developments in the long term. Also, the gradually declining dependency on iPhone sales in terms of revenue and the increasing revenue from the “Services” category is a good sign, in our view.

The firm is currently trading at price multiples close to its 5-years averages and the respective sector medians. We believe that this valuation is justified, and we maintain our “buy” rating on Apple.

Be the first to comment