Talaj

The fact that Target Corporation (NYSE:TGT) is trading some 30%+ below 2021 highs may indicate that investors have an opportunity to enter the stock at a more reasonable valuation. The company offers high-quality, on-trend merchandise via their stores or digital channels. Target is focusing on the lower-middle class and upper end of the population, which differentiates it from peers. This means that even as an economic downturn unfolds, the key customer demographic should have enough earning power to keep shopping at Target.

As bad as a recession may be, the pressure means that Target will become even more disciplined in its product portfolio and operations. Cutting off inefficiencies can cause the company to focus on higher-return projects like their digital channels, which can create even more value for investors after the downturn. In essence, the company experiencing a decline may not be a negative signal unless the company makes large mistakes in working capital management and debt. Unfortunately, Target has difficulties dealing with shoplifting and vandalism, which can be a deterrent for shoppers.

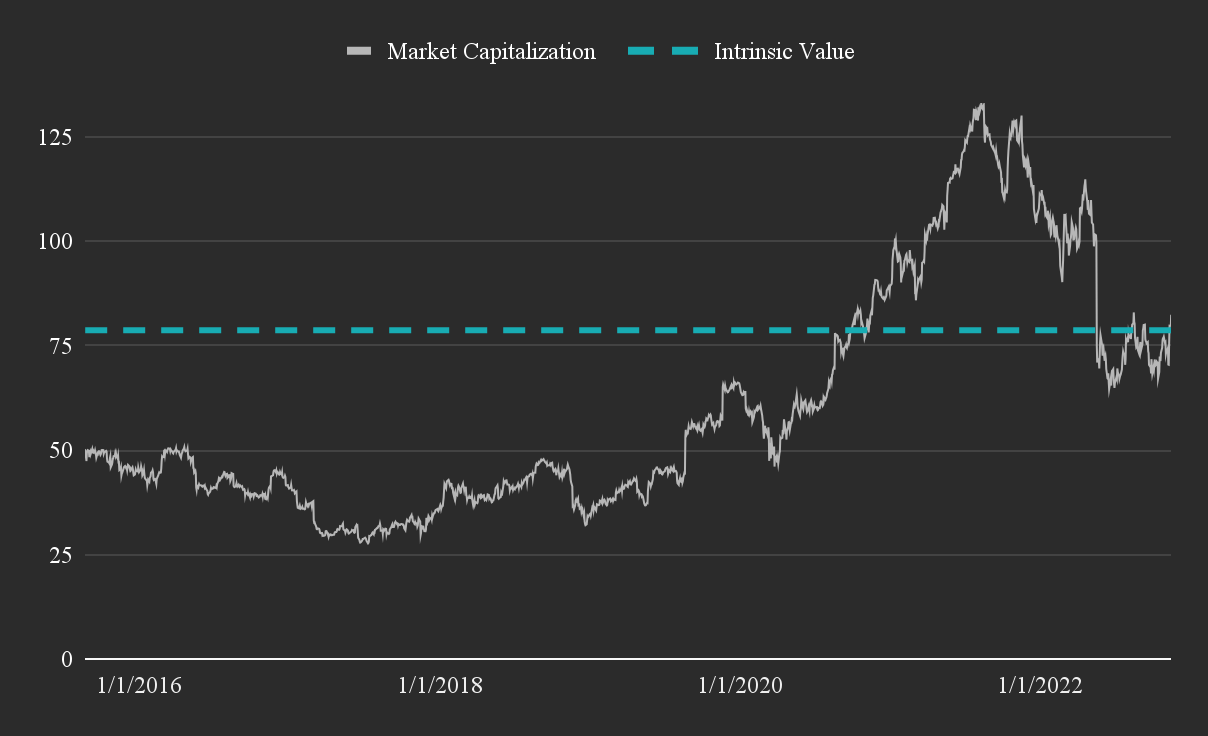

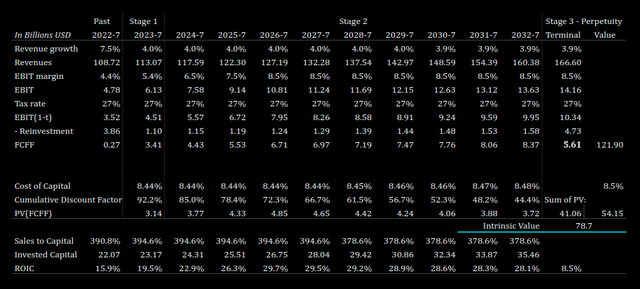

For investors, Target seems to be trading around fair value, but the long-term outlook seems to be positive as the company works through the crisis. I valued Target at $78.7 billion, with a 1-year price target of $180.5. You can view the full analysis spreadsheet, and even change the estimates to reflect how you see the company.

Target’s estimated Intrinsic value (Author image with data from SEC and FMP)

In our analysis, we will recap Target’s November 16, 2022, earnings results and compare the company’s pricing to key peers in order to see who is in the best position in the U.S. retail market.

Earnings Review

Target’s 3rd quarter earnings were just released. Highlights:

- Revenue of $26.5 bn, up 3.2% YoY

- Gross margin 24.7%

- Operating income of $1.022 bn, down 49.2% YOY

- EPS of $1.54, down 49.3% from $3.04 in 2021

- Adj. EPS of $1.54 decreased 49.1% vs $3.03 in 2021.

The company noted:

“In the latter weeks of the quarter, sales and profit trends softened meaningfully,…”

Outlook

Management issued the following guidance:

- Wide range of Q4 sales outcomes centered around a low-single digit decline

- Wide range of operating margin around 3%.

Valuation Implications

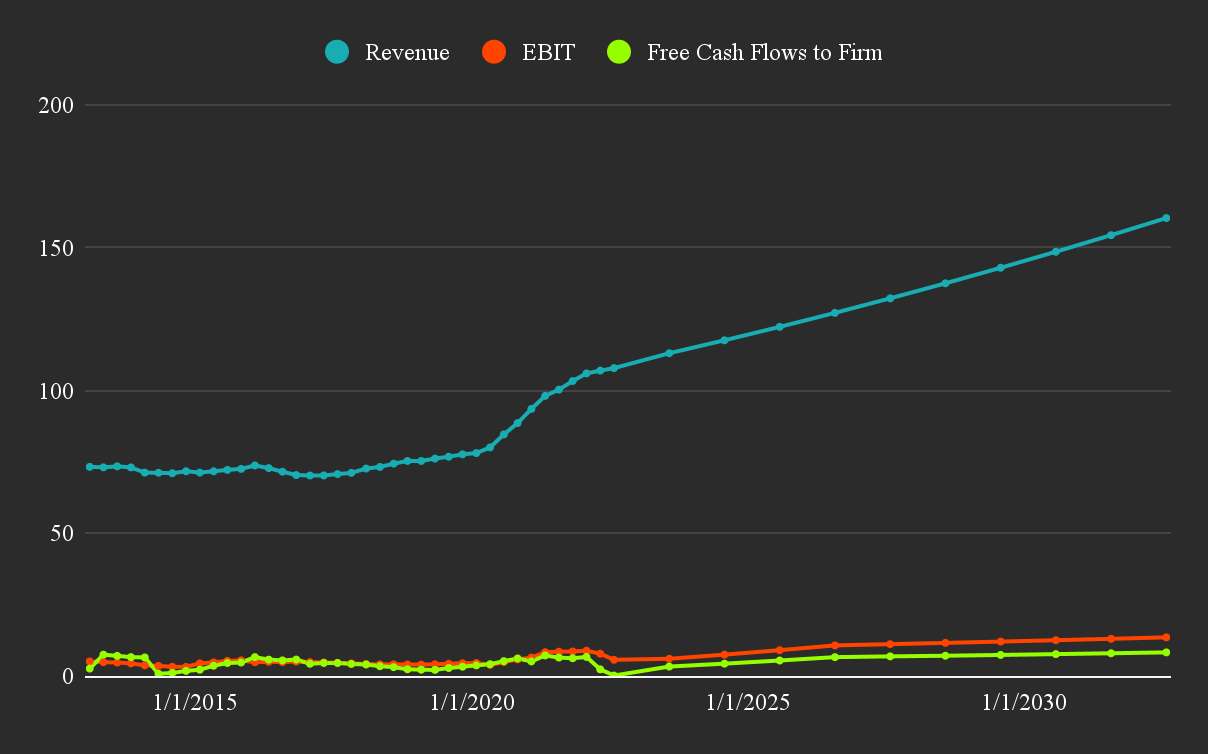

For our intrinsic valuation, we model the future expected fundamentals on top of the latest earnings report. We are interested in 3 items for our model: future revenue, EBIT and free cash flows to the firm. Constructing a model gives us a chance to assess how realistic are your expectations, as well as to align the numbers to their most likely values.

After the earnings report, I updated the valuation model using management’s outlook. Here’s how that translates into the future fundamentals:

Target’s Updated Valuation Model (Author image with data from SEC and FMP)

There are two things that immediately stand out in the model above.

Growth

One is the increased growth rate versus historical levels. The reason why I see Target as a growing company lies in increased future prices from inflation, and organic growth from digital offerings, this is why I have set the revenue growth rate to 4% in the next 4 years.

Profitability

The second is the increased operating margin from 2026, estimated around 8.5%. My assumption is that the company has a good chance to recover in four years, and can maintain a higher value business in the future.

We can also see the specifics of how I expect the company to perform in the model below:

Target’s Valuation Table (Author image with data from SEC and FMP)

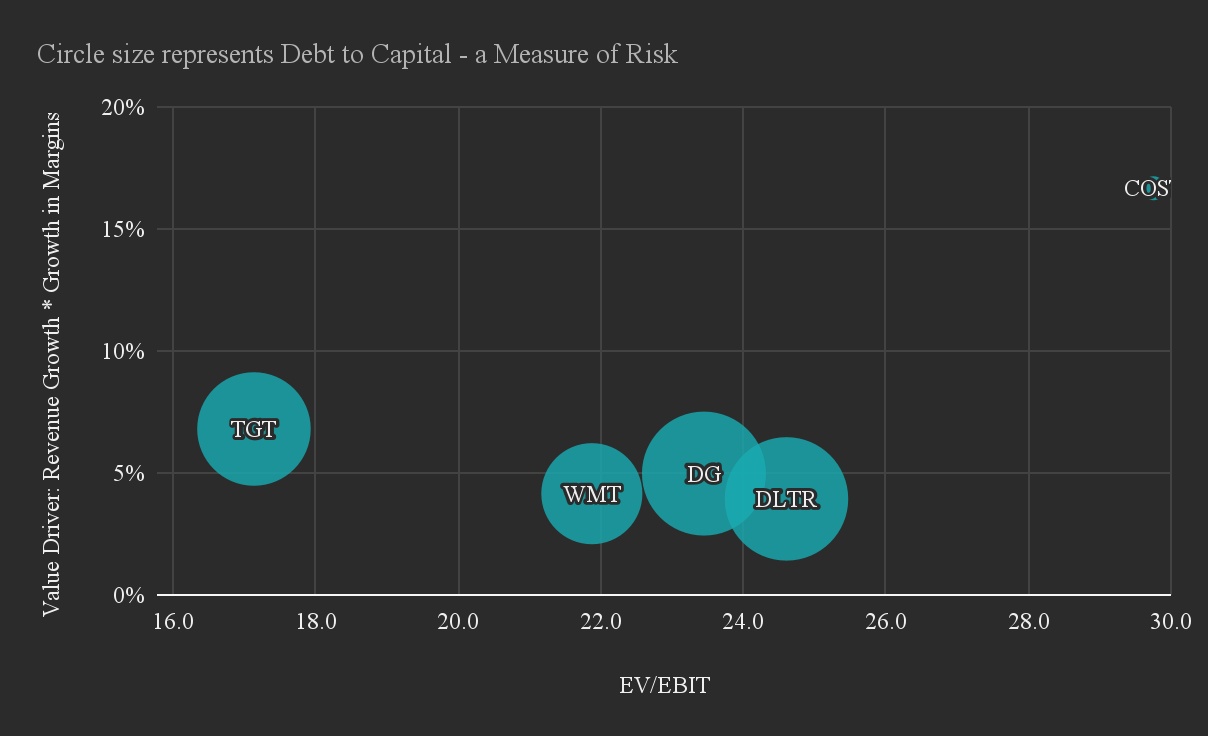

Peers and Pricing Analysis

Sometimes it is revealing to line up key peers in an industry and see who is in the best position on the fundamentals vs. the pricing. With this approach, we are measuring where companies stand on revenue growth, coupled with the growth in operating margins, on the vertical axis.

The price to operating profit is on the horizontal axis. Additionally, we include a third dimension of debt-related risk in order to evaluate if a company is borrowing from the future performance by leveraging debt.

Ultimately, the goal is to get a snapshot of how the market is pricing performance, and see if there are any potential opportunities.

For that, we selected Target’s closest competitors: Walmart (WMT), Costco (COST), Dollar General (DG), and Dollar Tree (DLTR). The list is subjective, but allows us to get a good sense of how Target is priced on a relative basis:

Relative Key Peer Comparison in the Retail Industry (Author image with data from SEC and FMP)

The chart reveals that Target’s latest earnings release places the company slightly above what it was pre-open on Nov-16, but the market data suggests that it will revert as investors are disappointed with the earnings release. While the company is having difficulties, the stock seems to be the least exposed to a downturn amongst peers, which is why investors looking to get more exposure to the retail segment should explore Target as a possible candidate.

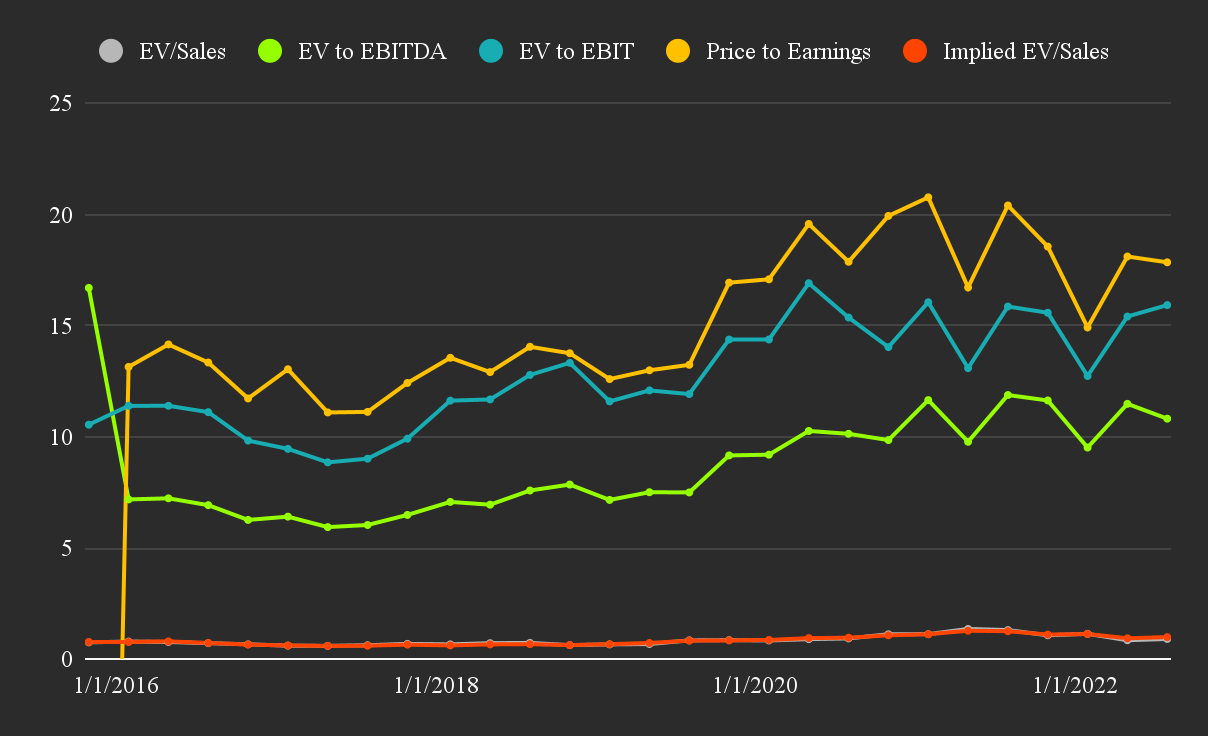

We should also note that Target has been maintaining elevated pricing since 2019, which is partly justified by the rise in profitability, as well as a low interest rate environment in that period.

Target’s Historical Pricing Levels (Author image with data from SEC and FMP)

This implies that either the fundamentals must improve, i.e., an expectation of higher future growth must be maintained, or inflation-driven (as opposed to policy driven) interest rates need to decline. The best approach is to pair this analysis with an intrinsic valuation as shown above, and check if they produce a similar conclusion.

In our case, it seems that Target stock is fairly valued. However, the market is reacting negatively to the initial report, and may cause a crowded trade in today’s session.

Possible Investment Approach

Target is currently trading within the margin of error in my intrinsic valuation. The key metric to watch, in my opinion, are tail risks which can cause the business to have operational problems. Excluding this, the company is poised to recover, while investors may be able to buy the equity at a discount after an institutional and retail selloff.

I would monitor for an attractive entry point between a market value of $65bn to 70bn. For investors, a continuous investment approach may be better, as opposed to a buy and hold strategy, since Target stock is trading around fair value, and they can mitigate some of the risk from a short-term drawdown.

Be the first to comment