Justin Sullivan

Nvidia (NASDAQ:NVDA) stock has skyrocketed by approximately 60% since it hit our buy-in target of around $100. However, at about 50 times forward earnings estimates, Nvidia’s valuation isn’t exactly cheap anymore. Naturally, many investors are asking whether to buy, sell, or hold now, especially since the company is about to report earnings.

Nvidia provided disappointing preliminary results on Aug. 24. The company pointed to a challenging macro environment and hinted at a 19% sequential drop in revenues. Thus, investors are prepared for a shortfall in the upcoming earnings announcement. Moreover, Nvidia remains a dominant market-leading company in its segments, and its shares should continue garnering demand as we move forward. Additionally, Nvidia’s long-term revenue growth prospects and profitability potential are solid despite the likelihood of near-term difficulties. Furthermore, revenue and earnings estimates may be lowballed now, and analysts may need to readjust estimates higher as the company advances. Therefore, despite the probability of near-term volatility, Nvidia hit a long-term bottom in the $100-120 range, and its stock price will likely appreciate significantly in the coming years.

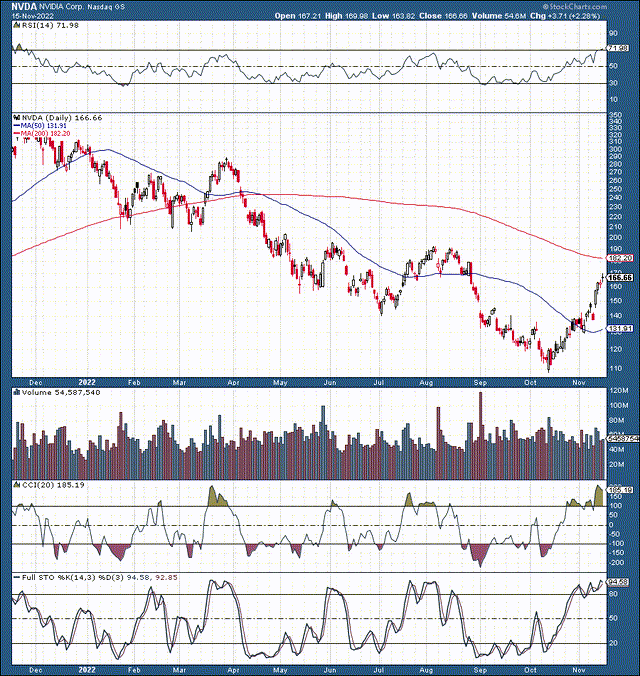

The Technical Image

Nvidia 1-Year Chart

NVDA (StockCharts.com)

Nvidia has experienced one of the best rebounds in the tech sector, surging by roughly 60% from its mid-October low in our $100-120 buy-in range. However, recent price action suggests that the stock may have gotten ahead of itself in the near term and is technically overbought here. The RSI went above 70 recently, and the CCI got above 200. Other technical indicators also imply that there may be some volatility ahead. However, despite the likelihood of a near-term retracement, there’s a high probability for continued strength and a higher stock price in the intermediate and long term.

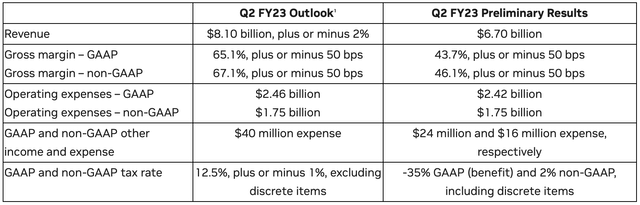

Upcoming Earnings Surprise is Unlikely

We know that Nvidia will probably report a kitchen sink quarter. The company’s preliminary results were very disappointing and surprising at the time.

Nvidia’s Preliminary Results

Preliminary results (Nvidia.com)

Nvidia lowered its revenue guidance by 17% to just $6.7 billion last quarter. Margin pressure also caused profitability to drop. Instead of a GAAP operating margin of 65%, the company is looking to report just 44% for its recent quarter.

However, we’ve seen a similar story from many companies in the tech sector. Meta Platforms (META), Amazon (AMZN), Advanced Micro Devices (AMD), and many other prominent companies expressed transitory difficulties in their recent earnings announcements. Thus, Nvidia is not alone. Instead, we’re likely witnessing a temporary slowdown phase that should improve and fade over time. Nvidia has excellent revenue growth prospects and immense profitability potential, and its stock price will likely advance much higher in future years.

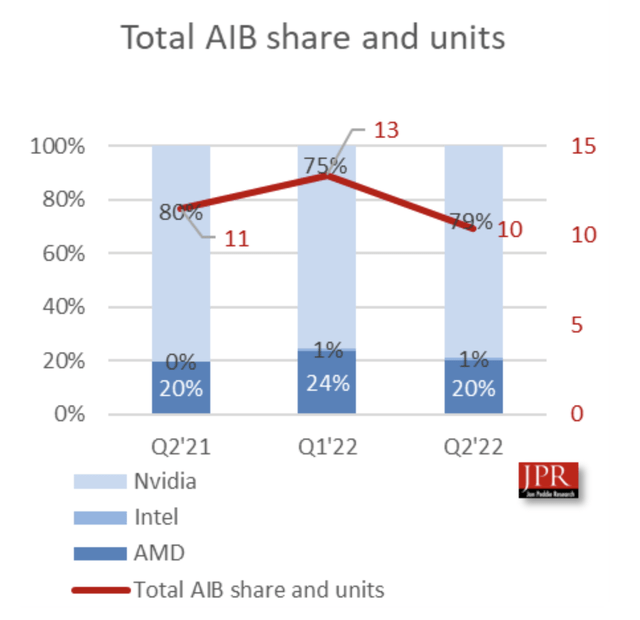

Nvidia Remains A Top Play For The Future

GPU market share (wccftech.com)

Nvidia remains the dominant force in the lucrative dGPU market. The company’s market share bounced back to approximately 80% in Q2 2022 from its 75% market share in Q1. Due to Nvidia’s leading position in the dGPU space, the company should continue delivering excellent results, leading to higher revenues and profitability in the segment.

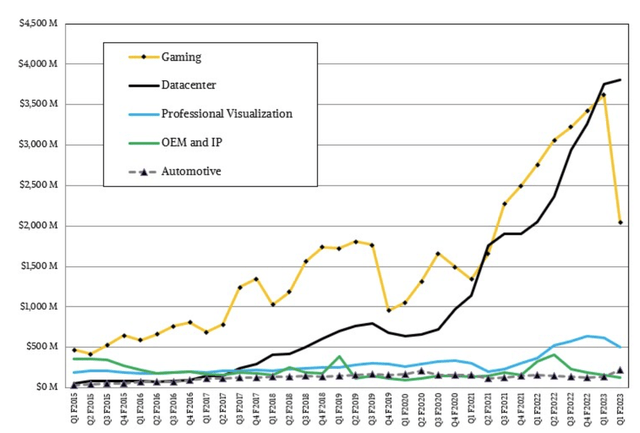

Data Center Powering Revenues

Revenues (nextplatform.com)

We know about Nvidia’s recent collapse in gaming revenues. However, gaming revenues will recover, but we see that Nvidia’s data center segment is set to drive revenue growth as we advance. The data center revenues overtook gaming revenues as the company’s leading segment, and expansion in this space should continue to power ahead in the coming years. Several factors were responsible for this phenomenon.

Some of the reasons for the drop in gaming revenues include:

- The coronavirus effect – Nvidia’s gaming unit experienced increased demand during the coronavirus lockdowns.

- The video card shortage – As demand increased for GPUs, prices rose significantly. There was a GPU shortage recently, and Nvidia’s revenues increased substantially due to higher prices. Now that there’s a GPU surplus, prices are going through a transitory decline, leading to lower sales for Nvidia.

- The decline in cryptocurrency mining demand – Many of Nvidia’s gaming GPUs went towards cryptocurrency mining. However, now that Ethereum and other networks are moving away from GPU mining, Nvidia faces decreased demand for some of its products.

- The overall economic slowdown – The global economy is in a slowdown. Therefore, it’s normal seeing less demand for gaming products. Moreover, the effect is compounding as GPU prices drop below MSRP.

- The Takeaway – The factors responsible for the drop in gaming revenues are transitory. It’s not like Nvidia began making inferior products or someone began producing better GPUs. Nvidia remains the dominant market leader in the discrete GPU segment, which probably won’t change soon. Therefore, as the global economy gets back on track, gaming revenues should improve, GPU prices should rise, and Nvidia’s gaming revenues should increase significantly in the coming years.

The Valuation Perspective

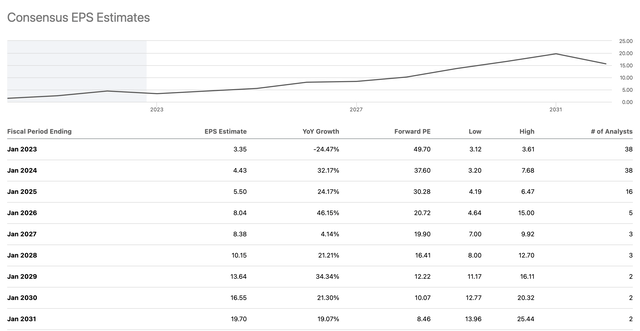

EPS Estimates

EPS estimates (SeekingAlpha.com)

While the company’s valuation may look expensive at approximately 50 times this year’s EPS estimates, the company should become increasingly profitable in future years. While this year’s EPS estimate is only about $3.35, Nvidia should earn approximately $4.50 next year, illustrating EPS growth of more than 30%. Additionally, EPS estimates have come down dramatically during this downturn and are likely to be revised higher as the economy improves and Nvidia advances.

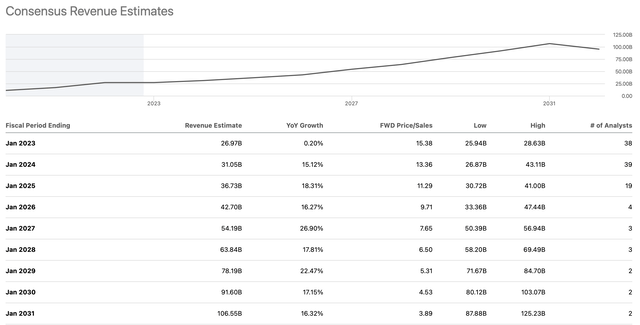

Revenue Outlook

Revenue estimates (SeekingAlpha.com )

The company’s revenues are set to skyrocket, moving from around $27 billion this year to approximately $100 billion by 2030. This remarkable revenue growth and the company’s immense earnings potential should enable shares to rise substantially in the coming years.

What Nvidia’s financials could look like in future years:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Revenue Bs | $27 | $33 | $40 | $47 | $55 | $67 | $80 | $95 | $112 |

| Revenue growth | 0.2% | 22% | 21% | 18% | 17% | 22% | 19% | 19% | 18% |

| EPS | $3.35 | $5 | $6 | $9 | $10 | $12 | $15 | $18 | $22 |

| Forward P/E | 33 | 34 | 35 | 34 | 33 | 32 | 31 | 30 | 29 |

| Stock price | $165 | $204 | $315 | $340 | $396 | $480 | $558 | $660 | $725 |

Source: The Financial Prophet

Due to Nvidia’s exceptional revenue growth prospects and high-margin potential, the company will likely become increasingly profitable in the coming years. Therefore, we should see Nvidia’s EPS climb significantly as the company advances. In addition, as the transitory slowdown passes and Nvidia’s profitability potential returns sentiment should improve, driving multiple expansion in the coming years. While I’m keeping multiple expansion prospects relatively modest (peaking at around 35 forward P/E), the company’s share price should appreciate considerably as the company advances, reaching the $500-700 range by 2027-2030.

Risks to Nvidia

While I’m bullish on Nvidia in the intermediate and longer term, technically, we’re still in a bear market. However, near-term declines should be transitory and may not affect my medium and long-term price targets for the stock. Nevertheless, risks exist, and Nvidia could face increased competition in the GPU sector and other areas. Moreover, the company could face margin pressure due to higher costs associated with inflation, leading to decreased profitability. Ultimately, the company could deliver less growth and worse EPS than my estimated forecast. Investors should consider these and other risks before investing in Nvidia.

Be the first to comment