Delpixart/iStock via Getty Images

As investors have been warned over and over, Apple (NASDAQ:AAPL) is trending in the wrong direction after a decade or two of massive outperformance. The tech giant remains a great company, but Apple has been growth challenged for years prior to covid. My investment thesis remains Bearish on the tech stock until the valuation normalizes in relation with their historical growth trends.

Relative Performance Ends

Carter Worth from FastMoney highlighted how a 20-year trend for Apple is breaking down. The relative performance of the tech stock compared to the S&P 500 has been off the charts since the lows back in 2002 following the dotcom crash.

Due to Covid boosts and the 5G iPhone release, Apple pulled together impressive 33% growth in FY21. As those effects pass, the stock appears set to finally spend a period under performing the S&P 500.

As Carter Worth suggested, Apple started hitting relative performance struggles back in 2020. The stock had dipped due to covid and the tech giant wasn’t producing the growth to warrant much of an outperformance with FY19 revenues actually falling 2%.

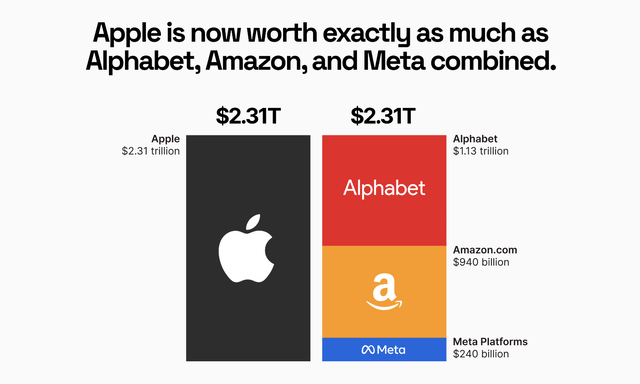

Most of the other tech giants have already given up any relative outperformance. So much so that Apple is now roughly the same market cap as the combined market caps of Alphabet (GOOG, GOOGL), Amazon (AMZN) and Meta Platforms (META).

The prime reason for being so bearish on Apple is that the market appears to have fallen in love with the stock without any reason. The tech giant just reported 8% growth in the September quarter after a weak June quarter with only 2% growth.

Both Alphabet and Amazon reported similar, if not better, quarterly results. As an example, Amazon reported June quarter revenue of 7% and nearly 15% growth in September. For the December quarter, Apple is definitely not expected to lead the pack with only 3% growth ahead followed by a March quarter with no growth.

The Apple warning on iPhone 14 Pro production isn’t going to help the stock performance in the short term. While the production issues in China will pass, these issues will contribute to the reduced interest in the stock.

Normalized Growth Ahead

Apple now produces $400 billion in annual revenues, making the ability of the tech giant to grow far more difficult. Prior research has highlighted how the AR/VR devices and the Apple Car products don’t provide material revenue growth opportunities over the next few years, leading to the call that the stock wouldn’t rise through FY26.

After management guided to FQ1’23 revenues decelerating from the growth rates of the prior quarter, investors now have to come to grips with growth normalization going forward. Apple only grew revenues 8% during the just ended FY22, and all indications are for a tough couple years of growth ahead.

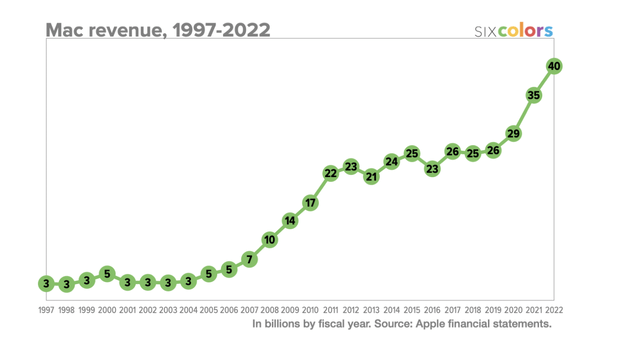

In general, Apple has to grow iPhone and Mac sales beyond peak covid levels, or the growth story will struggle. Without these categories growing, and the tech giant just guided on the FQ4 earnings call to a big dip in Mac sales in the December quarter, Apple is stuck with meager growth potential ahead.

Over the past decade, Apple generally failed to grow Mac revenues. The use of internal M1/2 chips have possibly increased the overall market for Macs. The massive revenue growth in the last couple of years question the ability for the tech giant to extend annual revenues, considering revenue in the mid-$30 billion range would generally have been considered as positive.

This meager revenue growth potential leads to the following EPS growth estimates for the next 3 years:

Investors must note how EPS growth rates of 3%, 8% and 4% annually through FY25 still leaves Apple with a 20x forward PE at the end of the period. The only reason to pay a premium for a stock is due to growth rates warranting the higher valuation multiple, leading to higher returns over time. In this case, Apple is still expensive at the end of the cycle, offering limited to no positive returns for shareholders.

Even Sensor Tower has the App Store sales turning negative in October in a sign Apple might struggle to generate any growth in the Services sector. The tech giant hiked prices on several services a few weeks back on the principal of covering higher licensing fees, but Apple might want to reinvigorate revenue growth in the sector by hiking prices by $1 to $2 per service. The price hike actually amounts to a 40% hike for a service like Apple TV+.

Takeaway

The key investor takeaway is that Apple continues to trend downwards, while most bulls are still in denial. The stock is headed for a multi-year period of underperformance against the market, with Apple entering a period of subpar growth similar to the pre-Covid lull.

Note, a multiple of 15x FY25 EPS estimates of $7.06 predicts a stock price of $106. This base case target isn’t very appealing for a stock still trading at $138 and just now entering a downtrend.

Be the first to comment