Liudmila Chernetska/iStock via Getty Images

Managing an aggressive growth portfolio in the current environment is not a super fun task, as I am sure many of my readers can attest too. The markets have taken the guillotine to any name that shows even a hint of weakness in the market, with special attention given to unprofitable, or high multiple stocks.

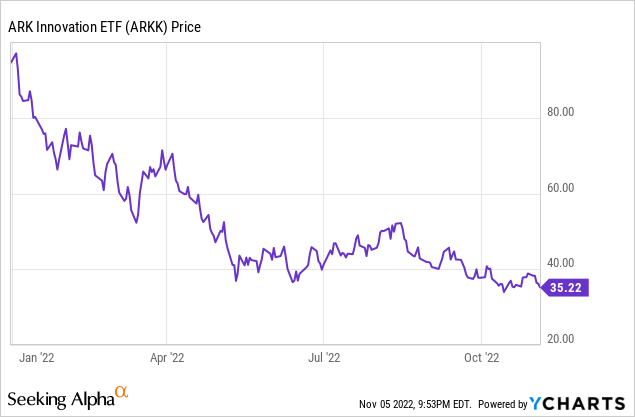

The best peer example that I can find continues to be Cathy Wood’s ARK Innovation ETF (ARKK). As you can see, it has not been a pretty year for aggressive growth names.

In this article, I would like to go over and reveal my complete aggressive growth portfolio and cover a few key moves that I made during the quarter, which, so far, has led to outperformance during the year to date.

Overview

As I do for each of these updates, I would like to remind readers of my overall investment philosophy. I hold two distinct and separate investment portfolios for myself. The first is made up predominantly of large cap, high quality, predominantly dividend paying stocks. My so called “safe” portfolio.

For example, my current top 10 positions in the “safe” portfolio are:

- Markel Corp. (MKL)

- Cedar Fair, L.P. (FUN)

- Alexandria Real Estate Equities (ARE)

- Unilever PLC (UL)

- Wells Fargo & Company (WFC)

- Berkshire Hathaway (BRK.B)

- Corning Inc. (GLW)

- Texas Instruments Inc. (TXN)

- Raytheon Technologies (RTX)

- Honeywell International (HON)

Now, I do have some large cap tech and growth sprinkled throughout, such as Mastercard (MA), Salesforce (CRM), Alphabet (GOOGL), Veeva Systems (VEEV), Amazon (AMZN), Microsoft (MSFT), NVIDIA (NVDA) and others, but this is a portfolio comprised of 37 high-quality companies that I can rely on for both income and long-term capital appreciation. The allocation and structure of which I believe will outperform when value / defensive stocks are in vogue, such as today.

In general, I aim to funnel 70-75% of my investable income into my “safe” portfolio to build a solid foundation from which I can experiment and take greater risk.

With the remainder of my investable income, I deposit into my aggressive growth portfolio, which we will discuss today. In this portfolio, I have no set rules other than to seek out predominantly smaller companies with high return potentials.

Historically, I have held between 20 and 40 positions in this portfolio. Currently I hold 19 individual positions. Up until November of 2021, my aggressive portfolio had vastly overperformed my safe portfolio and trounced the S&P 500 by quite a wide margin. Like many others with similar portfolios however, the party came to a screeching halt late in 2021.

So far, year to date in 2022, my aggressive portfolio is down 33.4%. While this number is indeed quite painful, it compares extremely favorably to ARK Innovation’s 63.69% year-to-date decline and even with the broader NASDAQ’s 33.8% decline. So while I certainly wish my losses were less, it clearly could have been worse so far in 2022… Knock on wood!

As you will see below, I have continued the recent trend of concentration in my top 5 holdings along with selling out of, or reducing, many unprofitable companies in the portfolio.

Below, take a peek behind the curtain to see my complete aggressive growth portfolio as of 11/05/2022.

| POSITION NAME | PORTFOLIO WEIGHTING |

| AbCellera Biologics, Inc. (ABCL) | 46.1% |

| Dynatrace, Inc. (DT) | 11.4% |

| Splunk, Inc. (SPLK) | 7.0% |

| Spire Global, Inc. (SPIR) | 5.6% |

| Palantir Technologies, Inc. (PLTR) | 4.7% |

| Datadog, Inc. (DDOG) | 4.1% |

| Coda Octopus Group, Inc. (CODA) | 3.5% |

| Guidewire Software (GWRE) | 3.1% |

| Elastic N.V. (ESTC) | 3.1% |

| Array Technologies (ARRY) | 2.5% |

| Schrodinger, Inc. (SDGR) | 2.5% |

| Intellia Therapeutics (NTLA) | 1.5% |

| Teradyne, Inc. (TER) | 1.3% |

| CRISPR Therapeutics AG (CRSP) | 1.2% |

| AST SpaceMobile, Inc. (ASTS) | 1.0% |

| SomaLogic, Inc. (SLGC) | 0.5% |

| Nautilus Biotechnology (NAUT) | 0.4% |

| Arqit Quantum, Inc. (ARQQ) | 0.3% |

| Vicarious Surgical (RBOT) | 0.2% |

As I am sure you have noticed, this portfolio is currently dominated by AbCellera Biologics, holding a 46.1% weighting in the account. The reasons for this heavy concentration is due both to the overperformance in shares throughout 2022, particularly since May, to go along with further, significant purchases made in the mid-May time frame.

I have written extensively as to why I believe that this company is a compelling long-term holding and also in the extreme patience needed to develop non-COVID related revenues. I encourage you to read my many articles on the name to learn more if you are unfamiliar.

This has now become a VERY concentrated portfolio, with 74.8% of my funds spread over just the top 5 names. I have added extensively to Dynatrace, Splunk and a new position in Spire Global throughout the quarter.

I am not adverse to keeping this portfolio a concentrated one, as I clearly believe in my top positions; however, I do see this portfolio becoming more even throughout my top ten positions as time goes on.

Sells

Since my last update on this portfolio, I have made some significant changes under the hood. Frankly, I was extremely lucky during the May timeframe, just after my last update, in the timing of a few of my sells listed below. These moves have nearly singlehandedly allowed this portfolio to significantly overperform during the period.

Since my last update, I sold the following names, Kaleyra (KLR), Twilio (TWLO), MercadoLibre (MELI), Unity Software (U), SentinalOne (S), Rocket Lab USA (RKLB) and Editas Medicine (EDIT).

Veeva Software (VEEV) I transitioned into my main portfolio and thus sold out of it in this portfolio, though I am still long the name.

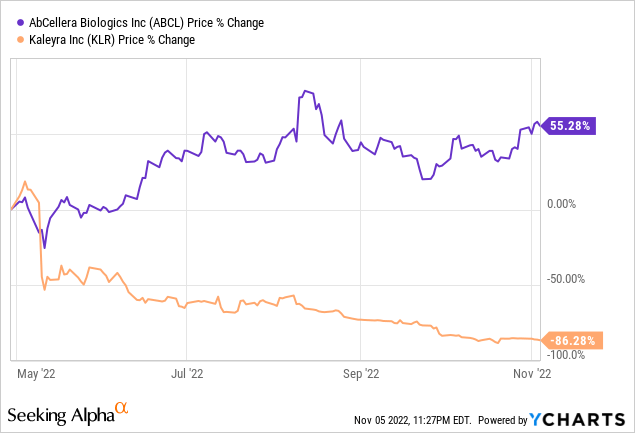

The transaction that stands out the most since my last update is the sale of my rather sizable Kaleyra position in May. This sale was primarily driven by the rapid decline in shares of AbCellera in early May and in my desire to further build up the position. In addition, I turned increasingly negative on the wider CPaaS market given the substantial margin issues inherently present.

Thankfully, I was able to sell a sizable chunk of my position in Kaleyra in the $6 to $4 range and then purchase a significant amount of AbCellera around $7 a share. As you can see below, this has been a wise move thus far and is the main driver of the current concentration in AbCellera.

In addition, I sold roughly 75% of my position in Array Technologies after shares nearly doubled to the low $20’s following the Q2 earnings beat in August. I utilized the funds received from this and my other sells mentioned to purchase the following positions which are new to the account.

Buys

Since my last update, I have added the following names to the account, Spire Global, Datadog, Guidewire Software, Teradyne, Inc. and Vicarious Surgical.

I have published two articles on Spire Global since my purchase in late June here and here so I will not speak to that name in this article and Vicarious Surgical and Teradyne are small tracking position at this point and I will refrain from spending too much time on them, however, Datadog and Guidewire have both made it all the way to my top ten holdings and I am happy to give you my “elevator pitch” for each name below.

Datadog

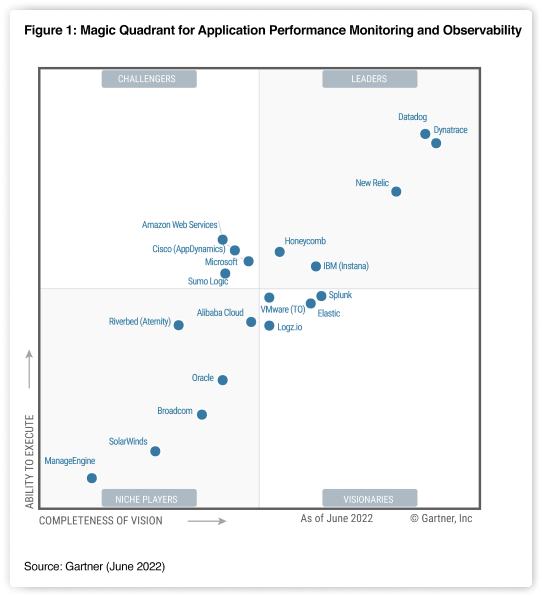

If you are not familiar with Datadog, the company operates within the observability software market, which is one of the most exciting and fastest growing fields in technology. The company’s software assists businesses in managing and handling the vast amounts of data that is generated on a day-to-day basis.

The point of observability is to understand and utilize what is actually happening across the entire IT network of a customers business, so that the customer can detect and resolve issues to keep their systems efficient, reliable and secure.

Gartner

As you can see above, Datadog is locked in a heated battle with another of my favorite holdings, Dynatrace, for technological leadership in this rapidly growing space. I would note however that these two leaders, thus far, have not seen many competitive battles in the market, as both company’s tend to focus on different areas of the market with Dynatrace primarily focusing on the enterprise market and Datadog focusing on mid-level business. Eventually, these two company’s will battle it out toe-to-toe, however, for now, it appears that both still enjoy significant greenfield opportunities.

Both Dynatrace and Datadog are profitable and generate significant free cash flow and while in the past, Datadog had reached nosebleed valuations, at the current $70.38 a share price levels, the company is looking increasingly attractive for long-term investors interested in exposure to this rapidly growing field.

I began building my position in Datadog around $90 a share and look to significantly increase this position in the near future if shares remain under $80.

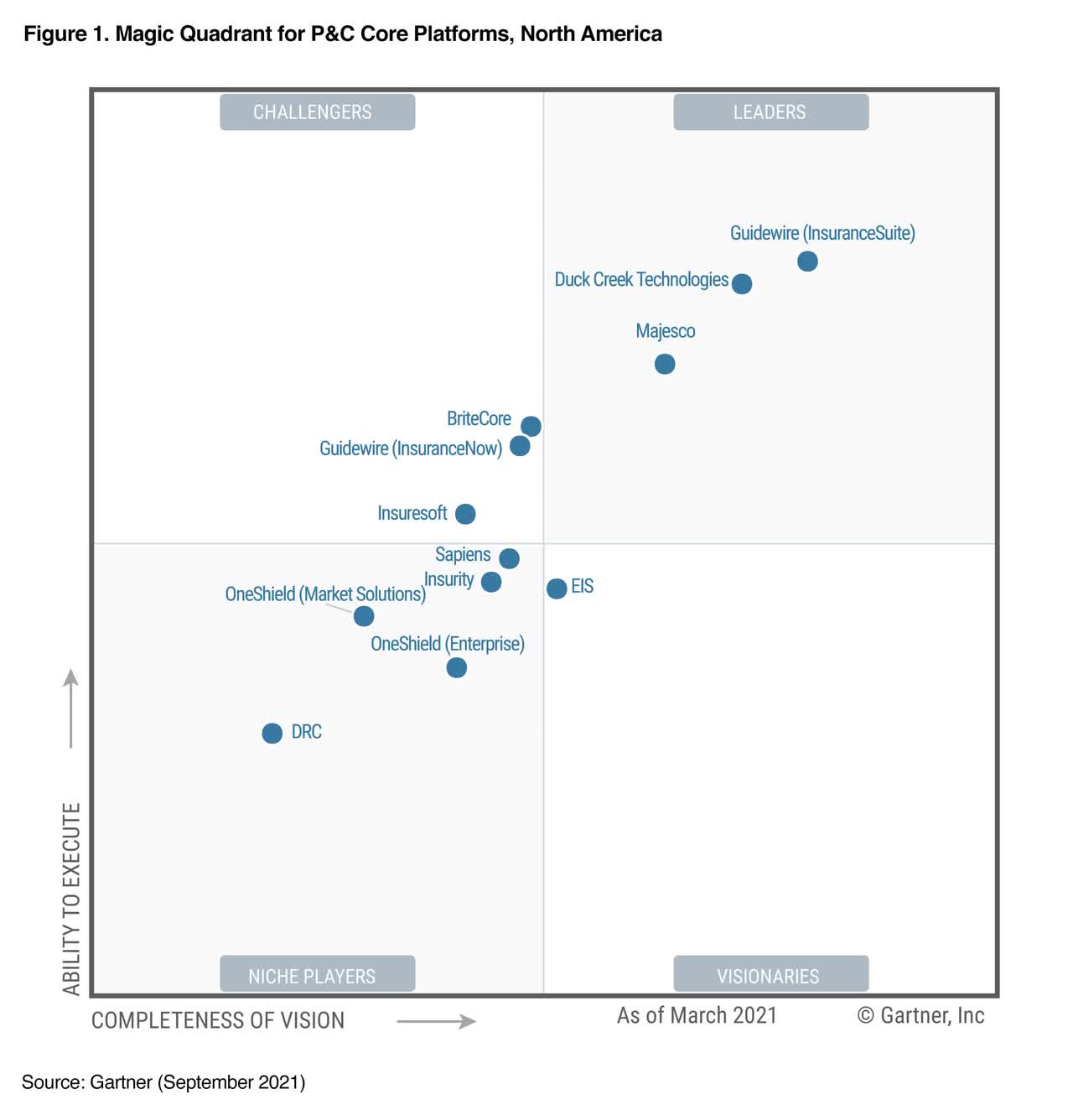

Guidewire Software

I have had Guidewire on my shopping list for nearly a half-decade now and finally took the plunge into a position in late September given the rapid decline in price so far this year.

Guidewires business is centered on creating software for the notoriously slow moving insurance industry. If you are not familiar, the insurance industry today still relies heavily on mainframes created in the 1970’s and in many cases are held together with duct tape, paperclips and vacuum tubing… Sadly, I am only half kidding about that.

Gartner

In the insurance software market, Guidewire is the undisputed 900lb gorilla. The company has been rumored to hold a rather ridiculous 90% win rate and is currently engaged in a protracted cloud transition which dramatically skews its financial results, making the company appear unattractive using traditional financial metrics.

The fact is that the insurance industry as a whole is quickly approaching a do-or-die period where, bluntly, they are running out of people due to deaths and retirements who can still service their patchwork mainframe systems, forcing them to upgrade to a modern infrastructure. Guidewire is ready and able to pounce on these opportunities when they become available.

The case for Guidewire is rather clear in my eyes, the industry desperately needs to upgrade and is notorious for sticking with what works. If Guidewire is able to upgrade carriers systems, it is highly unlikely that they will switch anytime soon. In addition, the cloud transition is heading into the home stretch, which should smooth out the financial results, leading to significant free cash flows going forward.

I took advantage of the 50% decline YTD and opened a position at the $60 level and look to continue to build this out over time.

Bottom Line

Since my last update in early May, I must admit to being a bit lucky in the timing of a few of my sells and also fortunate in the substantial overperformance of AbCellera and Spire Global, along with the quick double up of my formerly significant position in Array Technologies.

I continue to see significant long-term opportunities in my holdings and plan to continue to increase my positions in Dynatrace, Datadog, Splunk and Guidewire Software as funds become available as I view each name as attractively priced and poised for significant growth, profitability and cash flows in the future.

AbCellera Biologics will likely continue to drive this portfolio in the near future and I do not plan to sell a single share for quite some time; however, as this position is now approaching 10% of my entire net worth, I may be reaching the maximum amount of shares I can realistically handle, barring a substantial drop, which I will certainly take advantage of.

It has been a difficult 2022 so far for nearly all aggressive growth investors. Keeping a long-term mindset is certainly easier said-than-done when your portfolio is dropping precipitously nearly every single day, however, if your original thesis for buying remains intact, eventually, you are likely to be rewarded.

I look forward to your comments below. Thank you for reading and good luck to all!

Be the first to comment