Stephen Lam

Once again, Apple (NASDAQ:AAPL) demonstrated why it’s regarded as the S&P bellwether. AAPL just beat expectations, and this report could send a ripple effect throughout the markets. AAPL is the largest holding in many of the most significant mutual and exchange-traded funds (ETFs), and its first 9 months of operations in the fiscal year 2022 sent a strong message. The fiscal year 2021 was a record-setting year for AAPL across the board, and in 2022 AAPL has surpassed where it was in 2021 by $21.73 billion of revenue, $15.03 billion of gross profit, and $4.95 billion of net income. AAPL is on track to deliver back-to-back record-setting years and if that wasn’t enough, the unsung hero of the story is Services. Bears have often indicated that AAPL has been a one-trick pony, but Services has shown AAPL’s ability to diversify away from hardware and generate reoccurring revenue. In addition to generating market-shattering numbers, AAPL bought back $21.7 billion of shares throughout the quarter and paid out $3.8 billion in dividends. I truly believe there is never a bad time to buy AAPL and to just buy shares on a continuous basis. AAPL continues to repurchase shares hand over fist, and the charts look like the bottom is in.

Apple is on track to deliver a record-breaking year again

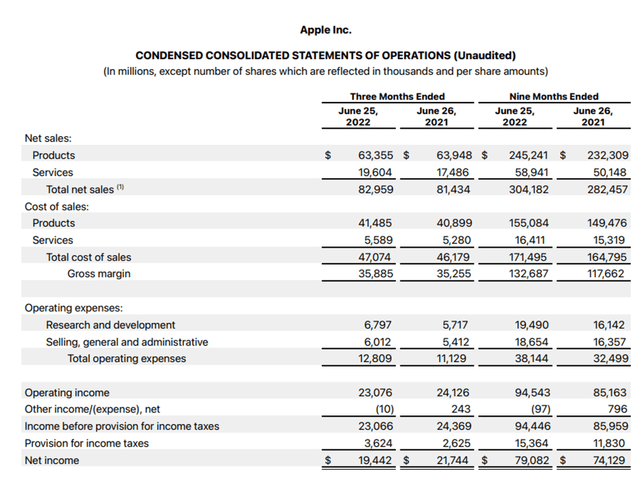

In 2021 AAPL generated $365.82 billion in revenue, $152.84 billion in gross profit, and $79.08 billion in net income. In Q3 2022, AAPL generated Q3 record revenue of $83 billion, building upon its impressive year. 2022 has been the year nothing went right, from Russia invading Ukraine to inflation and recession. Throughout the volatility and uncertainty, AAPL has remained one of the companies that can always be counted on. AAPL demonstrated remarkable execution throughout an operationally challenging environment. There were 91 days in the June quarter, and AAPL drove $911.64 million in revenue each day from its operations. From its revenue, AAPL delivered $394.34 million in gross profit and $213.65 million in net income daily.

For the first 9 months of its 2022 fiscal year, AAPL has generated $304.18 billion in revenue, $132.69 billion of gross profit, and $79.08 billion of net income. It’s operating at a 43.62% gross margin and 26% profit margin. Compared to this period in 2021, AAPL is ahead of the game by $21.73 billion of revenue (7.69%), $15.03 billion of gross profit (12.77%), and $4.95 billion of net income (6.68%). This is a testament to how important AAPL products are to the marketplace, as AAPL is breaking records in a harsh environment. When I look at 2021, which was AAPL’s best year ever, there is no question in my mind that AAPL has set itself up to surpass its 2021 numbers up and down the line next quarter. AAPL has currently generated 83.15% of 2021’s total revenue, 86.82% of its gross profit, and 83.53% of its net income in the first 9 months of 2022.

AAPL isn’t just spending money to drive revenue; it’s delivering large amounts of profits. The $79.08 billion in net income is more than most companies will generate over a 10-year period, let alone over the course of 9 months. This has correlated to $4.86 in EPS which is up $0.44 (9.96%) from this period last year. The whisper number for Q4 is $1.31 of EPS which would place 2022’s EPS at $6.17. AAPL continues to grow its top and bottom line, and its forward P/E is now 26.09 based on a $161 after-hours share price. I think that this is too low for the largest profit center in America and that if any company deserves a premium, it’s AAPL.

Services is the unsung hero and is on track to become a $100 billion revenue segment

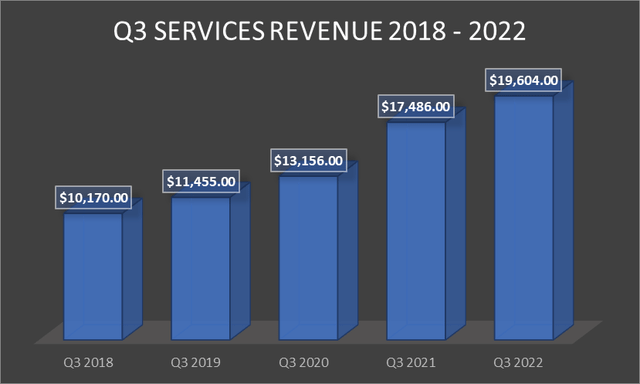

Q3 2022 was a slim YoY increase in revenue of $1.53 billion (1.87%), but the highlight should be Services. AAPL is diversifying its revenue from hardware as Services are delivering a larger amount of reoccurring revenue on its top line. In Q3 2022, Services represented $19.6 billion of AAPL’s quarterly revenue mix compared to $17.49 billion in 2021. This is a YoY growth rate of 12.11%. Over the previous 4 fiscal years, Services in Q3 have grown by $9.43 billion (92.76%) from $10.17 billion to $19.6 billion. Services is still a fairly new business segment, and it’s on the verge of breaking $20 billion quarterly of revenue.

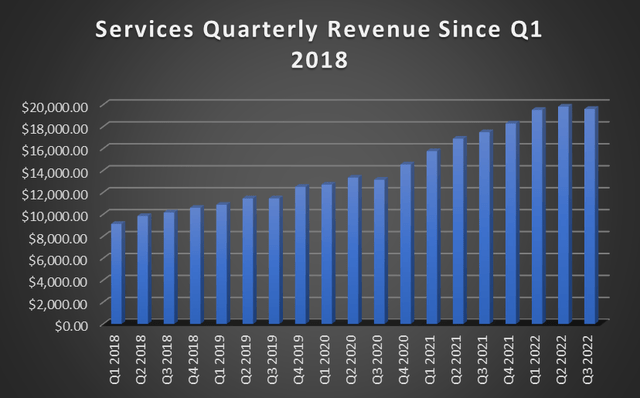

Compared to 2021, Services has significantly increased its position in AAPL’s revenue mix as its grew from 17.75% to 19.38% of AAPL’s overall revenue in the first 9 months of operations. Services have accounted for $58.94 billion of revenue compared to $50.15 billion in 2021, which is a 17.53% YoY increase. I created a chart going back to Q1 2018 because I wanted to show several years of quarterly data. Some may be alarmed that QoQ Services declined by $217 million in revenue. I don’t believe there is any reason to be worried. In Q3 2019, Services grew by $5 million, and in Q3 2020, its QoQ decline was $192 million. Ultimately Services have continued to grow as AAPL added new products in this category.

In the fiscal year, 2021, Services generated $68.43 billion of revenue. In the fiscal year, 2022, Services has already generated 86.14% of its 2021 revenue. If Q4 is flat, Services would generate $78.55 billion of revenue in 2022. This would be a 14.79% YoY increase. Based on its prior history, Services could become a $100 billion revenue segment in 2024. In the first 9 months of 2022, Services generated an additional $8.15 billion (16%) revenue than iPads and Macs combined. Services is the unsung hero within AAPL’s numbers as it’s grown into its 2nd largest revenue generator and, over the next several years, could be larger than iPad, Mac, and Wearables combined.

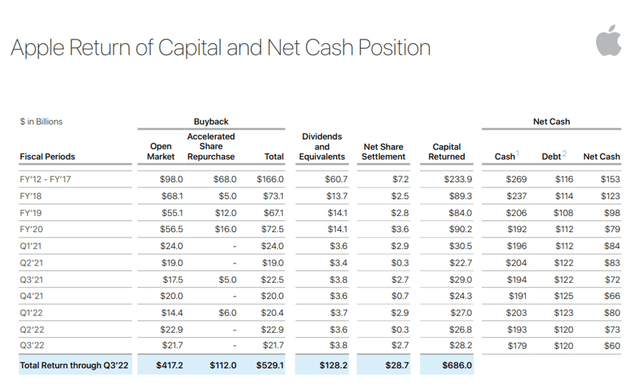

Apple is the most shareholder-friendly company in the market

Regardless of what the market values shares of AAPL at, Tim Cook continues to buy back shares. There has never been a company as shareholder-friendly as AAPL. Since 2012, AAPL has returned $686 billion back to shareholders through buybacks and dividends. In Q3 alone, AAPL repurchased $21.7 billion worth of shares on the open market. Throughout Q3, there were 62 trading days, meaning that AAPL purchased the equivalent of $350 million worth of AAPL shares daily. In 2022 AAPL has already returned $82 billion back to shareholders through buybacks and dividends.

AAPL has provided shareholders with 9 consecutive years of dividend growth with a 5-year growth rate of 8.75%. Granted, its dividend doesn’t have a large yield, shareholders are still getting a small portion of AAPL’s earnings returned to them through a dividend program. Each quarter AAPL returns billions in the form of a dividend, and with paying out only 14.29% of its earnings through its dividend, there is more than enough room for AAPL to continue its increases.

Conclusion

The GDP growth rate contracted today, and the U.S. fell into a technical recession. The markets didn’t seem to care as the S&P gained 1.21% on the session. AAPL just delivered a Q3 beat on earnings, and shares are up 3% after-hours. The question is, do you buy AAPL here or not? I believe AAPL is always a buy, and with Tim Cook buying back hundreds of millions in stock each day, he is continuously increasing your equity in the company. AAPL has been ahead of the curve and held the markets up for quite some time before ultimately declining in 2022. AAPL is on track to deliver close to $100 billion of net income in the fiscal year 2022, and its products continue to stay relevant throughout the marketplace. I think that you’re buying an equity position in the best business in America when you own shares of AAPL, as no other company produces the level of profits that AAPL does. If you believe the markets will rebound from here, whether in the back half of 2022 or 2023, then AAPL is a must-own. If the economic environment improves over the next several months, I think we could see AAPL at all-time highs again by February 2023. A record of 2022 being reported in September should act as a catalyst for AAPL, and a strong Q1 from the holiday season should be enough to propel AAPL past the $182.94 level if the economy recovers.

Be the first to comment