bjdlzx

(Note: This article was in the newsletter on August 7, 2022 and has been updated as needed. This is a Canadian company that reports in Canadian dollars unless otherwise noted.)

Oil has long been the source of stories about how finding it made people rich. In practice that story is far more complicated than the successes one hears about through secondary and tertiary sources. It takes a lot of knowledge and darn good management combined with luck (of course) for one of those stories to happen. That is what makes Headwater Exploration (OTCPK:CDDRF) a very special story in the industry. Others were in the area and knew about the profitability of the Clearwater play as well as some related intervals there.

But Headwater began operations at a time when decent acreage was still available. Headwater may or may not have “the best acreage” depending upon who is asked. But the acreage is clearly above average profitability. That likely means when it comes time to explore the “second choice” of remaining potential reserves, there will also be some very profitable possibilities. No guarantees of course.

Then the reserve report clearly understates the potential of this acreage for years to come. This is often true throughout the industry. If companies ran out of oil when the reserve reports so stated, then the United States would long ago have watched the extinction of the oil and gas industry. But as technology continues to march forward, then more and more commodity product becomes commercially viable. Investors need to keep watching technology improvements for a clue as to how long acreage can really produce. There will likely be a lot of Clearwater plays (in terms of profitability) in the future as long as technology continues to advance.

The other consideration is that reserve reports only consider the fraction of oil and gas in the ground that can be commercially produced. That fraction rises as technology advances forward. So, when a well “runs dry” or cannot produce commercial quantities of commodity products, there is often still quite a bit of resource still in the ground. This is why intervals like the Austin Chalk, The Scoop, and Stack intervals are experiencing a revival after years of production.

Headwater Exploration Q2 Financial Results

One indication of the technology improvements is the very good financial results from an interval that a decade ago was really not a consideration by many producers.

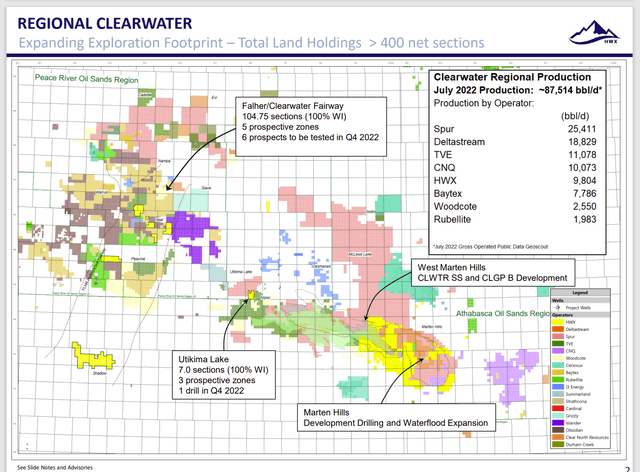

Headwater Exploration Summary Of Second Quarter Financial Results (Headwater Exploration Second Quarter 2022, Earnings Press Release)

The funds flow from operations is probably near the top of the industry compared to many operators for the amount of product produced. Even though commodity prices are high, that adjusted funds flow shown above is a huge percentage of revenue compared to many in the industry. So is net income for that matter. This implies an extremely low breakeven point for wells drilled when the next inevitable industry downturn occurs.

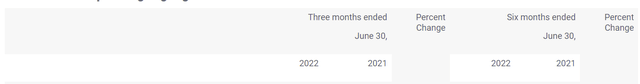

Column Headings (Headwater Exploration Second Quarter 2022, Earnings Press Release) Headwater Exploration Second Quarter 2022, Production Results (Headwater Exploration Second Quarter 2022, Earnings Press Release)

Seldom does one see that kind of cash flow reported by a company on this level of production. Clearly if oil is “black gold” this management found a giant gold mine.

Baytex Energy Comparison

To understand just how good the Headwater leases are, there will be a comparison to Baytex Energy (OTCPK:BTEGF). Baytex Energy began as a purely heavy oil producer that later diversified into lighter oil. The company is fairly profitable in its own right.

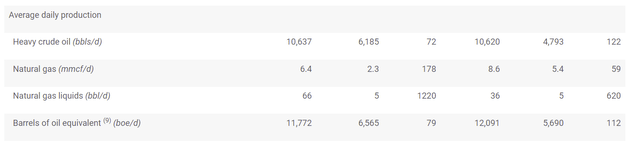

Baytex Energy Second Quarter 2022, Operating And Financial Summary. (Baytex Energy Second Quarter 2022, Earnings Press Release)

Baytex Energy, even with light oil in the mix needs roughly 8 times the production to report four times the adjusted funds flow in the latest quarter. That makes the Clearwater play unusually profitable by a wide margin. The fact that the heavy oil produced by the Clearwater play is a discounted product makes this result even more remarkable.

This kind of profitability explains why Baytex is shifting the heavy oil emphasis to Clearwater while Headwater Exploration can grow very fast while still increasing the cash balance.

Acreage

One of the things to note about this new play is all the acreage that no one has yet claimed. That is likely a sign that the development of this play is in its early stages.

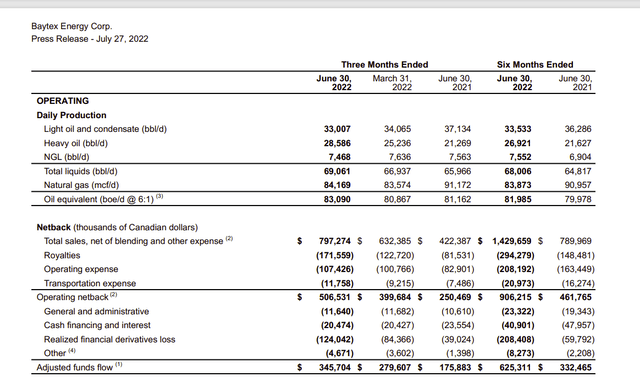

Headwater Exploration Map Of Clearwater Play Holdings (Headwater Exploration September 2022, Corporate Presentation)

Several companies came in and grabbed what they believed to be superior acreage. Oftentimes, companies like Baytex Energy with considerably more resources can do that simply because of those greater resources and their reputation.

But as the map above shows, there is still a lot of unclaimed acreage that companies are bidding on in current and future lease offerings. Investors should expect this map to fill in over the next few years as more viable acreage is claimed by winning bidders.

A smaller company like Headwater Exploration may be at a competitive disadvantage when compared to an established producer like Baytex Energy. But sometimes a basin is so large and very profitable that multiple startups can thrive in the basin with less starting resources. Clearly that is the case this time around. As the chart above shows, companies of all size are establishing operations in this basin.

It has been discussed that there is consolidation potential. That is probably not the case yet until it is clear that most of the acreage that is good is successfully acquired (and only junk is left).

The Future

Long-time readers know that heavy oil profitability is extremely volatile because the product is discounted from light oil prices. That discount can widen during times of weak pricing. That means that heavy oil production can be shut-in during times of weak prices to await the coming cyclical recovery.

That makes the current strategy of no debt a very key investment consideration by investors considering an investment in Headwater Exploration. It also explains the current emphasis by Baytex Energy management on debt reduction.

A play as profitable as Clearwater is unlikely to shut-in production because of the unusually low costs to produce this heavy oil. However, the volatility of heavy oil profits would still exist, even if it is reduced somewhat by the low breakeven point.

Traditionally heavy oil does not command the valuation as a business as does the preferred lighter oil or condensate in Canada. How the market will value this production is therefore still an open question. There is the superior profitability as an advantage combined with the discounted product characteristics as a disadvantage. It will take time for the market to figure this out because heavy oil plays are rarely this profitable. Investors will need to be patient.

In the meantime, the very generous cash flow will allow both companies to grow profitability in exceptional fashion until the next downturn. In the case of Headwater, investors probably would want to consider holding the shares long-term as a cyclical growth story until that story changes. The way things look currently, it appears that the story will stay the same for a very long time.

Be the first to comment