Richard Villalonundefined undefined/iStock via Getty Images

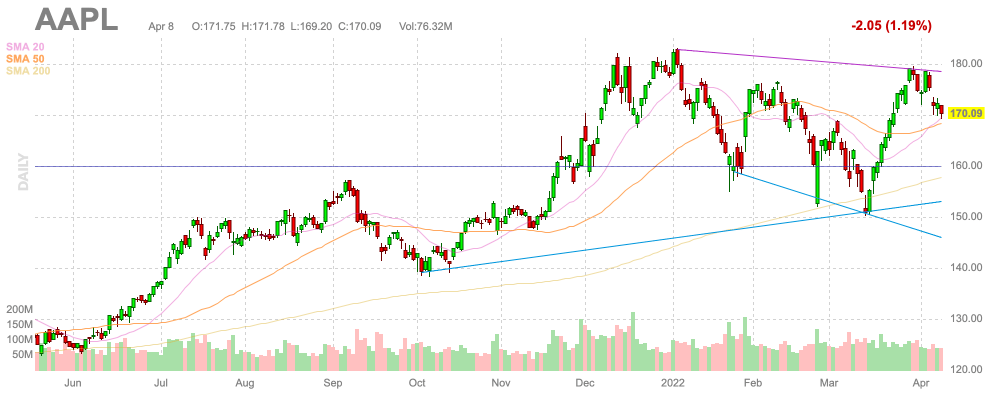

Apple (NASDAQ:AAPL) still trades near all-time highs, yet logical signs of cracks are starting to appear to the business facade. The consensus estimates already point to limit growth and the Covid pull forwards along with recession fears are starting to turn into visible slowdowns. My investment thesis remains bearish on Apple until the stock price resets similar to just about every other stock in the market.

FinViz

Waning Consumer Demand

Apple relies heavily on consumer demand to fuel sales. The tech giant isn’t heavily focused on corporate customers, and the recent warning from chips suppliers and analysts all point to the current market weakness coming from electronics and smartphone-related products bought by consumers.

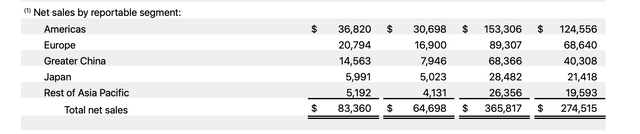

The biggest concern was the end of March warning from Apple supplier Taiwan Semiconductor Manufacturing Co. (TSM). Chairman Mark Liu suggested demand was slowing down in prime Apple markets such as smartphones and PCs. The chip manufacturer further suggested demand is especially weak in China, where Apple has the 3rd largest market by sales based on FY21 numbers.

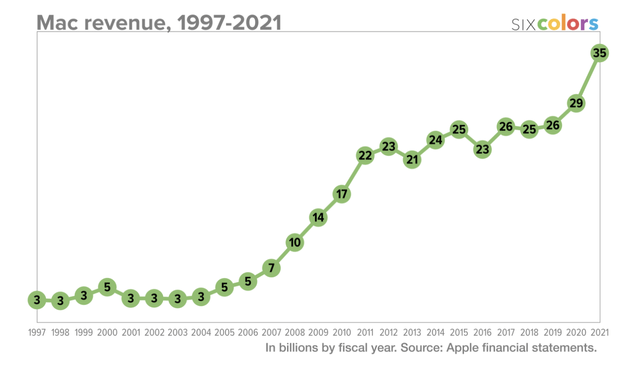

The biggest slowdown impact is likely in the lower-tier smartphones where Apple doesn’t operate, but any lower demand in premium smartphones will hurt the tech giant. Remember, Apple saw substantial sales pull forward beyond smartphones, with Macs and iPad sales jumping to record sales levels for products struggling in previous periods to even grow.

In total, sales surged in FY21 by a massive $91 billion to reach $366 billion. Historically, Apple has seen iPhone cycles pull forward demand, and the 5G iPhone released at the end of 2020 was such a scenario.

The combined Mac and iPad revenue used for WFM and virtual school saw revenues surge from $47 billion in FY19 to $67 billion during FY21. Mac revenues likely saw a small boost from new M1 chips pushing up demand, but sales were a very strong $9 billion above FY19 levels for a company with no growth in the category going on 5 years.

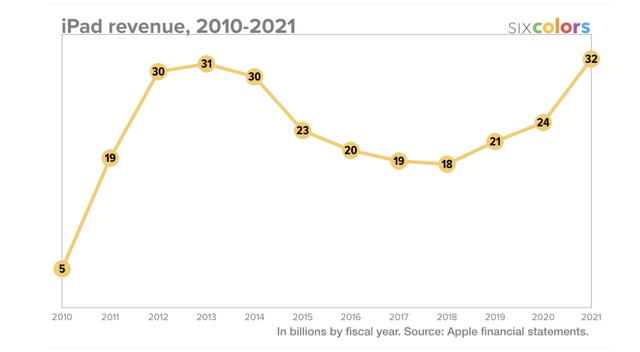

iPad revenue saw the biggest boost likely due to the demand to supplement virtual school demand for people lacking enough PCs at home. The category had seen demand plunge from FY13 peaks at $31 billion to only see Covid pull forward and push total sales to a record $32 billion.

Other areas such as Services won’t see any giveback, but the company faces headwinds in demand for Macs and iPads on top of potential flattish sales for iPhones. Any slowdown expectations hasn’t actually been embraced by the stock market yet.

The chip market isn’t completely falling apart as the automotive market still can’t meet demand and the high-performance computing and IoT sectors are riding trends beyond Covid pull forwards. After all, TSMC still can’t fully meet chip demand.

Elevated Risks

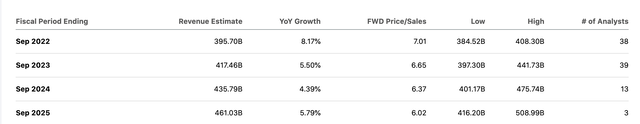

The risk isn’t that Apple misses consensus analyst targets, but rather that the tech giant actually matches current weak growth targets. Most readers are probably tired of hearing this point, but nobody actually expected the tech giant to record fast growth over the next 4 years.

The highest forecasted growth rates through FY25 is the 8.2% rate this fiscal year. The quarterly growth rates are set to dip to the 5% to 7% range for the next few years with Apple likely reporting the last double-digit growth in FQ1’22.

In essence, Apple analysts didn’t expect fast growth and the company only matching analyst estimates won’t warrant the stock still trading at ~28x EPS estimates. The trend over the last month has been revenue estimates actually trending lower. The exact opposite of expectations has occurred after Apple reported a blowout December quarter where EPS grew a surprising 25%.

JPMorgan analyst Samik Chatterjee just cut earnings estimates due to weak iPhone demand led by disappointing SE sales. The analyst even suggests high-end smartphone and laptop demand remains strong, but Mr. Chatterjee had to cut FY22 targets anyway.

Remember, the key is that demand for existing products surged during Covid shutdowns, while the exciting new products pushing the stock up the last year won’t materially add to revenues for years. The AR/VR device isn’t likely to reach the market until FY23, and AVs have an even more questionable future, with sales not set to materially impact numbers until possibly FY26, at the earliest.

Takeaway

The key investor takeaway is that Apple is starting to face an increasingly more difficult consumer demand environment and the stock hasn’t corrected. The tech giant still trades at 28x EPS targets despite meager forecasted growth rates that analysts are starting to actually cut.

Investors still have the time to sell Apple at the top unlike just about any other tech stock.

Be the first to comment