hapabapa/iStock Editorial via Getty Images

Apple (NASDAQ:AAPL) has been producing stellar returns for investors for two decades now. Even though past success will be hard to replicate, I will argue that double-digit returns are still attainable going forward. Though the yield is low due to the rapidly rising share price, it is extremely safe and will grow for as long as the eye can see. In late April, the company is likely to hike the dividend for the tenth year in a row by as much as 9%.

This wealth compounder had another good year last year and in the first quarter with revenue up 11% and new all-time high revenues for several important segments such as the iPhone and Services. And about that safe dividend? The company made $2.10 per share in the quarter — up 25% from last year — and paid a $0.22 dividend. Suffice it to say, it is well covered. It is truly quite remarkable that a nearly $3 trillion company can continue to grow this fast.

The growth rate is even more astounding considering that it is larger than the total of all listed companies of many countries, and it continues to grow faster. Apple has a higher market cap than Deutsche Börse and only a little smaller than the London Stock Exchange, which by the way includes Milan.

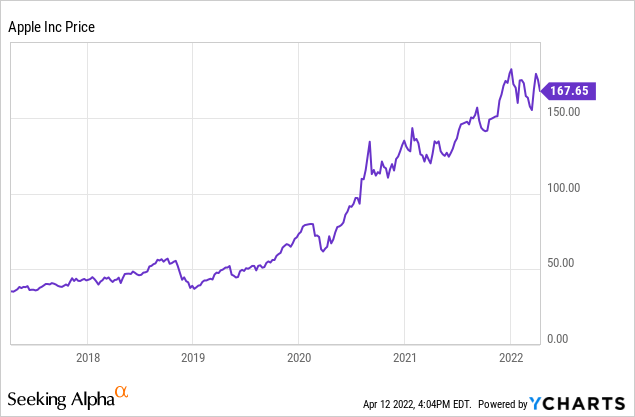

Over the last five years, the stock has truly been on a tear, having gone from $35.26 to the current level of $167.65 for a multiple of 4.75x. That is equal to an annualized return of 36.6%. Adding in the admittedly low dividend yield will push the return even higher. Remember, Apple was already one of the largest and safest companies in the world back then and still managed to produce these magnificent returns.

Apparently, the people over at Apple haven’t heard about the law of large numbers. It seems investors shouldn’t mind that.

Apple’s Dividend History

Apple has a somewhat erratic dividend history if we go all the way back to the Apple of the old days. In newer times, Steve Jobs famously refused to pay dividends believing it didn’t increase the value of the firm. Finally, though, in 2012, it was reinstated. It has been increased every April or May ever since.

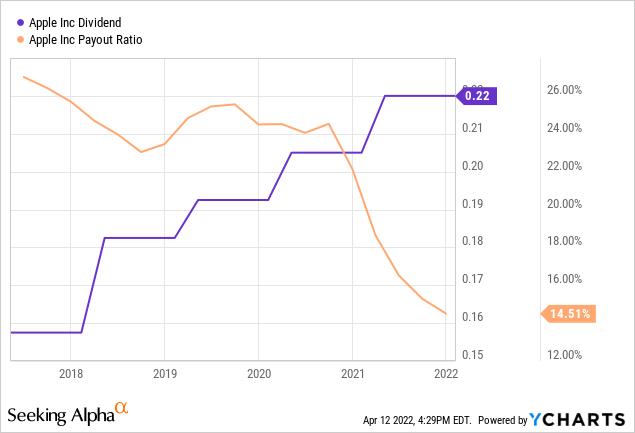

As we can see above, the dividend has been increasing at a steady pace every year, with the small exception of 2018 when it was raised by a full 16%. Back in the spring of 2017, the dividend was $0.1425 split-adjusted while it currently sits at $0.22, which is 54.3% higher. Annualized, the growth rate is a rather modest 9.1% increase, which is slightly higher than the current rate of inflation. Considering the enormous growth of the company, the dividend growth rate is not that impressive. Almost like a compromise with the late Steve Jobs. There will be a dividend, but it will only grow modestly.

The growth rate above is skewed upwards by the bumper dividend increase in 2018, partly due to the tax cuts that year. If we look at the cleaner years of late, the typical increase has been about 6-7%. Last year, it was up 7.3% and 6.5% the year before that. It is pretty clear that the Board does not stress about offering the highest growth rate in town, but is rather quite conservative as to the growth rate.

Buybacks are more of the thing at this company. In the latest quarter, it paid dividends of $3.7 billion but bought back stock of $20.4 billion or 5.5x more money spent on buybacks as opposed to dividends. In that sense, we can say that Apple has a stealth dividend yield of 3.3%. This is part of the reason why I believe double-digit returns are still attainable. With a capital return to investors of 3.3%, you only need growth of 7% to tip you over into double-digit territory. With inflation currently around 8%, that should be well within reach. And the best thing of all, the company is producing more cash flow than ever and still has net cash of $80 billion to spend on buybacks and dividends.

Apple’s Growth Prospects and Upcoming Dividend Hike

Of course, even with a lot of cash, all dividend growth streaks are not sustainable over the long term if there is no underlying earnings growth. Fortunately, it is highly likely that earnings growth will not be lacking for Apple for a very long time. From Q1 2021 to Q1 2022, services revenue was up by 23.8% while products revenue was up 9.1%.

The good thing about services is that they tend to be sticky and increase over time. On a personal note, I recently had to upgrade my iCloud backup capacity and it’s highly unlikely that it will ever be downgraded as I continue to store more things. Over time, it will have to be upgraded again so the company will grow services revenue over time almost automatically. Add on a few more customers here and there, some new services related to AR/VR, and improve existing services like Apple TV+ and you have a recipe for robust services growth for a long time to come. Another nicety is that margins are extremely high in this segment at 72.4% in Q1 2022. On top of all of this, services enjoy an add-on effect on hardware sale. A larger installed base, be it from Macs or iPhones, will increase App Store sales, iCloud sales, Music sales, and all the rest of the categories within services. This is a big part of the reason for the multiple expansion of Apple over the years. It used to be viewed strictly as a hardware company but is now recognized as a hybrid with high-margin hardware driving even higher-margin services revenue.

On the hardware side of things, the sales of the iPhone increased by 9.1%. Demand for the iPhone 13 has been robust and the continuing rollout of 5G networks worldwide will continue to increase demand for 5G phones, like the iPhone 13 and the coming iPhone 14. Wearables is continuing to grow robustly at 13.3% and let’s not forget all the rumored new products coming up, from Apple Car to Apple VR/AR glasses. If any of these materialize and become even remotely successful, they will not only increase earnings on their own but will also boost services growth.

Put together, with the growth trends we have seen lately and with all the plans for the future, a revenue growth rate just below 10% for the long term should be well within reach. Adding in buybacks and the dividend should result in total shareholder returns comfortably above 10% annually.

With this as a backdrop, we can analyze what a potential dividend hike in late April could look like. On the upside, the payout ratio has been falling precipitously over the last two years which leaves the Board with a lot of headroom in terms of dividend growth. At current levels of 14.5%, I think we can safely conclude that there is no hindrance to the dividend based on this metric. A double-digit dividend increase to say 25 cents would only increase the payout ratio to 16.5% — still ultra-conservative.

On the low end, the world is quite uncertain at the moment, both in terms of disrupted supply chains but also in terms of higher raw material prices. This is an argument for sticking with the customary increases of 6-7%. After all, investors have gotten used to the fact that buybacks — and not dividends — are the real thing at Apple. Even so, not even being compensated for inflation from a company like Apple is bound to be a disappointment to most investors. U.S. headline inflation is currently at 8.5% while core CPI came in at 6.5%. When revenues were up 11% from last year and EPS up by even more and a payout ratio as low as it is, even a conservative Board should strike a balance between safety and compensating investors properly.

If the dividend were to increase to $0.235 per share per quarter, that would mean a growth rate of 6.8%. In my book that would be an absolute minimum. On the trajectory this company is on, the payout ratio would fall further and investors would almost be compensated for inflation. It is totally unnecessary to be this conservative, so I think the Board would go up one step to $0.24, which represents a 9.1% bump up from the current level. This will more than compensate for inflation, still be in the conservative range below double-digits, and will not make a negative impact on the ultra-low payout ratio. Incidentally, it is exactly the same as the average growth rate over the last five years.

Risk Factors

Geopolitics is a very visible risk factor at the moment. Due to Russia’s invasion of Ukraine, many companies, including Apple, decided to discontinue operations in Russia. Even though it is estimated that only about 1.4% of Apple’s revenues come from Russia, there is a risk that the same will happen in future conflicts in other countries as well. Another risk is the rather long-lasting struggle in global supply chains. First, the pandemic caused a lot of trouble and now a war with further strains on access to important minerals creates even more trouble. This is not a quick fix as raw materials lie where they lie and it is difficult to find alternatives over the short term. Competition is an omnipresent risk. Every day, brainy people are working hard on the next version of a product or even an entirely new product to make inroads into Apple’s territory.

Current Valuation

Valuation is always important, especially for longer-term investors. Valuation can get out of whack for a period of time, but eventually, all assets get repriced as reality dawns on people, just ask holders of ARK Innovation ETF (ARKK). So, in order to evaluate that, I have chosen two close peers to see how Apple is valued both on its own and relative to its competition.

The two other companies are Samsung (OTC:SSNLF) and Microsoft (MSFT). The first one was chosen due to its smartphones and the second one due to its software.

| Apple | Samsung | Microsoft | |

| Price/Sales | 6.8x | 1.6x | 10.8x |

| Price/Earnings | 26.9x | 11.5x | 29.5x |

| Yield | 0.5% | 2.2% | 0.8% |

Source: Seeking Alpha

Right off the bat, we can see that Samsung is clearly the cheapest option here on all three metrics. Samsung has always been pretty cheap in relation to its U.S. counterparts and will likely always be so. So, on pure metrics, Samsung is the most enticing buy, but a cheap buy isn’t necessarily the best option if it always remains the cheapest buy.

Apple is in second place both in terms of Price/Sales and in terms of Price/Earnings where it is slightly cheaper than Microsoft. The difference is not huge, however, and probably due to the fact that Microsoft is a more pure-play recurring revenue software company than Apple. A P/E multiple just below 30x is not by any means cheap, but can absolutely be justified for these companies on the back of super-solid balance sheets and still robust growth prospects.

The dividend yield is not at all exciting for neither Apple nor Microsoft. The yield should not be your reason for buying Apple, but should rather be viewed as icing on the cake. Wall Street analysts see a long-term EPS growth of 11.6% from Apple. Adding in the dividend yield and assuming that the relatively fair multiple stays the same, investors have an expected total shareholder return of 12.1% over the next five years. This is comfortably above what the market has produced over time, and you get this from one of the most solid businesses on earth. It has so much cash it is still working on getting to a neutral net cash level, it has an enormous — and growing — installed base, it is buying back more stock in dollars every year than most companies’ market cap, and it looks set to keep growing EPS at double-digit rates for many years to come. Relatively young investors who want to be invested in a solid company with good growth prospects and a dividend that over time will grow into a considerable income stream should buy Apple at these levels. Investors who only care for current income should look for other opportunities than this 0.5% yielder.

Conclusion

Apple has been increasing its dividend for a decade soon. The stock has pulled back slightly from recent highs and looks set to reclaim the $3 trillion throne again as organic earnings growth in conjunction with buybacks ensures double-digit earnings growth for many years to come. The dividend is likely to be increased in late April by 9%. With a low starting yield, there will be a long time before meaningful income can be produced from this stock. Even so, for relatively young investors who seek safety and robust long-term growth in both the share price and the dividend, Apple is one of the better buys in this market at the current level.

Be the first to comment