claffra

Energy production is not easy or cheap. There are many working parts that create demand for various services within the space. One company that has made it its goal to make energy production easier, particularly related to the oil and gas industry, is Schlumberger (NYSE:SLB). Although the company has more recently envisioned itself as a technology firm that focuses on providing digital solutions and technologies, at its heart, it’s really a business centered around facilitating oil and gas exploration and production. The current market has proven itself to be incredibly volatile as investors fear a potential global economic downturn. However, that has not stopped shares of the company, backed by strong financial performance, to roar higher. Add on top of this how affordable shares look at this moment, and I do believe that the company makes for an appealing ‘buy’ prospect at this time.

Great performance continues

The last time I wrote an article about Schlumberger was back in early July of this year. In that article, I acknowledged that the company’s shares had not kept pace with the financial performance of other players in the market. However, this came even at a time when the financial performance of the firm remained strong. On top of that strong performance, I also concluded that shares looked cheap and that the long-term outlook for the company was favorable. All combined, this led me to keep my ‘buy’ rating on the stock, reflecting my belief at that moment that the firm would likely outperform the broader market for the foreseeable future. Since then, the company has definitely delivered. While the S&P 500 is down by 0.2%, shares of Schlumberger have generated a return for investors of 20.9%.

Given this massive return disparity, investors would be wise to ask whether additional upside potential is still on the table. To begin to answer this question, I would first like to point out to financial results covering the second quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the business. During that quarter, revenue came in strong at $6.77 billion. That’s 20.2% higher than the $5.63 billion in revenue the company generated the same quarter one year earlier. This strong increase in sales was driven by robust performance across all four of the company’s segments. Digital & Integration revenue rose by 16.9% year over year. The increase for the Reservoir Performance segment was even greater at 19.3%. Production Systems revenue grew a more modest 12.6%. But the greatest growth came from the Well Construction segment, with revenue skyrocketing by 27.3% from $2.11 billion to $2.69 billion. Considering that just in the month of June alone, the number of wells drilled in the shale regions of the US were up 68.6%, while the number of completions were up 35.1%, strong performance on this front is not surprising.

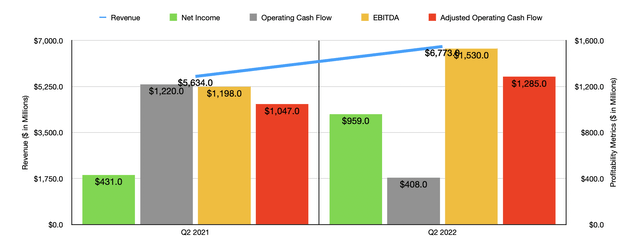

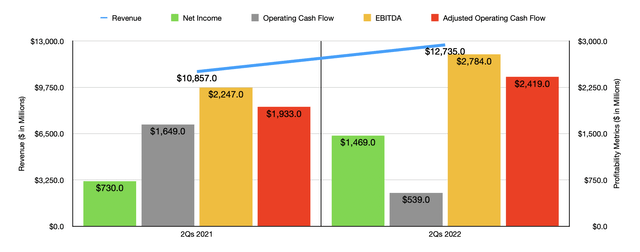

With the improvement in revenue came a significant improvement in profitability. Net income in the latest quarter came in at $959 million. That’s more than double the $431 million the company reported for the second quarter of its 2021 fiscal year. We should also pay attention to other profitability metrics. For instance, operating cash flow fell year over year, dropping from $1.22 billion to $408 million. But if we adjust for changes in working capital, it would have risen from $1.05 billion to $1.29 billion. And over that same window of time, we also saw EBITDA improve, rising from $1.20 billion to $1.53 billion. This strong performance on both the top and bottom lines for the company was instrumental in pushing results for the entirety of the first half of this year up compared to the same time last year. This much can be seen in the chart above, with revenue, profits, and two of the three cash flow metrics showing impressive year-over-year growth.

For the 2022 fiscal year as a whole, management has been a little vague regarding guidance. They have said that revenue should come in at no less than $27 billion. If it comes in at exactly that point, it would translate to a 17.8% increase over the $22.93 billion in revenue the company generated in 2021. It would also be the highest revenue the company has reported since the 2019 fiscal year when sales totaled $32.92 billion. Profitability is a bit more complicated. The only guidance management gave was that the EBITDA margin should be 2% higher than what it was in the final quarter of 2021. If this comes to fruition, and if sales total $27 billion exactly, that would imply EBITDA of $6.53 billion. Assuming that adjusted operating cash flow should rise at the same rate, we should anticipate a reading for that metric of $5.69 billion.

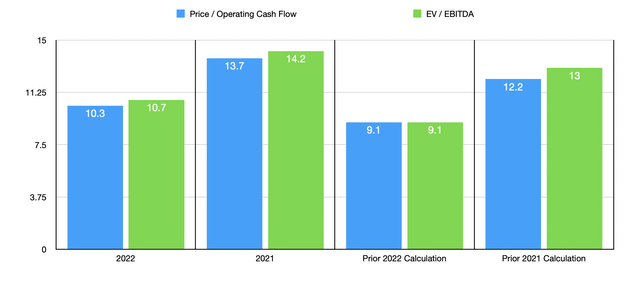

Based on these figures, shares of the company look quite cheap. The firm is trading at a forward price to adjusted operating cash flow multiple of 10.3 and at a forward EV to EBITDA multiple of 10.7. These compare favorably to the 13.7 and 14.2, respectively, that we get using data from the 2021 fiscal year. As part of my analysis, I also compared Schlumberger to five similar companies. On a price to operating cash flow basis, these firms ranged from a low of 8.4 to a high of 103.4. And using the EV to EBITDA approach, the range was between 6.5 and 36. In both cases, three of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Schlumberger | 13.7 | 14.2 |

| Baker Hughes Company (BKR) | 8.4 | 14.6 |

| Halliburton Company (HAL) | 10.7 | 10.1 |

| Tenaris S.A. (TS) | 103.4 | 6.5 |

| NOV Inc. (NOV) | 18.0 | 36.0 |

| ChampionX Corporation (CHX) | 12.8 | 10.3 |

Of course, some investors might be worried about what the future holds. However, the data I am seeing looks positive. Most recently, news broke that OPEC+ has decided to slash daily oil production by two million barrels. This will definitely lead to higher pricing that, in turn, should result in further investments in the space. Some investors will argue that recessionary fears could result in reduced demand. However, I don’t see that as a high risk. After all, there was already a shortage of production totaling around 180,000 barrels per day in the second quarter of this year. On top of that, even in the worst-case scenario where we see production drop like it did during the 2007 and 2008 financial crisis, a similar percentage decline today would decrease daily demand by around 3 million barrels. of course, that could always happen again. But I think the probability of us seeing another time like that in the foreseeable future is incredibly small.

It’s also worth bearing in mind that management remains incredibly dedicated to preparing for the long haul. Financially, the most recent example we can point to is the company’s decision to redeem over $895 million of fixed senior notes, a move that will save the company, before factoring in the tax shield implications of the maneuver, $26.6 million annually. Outside of the immediate financial picture, the company is also making other interesting moves. In September, for instance, the firm launched a digital platform partner program that will empower independent software vendors to leverage the openness and extensibility of the company’s digital platform in order to build new applications and software for the energy sector. Another interesting move was the company’s announcement, on October 5th, that it was entering into a partnership with Gradiant, a global water solutions provider, in order to introduce a key sustainable technology into the production process for battery-grade lithium compounds. The list of examples goes on.

Takeaway

All things considered, shares of Schlumberger may look more or less fairly valued compared to similar firms. But in the grand scheme of things, shares definitely looked cheap. Admittedly, they are not as cheap as they were when I last wrote about them. But for investors who are focused on a quality company at an attractive price, now may be a good time to consider buying or, if you do own SLB stock already, consider adding.

Be the first to comment